Table of Contents

Overview

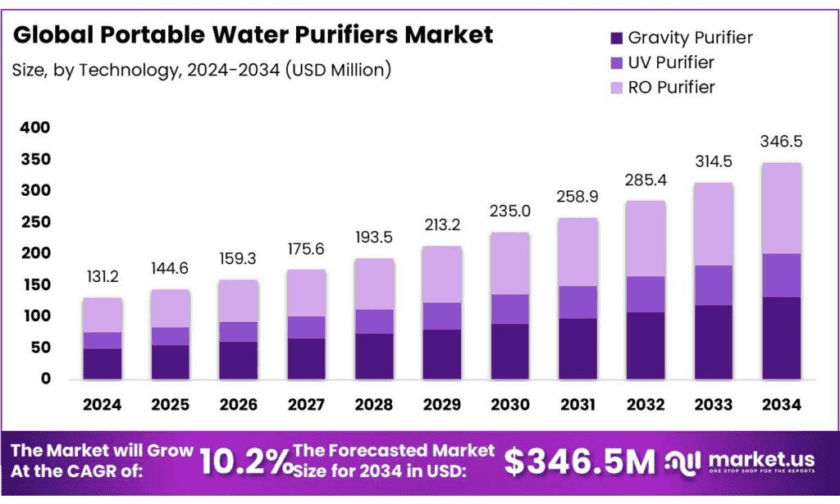

New York, NY – Dec 01, 2025 – The global portable water purifiers market is projected to reach USD 346.5 million by 2034, increasing from USD 131.2 million in 2024, supported by a 10.2% CAGR from 2025 to 2034. Strong industrial expansion and rising chemical output have reinforced Asia-Pacific’s leading 43.8% regional share. Portable water purifiers are compact, mobile systems that convert untreated or unsafe sources into drinkable water using membranes, UV treatment, activated carbon, or hybrid technologies. Their versatility makes them essential in outdoor activities, disaster response, military operations, travel, and regions lacking reliable municipal treatment.

Market momentum is being shaped by increasing concerns over microbial and chemical contamination in drinking water. In India, the economic impact of waterborne diseases is estimated at USD 600 million annually, demonstrating the scale of unmet need. Globally, the WHO reports around 505,000 diarrhoeal deaths each year linked to contaminated drinking water, while an estimated 1.4 million deaths could be prevented with improvements in safe water, sanitation, and hygiene—underscoring growing demand for portable purification systems in rural, emergency, and transitional contexts.

Government initiatives are reshaping demand patterns. India’s Jal Jeevan Mission, as of October 6, 2024, had delivered tap-water access to 15.19 crore (151.9 million) rural households, achieving roughly 78.6% coverage. This expansion reduces dependency on untreated sources but simultaneously increases the need for point-of-use and portable devices for intermittent or contaminated supplies. In the U.S., the Infrastructure Investment and Jobs Act allocates over USD 50 billion for national water infrastructure upgrades, indirectly supporting adoption of complementary purification technologies. Additional regional programs—such as a ₹50-crore solar-powered well rejuvenation and filtration initiative in Thane, India—demonstrate the growing interest in hybrid, decentralized water purification solutions.

Key Takeaways

- Portable Water Purifiers Market size is expected to be worth around USD 346.5 Million by 2034, from USD 131.2 Million in 2024, growing at a CAGR of 10.2%.

- RO Purifier held a dominant market position, capturing more than a 48.5% share of the portable water purifier market.

- Residential held a dominant market position, capturing more than a 69.2% share of the portable water purifier market.

- Retail Stores held a dominant market position, capturing more than a 49.6% share of the portable water purifier market.

- Asia-Pacific region held a dominant position in the portable water purifier market, capturing more than 43.8% of the global share, equating to an estimated market value of USD 57.4 million.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-portable-water-purifiers-market/free-sample/

Report Scope

| Market Value (2024) | USD 131.2 Mn |

| Forecast Revenue (2034) | USD 346.5 Mn |

| CAGR (2025-2034) | 10.2% |

| Segments Covered | By Technology (Gravity Purifier, UV Purifier, RO Purifier), By End-User (Residential, Commercial, Industrial), By Distribution Channels (Retail Stores, Direct Sales, Online, Others) |

| Competitive Landscape | Kent RO limited, GE Corporation, Whirlpool, Brita, SteriPEN, General Ecology Inc., SAFH20 UV, GRAYL, Inc, Aquasana, Inc.., Panasonic |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161028

Key Market Segments

By Technology Analysis: RO Purifier dominates with 48.5% share in 2024 due to high contaminant removal efficiency.

