Table of Contents

Overview

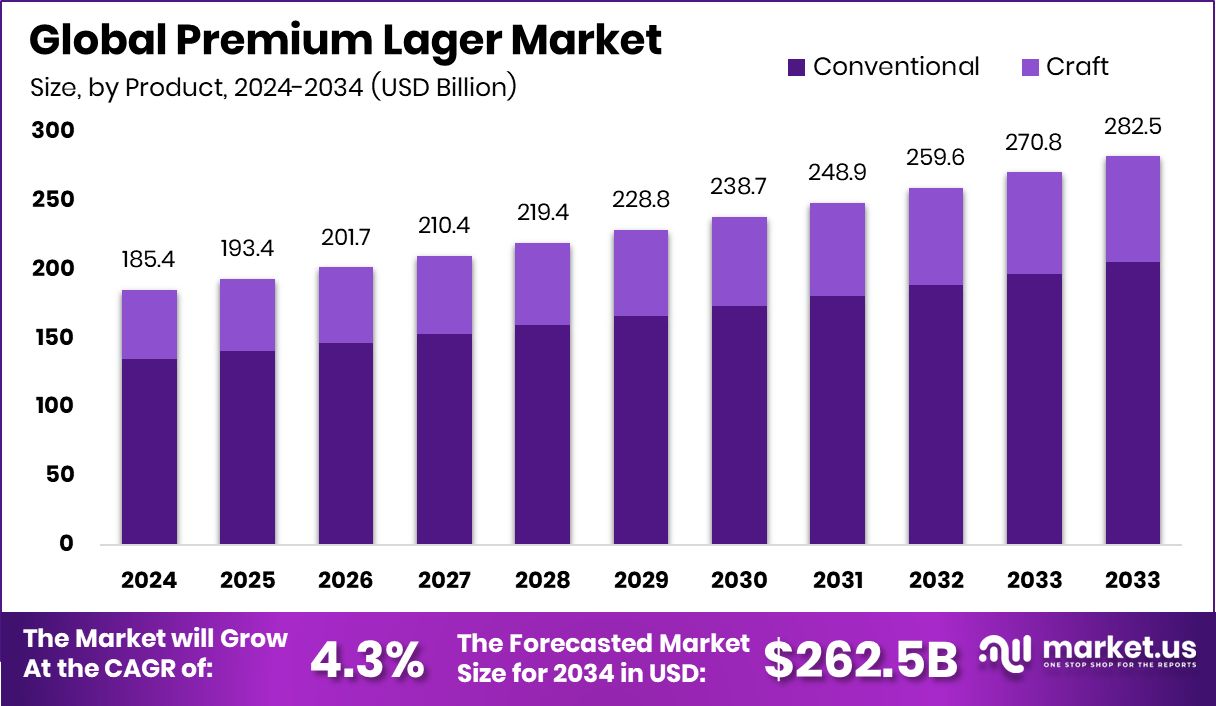

The premium lager market, valued at USD 185.4 billion in 2024, is set to reach USD 262.5 billion by 2034, growing at a steady 4.3% CAGR. Europe leads the category with a 48.20% share, equal to USD 89.3 billion, driven by its strong brewing culture and demand for refined, high-quality beer.

Premium lager is defined by superior ingredients, precise brewing, and longer aging, resulting in a clean, smooth taste. Its appeal continues to grow as consumers gravitate toward better-quality beverages, stylish packaging, and elevated drinking experiences. The market is shaped by shifting lifestyles, urban social habits, and a preference for premium offerings during dining and leisure occasions.

Rising disposable incomes and exposure to global beer trends are accelerating premium adoption, especially in India. Investor confidence remains strong: Medusa Beverages raised Rs 56 Cr (Series A), White Owl secured Rs 40 Cr (Series B), Proost obtained Rs 30 Cr in its ongoing Series A, and Goa Brewing Co received $700k. These funds are fueling product innovation and wider market reach. The momentum is reinforced by Bira 91, which attracted $70 million from Kirin Holdings in Series D, along with a $30 million round led by Sequoia, underscoring long-term growth potential. Collectively, these investments highlight rising demand for premium, experiential beer brands and signal a maturing market with strong expansion prospects.

Top Key Players in the Market

- Anheuser-Busch InBev

- Heineken N.V.

- China Resources Snow Breweries

- Carlsberg Breweries A/S

- Molson Coors Brewing

- Tsingtao Brewery Group

- Bira 91

- Asahi Group Holdings

- Constellation Brands

- B9 Beverages Pvt. Ltd.

- The Beijing Yanjing Beer Group Corporation

1. Anheuser-Busch InBev

Anheuser-Busch InBev continues to strengthen its global leadership in the beverage industry with a diversified premium beer portfolio and strong market penetration across more than 150 countries. The company emphasizes sustainable brewing, digital transformation in sales, and consistent innovation to build long-term consumer loyalty. Its global scale allows it to maintain efficient distribution networks and expand premium product lines in high-growth regions.

