Table of Contents

Overview

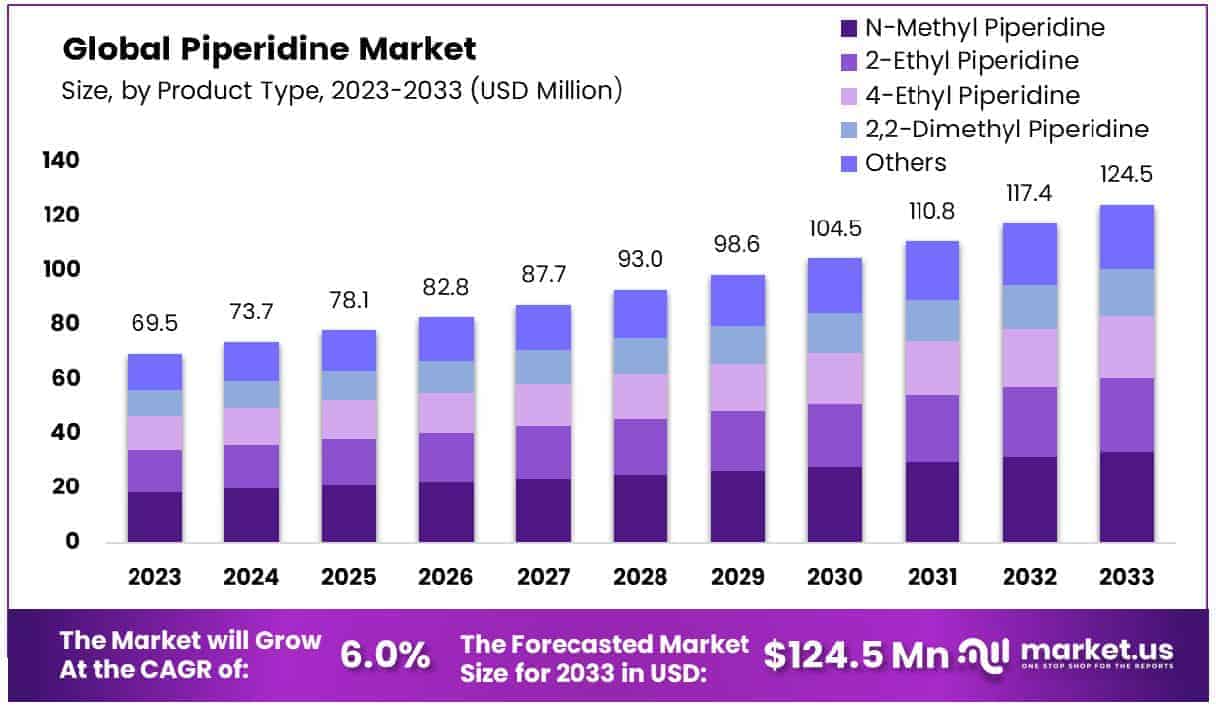

New York, NY – January 9, 2025 – The global piperidine market, valued at USD 69.5 million in 2023, is anticipated to grow to USD 124.5 million by 2033, achieving a CAGR of 6.0% during the forecast period from 2024 to 2033. This robust expansion is primarily driven by the increasing demand from the pharmaceutical and agrochemical sectors, where piperidine is essential for the synthesis of various therapeutic agents and agrochemical products. Moreover, advancements in synthetic organic chemistry have enhanced the production efficiency and scalability of piperidine, broadening its applications across multiple industries

Recent developments in the market include strategic expansions such as Avantor’s new manufacturing and distribution hub in Singapore, which aims to enhance the company’s capabilities and reach in the Asia Pacific biopharma market. The market faces challenges, however, from stringent environmental regulations and the volatility in raw material prices, which could impede growth by increasing operational costs and affecting profitability.

Key Takeaways

- Piperidine Market Growth Projected to reach USD 124.5 million by 2033, up from USD 69.5 million in 2023, with a CAGR of 6.0% from 2024 to 2033.

N-methyl piperidine captures a 28.6% market share. - 98% purity variant is the most prevalent, with a 72.4% market presence.

- Pharmaceuticals are the leading application, accounting for 37.5% of usage.

- Asia-Pacific holds the largest market share of 37.2%, valued at USD 25.8 million in 2023.

Key Market Segments

In 2023, N-methyl piperidine emerged as a significant contender in the Piperidine Market’s product type segment, capturing over 28.6% of the market. Its substantial share is credited to its extensive use in diverse industrial applications such as pharmaceuticals and agrochemicals, where it serves as a foundational element for synthesis. The robust demand for N-Methyl Piperidine is due to its ability to enhance the chemical properties of final products, improving their stability and potency, especially in pharmaceutical formulations.

Regarding purity, the 98% purity level dominated the market, accounting for more than 72.4% of the segment. The highest demand within this category was for the 99% purity type, extensively used in high-grade pharmaceutical applications and complex chemical syntheses. This purity level is crucial for ensuring the efficacy and safety of products, particularly in sensitive applications like drug development and biotechnology, where even minor impurities can significantly impact the final outcomes.

In the application segment of the market, pharmaceuticals held a dominant position, accounting for more than 37.5% of the market share. Piperidine’s pivotal role in manufacturing various pharmaceutical compounds, such as analgesics, antipsychotics, and anticonvulsants, drives this dominance. The segment’s growth is fueled by continuous advancements in medical research and the escalating demand for innovative therapeutic agents, highlighting the critical importance of high-quality Piperidine in the development and production of drugs.

