Table of Contents

Overview

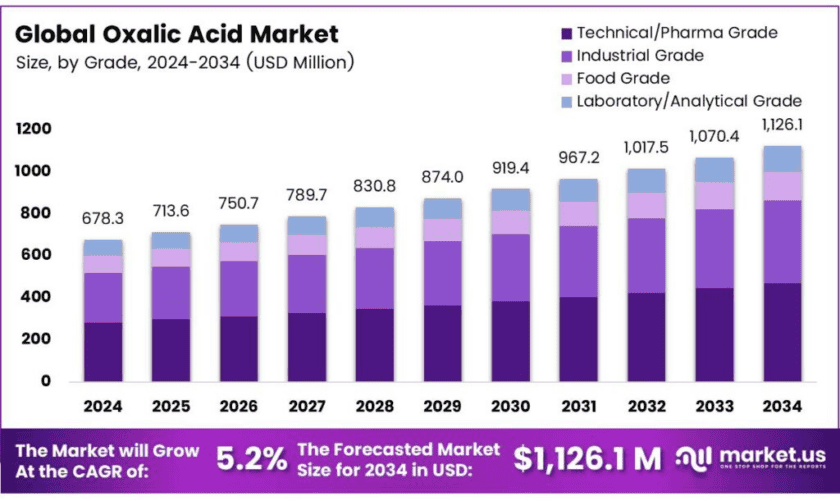

New York, NY – Dec 04, 2025 – The global oxalic acid market is projected to reach approximately USD 1,126.1 million by 2034, up from USD 678.3 million in 2024, registering a CAGR of 5.2% between 2025 and 2034. Oxalic acid is a naturally occurring organic compound produced by various organisms including fungi, bacteria, plants, animals, and humans. In plants, oxalic acid binds to minerals forming oxalates, and in the human body, oxalate is either generated as a metabolic waste product or acquired from dietary sources. These oxalates can combine with minerals such as calcium or iron, forming compounds like calcium oxalate or iron oxalate, which are excreted via urine or stool.

Electrochemical studies have revealed key characteristics of oxalic acid. Techniques such as cyclic voltammetry (CV) and flow injection analysis (FIA) with amperometric detection show an oxidation current at 1.35 V (vs. Ag/AgCl), a high potential uncommon with standard electrodes. The system demonstrated a linear response for oxalic acid concentrations ranging from 50 nM to 10 μM, with a detection limit of 0.5 nM, highlighting its sensitivity for trace-level detection.

In the human gut, bacteria like Oxalobacter formigenes metabolize dietary oxalate, reducing its harmful effects by using it as an energy source. This bacterium is found in 60–80% of adults’ feces, but its abundance is lower in individuals prone to calcium oxalate kidney stones. Dietary approaches, such as boiling vegetables to reduce oxalate content by up to 76% and consuming calcium-rich foods like milk, yogurt, or cheese, can bind oxalate in the gut, lowering absorption and mitigating kidney stone risks.

Oxalic acid also serves as an important metabolite in the TCA cycle, and its measurement is critical for diagnosing urolithiasis and intestinal disorders via urine and blood oxalate levels. Traditional analytical methods are often bulky, slow, and less sensitive, requiring extensive sample preparation. In contrast, a recently developed biosensor demonstrated a linear response range of 8.4 mM to 272 mM, a correlation coefficient of 0.93, a sensitivity of 0.0113 A/M, a detection limit of 3.0 mM, and a rapid response time of 5 seconds at 0.4 V (vs Ag/AgCl), effectively enabling precise measurement of oxalate in human urine samples.

Key Takeaways

- The Global Oxalic Acid Market is projected to grow from USD 678.3 million in 2024 to USD 1126.1 million by 2034, at a CAGR of 5.2%.

- Technical and Pharma Grade oxalic acid held a 41.7% market share in 2024, driven by metal cleaning, textile dyeing, and leather processing.

- Pharmaceuticals captured a 31.8% market share in 2024, fueled by drug synthesis and API purification.

- Asia-Pacific led with a 45.7% share in 2024, valued at USD 309.9 million, due to its robust industrial base.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-oxalic-acid-market/free-sample/

Report Scope

| Market Value (2024) | USD 678.3 Million |

| Forecast Revenue (2034) | USD 1126.1 Million |

| CAGR (2025-2034) | 5.2% |

| Segments Covered | By Grade (Technical and Pharma Grade, Industrial Grade, Food Grade, Laboratory and Analytical Grade), By End Use (Pharmaceuticals, Rare-earth and Metal Processing, Textile and Leather, Electronics and Semiconductor, Chemical Synthesis, Others) |

| Competitive Landscape | Mudanjiang Fengda Chemical Co., Ltd., Oxaquim, UBE Industries Ltd., Indian Oxalate Limited, Shijiazhuang Taihe Chemical Co., Ltd., Spectrum Chemical Manufacturing Corp., Penta s.r.o, Connect Chemical GmbH, Radiant Indus Chem Pvt. Ltd., Spectrum Chemical Mfg. Corp. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161360

