Table of Contents

Overview

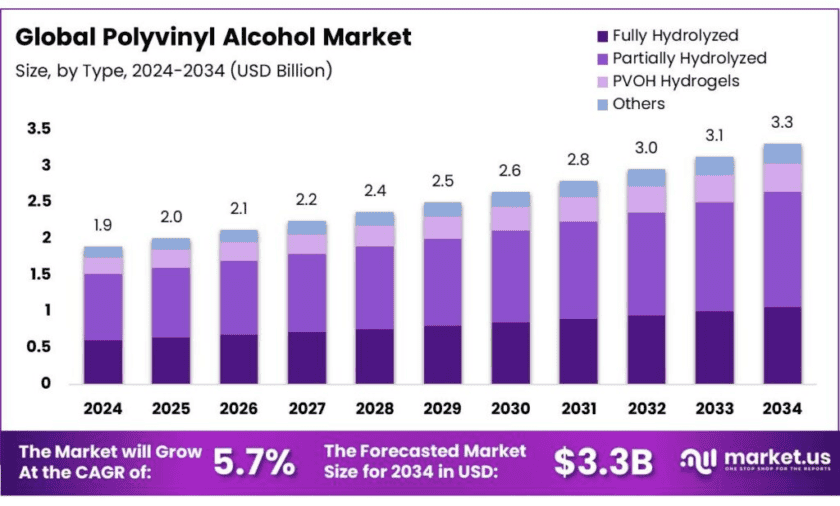

New York, NY – Dec 04, 2025 – The global polyvinyl alcohol market is projected to increase from USD 1.9 billion in 2024 to USD 3.3 billion by 2034, advancing at a CAGR of 5.7% during 2025–2034. In 2024, Asia-Pacific accounted for 46.8% of total revenue, contributing about USD 0.8 billion, supported by strong textile, detergent-pod, and packaging demand. Polyvinyl alcohol, a water-soluble synthetic polymer derived from the hydrolysis of polyvinyl acetate, is valued for its film-forming, emulsifying, and adhesive properties, and its biodegradability continues to encourage wider industrial adoption.

Global production capacity has been reported at more than 800,000 tonnes per year, with ongoing expansion by major producers to meet rising downstream consumption. Broader energy trends also influence supply conditions, as the chemical sector remains one of the world’s most energy-intensive industries, contributing to the industrial sector’s 37% share of global energy use (≈166 EJ in 2022), driving investment in efficient and flexible production technologies.

Key Takeaways

- Polyvinyl Alcohol Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 5.7%.

- Partially Hydrolyzed held a dominant market position, capturing more than a 47.9% share.

- Powder held a dominant market position, capturing more than a 34.5% share of the global polyvinyl alcohol (PVA) market.

- Food Packaging held a dominant market position, capturing more than a 31.4% share of the global polyvinyl alcohol (PVA) market.

- Asia Pacific held a dominant position in the global polyvinyl alcohol (PVA) market, capturing more than 46.8% of the total share, equivalent to a market value of approximately USD 0.8 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/polyvinyl-alcohol-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.9 Bn |

| Forecast Revenue (2034) | USD 3.3 Bn |

| CAGR (2025-2034) | 5.7% |

| Segments Covered | By Type (Fully Hydrolyzed, Partially Hydrolyzed, PVOH Hydrogels, Others), By Form (Powder, Granules, Flakes, Films (Water-Soluble), Fibers), By End-Use (Food Packaging, Paper Manufacturing, Construction, Electronics, Textile, Others) |

| Competitive Landscape | Nippon Synthetic Chemical Industry Co., Sekisui Chemical Co. Ltd., Kuraray Co. Ltd., Astrra Chemicals, Chang Chun Group, Shin-Etsu Chemical Co., Ltd, Nippon Chemical Industrial CO., LTD., Polysciences, SEKISUI CHEMICAL CO., LTD., Shandong Tiancheng Chemical Co., Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161180

Key Market Segments

By Type Analysis

In 2024, the partially hydrolyzed grade accounted for over 47.9% of the global PVA market, reflecting its broad functional suitability and strong film-forming behavior. Its balanced solubility and reliable adhesive strength supported extensive use across packaging films, textiles, paper coatings, and adhesive formulations. The material’s quick dissolution in cold or warm water also increased its adoption in water-soluble packaging formats, including detergent pods and agricultural films. In 2025, its demand is expected to rise further, driven by the expanding requirement for biodegradable and water-soluble polymers and ongoing investments in sustainable film production.

