Table of Contents

Overview

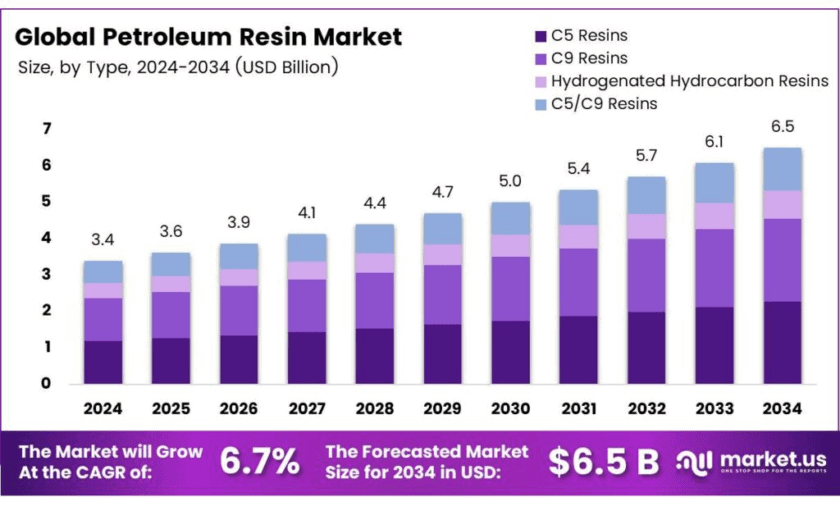

New York, NY – Dec 02, 2025 – The global petroleum resin market is projected to reach USD 6.5 billion by 2034, rising from USD 3.4 billion in 2024 and advancing at a 6.7% CAGR between 2025 and 2034. Petroleum resin, or hydrocarbon resin, is produced through the polymerization of petroleum-based monomers such as styrene, vinyltoluene, and alpha-methylstyrene, and is widely applied in adhesives, coatings, inks, and rubber compounds.

- Key physical characteristics include a softening point of 120 °C (±5 °C), Gardner color ≤10, bromine number ≤25, acid value ≤0.1, specific gravity of 1.05–1.10, and ash content ≤0.05%. These specifications support compliance with FDA 175.105 for adhesive applications. Commercial packaging often includes 25 kg bags or 500 kg jumbo bags, with recommended storage below 30 °C to preserve quality.

C9 petroleum resin, also known as aromatic petroleum resin, is produced from aromatic hydrocarbons, aldehydes, and terpenes containing roughly nine carbon atoms. It typically appears as light yellow to brown granules or flakes, with an average molecular weight of 2,000–5,000 and relative density of 0.97–1.04. Its physical performance is defined by a softening point of 80–140 °C, glass transition temperature around 81 °C, refractive index of 1.512, flash point of 260 °C, acid value 0.1–1.0, and iodine value 30–120, indicating moderate unsaturation. Available in aliphatic, aromatic, and modified grades, petroleum resin is valued for its transparency, tunable formulations, and adaptability across industrial applications.

Key Takeaways

- The Global Petroleum Resin Market is expected to reach USD 6.5 billion by 2034 from USD 3.4 billion in 2024, with a CAGR of 6.7%.

- C5 Resins held a 34.9% market share in 2024, valued for tackifying in adhesives and rubber compounding.

- Hot-melt Adhesives dominated with a 38.1% share in 2024, enhancing bonding in the packaging and automotive sectors.

- The Building and Construction sector led with a 28.3% share in 2024, driven by coatings and sealants.

- Asia-Pacific captured a 45.8% market share in 2024, valued at USD 1.5 billion, led by China and India.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-petroleum-resin-market/free-sample/

Report Scope

| Market Value (2024) | USD 3.4 Bn |

| Forecast Revenue (2034) | USD 6.5 Bn |

| CAGR (2025-2034) | 6.7% |

| Segments Covered | By Type (C5 Resins, C9 Resins, C5/C9 Resins, Hydrogenated Hydrocarbon Resins), By Application (Hot-melt Adhesives, Pressure-sensitive Adhesives, Rubber Compounding and Tires, Road-marking Paints and Industrial Coatings, Printing Inks and Flexible Packaging Films), By End-Use (Building and Construction, Tire Industry, Personal Hygiene, Consumer Goods, Automotive, Others) |

| Competitive Landscape | Arakawa Chemical Industries Ltd., Braskem, China Petrochemical Corporation, Cray Valley, Henghe Material and Science Technology Co., Ltd., Idemitsu Kosan Co., Ltd, Kolon Industries, Inc., Kumho Petrochemical Co., Ltd., Neville Chemical, PetroChina Company Limited, Puyang Tiancheng Chemical Co., Ltd, Shandong Qilong Chemical Co., Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161198

