Table of Contents

Overview

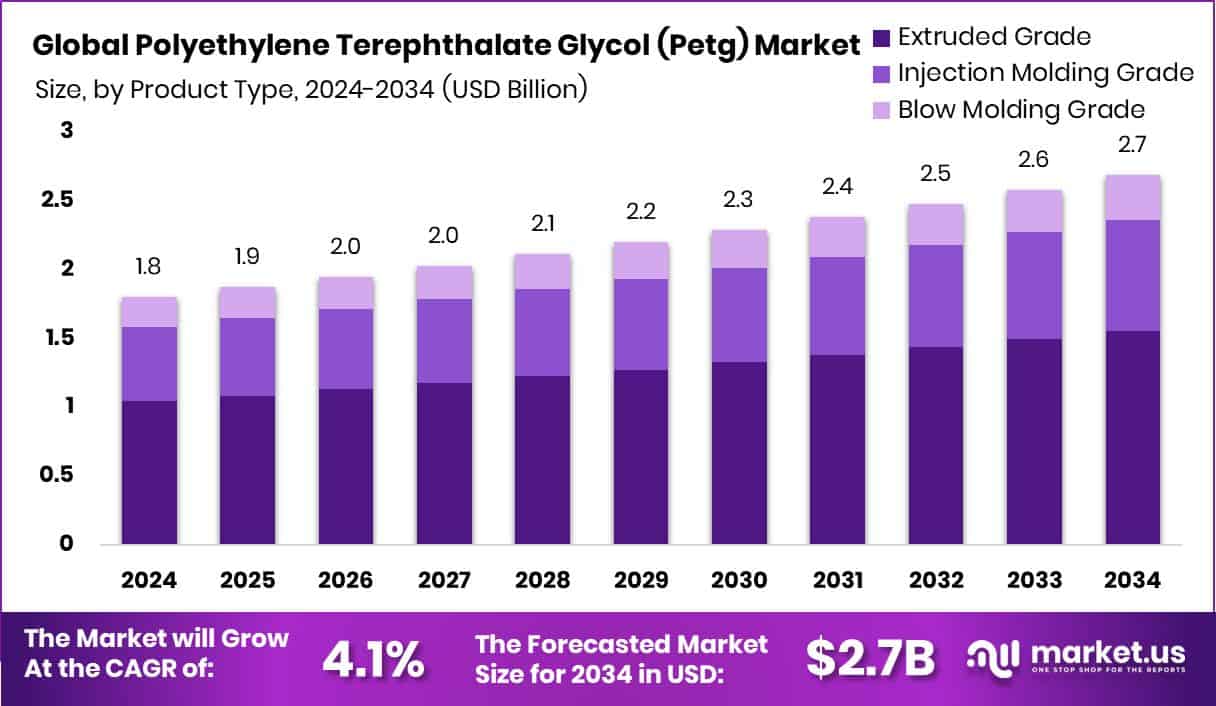

New York, NY – Dec 03, 2025 – The global Polyethylene Terephthalate Glycol (PETG) market is showing steady expansion, projected to grow from USD 1.8 billion in 2024 to around USD 2.7 billion by 2034, at a CAGR of 4.1% between 2025 and 2034. North America continues to dominate, holding a 43.10% share, valued at nearly USD 0.7 billion, supported by strong consumer goods and packaging demand.

PETG is a modified form of PET enhanced with glycol, which improves clarity, flexibility, and impact strength. These properties make PETG suitable for packaging, medical devices, electronics housings, and 3D printing filaments. Its ease of thermoforming, chemical resistance, and crystal-clear appearance help manufacturers balance performance with processing efficiency.

Market growth is closely tied to expansion in beauty, personal care, and premium consumer packaging. For example, Renee Cosmetics securing USD 30 million in fresh funding along with another USD 30 million in a Series C round at a USD 200 million valuation directly supports higher packaging demand, including PETG containers and displays. Similarly, SUGAR Cosmetics raising USD 5 million from Anicut Capital and K-beauty startups obtaining USD 4.9 million in early 2025 are accelerating new product launches that require visually appealing, durable packaging.