By Form Analysis

In 2024, the powder form maintained a leading position with more than a 34.5% market share, supported by its stability, purity, and ease of handling. Its longer shelf life and suitability for storage and transport strengthened its application across adhesives, construction binders, textile processing, and paper coatings. The form’s consistent solubility and performance ensured strong preference in water-soluble films and packaging applications. By 2025, increased adoption of automated production systems and a growing shift toward lightweight, economical raw materials are expected to support continued dominance of the powder segment.

By End-Use Analysis

In 2024, the food packaging segment led the market with a 31.4% share, driven by rising demand for sustainable, biodegradable, and water-soluble packaging solutions. PVA’s high barrier performance against oxygen, grease, and oil, along with its non-toxic profile, has strengthened its use in edible films, single-use packaging, and protective food-grade coatings. By 2025, growth is anticipated to remain steady as regulatory bodies reinforce limitations on traditional plastics and food manufacturers continue shifting toward environmentally responsible materials. Increasing consumer emphasis on eco-safe packaging is expected to further reinforce the segment’s leadership.

List of Segments

By Type

- Fully Hydrolyzed

- Partially Hydrolyzed

- PVOH Hydrogels

- Others

By Form

- Powder

- Granules

- Flakes

- Films (Water-Soluble)

- Fibers

By End-Use

- Food Packaging

- Paper Manufacturing

- Construction

- Electronics

- Textile

- Others

Regional Analysis

Asia Pacific Leads with 46.8% Share Driven by Strong Industrial and Packaging Demand

In 2024, Asia Pacific accounted for more than 46.8% of the global polyvinyl alcohol (PVA) market, representing an estimated value of USD 0.8 billion. This leadership was supported by large-scale production capacity, rising consumption across industrial applications, and regulatory initiatives promoting sustainable materials.

China, Japan, South Korea, and India remained key contributors, with China alone representing nearly 55% of global PVA manufacturing capacity, underscoring its role as the leading producer and consumer. Expanding packaging, textile, and construction activities across the region continued to support robust demand for both partially and fully hydrolyzed PVA grades.

Top Use Cases

Textile & Fabric Processing: PVA is widely used as a warp‑sizing agent in textile manufacturing to protect yarns during weaving. It reduces yarn breakage and improves weaving efficiency, and being water‑soluble allows easy removal after weaving without leaving residues. According to recent data, roughly 37% of global PVA consumption is allocated to textile applications.

Paper, Packaging & Coatings: PVA enhances paper quality as a coating or binder, improving strength, printability, moisture resistance, and gas or grease barrier properties — especially relevant for specialty paper and packaging. In packaging, PVA enables water‑soluble films, used for items such as detergent pods, dishwasher tablets, and agro‑chemical packaging, offering a biodegradable alternative to conventional plastics.

Construction and Building Materials: In construction, PVA is blended into cement, mortar, tiles and plasters to improve adhesion, flexibility, water resistance, and to reduce cracking. Its use enhances durability and workability of cementitious materials. PVA‑modified mortars and tile adhesives are increasingly adopted in modern infrastructure and finishing works.

Sustainable & Water‑Soluble Packaging Films: PVA enables the production of water‑soluble, biodegradable packaging films, reducing plastic waste and improving environmental sustainability. Products such as laundry detergent pods or water-soluble packaging bags are typical use cases. This segment is one of the fastest-growing areas for PVA, reflecting growing regulatory and consumer preference for greener packaging solutions.

Recent Developments

Nippon Synthetic Chemical Industry Co. — In the polyvinyl alcohol sector, Nippon Synthetic Chemical produces high-quality PVA under its “Gohsenol™” brand, supplying PVA resins and films for adhesives, packaging, textiles and specialty industrial uses. As of 2024, the company continues to leverage ISO‑certified manufacturing and a diversified product line—including films for LCD polarizers and PVA resins for adhesives—serving both domestic and export markets.

