Table of Contents

Overview

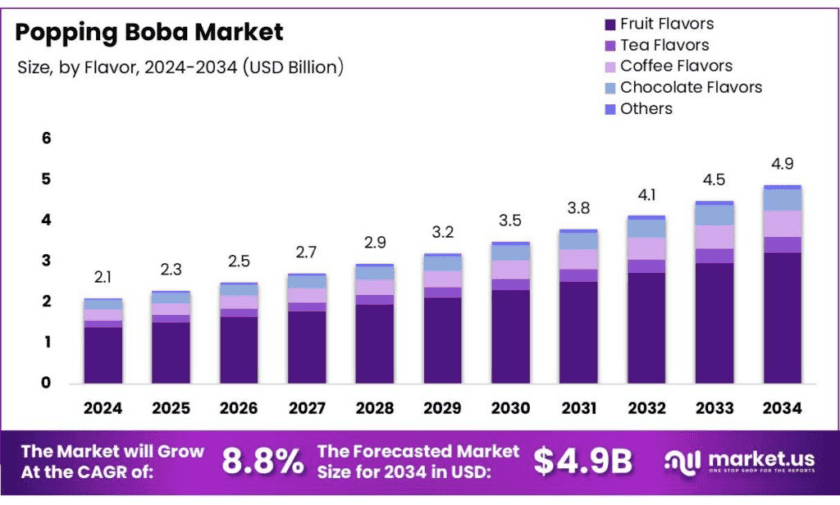

New York, NY – Nov 05, 2025 – The global popping boba market is projected to reach USD 4.9 billion by 2034, up from USD 2.1 billion in 2024, growing at a CAGR of 8.8% between 2025 and 2034. In 2024, North America dominated the market with a 43.7% share, generating around USD 0.9 billion in revenue. Popping boba—juice-filled spheres created through spherification using sodium alginate and calcium salts—combines hydrocolloid science with innovative beverage concepts. Its key input, alginate, comes from brown seaweed, making raw material supply vital for large-scale production.

- According to the Food and Agriculture Organization (FAO), global fisheries and aquaculture output reached 223.2 million tonnes in 2022, including 37.8 million tonnes of algae, ensuring a robust supply base for alginate extraction.

Asia continues to dominate the upstream supply chain and retail innovation, driven by its long-established seaweed cultivation and bubble-tea culture. FAO data show global seaweed output climbed from 11.8 million tonnes in 2001 to 36.3 million tonnes in 2021, underscoring strong feedstock growth for alginate producers. On the consumption side, beverage markets remain vibrant—Taiwan, a key bubble-tea hub, imported USD 177.5 million worth of soft drinks in 2024, including USD 6.8 million from the United States, reflecting sustained consumer activity that supports demand for toppings such as popping boba.

Upstream development is also being encouraged through government initiatives. In India, the Department of Fisheries under the Pradhan Mantri Matsya Sampada Yojana (PMMSY) aims to achieve over 1.12 million tonnes of seaweed by 2025, backed by an investment of ₹127.7 crore for a Multipurpose Seaweed Park in Tamil Nadu—initiatives that enhance domestic alginate availability and strengthen supply chains for hydrocolloid users, including popping boba producers.

Key Takeaways

- Popping Boba Market size is expected to be worth around USD 4.9 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 8.8%.

- Fruit Flavors held a dominant market position, capturing more than a 65.9% share of the global Popping Boba market.

- Bubble Tea held a dominant market position, capturing more than a 56.5% share of the global Popping Boba market.

- Food Service held a dominant market position, capturing more than a 59.1% share of the global Popping Boba market.

- North America held a dominant position in the global Popping Boba market, capturing more than a 43.7% share, valued at approximately USD 0.9 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/popping-boba-market/free-sample/

Report Scope

| Market Value (2024) | USD 2.1 Bn |

| Forecast Revenue (2034) | USD 4.9 Bn |

| CAGR (2025-2034) | 8.8% |

| Segments Covered | By Flavor (Fruit Flavors, Tea Flavors, Coffee Flavors, Chocolate Flavors, Others), By Application (Bubble Tea, Frozen Yogurt Toppings, Ice Cream Toppings, Smoothies and Beverages, Others), By Distribution Channel (Food Service, Retail, Supermarkets and Hypermarkets, Convenience Stores, Online, Others) |

| Competitive Landscape | Tachiz Group, PT. Formosa Ingredient Factory Tbk., Nam Viet F&B, Italian Beverage Company, Brilsta, Sunnysyrup Food Co, Ltd., Possmei, Golden Choice Marketing Sdn Bhd, Bossen, Boba Box Limited |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159298

Key Market Segments

By Flavor Analysis – Fruit Flavors Lead with 65.9% Share in 2024

In 2024, the Fruit Flavors segment dominated the global popping boba market, accounting for 65.9% of total market share. This leadership is driven by the strong consumer preference for natural, fruity, and refreshing tastes, which make fruit flavors universally appealing. Popular varieties such as mango, strawberry, lychee, and passion fruit have become staples across bubble tea, smoothies, and dessert applications. Fruit-based popping boba enhances both the taste and visual appeal of beverages, helping brands cater to a wide range of flavor preferences. The ongoing trend toward natural ingredients and the introduction of exotic fruit blends have further reinforced the segment’s dominance, positioning fruit flavors as the backbone of the market’s flavor portfolio.