Key Market Segments

By Grade

In 2024, Technical and Pharma Grade oxalic acid dominated the global market, capturing a 41.7% share. The technical grade was primarily utilized in metal cleaning, textile dyeing, and leather processing, favored for its strong reducing properties and cost-effectiveness in high-volume applications where moderate purity suffices. The pharma grade, meeting strict pharmaceutical and laboratory standards, was employed in drug formulation, reagent preparation, and purification processes. Growth was supported by expanding surface treatment, chemical, and healthcare industries, with rising investments in high-purity and cleaner production technologies enhancing competitiveness.

By End Use

In 2024, the pharmaceutical segment led the oxalic acid market, capturing a 31.8% share. Oxalic acid is extensively used in drug synthesis, laboratory reagents, and purification of active pharmaceutical ingredients (APIs). Its reducing and purifying capabilities make it critical for producing antibiotics, vitamins, and fine chemical intermediates. Rising local drug manufacturing in developing countries, increasing research on new formulations, and a global push toward cleaner synthesis processes further reinforced demand. Regulatory initiatives supporting domestic pharmaceutical production in Asia and Europe also contributed to market growth.

List of Segments

By Grade

- Technical and Pharma Grade

- 99.0-99.5% Purity

- 99.5-99.9%

- Anhydrous and Low-water Specialty

- Industrial Grade

- Food Grade

- Laboratory and Analytical Grade

By End Use

- Pharmaceuticals

- Rare-earth and Metal Processing

- Textile and Leather

- Electronics and Semiconductors

- Chemical Synthesis

- Others

Regional Analysis

Asia-Pacific Leads Alpha Olefin Market with 45.7% Share, Valued at USD 309.9 Million

In 2024, the Asia-Pacific region dominated the global oxalic acid market, capturing a 45.7% share with a market value of approximately USD 309.9 million. The region’s growth is driven by its extensive industrial base, including pharmaceuticals, textiles, agrochemicals, and metal processing. Leading countries such as China, India, and Japan benefit from abundant raw materials and cost-efficient manufacturing. China accounted for a significant portion of production due to advanced chemical infrastructure and strong export capabilities to North America and Europe. Rising applications in pharmaceuticals, food processing, dye manufacturing, and metal treatment, along with growing investments in textile and industrial cleaning sectors, continue to propel regional demand.

Top Use Cases

Metal Cleaning, Rust Removal, and Surface Treatment: Oxalic acid is extensively used for cleaning and removing rust from metal surfaces. Its ability to chelate iron ions allows it to dissolve rust and mineral deposits, making it a preferred agent for metal restoration, boiler and pipe descaling, and preparation of metal parts prior to plating or painting. In industrial metal‑treatment applications, reports indicate that up to 70% of metal restoration projects rely on oxalic‑acid solutions, underlining its role as a cost‑effective and widely used surface‑treatment chemical.

Textile, Leather, Wood and Fabric Bleaching / Dyeing Aid: Oxalic acid serves as a bleaching agent and dye‑processing auxiliary in textile, leather, wood, and pulp/wood‑processing industries. Approximately 25% of global oxalic acid production is employed as a mordant in dyeing processes, helping dyes bond with fibers, improving color fastness, and neutralizing metal ions that might otherwise interfere with dye uniformity. It is also used for bleaching wood, paper pulp, cork, and straw — facilitating cleaning, stain removal, or surface brightening before further finishing.

Chemical Intermediate — Synthesis of Chemicals, Catalysts, and Rare‑Earth Extraction: Oxalic acid is used as an intermediate or reducing agent in various chemical processes: synthesis of hydroquinone, pentaerythritol, metal oxalates (e.g. cobalt, nickel), and specialty chemicals. In rare‑earth and metal‑recovery sectors, oxalic acid aids in the extraction and precipitation of metals as oxalates — an important step in producing pure metal oxides and catalysts.

Wood and Furniture Restoration, Cleaning Stains and Surface Renewal: For woodworking and furniture restoration, oxalic acid acts as a gentle bleaching/stain‑removal agent. It removes water, ink, or rust stains from wood, brick, stone, or other surfaces prior to refinishing. This application supports restoration of antique furniture, floors, decks, or interior woodwork — offering an inexpensive method to revive surface appearance and prepare items for repainting or staining.

Analytical, Laboratory, and Pharmaceutical Uses: Oxalic acid functions as a reagent in analytical chemistry and laboratory processes: used for titration, metal‑ion complexation, and preparation of reagent solutions. Oxalic acid functions as a reagent in analytical chemistry and laboratory processes: used for titration, metal‑ion complexation, and preparation of reagent solutions.