Key Market Segments

By Type – C5 Resins

In 2024, C5 resins accounted for 34.9% of the global petroleum resin market, establishing themselves as the leading segment. These aliphatic resins, produced from hydrocarbons such as pentene and isoprene, are widely valued for their strong tackifying performance. Their high compatibility with natural and synthetic rubbers supports extensive use in tire manufacturing, road-marking paints, and hot-melt adhesives. Growing infrastructure activities and demand within the packaging and construction sectors are expected to sustain stable consumption. Expanding production capacities across Asia-Pacific are also expected to improve supply availability and reinforce growth for the C5 resin segment.

By Application – Hot-Melt Adhesives

Hot-melt adhesives dominated the market in 2024 with a 38.1% share, reflecting their strong reliance on petroleum resins as tackifiers to enhance adhesion, flexibility, and thermal resistance. Their rapid setting time and versatility across substrates support applications in packaging, woodworking, automotive, and construction. Growth in flexible packaging and furniture manufacturing continues to drive demand. Industrial expansion in Asia-Pacific and North America, along with a shift toward solvent-free and high-performance adhesive solutions, is expected to sustain the leading position of this segment.

By End-Use – Building and Construction

The building and construction sector led the petroleum resin market in 2024 with a 28.3% share. Petroleum resins are extensively used to improve adhesion, durability, and weather resistance in coatings, sealants, waterproofing membranes, and road-marking materials. Rising urban development, particularly in emerging economies, along with increased government spending on road upgrades, housing, and smart infrastructure projects, has supported segment expansion. Continued preference for cost-efficient and high-performance materials is expected to maintain the strong presence of petroleum resins in construction-related applications.

List of Segments

By Type

- C5 Resins

- C9 Resins

- C5/C9 Resins

- Hydrogenated Hydrocarbon Resins

By Application

- Hot-melt Adhesives

- Pressure-sensitive Adhesives

- Rubber Compounding and Tires

- Road-marking Paints and Industrial Coatings

- Printing Inks and Flexible Packaging Films

By End-Use

- Building and Construction

- Tire Industry

- Personal Hygiene

- Consumer Goods

- Automotive

- Others

Regional Analysis

Asia-Pacific Dominates the Petroleum Resin Market with 45.8% Share in 2024

In 2024, the Asia-Pacific region accounted for 45.8% of the global petroleum resin market, reaching an estimated value of USD 1.5 billion. This dominance was supported by the region’s rapidly expanding industrial base, driven by major economies such as China, India, South Korea, and Japan, which together contribute significantly to global demand for adhesives, coatings, and rubber compounding materials.

Strong growth in infrastructure development, rising automotive production, and increasing consumption of pressure-sensitive adhesives continue to accelerate resin demand across the region. China remains the leading production center, backed by large petrochemical complexes and integrated refining operations that ensure a stable supply of C5 and C9 feedstocks, strengthening the downstream value chain for resin manufacturers.

In India, supportive initiatives such as the Petroleum, Chemicals and Petrochemicals Investment Regions (PCPIR) policy and accelerated infrastructure development under “Make in India” have attracted substantial domestic and international investment in chemical and polymer production. These structural advantages—feedstock integration, cost competitiveness, and strong end-use demand—continue to reinforce Asia-Pacific’s leadership. The region is expected to maintain its dominant position and remain the primary growth engine for the global petroleum resin market over the coming decade.

Top Use Cases

Adhesives And Hot-Melt Tackifiers: Petroleum resins are widely used as tackifiers in hot-melt and pressure-sensitive adhesive (PSA) formulations to improve initial tack, peel strength and wetting. Typical formulation practice places tackifier content in the adhesive at ~10–50 wt.% (common preferred range 20–40 wt.% for many PSAs; hot-melt tackifier fractions often 10–25% depending on polymer system). Softening points for common C5-based tackifiers are often in the 85–100 °C range, and resin melt viscosities at 125 °C can be in the 20,000–24,000 cps band—important for processing.

