Table of Contents

Overview

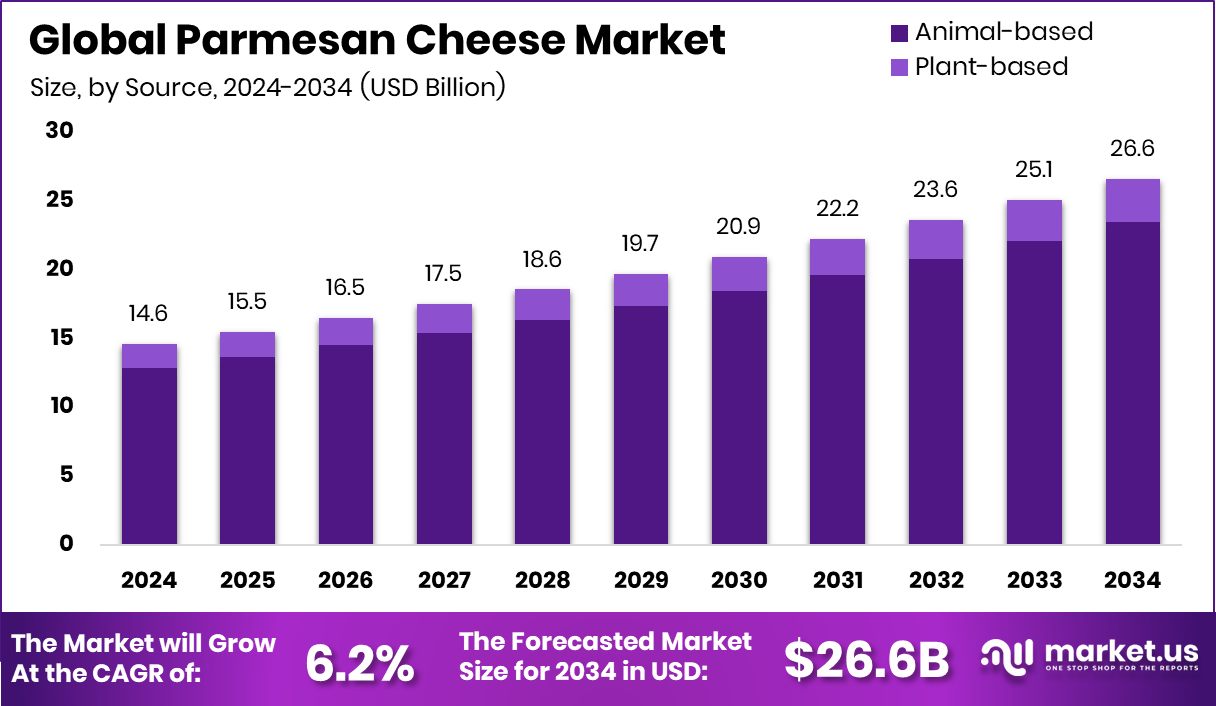

The global Parmesan cheese market is experiencing steady growth, driven by increasing demand for premium, aged dairy products. The market is projected to reach USD 26.6 billion by 2034, growing from USD 14.6 billion in 2024, at a CAGR of 6.2% between 2025 and 2034. Europe remains the most influential region, holding a 49.2% share, equivalent to USD 7.1 billion, supported by a strong culinary heritage and established production standards.

Parmesan cheese is a hard, aged cow’s milk cheese known for its granular texture, intense umami flavor, and long shelf life. It is widely used across home cooking, restaurants, and food manufacturing, particularly in pasta dishes, soups, salads, and grated applications, where small amounts deliver strong taste.

Market growth is strongly linked to increasing consumer interest in premium foods and home-cooked Italian cuisine. Shoppers prefer ingredients that offer versatility, longer storage life, and bold flavor profiles, positioning Parmesan as a staple in modern kitchens.

Innovation is also reshaping the category. Alternative cheese startups are gaining momentum, supported by USD 12 million in seed funding for plant-based cheese launches in U.S. cities, €5 million raised in Italy for fermented vegan cheese development, and USD 17 million in Series A funding to scale solid-state fermentation platforms. Premium branding presents further opportunity, reinforced by high-profile lifestyle trends and European support, including a €20 million EU bank deal backing plant-based food expansion.

Top Key Players in the Market

- The Kraft Heinz Company

- Sargento Foods

- Zanetti S.p.A.

- Bertinelli

- Fonterra Co-operative Group Limited

- Arla Foods amba

- FrieslandCampina

- Saputo Inc.