An important opportunity is emerging from the halal beauty market, expected to reach USD 118 billion by 2028. With GCC-backed investments and stronger anti-counterfeiting measures, PETG’s traceability, safety, and premium finish position it as a preferred packaging material in this fast-evolving segment.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-polyethylene-terephthalate-glycol-petg-market/request-sample/

Key Takeaways

- The global Polyethylene Terephthalate Glycol (Petg) Market is expected to be worth around USD 2.7 billion by 2034, up from USD 1.8 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034.

- Extruded grade dominated the PETG market with 57.9%, driven by strong clarity and easy processing qualities.

- Containers and packaging led the market with 44.2%, supported by rising consumer product launches globally.

- The food and beverage segment held 47.1%, driven by rising demand for safe, transparent packaging.

- The North American strong packaging industry supported the 43.10% share and USD 0.7 Bn value.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=167039

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.8 Billion |

| Forecast Revenue (2034) | USD 2.7 Billion |

| CAGR (2025-2034) | 4.1% |

| Segments Covered | By Product Type (Extruded Grade, Injection Molding Grade, Blow Molding Grade), By Application (Prototypes, Containers and Packaging, Tools, Jigs, Fixtures, Equipment and Machinery, Others), By End-Use (Food and Beverage, Cosmetics, Medical, Others) |

| Competitive Landscape | Eastman, SK Chemicals, Henan Yinjinda New Materials, PolimexSrl, Magical Film Enterprises, Allen Plastic Industries |

Key Market Segments

By Product Type Analysis

In 2024, the Extruded Grade segment led the By Product Type category in the Polyethylene Terephthalate Glycol (PETG) market, accounting for a 57.9% share. This dominance was driven by its combination of high transparency, strong impact strength, and consistent processing behavior, making it suitable for packaging, cosmetic containers, medical trays, and point-of-sale displays. Manufacturers favored this grade because it allows smooth thermoforming while preserving visual clarity across high-volume production.

Growth in premium beauty, personal care, and consumer goods products further supported demand for Extruded Grade PETG, as brands increasingly focused on shelf-appeal and packaging reliability. At the same time, the broader shift toward recyclable and long-lasting plastic materials reinforced its market leadership. These factors together enabled Extruded Grade PETG to maintain its leading position throughout the year, as producers and brand owners sought materials that balance appearance, durability, and manufacturing efficiency.

By Application Analysis

In 2024, the Containers and Packaging segment emerged as the leading application in the Polyethylene Terephthalate Glycol (PETG) market, capturing a 44.2% share. This strong position was supported by rising use of PETG in cosmetic bottles, personal care packs, food containers, and clear display packaging where both strength and visual appeal are essential. Brands favored PETG for its ability to enhance shelf presentation while remaining durable during storage and transportation.

PETG’s easy thermoforming characteristics and resistance to chemicals allowed manufacturers to develop lightweight yet robust packaging designs without sacrificing product safety. Increasing product introductions across beauty, personal care, and lifestyle segments further boosted demand for PETG-based packaging solutions. These factors collectively reinforced Containers and Packaging as the most widely adopted PETG application during the year, driven by consistent performance, design flexibility, and growing emphasis on premium packaging formats.

By End-Use Analysis

In 2024, the Food and Beverage segment led the By End-Use category of the Polyethylene Terephthalate Glycol (PETG) market, holding a 47.1% share. This dominance was driven by increasing demand for transparent, strong, and contamination-resistant packaging for bottles, trays, and protective covers. PETG stood out for maintaining product visibility while offering high impact resistance, which supports both safety and premium shelf presentation.