In 2024, RO Purifier secured a leading position with a 48.5% share of the portable water purifiers market. Its dominance was supported by the technology’s ability to remove dissolved salts, heavy metals and various chemical impurities with high precision. This capability made RO systems the preferred option in regions facing hard water and elevated contamination levels. Growing awareness of drinking-water safety and the need for compact, easy-to-use purification devices further strengthened demand. With ongoing advancements in membrane design and energy efficiency, RO technology is expected to maintain its leading role beyond 2024.

By End-User Analysis: Residential dominates with 69.2% share in 2024 due to rising household demand for safe water.

In 2024, the Residential segment captured 69.2% of the total market, sustaining its position as the primary end-user category. This leadership was driven by heightened health consciousness among households and increased concerns over microbial and chemical contamination in local water supplies. Portable purifiers gained traction as families sought reliable, convenient and maintenance-friendly solutions. Urbanization trends and the preference for compact water-treatment devices that ensure consistent water quality supported the segment’s expansion. Continued emphasis on hygiene and household safety is projected to reinforce the residential segment’s dominance in the years ahead.

By Distribution Channel Analysis: Retail Stores dominate with 49.6% share in 2024 due to strong accessibility and product variety.

In 2024, Retail Stores accounted for 49.6% of the portable water purifier market, retaining their status as the most influential distribution channel. Consumers benefited from the ability to compare models in person, review specifications and access immediate purchases, which encouraged higher adoption. The presence of branded outlets, supermarkets and specialized electronics stores further improved trust through reliable after-sales and installation support. Promotional offers and retail-based discounts also played a significant role in segment growth. With consistent shopper preference for in-store evaluation and direct availability, retail stores are likely to sustain their leading share beyond 2024.

List of Segments

By Technology

- Gravity Purifier

- UV Purifier

- RO Purifier

By End-User

- Residential

- Commercial

- Industrial

By Distribution Channels

- Retail Stores

- Direct Sales

- Online

- Others

Regional Analysis

Asia-Pacific leads with 43.8% share in 2024, valued at USD 57.4 million, supported by rapid urban growth and rising health awareness.

In 2024, the Asia-Pacific region accounted for 43.8% of the global portable water purifier market, representing an estimated value of USD 57.4 million. This dominant position was reinforced by accelerating urbanization, heightened concerns about waterborne diseases and growing public awareness of the health risks linked to untreated water. Demand remained strong across China, India, Japan and several Southeast Asian countries, where issues such as water scarcity, contamination and the need for reliable access to safe drinking water continued to influence consumer behaviour.

Government-led water quality improvement programs further bolstered market expansion, including large-scale efforts such as India’s Jal Jeevan Mission, which targets universal access to safe household drinking water. The region also benefited from continuing advances in purification technologies that improved system efficiency and affordability, encouraging broader adoption of portable water treatment solutions.

Top Use Cases

Emergency & Disaster Relief: Portable purifiers are widely deployed in disaster response to provide immediate safe drinking water where infrastructure has failed. Rapid distribution is favoured because units deliver potable water on-site and reduce outbreak risk; this application is critical given that unsafe water contributes substantially to diarrhoeal disease burden (an estimated ~505,000 diarrhoeal deaths annually are associated with unsafe drinking water and related WASH failures).

Humanitarian and Refugee Operations: Humanitarian agencies use compact purification units for camps and transient settlements where centralized treatment is unavailable. These devices are used to cover thousands of beneficiaries per deployment and are often included in emergency kits because they lower immediate public-health risk while longer-term water systems are restored. The global scale of need is underscored by the fact that ~2.1 billion people lack safely managed drinking water.

Remote and rural household use: Portable purifiers are adopted in off-grid homes and remote communities where piped water is unreliable or intermittent. In India, for example, while national tap-connection coverage under the Jal Jeevan Mission reached ~15.19 crore rural households (78.58%) as of 6 October 2024, remaining gaps and intermittency sustain demand for point-of-use solutions.

Health clinics, schools and small institutions: Small clinics, schools and day-care centres in low-resource settings use portable purifiers as an interim or complementary solution to protect children and patients. Given that improved WASH could avert up to 1.4 million deaths annually associated with poor water, sanitation and hygiene, portable devices are often procured to reduce immediate exposure while infrastructure upgrades proceed.

Military, expeditionary and commercial field operations: Armed forces, scientific expeditions and remote industrial crews use rugged portable purifiers to guarantee safe water for personnel. These systems are specified for capacity (litres/hour), contaminant removal levels, and reliability under field conditions; procurement decisions are frequently based on throughput metrics and lifecycle costs.

Recent Developments

Kent RO Systems remained a leading player in household purification in FY2024, with reported consolidated revenue of ₹1,178 crore in FY24 (up ~8.7% YoY) and net profit expansion noted in early 2025 filings; water purifiers accounted for ~85% of Q1 FY25 revenue (₹637 crore), underscoring product-line concentration. The company progressed toward an IPO in January 2025, signaling capital-raising to scale manufacturing and distribution. In 2024–2025, Kent’s market strategy emphasised bundled service, broader after-sales networks and expansion of adjacent home-appliance categories.