- Organic Valley

- SAVENCIA SA

1. The Kraft Heinz Company

The Kraft Heinz Company is a global food and beverage manufacturer with a strong portfolio across sauces, condiments, cheese, meals, and packaged foods. The company operates across multiple continents and serves both retail and foodservice customers, leveraging well-established brands and large-scale manufacturing.

Its strategy focuses on brand renovation, product innovation, and improving operational efficiency. Kraft Heinz continues to strengthen its cheese and dairy presence through product upgrades and value-added formats that align with modern cooking habits. Sustainability, responsible sourcing, and long-term brand equity remain central to its global growth approach.

| Headquarters | Chicago, Illinois & Pittsburgh, Pennsylvania |

|---|---|

| CEO | Carlos Abrams-Rivera |

| Founded | 2015 |

| Business Type | Food & Beverage Manufacturer |

| Key Products | Cheese, sauces, meals, condiments |

| Revenue | USD 26 billion (approx.) |

| Global Presence | 40+ countries |

| Employees | ~37,000 |

| Market Position | Global packaged food leader |

| Ownership | Public company |

2. Sargento Foods

Sargento Foods is a family-owned American cheese company recognized for its focus on natural cheese products. The company pioneered pre-packaged sliced and shredded cheese and remains closely associated with quality, consistency, and consumer trust in the U.S. retail market.

Its portfolio includes shredded, sliced, and snack cheeses that serve both households and foodservice operators. Sargento maintains a strong emphasis on innovation, employee culture, and long-term brand values.

| Headquarters | Plymouth, Wisconsin, USA |

|---|---|

| Founded | 1953 |

| Founder | Leonard A. Gentine |

| Ownership | Family-owned |

| Products | Shredded, sliced, snack cheeses |

| Revenue | USD 1.7 billion (approx.) |

| Employees | 2,500+ |

| Manufacturing Sites | 5 facilities |

| Primary Market | United States |

| Industry Focus | Natural cheese |

3. Zanetti S.p.A.

Zanetti S.p.A. is one of Italy’s largest producers of hard cheeses, particularly Grana Padano and Parmigiano Reggiano. The company blends traditional Italian cheesemaking with modern processing and large-scale export

capabilities.

With a strong international footprint, Zanetti supplies premium Italian cheeses to global retail and foodservice markets. Its focus on protected designation cheeses reinforces its leadership in authentic Italian dairy products.

| Headquarters | Italy |

|---|---|

| Business Type | Family-owned dairy company |

| Key Products | Grana Padano, Parmigiano Reggiano |

| Export Markets | 110+ countries |

| Turnover | ~EUR 750 million |

| Milk Processing | 6,100 hl/day |

| Maturation Capacity | 1 million cheese wheels |

| Generations | 5th generation family business |

| Market Position | Leading Italian cheese exporter |

| Specialization | PDO cheeses |

4. Bertinelli

Caseificio Bertinelli is an artisanal Parmigiano Reggiano producer with roots dating back more than a century. The company operates under strict traditional methods while integrating sustainable agriculture and animal

welfare practices.

Bertinelli focuses on premium, long-aged Parmigiano Reggiano targeted at gourmet and specialty markets. Its brand is closely tied to authenticity, traceability, and environmental responsibility.

| Headquarters | Noceto, Italy |

|---|---|

| Founded | 1895 |

| Business Type | Family-owned artisanal dairy |

| Products | Parmigiano Reggiano |

| Production Style | Traditional & artisanal |

| Key Focus | Sustainability & quality |

| Market Segment | Premium cheese |

| Certifications | PDO compliant |

| Core Strength | Heritage production |

| Export Orientation | Yes |

5. Fonterra Co-operative Group Limited

Fonterra is a New Zealand-based dairy cooperative owned by thousands of farmer shareholders. It plays a major role in global dairy trade, supplying ingredients, consumer dairy products, and cheese to markets worldwide.

The cooperative model allows Fonterra to control quality from farm to finished product. Its cheese portfolio supports both consumer and industrial applications across Asia, Oceania, and the Americas.

| Headquarters | Auckland, New Zealand |

|---|---|

| Founded | 2001 |

| Ownership | Farmer-owned cooperative |

| Products | Cheese, milk, dairy ingredients |

| Revenue | USD 26 billion (approx.) |

| Global Rank | Top global dairy exporter |

| Export Share | ~30% of global dairy exports |

| Key Brands | Anchor, Mainland |

| Market Reach | 100+ markets |

| Business Model | Integrated dairy supply chain |

6. Arla Foods amba

Arla Foods is a European farmer-owned dairy cooperative producing milk, cheese, butter, and dairy nutrition products. The company is well known for combining scale with sustainability-driven dairy farming.