AB InBev also invests heavily in smart manufacturing and environmental stewardship, reducing water usage and embracing circular packaging solutions. With iconic brands and strong distribution, the company continues driving value through strategic acquisitions and expansion. Its financial resilience and technology-driven retail execution keep it at the forefront of the global premium beer category.

| Key Information | Details |

|---|---|

| CEO | Michel Doukeris |

| Founded | 2008 (formation of AB InBev) |

| Origin Companies | Interbrew, AmBev, Anheuser-Busch |

| Headquarters | Leuven, Belgium |

| Revenue | USD 59.3 Bn (2023 Annual Report) |

| Employees | 167,000+ |

| Global Rank | World’s largest brewer |

| Key Brands | Budweiser, Stella Artois, Corona |

| Markets Served | 150+ countries |

| Business Type | Multinational Beverage & Brewing |

| Website | https://www.ab-inbev.com |

2. Heineken N.V.

Heineken N.V. remains one of the most globally recognized brewing companies, known for its distinctive green bottle and premium taste profile. The company continues expanding its premium lager presence through regional brewing innovations and strong distribution partnerships. Its focus on responsible consumption and sustainable brewing enhances brand credibility worldwide.

Through digital sales platforms and market-driven innovations, Heineken is actively expanding in emerging markets. Strong marketing investments and iconic global campaigns help the brand maintain relevance among younger consumers. Its balanced portfolio offers resilience across multiple price segments while strengthening its premium positioning.

| Key Information | Details |

|---|---|

| CEO | Dolf van den Brink |

| Founded | 1864 |

| Founder | Gerard Adriaan Heineken |

| Headquarters | Amsterdam, Netherlands |

| Revenue | EUR 36.4 Bn (2023 Report) |

| Employees | 90,000+ |

| Global Rank | No. 2 global brewer |

| Key Brands | Heineken, Amstel, Tiger |

| Markets Served | 190+ countries |

| Business Type | Global Brewing |

| Website | https://www.theheinekencompany.com |

3. China Resources Snow Breweries

China Resources Snow Breweries is China’s largest beer producer and one of the world’s highest-volume brewers, driven by its flagship brand Snow Beer. The company has rapidly expanded its premium offerings to match rising consumer preferences for refined brewing quality. Its strong domestic distribution gives it exceptional reach across urban and rural markets.

Through modernization of production lines and investment in automated brewing facilities, the company continues to scale efficiently. Strategic partnerships and brand enhancement programs reinforce its leadership in China’s fast-evolving beer segment, particularly within premium and super-premium lager categories.

| Key Information | Details |

|---|---|

| Parent Company | China Resources Beer |

| CEO | Hou Xiaohai |

| Founded | 1994 |

| Headquarters | Beijing, China |

| Flagship Brand | Snow Beer |

| Revenue | RMB 42.9 Bn (2023 Report) |

| Production Sites | 70+ breweries |

| Employees | 50,000+ |

| Market Position | No. 1 in China |

| Business Type | Brewery |

| Website | https://www.crbeer.com.hk |

4. Carlsberg Breweries A/S

Carlsberg Breweries A/S has built a powerful global presence through heritage brewing and strong brand equity across European and Asian markets. The company’s commitment to responsible drinking, sustainable brewing, and water-saving technologies strengthens its modern growth strategy. Its premium beers continue gaining traction due to refined taste profiles and strong retail presence.

Carlsberg’s portfolio diversification and market-specific innovations help maintain competitiveness across regions. Through its “Together Towards ZERO” strategy, the company is actively reducing carbon emissions, responsible marketing risks, and water consumption. Its balanced global footprint supports steady growth across premium beer categories.

| Key Information | Details |

|---|---|

| CEO | Jacob Aarup-Andersen |

| Founded | 1847 |

| Founder | J.C. Jacobsen |

| Headquarters | Copenhagen, Denmark |

| Revenue | DKK 73.6 Bn (2023 Report) |

| Employees | 30,000+ |

| Key Brands | Carlsberg, Tuborg, 1664 |

| Markets Served | 150+ countries |

| Business Focus | Global Brewer |

| Website | https://www.carlsberggroup.com |

5. Molson Coors Brewing

Molson Coors Brewing is a major North American and European beverage company with a portfolio built around iconic brands and expanding premium beer categories. The company continues to transform through modern brewing upgrades, sustainability programs, and diversified beverage offerings beyond beer.

Its focus on strengthening brand relevance, improving supply chain efficiency, and expanding premium segments positions the company as a strong competitor globally. Molson Coors continues delivering value through innovation and category expansion.

| Key Information | Details |

|---|---|

| CEO | Gavin Hattersley |

| Founded | 2005 (merger) |

| Origin Companies | Molson (1786), Coors (1873) |

| Headquarters | Chicago, USA |

| Revenue | USD 11.7 Bn (2023 Report) |

| Employees | 16,000+ |

| Major Brands | Coors, Miller, Blue Moon |

| Business Type | Beverages & Brewing |

| Market Reach | North America, Europe |

| Website | https://www.molsoncoors.com |

6. Tsingtao Brewery Group

Tsingtao Brewery Group is one of China’s oldest and most globally recognized beer brands. The company continues building its premium positioning through heritage brewing, export expansion, and strong brand marketing. Its premium lagers maintain consistent international demand owing to their crisp quality.