Sekisui Chemical Co. Ltd. — Sekisui remains a major PVA supplier, with a legacy dating to 1952, producing PVA resins that serve in coatings, adhesives, water‑soluble films, and specialty plastics. Sekisui Chemical Co. Ltd. — Sekisui remains a major PVA supplier, with a legacy dating to 1952, producing PVA resins that serve in coatings, adhesives, water‑soluble films, and specialty plastics.

Kuraray markets polyvinyl alcohol under the brand KURARAY POVAL™, supplying a wide variety of grades used in paper, adhesives, textiles, construction, packaging, ceramics, and electronics. In January 2025, Kuraray announced that its global PVA production capacity would be increased by 40,000 tons per year to meet growing demand from construction and automotive sectors. The firm’s recent sustainability initiative has reduced the carbon footprint of its POVA production to 1.62 kg CO₂ equivalent per kg—down from 2.36 kg CO₂ equivalent in 2023—highlighting a shift toward more environmentally responsible manufacturing.

No credible public domain evidence was found that confirms Astrra Chemicals (or similarly spelled Astra/Astrra Chemicals) produces or supplies polyvinyl alcohol (PVA). Available company documentation indicates that the firm specializes in industrial chemicals and coatings for metal finishing, construction, and associated sectors. Consequently, it appears that Astrra Chemicals does not operate in the PVA segment, or at least there is no verifiable source showing its involvement in PVA resin or film production as of 2024–2025.

Chang Chun Group is a major global producer of polyvinyl alcohol (PVA/PVOH), offering a wide range of resin grades used in adhesives, coatings, textiles, paper, and specialty industrial applications. By 2024, its PVA production capacity reportedly reached about 60,000 metric tonnes per year, meeting both domestic and export demand across Asia, Europe, the Americas, and Africa. Chang Chun’s broad product line and global distribution network support its position as a competitive and cost‑effective supplier in the PVA market.

Shin-Etsu Chemical supplies polyvinyl alcohol (POVAL) alongside its broader resin and chemical portfolio, making it a recognized PVA provider globally. As of 2024, the company maintained leading global positions across multiple resin categories and also listed PVA among its supplied products. The firm leverages its extensive manufacturing infrastructure and global supply capabilities to provide stable and diversified PVA resin supply to customers in packaging, industrial, and speciality‑material segments.

Nippon Chemical Industrial Co., Ltd. does not appear to list polyvinyl alcohol (PVA) among its core product lines. Its 2025 financial report shows net sales of JPY 36,940 million and ordinary profit of JPY 3,135 million for FY 2025, but the publicly available product catalogue refers exclusively to inorganic chemicals, specialty chemicals, and electronic/ceramic materials—not PVA resins or films. Nippon Chemical Industrial Co., Ltd. does not appear to list polyvinyl alcohol (PVA) among its core product lines. Its 2025 financial report shows net sales of JPY 36,940 million and ordinary profit of JPY 3,135 million for FY 2025, but the publicly available product catalogue refers exclusively to inorganic chemicals, specialty chemicals, and electronic/ceramic materials—not PVA resins or films.

Polysciences, Inc. supplies high-purity polyvinyl alcohol (PVA) polymers for research, pharmaceutical, biomedical, and specialty‑use applications. Its catalog includes PVA with molecular weights around 133,000 MW (99 % hydrolyzed) and 25,000 MW (88 % hydrolyzed), available from its U.S.-based manufacturing facility as of 2025. This product offering supports high‑precision uses such as hydrogel formation, drug‑delivery systems, water‑soluble films, and as a binding or coating polymer for lab and medical‑grade applications.

Conclusion

The outlook for Polyvinyl Alcohol (PVA) appears robust as the material continues to demonstrate versatility, sustainability, and growing end‑use demand. Market estimates suggest that global PVA consumption reached approximately 1.45 million tons in 2024, with the industry increasingly driven by packaging, textile, construction, and medical applications. The rising global emphasis on eco‑friendly, water‑soluble, and biodegradable materials is reinforcing PVA’s appeal, particularly in packaging films, detergent pods, and sustainable textile processing.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)