Modifier and Binder in Coatings & Printing Inks: Aromatic (C9) and modified C5/C9 resins are blended into solvent-based and certain radiation-cure coatings and printing-ink vehicles to raise gloss, improve drying and enhance block resistance. Typical resin softening points vary by grade (commonly 80–140 °C), and C9 resins often exhibit molecular weights around 2,000–5,000—parameters that influence hardness and gloss in coatings. Their good solubility in hydrocarbon solvents makes them a standard binder/modifier in offset and gravure inks.

Rubber Compounding & Tyre Additives: C5 and C9 resins are added to rubber mixes (SBR, NR) as tackifiers, softeners or partial extenders to improve green tack and processability. They are frequently used in tire and auto-rubber compounds because of strong compatibility with elastomers and limited interference with vulcanization. Resin additions are typically modest (single-digit to low-teens wt.% of compound) but materially improve handling and bonding of rubber sheets.

Hot-Melt Road Marking Paints & Sealants: Aliphatic C5 resins are favoured in thermoplastic road-marking formulations and hot-melt sealants for their tack, rapid set and weather resistance. Because these resins improve initial adhesion and hardness, they are a standard ingredient in road marking binders and in sealants that must set quickly on pavement. Softening points and glass transition temperatures (resin Tg values) are selected to match service temperature ranges for pavement applications.

Pressure-Sensitive Tapes, Labels and Packaging: In tape and label adhesives, hydrocarbon resins are used to tune tack, peel and cohesion. Formulators typically use 20–60 wt.% tackifier content in certain tape formulations (many practical PSA formulations center around 15–35 wt.% tackifier). The result is strong initial tack to varied substrates (cardboard, film, metal) plus cost-efficient performance for high-volume packaging lines.

Electrical Varnishes, Flooring & Specialist Applications: Because of their solvent compatibility and film-forming ability, petroleum resins are used in insulating varnishes, adhesive primers, floor coatings and specialty compounding (release agents, dipping agents). Grades with low color (Gardner color ≤ 4–6 in 50% solids) and low acid values (<1) are specified for colour-sensitive and electrical applications. Typical commercial packaging: 25 kg bags or 500 kg jumbo bags; recommended storage <30 °C to preserve quality.

Recent Developments

Arakawa Chemical Industries remained focused in 2024–2025 on specialty hydrocarbon resins and allied polymer additives used in adhesives, coatings and printing inks. In 2024 the company emphasized product quality and low-color grades suited to high-end coatings and electrical varnish applications, while incremental capacity and formulation support helped strengthen downstream supply to Japanese and Asia-Pacific converters. Commercial activity in 2025 continued to prioritise hydrogenated and modified resin grades that improve thermal stability and colour, supporting demand from automotive and electronics coatings segments.

Braskem, a leading petrochemical producer, continued to supply base hydrocarbons and polymer intermediates supporting petroleum-resin manufacture through 2024–2025. During 2024 the company’s integration across feedstock, monomer and polymer production underpinned regional cost competitiveness in Latin America, helping resin processors secure C5/C9 feedstocks. In 2025 Braskem’s focus on operational stability and selective downstream partnerships aimed to stabilise supply for adhesives and rubber compounding customers, while sustainability initiatives (feedstock optimisation and circular-economy projects) were advanced to align product lines with evolving customer ESG requirements.

China Petrochemical Corporation (Sinopec) continued to act as a major upstream and midstream supplier for petroleum resin feedstocks in 2024–2025, with integrated refining and petrochemical complexes supporting reliable C5/C9 availability for resin producers. In 2024 the group’s operational focus remained on securing feedstock integration and optimising cracker yields to stabilise supply for adhesives, coatings and rubber compounds. Through 2025 capacity optimisation and downstream partnerships were pursued to support domestic resin processors while aligning production with tighter environmental and product-quality requirements.

Cray Valley remained positioned as a specialty hydrocarbon-resin and additive supplier serving adhesives, coatings and construction markets in 2024–2025. The company’s portfolio of C5/C9 and modified resins was applied as tackifiers and binders, with commercial emphasis on low-colour and hydrogenated grades for high-end coatings and electrical applications. In 2024 Cray Valley’s commercial activity focused on technical support to converters and incremental capacity planning; into 2025 the firm pursued formulation collaborations and sustainability initiatives to improve product lifecycle impacts and customer value.