The company invests heavily in production modernization and expanding distribution networks across Asia-Pacific and global markets. Tsingtao’s premium branding strategy strengthens long-term competitiveness in the evolving beer sector.

| Key Information | Details |

|---|---|

| CEO | Huang Kexing |

| Founded | 1903 |

| Headquarters | Qingdao, China |

| Revenue | RMB 34.7 Bn (2023 Report) |

| Employees | 40,000+ |

| Key Brands | Tsingtao |

| Market Reach | 100+ countries |

| Business Type | Brewery |

| Website | http://www.tsingtao.com.cn |

7. Bira 91 (B9 Beverages Pvt. Ltd.)

Bira 91 has quickly transformed India’s premium beer landscape through youth-centric branding, craft-driven brewing, and modern retail presence. The company is known for refreshing flavor profiles and innovative packaging that strongly appeal to millennial and Gen Z consumers. Strong funding support has accelerated capacity expansion and product innovation.

With state-of-the-art breweries and rising distribution across metros and tier-1 cities, Bira 91 continues scaling its premium and craft offerings. Investor backing from global players reinforces long-term confidence in the brand’s growth trajectory.

| Key Information | Details |

|---|---|

| CEO | Ankur Jain |

| Founded | 2015 |

| Headquarters | New Delhi, India |

| Revenue | Not publicly disclosed |

| Key Brands | Bira 91 Blonde, Wheat, IPA |

| Investors | Kirin Holdings, Sequoia |

| Market Focus | Premium & Craft Beer |

| Business Type | Brewer |

| Website | https://www.bira91.com |

8. Asahi Group Holdings

Asahi Group Holdings is a global leader in premium beer and beverages, driven by a strong focus on product quality, technological innovation, and sustainability. Its premium lagers, including Asahi Super Dry, dominate several global markets and continue expanding through advanced brewing techniques.

The company invests heavily in sustainable packaging, carbon neutrality, and digital transformation across operations. Strong acquisition strategies and global distribution networks help sustain growth momentum.

| Key Information | Details |

|---|---|

| CEO | Atsushi Katsuki |

| Founded | 1889 |

| Headquarters | Tokyo, Japan |

| Revenue | JPY 2.7 Trillion (2023 Report) |

| Employees | 30,000+ |

| Key Brands | Asahi Super Dry, Peroni |

| Markets Served | 100+ countries |

| Business Type | Global Beverage Group |

| Website | https://www.asahigroup-holdings.com |

9. Constellation Brands

Constellation Brands holds a strong presence in premium beer and alcoholic beverages, with leading brands driving high consumer loyalty. The company continues expanding through strategic investments, portfolio upgrades, and premium positioning across global markets.

Its focus on brand-building, innovation, and expanding high-growth categories supports sustained performance. Constellation remains a major force in the premium beer segment, especially through imported and specialty offerings.

| Key Information | Details |

|---|---|

| CEO | Bill Newlands |

| Founded | 1945 |

| Headquarters | New York, USA |

| Revenue | USD 9.5 Bn (2023) |

| Employees | 10,000+ |

| Key Brands | Modelo, Corona (U.S. rights) |

| Business Type | Beverage & Alcohol |

| Website | https://www.cbrands.com |

10. Beijing Yanjing Beer Group

Beijing Yanjing Beer Group is one of China’s major state-owned breweries, recognized for its strong domestic distribution and established brand heritage. The company has expanded its premium beer offerings while maintaining a loyal consumer base across major regions.

Through modernization of brewing facilities and innovation in product development, Yanjing continues to hold a significant share in China’s beer industry. Its regional dominance and large-scale production support stable long-term growth.

| Key Information | Details |

|---|---|

| Chairman | Wang Xiaodong |

| Founded | 1980 |

| Headquarters | Beijing, China |

| Revenue | RMB 12.1 Bn (2023) |

| Employees | 40,000+ |

| Key Brands | Yanjing Beer |

| Market Focus | Domestic Premium & Standard Lagers |

| Business Type | Brewery |

| Website | http://www.yanjing.com.cn |

Conculsion

Premium lager continues to strengthen its position as a preferred choice among modern consumers seeking quality, refined taste, and a more elevated drinking experience. As lifestyles evolve and social dining trends grow, premium lager benefits from rising interest in better ingredients, crafted brewing methods, and distinctive brand identities.

Investors and brands alike are supporting this shift, driving innovation, expanding distribution, and improving product variety. With changing consumer expectations and strong brand storytelling, the category is set for steady long-term growth. Premium lager now represents more than just a beverage—it reflects aspiration, modern culture, and a desire for memorable social moments.