Regional Analysis

The piperidine market is characterized by distinct regional growth dynamics influenced by various economic, industrial, and technological factors. In North America, the presence of major pharmaceutical companies and substantial investments in agritech innovation drive the demand for piperidine. Europe’s market growth is supported by stringent regulatory standards that promote the use of high-quality chemical intermediates, coupled with a focus on sustainable practices in chemical manufacturing.

The Asia-Pacific region is the most significant, holding a dominant market share of 37.2% with a valuation of USD 25.8 million. This prominence is due to the rapid expansion of the pharmaceutical and agrochemical sectors in countries like China and India, enhanced by urbanization and modern agricultural techniques.

The Middle East & Africa are experiencing gradual growth, driven by the development of their chemical and pharmaceutical sectors and increased industrial activities and investments. Latin America, while smaller in market size, is seeing growth spurred by increased agricultural activities and a focus on bio-agricultural developments that utilize piperidine.

Top Use Cases of Piperidine Market

- Pharmaceuticals: Piperidine is extensively used in the pharmaceutical industry to synthesize a variety of therapeutic agents, including analgesics, antidepressants, and antipsychotics. It serves as a critical building block for active pharmaceutical ingredients (APIs), contributing to the development of new and effective medications.

- Agrochemicals: In the agrochemical industry, piperidine is employed in the production of pesticides, herbicides, and fungicides. Its chemical properties are leveraged to enhance the efficacy of crop protection chemicals, which helps improve yield and protect crops from pests and diseases.

- Rubber Industry: Piperidine derivatives are used as accelerators in the vulcanization of rubber. This application is crucial in manufacturing various rubber products, enhancing the efficiency and quality of the vulcanization process.

- Chemical Synthesis: Due to its reactivity, piperidine is a valuable reagent in organic synthesis, used in creating complex organic compounds. This includes its use in synthesizing solvents and as a catalyst in various chemical reactions.

- Research and Development: Piperidine is also pivotal in research settings, particularly in chemical research where it is used to develop new synthetic pathways and processes. Its utility in research labs underscores its fundamental role in advancing chemical science.

Emerging Trends

- Increased Use in Pharmaceutical Applications: Piperidine’s role as a key intermediate in synthesizing active pharmaceutical ingredients (APIs) is gaining prominence. Its application in producing medications like analgesics, antipsychotics, and anticonvulsants is expanding due to the rising demand for innovative therapies and advancements in drug development processes. This trend is driven by the pharmaceutical industry’s rapid growth globally.

- Rising Demand in Agrochemical Sector: The agrochemical industry relies on piperidine for manufacturing pesticides, herbicides, and fungicides. The push for higher agricultural productivity to meet food security challenges is spurring the demand for piperidine-based formulations. Emerging economies in Asia-Pacific and Latin America are particularly driving this trend.

- Focus on High-Purity Grades: The growing emphasis on product efficacy and safety in sensitive applications, such as drug synthesis and biotechnology, is leading to increased demand for high-purity piperidine (98% and 99% purity). This trend aligns with stricter quality standards and regulatory requirements, especially in Europe and North America.

- Green Chemistry and Sustainable Practices: Sustainability is becoming a critical focus for manufacturers. Efforts to develop environmentally friendly production processes for piperidine, such as adopting green chemistry principles, are gaining traction. This trend is fueled by global environmental regulations and the need to minimize ecological impact.

- Technological Advancements in Production: Innovations in chemical synthesis and process optimization are enhancing production efficiency and scalability. Advancements in catalysis and biotechnological approaches are reducing costs and environmental impact while increasing yield and product quality.

- Growth in Emerging Markets: The Asia-Pacific region, particularly China and India, is witnessing significant growth in piperidine production and consumption. Rapid industrialization, urbanization, and expansion of the pharmaceutical and agrochemical industries in these regions are key contributors to this trend.

- Applications in Specialty Chemicals and R&D: Beyond traditional industries, piperidine is being explored in niche applications, including specialty chemicals and advanced research. Its role in developing new materials and synthetic pathways is expanding, driven by increasing R&D activities across industries.

Recent Developments

- In 2023, Evonik maintained its research and development expenses at the previous year’s level of €443 million, despite the challenging economic situation.

- Merck KGaA, a leading science and technology company, reported group net sales of €21.0 billion and an EBITDA pre of €5.9 billion for the fiscal year 2023.

- Eastman Chemical Company, a global specialty materials firm, reported sales revenue of $2.46 billion in the third quarter of 2024, marking a 9% increase from $2.27 billion in the same quarter of 2023.

- Mitsubishi Chemical Corporation, a core company of Mitsubishi Chemical Group, reported consolidated sales revenue of ¥4,387.2 billion for the fiscal year ending March 31, 2024, a 5.3% decrease from the previous year.

- Financially, for the nine months ending September 30, 2024, Nanjing Red Sun reported sales of CNY 2,702.54 million, a slight increase from CNY 2,652.87 million in the same period the previous year. Net income for this period was CNY 26.75 million, up from CNY 23.45 million year-over-year.

- In the third quarter of the fiscal year 2024, Jubilant Pharmova reported a total income of ₹1,713 crore, marking a 10% increase from the same period in the previous year. This growth was driven by improved performance across segments, including radiopharmaceuticals and allergy immunotherapy.

- In the fiscal year 2024, the company reported a 5.3% decrease in consolidated sales revenue, totaling ¥4,387.2 billion, compared to the previous year.

Conclusion

In conclusion, the piperidine market is expected to witness steady growth due to its wide applications in industries such as pharmaceuticals, agrochemicals, and chemical manufacturing. Piperidine serves as a crucial building block in the synthesis of various compounds, including drugs, pesticides, and specialty chemicals. Increasing demand for effective pharmaceutical products and agrochemical formulations is likely to drive market expansion.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)