Henghe Material and Science Technology is positioned as a regional supplier of hydrocarbon resins and polymer additives serving adhesives, inks and rubber compounding. In 2024 the company focused on strengthening local production capacity and improving low-colour, hydrogenated grades to meet demand from packaging and hot-melt adhesive formulators. In 2025 product development priorities were reported to include improved thermal stability and lower odor for electrical and coating applications, while sales channels were expanded across Asia-Pacific to support downstream converters and regional exports.

Idemitsu Kosan continued to supply specialty petroleum resins and polymer intermediates to coatings, adhesives and automotive markets in 2024, with emphasis on high-purity and hydrogenated grades suited to colour-sensitive applications. The company’s 2024 activities were oriented towards operational stability and tighter quality controls to meet stringent OEM and electronics standards. In 2025 strategic priorities were reported to include feedstock optimisation and incremental moves toward circular feedstock trials, alongside technical support programmes for formulators seeking lower VOC and longer-life resin solutions in demanding end-uses.

In 2024, Henghe Material and Science Technology was positioned as a regional hydrocarbon-resin and polymer-additive supplier focused on adhesives, inks and rubber compounding. Emphasis was placed on expanding local manufacturing capacity and supplying low-colour, hydrogenated grades to meet demand from packaging and hot-melt formulators. During 2025 product development priorities were reported to centre on improved thermal stability, lower odour and enhanced colour performance for electrical and coating applications, while commercial efforts targeted broader Asia-Pacific distribution and closer technical support for downstream converters.

In 2024, Kumho Petrochemical continued to supply base petrochemical feedstocks and specialty hydrocarbon resins to adhesives, coatings and rubber industries, leveraging integrated cracker and refining assets to stabilise C5/C9 availability for resin makers. Operational focus was placed on optimising capacity utilisation and strengthening downstream partnerships across Asia. In 2025 the company’s strategic priorities were reported to include development of hydrogenated and modified resin grades, pilot work on circular feedstocks, and expanded technical-service programmes for formulators seeking low-colour, low-VOC solutions for automotive and electrical end-uses.

In 2024 Neville Chemical remained focused on specialty hydrocarbon resins and resin modifiers for adhesives, coatings and rubber applications, supplying low-colour and hydrogenated grades suited to high-end coatings and electrical varnishes. Commercial activity centred on technical service to converters and modest capacity optimisation to meet regional demand. In 2025 the company continued product development for improved thermal stability and lower odour, while expanding feedstock relationships to secure C5/C9 supply. The firm’s positioning emphasised formulation support and niche grades for colour-sensitive end uses.

In 2024 PetroChina acted as a principal upstream feedstock and midstream supplier supporting petroleum-resin production via integrated refining and petrochemical operations, ensuring steady availability of C5/C9 streams for resin makers. Operational priorities included optimizing cracker yields and maintaining feedstock reliability for downstream resin processors. In 2025 strategic activities continued to emphasise refinery-to-petrochemical integration, capacity utilisation and environmental compliance, while selective partnerships with resin converters aimed to stabilise regional supply chains and support adhesives, coatings and rubber compounding demand across Greater China and neighbouring markets.

Conclusion

In conclusion, petroleum resin remains a foundational material across multiple industrial value-chains due to its versatility, cost-effectiveness, and performance reliability. Its favorable physical properties — such as softening points typically in the range of 80–140 °C, good solubility in common solvents, and compatibility with a variety of polymers — make it ideal as a tackifier in hot-melt and pressure-sensitive adhesives, as a binder/modifier in coatings and printing inks, and as a compounding agent in rubber formulations.

Its contribution to improved adhesion, enhanced durability, and reduced formulation costs ensures steady demand from packaging, construction, automotive, and infrastructure sectors. As global industrial production and construction activity continue to expand — particularly in regions with growing manufacturing and infrastructure investments — petroleum resin is expected to maintain its strong position. Its adaptability across application types, combined with stable feedstock supply in key producing regions, supports a positive outlook for continued growth in the petroleum resin market over the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)