Arla’s cheese portfolio serves both everyday consumption and premium segments. Its climate-focused farming programs strengthen its long-term competitiveness in environmentally conscious markets.

| Headquarters | Viby, Denmark |

|---|---|

| Ownership | Farmer-owned cooperative |

| Products | Cheese, milk, butter |

| Revenue | EUR 13+ billion |

| Farmer Members | 8,000+ |

| Market Reach | 100+ countries |

| Sustainability Program | FarmAhead™ |

| Key Focus | Low-carbon dairy |

| Business Model | Cooperative |

| Industry Position | Leading European dairy group |

7. FrieslandCampina

FrieslandCampina is a Dutch dairy cooperative with more than a century of history. The company produces a wide range of consumer and nutrition-focused dairy products for global markets.

Its cheese and dairy offerings are supported by strong farmer integration and long-term sustainability initiatives aimed at ensuring consistent milk quality and supply security.

| Headquarters | Amersfoort, Netherlands |

|---|---|

| Ownership | Dairy cooperative |

| Founded | 1871 |

| Products | Cheese, dairy nutrition |

| Revenue | EUR 13 billion (approx.) |

| Member Farms | 14,000+ |

| Global Reach | Worldwide |

| Key Brands | Dutch Lady, Friso |

| Core Strength | Nutrition & dairy expertise |

| Business Focus | Value-added dairy |

8. Saputo Inc.

Saputo Inc. is a Canada-based multinational dairy processor with operations across North America, Europe, Australia, and South America. The company has grown through strategic acquisitions and organic expansion. Saputo’s cheese business spans mozzarella, cheddar, specialty, and ingredient cheeses, serving both consumer and foodservice markets with a strong global manufacturing network.

| Headquarters | Montreal, Canada |

|---|---|

| Founded | 1954 |

| Founder | Giuseppe Saputo |

| Products | Cheese, milk, dairy ingredients |

| Revenue | CAD 18+ billion |

| Global Rank | Top 10 dairy processors |

| Markets Served | 5 continents |

| Business Model | Integrated dairy processing |

| Core Strength | Cheese manufacturing |

| Ownership | Public company |

9. Organic Valley

Organic Valley is a U.S. farmer-owned cooperative specializing in certified organic dairy and food products. The cooperative supports small-scale farmers while promoting organic and regenerative agricultural practices. Its cheese offerings focus on clean-label, organic positioning and appeal strongly to health-conscious and sustainability-driven consumers.

| Headquarters | La Farge, Wisconsin, USA |

|---|---|

| Founded | 1988 |

| Ownership | Farmer-owned cooperative |

| Products | Organic cheese, milk, butter |

| Market Focus | Organic foods |

| Farmer Members | 1,600+ |

| Certification | USDA Organic |

| Core Strength | Organic dairy leadership |

| Business Model | Cooperative |

| Sustainability Focus | Renewable energy & organic farming |

10. Savencia SA

Savencia SA is a France-based global dairy group specializing in high-value cheese and dairy specialties. The company operates through a decentralized model that supports local brands and regional expertise. Savencia’s cheese portfolio spans premium, specialty, and functional segments, reinforcing its position as one of the world’s largest cheese producers.

| Headquarters | Viroflay, France |

|---|---|

| Founded | 1956 |

| Business Type | Public company |

| Products | Cheese, dairy specialties |

| Revenue | EUR 7.1 billion |

| Global Rank | Top 5 cheese producers |

| Countries Present | 120+ |

| Employees | 21,000+ |

| Core Focus | Premium & specialty dairy |

| Business Model | Decentralized operations |

Conclusion

Parmesan cheese continues to hold a strong position in global food culture due to its rich flavor, long shelf life, and wide culinary versatility. Its ability to enhance taste with small quantities makes it a preferred choice for both home cooking and professional kitchens. Growing interest in premium ingredients, traditional cheese-making, and Italian-style cuisine supports steady demand across regions.

At the same time, innovation in packaging, aging techniques, and alternative formulations is helping the category evolve with modern food trends. As consumers increasingly value quality, authenticity, and functionality in everyday ingredients, Parmesan cheese remains a timeless and reliable staple within the global cheese landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)