By Application Analysis – Bubble Tea Dominates with 56.5% Share in 2024

The Bubble Tea segment held a commanding 56.5% share of the global popping boba market in 2024, underscoring the beverage’s continued global appeal. Popping boba serves as a key ingredient that enhances bubble tea’s texture, interactivity, and visual appeal, driving repeat purchases, especially among younger consumers. The growth of bubble tea is closely tied to the rise of experiential beverages, where customers seek fun, customizable, and shareable drink experiences.

By Distribution Channel Analysis – Food Service Leads with 59.1% Share in 2024

In 2024, the Food Service segment captured the largest share of the popping boba market at 59.1%, reflecting the growing influence of cafés, quick-service restaurants, and specialized boba shops. These establishments have become the main distribution channel for popping boba, allowing consumers to enjoy freshly prepared, customized boba drinks that align with modern dining experiences. The segment’s growth is supported by the expansion of bubble tea franchises and the creative use of popping boba in desserts, smoothies, cocktails, and specialty beverages.

List of Segments

By Flavor

- Fruit Flavors

- Tea Flavors

- Coffee Flavors

- Chocolate Flavors

- Others

By Application

- Bubble Tea

- Frozen Yogurt Toppings

- Ice Cream Toppings

- Smoothies & Beverages

- Others

By Distribution Channel

- Food Service

- Retail

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

Regional Analysis

In 2024, North America dominated the global popping boba market, capturing a strong 43.7% share, valued at around USD 0.9 billion. This regional leadership stems from the rapid expansion of bubble tea chains and the rising consumer appetite for customizable and visually appealing beverages. The United States and Canada represent the core of this growth, as both markets have witnessed a remarkable surge in the popularity of innovative drink formats.

According to the National Restaurant Association, the number of bubble tea outlets in the U.S. increased by over 15% between 2020 and 2024, reflecting sustained retail expansion and consumer enthusiasm. The region’s large, trend-driven consumer base—especially among younger demographics—has embraced popping boba as a fun, sensory addition to beverages and desserts. Furthermore, the inclusion of popping boba in café and restaurant menus to enhance visual appeal and customer engagement has reinforced North America’s position as the leading regional market in 2024.

Top Use Cases

Bubble tea core topping: Popping boba is a staple add-in for bubble tea, where throughput is shaped by robust beverage demand in “home” markets. Taiwan—birthplace of boba—imported USD 177.5 million of soft drinks in 2024 (including USD 6.8 million from the U.S.), signaling sustained drink traffic into which toppings slot naturally. In venues, popping boba increases ticket value via flavor add-ons and customization, supporting chain menu innovation and limited-time offers.

Smoothies, juices And RTD refreshers: Popping boba is made by alginate–calcium spherification, supply reliability for alginate matters. The FAO reports 223.2 million tonnes of fisheries & aquaculture output in 2022, including 37.8 million tonnes of algae, underlining a broad raw-material base for alginate extraction used in boba shells. This upstream depth supports placement in juice bars and smoothie franchises seeking visually engaging, textural “bursts” with fruit flavors.

Frozen desserts & edible ices: Popping boba functions as a textural garnish in edible ices, sorbets, and soft-serve. From a compliance lens, alginic acid (INS/E 400) is listed in the Codex GSFA for relevant categories (e.g., 03.0 Edible ices) and, in the EU, received an EFSA re-evaluation concluding “ADI not specified” for alginic acid and its salts (E 400–E 404). These positions ease multi-market launches where serving sizes vary. Sources: Codex GSFA; EFSA Journal (2017).

Café And QSR beverage platforms: In cafés and quick-service restaurants, popping boba adds visual differentiation and upsell potential to lemonades, sparkling waters, and iced teas. The upstream context is favorable: global seaweed production—the primary source of alginate—reached ~36.3 million tonnes in 2021, nearly 3× the 11.8 million tonnes recorded in 2001, with ~97% coming from aquaculture. This scale underpins consistent alginate availability for high-traffic beverage platforms. Sources: FAO seaweed trade & market potential; FAO synthesis references.

Desserts, bakery toppings And plated applications: Beyond beverages, popping boba is used on pancakes, waffles, parfaits, and plated desserts to add color and burst-in-mouth moments. The Codex Table 3 framework lists alginic acid among additives permitted at GMP levels (good manufacturing practice) in many foods (subject to category exceptions), simplifying cross-border menu standardization for multinational chains and commissaries. Source: Codex GSFA Online – Table 3 (updated through CAC47, 2024).