GE’s home-appliance business markets a range of water filtration and point-of-use systems—under the GE Appliances brand—covering under-sink, whole-house and refrigerator-filter solutions sold through retail and e-commerce channels in 2024–2025. The business highlighted continued manufacturing investment and local production scale in its 2024 economic impact reporting, supporting product availability and service networks. Typical retail SKUs indicate replacement-cycle economics (filters often replaced every ~6 months), a key commercial metric for recurring revenue and aftermarket service planning.

Whirlpool’s presence in water purification is embedded within its broader appliance portfolio, where under-sink, refrigerator-integrated and point-of-use filtration products are sold through retail and e-commerce channels. In 2024 the corporation reported approximately USD 17 billion in global sales, reflecting scale that supports distribution and service networks for water-related SKUs. In India, local operations recorded rising revenues into FY24–FY25 (reported Rs 69,936 crore in FY24; Rs 81,102 crore in FY25), underpinning expanded product availability and after-sales coverage for purifiers.

Brita is positioned as a specialist in consumer and professional water filtration, with a product range from filter jugs to professional dispensers used in homes and businesses. The company reported double-digit regional sales growth in recent reporting periods, with combined segment sales rising (professional filters and dispensers grew ~10% in 2024) and contributing roughly 31% of group revenues in 2024—evidence of balanced retail and institutional demand. Brita’s focus on filter replacement cycles and sustainability continues to drive recurring revenue and professional channel expansion.

SteriPEN remains a leading name in portable UV-based water purifiers, offering compact devices such as the Adventurer, Ultralight and Ultra that neutralize over 99.9% of bacteria, viruses and protozoa in seconds. The company’s 2025 launch of the “UltraPure X” model — designed for ultralight outdoor use — highlights its commitment to travellers, hikers and emergency users. SteriPEN’s UV-C technology, zero-chemical operation, and rechargeable configuration make it a preferred choice for on-the-go safe water across variable water sources.

General Ecology, Inc. delivers a broad range of portable and point-of-use water purifiers under brands such as Seagull® IV, Nature Pure®, First Need® and Trav-L-Pure®, covering household, RV/boat, travel and emergency use cases. Its proprietary Structured Matrix™ filtration technology meets stringent EPA and WHO microbiological standards, effectively removing bacteria, viruses, cysts, and chemical contaminants without electricity or chemicals. As of 2024–2025, General Ecology remains recognised internationally, supplying water purifiers to homes, institutions, marine users and aviation clients worldwide.

GRAYL continued to be recognised for fast, travel-ready purifier bottles in 2024–2025, broadening its GeoPress line with the GeoPress Ti (launched Feb 27, 2024) aimed at outdoor and emergency users. The GeoPress design purifies 24 oz in about eight seconds (≈5 L/min) and removes viruses, bacteria, protozoa, PFAS and heavy metals, supporting rugged, off-grid use and rapid throughput claims that appeal to hikers and aid groups. Product refreshes and retail placements in 2024 reinforced GRAYL’s position in the portable UV/filtration niche.

Aquasana, operating within A. O. Smith’s water-treatment portfolio (acquired in 2016 for about USD 87 million), remained a major U.S. supplier of point-of-use and whole-house filtration in 2024–2025. A. O. Smith reported North America water-treatment sales rose ~10% in 2024, reflecting channel expansion and recurring filter revenue; Aquasana’s 2025 consumer survey also highlighted rising public concern about PFAS and microplastics, underpinning demand for certified filtration and replacement cartridges. The brand’s retail reach and filter-consumable model continue to drive steady aftermarket income.

Panasonic remains active in home water purification in 2024–2025, offering versatile countertop, faucet, and under-sink water purifiers. For example, its TK‑CS600 countertop model is reported to remove 19 harmful substances using ultra‑filtration, eliminating 99.999% of bacteria and 99.9% of viruses, and one cartridge can filter up to 6,000 liters of water. The product line emphasises ease of installation, long cartridge life and consistency — features that support residential demand for reliable, everyday drinking water treatment.

Conclusion

The portable water purifier market is expected to expand materially as a practical complement to central water systems, driven by clear public-health needs, ongoing infrastructure investment and strong regional demand. Public-health data confirm the urgency for decentralized solutions: an estimated 505,000 diarrhoeal deaths were associated with unsafe drinking water in recent burden analyses, highlighting the role portable devices play in immediate risk reduction.

National and international investments in water systems are expected to shape medium-term demand: major programmes (for example, India’s Jal Jeevan Mission reaching 15.19 crore rural households as of 6 Oct 2024) reduce some baseline need but create last-mile and point-of-use opportunities, while large infrastructure packages will alter procurement and complementarity across segments.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)