Manufacturers were further encouraged by PETG’s suitability for food-grade processing, enabling reliable and compliant packaging solutions. Growing consumption of convenience foods, ready-to-drink beverages, and clear packaging formats continued to strengthen PETG adoption.

As consumers showed greater preference for visually appealing and safe packaging, PETG remained a key material choice, effectively balancing durability, hygiene, and aesthetic appeal across food and beverage applications.

Regional Analysis

In 2024, North America led the Polyethylene Terephthalate Glycol (PETG) market with a 43.10% share, valued at USD 0.7 billion. This dominance was driven by strong demand for premium packaging, expanding personal care products, and increasing use of PETG in food and beverage containers. The region’s advanced manufacturing capabilities and high acceptance of clear, durable packaging formats reinforced its leading position.

Europe maintained stable demand for PETG across cosmetics, pharmaceuticals, and industrial uses, supported by strict quality regulations and a growing focus on recyclable materials. Asia Pacific experienced rising PETG consumption as consumer goods markets expanded and investments in modern packaging technologies increased across major economies.

The Middle East & Africa recorded gradual adoption as food, beverage, and retail industries upgraded packaging standards. Latin America also showed steady growth, supported by increasing demand for clear, impact-resistant packaging within personal care and household product segments.

Top Use Cases

- Food & Beverage Packaging: PETG is widely used for bottles, clamshells, trays and food containers because it is clear, durable, and food-safe — letting consumers see what’s inside while keeping contents protected. Its impact resistance and chemical resistance make it ideal for items like drink bottles or storage containers.

- Medical Device & Pharmaceutical Packaging: Because PETG can meet regulatory standards and withstand sterilization (e.g. gamma-irradiation, EtO), it is used to package medical devices, surgical tools, implants, and pharmaceutical blister packs. Its clarity helps inspect contents, and its strength protects sensitive items.

- 3D Printing — Prototypes and Functional Parts: PETG filament is popular in 3D printing: it combines strength and flexibility, resists chemicals and impact, and prints more easily than some other plastics. Thus, it’s used to create durable prototypes, tooling jigs, housings, or even mechanical parts.

- Retail Displays, Signage & Promotional Packaging: Because PETG remains clear, glossy, and can be thermoformed or molded into complex shapes, it is used for point-of-purchase displays, retail stands, signage, blister packs, and display windows — anywhere visual clarity and attractive finish matter.

- Protective Covers, Machine Guards & Enclosures: In industrial and electronics settings, PETG is often used to make transparent protective covers, safety shields, equipment enclosures, or protective casings — providing impact resistance and visibility without heavy or opaque materials.

- Cosmetic & Personal-Care Packaging: Brands use PETG for packaging cosmetics, skincare, and personal-care products because it delivers clear, premium-looking containers that resist breakage, show off contents nicely, and maintain product safety — ideal for makeup bottles, creams, and toiletries.

Recent Developments

- In January 2025, Eastman received RecyClass recyclability approval for eight of its specialty PET resins (and their “Renew” recycled-content equivalents) — including several grades compatible with PET bottle recycling processes.

- In January 2025, SK Chemicals unveiled its 2025 strategy: the company will focus on high-value-added specialty materials, especially copolyesters, and expand its global circular-recycling business. It reorganized its structure into two key divisions: Green Materials and Recycling.

Conclusion

The Polyethylene Terephthalate Glycol (PETG) market continues to progress steadily as industries seek materials that combine clarity, durability, and processing flexibility. Its growing use across packaging, personal care, food, medical, and consumer goods highlights its ability to meet both aesthetic and performance expectations.

PETG benefits from rising preference for lightweight, recyclable, and impact-resistant plastics, especially in premium and transparent packaging formats. Advancements in sustainable production and circular material solutions are further strengthening market confidence.

As manufacturers focus on product safety, visual appeal, and efficient processing, PETG remains well-positioned as a reliable plastic material supporting evolving design trends and long-term application needs across global end-use sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)