Recent Developments

In 2023, Tachiz Group reported a 20% increase in order volumes in Europe, driven by demand for its customizable popping boba products. The Taiwanese manufacturer emphasizes customization—varying skin thickness, flavor profiles, and packaging options—and has achieved certifications such as FSSC 22000 and Halal. As a market research analyst, I view Tachiz’s growth as a strong indicator of wider global adoption of popping boba and its shift from novelty to scalable ingredient for drinks and desserts.

In 2024, PT Formosa Ingredient Factory Tbk. expanded its export markets in Asia for its “BOOMBA! Popping Boba” line and reported revenues of about IDR 181.88 billion and net income of IDR 20.52 billion in its previous period. The Indonesian firm produces tapioca pearls, jelly toppings and popping boba under the Boba King brand, supplying cafés and retail across Southeast Asia. From an analyst’s perspective, the company’s strong regional focus and rapid growth position it to benefit from rising bubble-tea and dessert consumption across ASEAN markets.

In 2024, Nam Viet F&B expanded its product line to include popping boba-infused canned bubble-tea drinks, launching in four fruit flavors—Strawberry, Lychee, Peach and Mango—as part of its “Vinut Pops” brand. As a market research analyst, I see this move as Nam Viet leveraging its six GMP-certified factories and automated production capacities (50+ lines) to scale popping-boba offerings for domestic and export markets, signalling that the company is positioning itself to ride the rising global demand for novel beverage toppings.

In 2023-24, Italian Beverage Company reportedly featured in industry listings as a key player in the global popping boba/juice-balls market. From an analyst’s view, this signals that the company is expanding its presence beyond traditional European beverage formats by incorporating popping boba into its portfolio, enabling it to cater to the novelty drink consumer and helping it tap into the fast-growing bubble-tea and textural beverage trend across the region.

In 2024, Nam Viet F&B expanded its “VINUT” brand with ready-to-drink 320 ml bubble tea cans featuring popping boba pearls, offering flavors like mango and lychee. As a market-research analyst, I interpret this move as Nam Viet utilising its production capacity (600 TW containers/month cited in one listing) to serve both domestic Vietnam and export markets. Their certification suite (BRC, FSSC22000, HACCP, HALAL) signals readiness for global beverage trends, positioning them well in the growing popping-boba space.

By 2023-24, The Italian Beverage Company (UK-based) included popping boba among its product range alongside syrups and smoothies for the food-service channel. From an analyst’s viewpoint, the company’s expansion into popping boba highlights how European beverage-service suppliers are adapting to the bubble-tea trend and textured beverage demand. The strategic shift enables them to serve cafés and QSRs with on-trend toppings, helping them capture share as popping-boba usage spreads beyond Asia.

In 2024, Brilsta introduced a specialized range of popping boba made from natural sea-weed extract with a solids content of ≥ 60% and particle sizes of 9-12 mm (ambient shelf-life: 9 months). As a market-research analyst, I view this move as Brilsta positioning itself firmly in the premium drink-and-dessert toppings space, targeting cafés and dessert bars that emphasize texture, visual appeal and premium ingredients. The tailored size control and sea-weed base strengthen its ability to serve multi-format beverage and dessert applications.

In 2023, Sunnysyrup expanded its “Sunny Popping Ball” line in over 20 flavors, supplied in 3.4 kg cans, exporting to more than 100 countries. From an analyst’s standpoint, Sunnysyrup leverages its 40-year experience in beverage ingredients and strong export footprint to capture global popping-boba demand. Their OEM/ODM service capability, wide flavor breadth and direct supply to bubble-tea shops support rapid scaling in drink-service and dessert channels worldwide.

In 2024, Possmei expanded its popping boba product line to include over 20 flavours in bulk-packs (3.2 kg+, example: “Green Apple Popping Boba 3.2 kg × 4”) for global export. As a market research analyst, I see Possmei leveraging its Taiwanese headquarters plus international branches (USA, Europe) to support bubble-tea businesses worldwide—showing how a specialist popping-boba supplier is scaling its global distribution and flavour variety to match rising textural-beverage demand.

In 2023, Golden Choice in Malaysia listed “Mango Coating Juice/Boba Pearl 3.2 kg” and “Yogurt Popping Boba 3.2 kg” as part of its topping series for cafés. From an analyst’s perspective, this indicates Golden Choice is serving the regional bubble-tea and dessert channel by supplying popping boba in ready-use packaging, reinforcing its role as a regional distributor bridging global ingredient supply and Southeast Asian drink-and-dessert operators.

Conclusion

In conclusion, the global popping boba market is clearly riding a wave of innovation and consumer enthusiasm. Two major enablers stand out: first, upstream supply of hydrocolloid-rich seaweed (used in alginate production) continues to expand; second, beverage trends — especially in regions like North America where popping boba captured roughly 43.7% of the market in 2024 — further validate the value-chain.

Looking ahead, companies that align product formulations with textures, flavor variety, clean-label ingredients and distribution channels will likely capture the strongest gains. Overall, from a market research analyst’s perspective, popping boba is moving beyond novelty into a substantive category — one driven by both sensory appeal and structural beverage/food system shifts.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)