Recent Developments

Mudanjiang Fengda Chemical Co., Ltd. — In 2025, Mudanjiang Fengda Chemical continued as a significant global supplier of oxalic acid, offering the compound alongside formic acid, sodium formate, calcium formate and other associated chemicals. The company’s oxalic acid exports reach over 100 countries across all continents, indicating broad geographic reach and global supply capacity. Their product meets multiple quality and regulatory certifications (including ISO 9001, REACH, and FAMI‑QS), supporting use across industries such as textiles, leather processing, water treatment, chemical manufacturing, and pharmaceuticals.

Oxaquim S.A. — As of 2024, Oxaquim remains the largest European producer of oxalic acid and is ranked the second‑largest globally, operating multiple plants and supplying oxalic acid and oxalates to over 80 countries worldwide. The company offers a variety of oxalic acid grades and derivatives, targeting traditional industries such as textiles, leather tanning, rust removal, and marble polishing, as well as emerging applications in metal recovery, rare‑earth purification, catalysts, and energy storage. In 2024, Oxaquim reported revenues of approximately USD 22 million for its oxalic acid operations, reflecting stable demand and positioning in global supply chains.

UBE Industries Ltd. — In 2024, UBE Industries remained a recognized name in the oxalic acid market, supplying high‑purity grades used in specialty chemicals and industrial applications. Its operations leverage integrated chemical processes originally developed for oxalic acid production under a carbon‑monoxide based C1‑chemicals chain. UBE emphasizes sustainable manufacturing and aims to support demanding sectors such as pharmaceuticals, electronics, and metal treatment with consistent quality and regulatory compliance.

Indian Oxalate Limited — As of 2024, Indian Oxalate Limited operates oxalic acid and diethyl oxalate production facilities in Ratnagiri, Maharashtra, serving domestic chemical, textile, leather‑processing, and export markets. The firm reports producing roughly 7,200 tonnes per annum of oxalic acid at its dedicated plant — enabling supply for industrial applications including metal cleaning, dyeing, and chemical intermediates. Its structured manufacturing and domestic distribution network support stable supply and responsiveness to demand cycles in India’s broader chemical industry.

Shijiazhuang Taihe Chemical Co., Ltd. — In 2024, Shijiazhuang Taihe Chemical operated with an annual capacity of about 20,000 metric tons of oxalic acid, in addition to other chemicals such as formic acid and sodium sulfate. Its oxalic acid products — often offered at purities around 99.6% — are exported to markets in Southeast Asia, Europe, and beyond, serving industries including textiles, leather processing, chemical manufacturing, and cleaning agents.

Spectrum Chemical Manufacturing Corp. — As of 2024–2025, Spectrum Chemical supplies oxalic acid dihydrate of ACS and technical grade standards (purity ~99.5–102.5%) for laboratory, reagent, and industrial use. Their oxalic acid is widely used in research labs, quality‑controlled chemical processing, and industrial applications requiring consistent purity, supporting demand across pharmaceuticals, fine chemicals, and metal‑treatment sectors.

Penta s.r.o. — In 2025, Penta s.r.o. continued to supply high‑purity and analytical‑grade oxalic acid under its brand, offering oxalic acid dihydrate with purity ≥ 99.5% for laboratory, pharmaceutical, and industrial applications. Its production is supported by modern manufacturing facilities, automated warehousing, and quality‑management certifications such as ISO 9001 and ISO 14001. This enables Penta to deliver consistent quality chemicals for sectors including research labs, chemical manufacturing, and specialty industrial use.

Connect Chemicals GmbH — As of 2025, Connect Chemicals GmbH operates as a Europe‑based specialty‑chemicals distributor that lists oxalic acid anhydrous in its global product catalogue for sale across industrial and chemical‑processing applications. Through its broad distribution network — spanning several international branches — the firm supports demand for oxalic acid in sectors such as cleaning agents, metal treatment, water treatment, coatings, and related chemical industries.

Radiant Indus Chem Pvt. Ltd. — In 2025, Radiant Indus Chem continues to rank among India’s largest manufacturers and exporters of oxalic acid, operating a plant in Aurangabad, Maharashtra. The company recently expanded its oxalic acid production capacity from roughly 10,200 MT/year to about 13,800 MT/year, reflecting rising demand in textile, leather‑processing, metal‑treatment, and chemical sectors. Its compliance with ISO 9001 standards and global export footprint underline its strong competitive position in both domestic and international oxalic acid supply chains.

Spectrum Chemical Manufacturing Corp. — In 2024–2025, Spectrum Chemical supplies high‑purity oxalic acid dihydrate (99.5–102.5% purity) under ACS and technical grades for laboratory, industrial, and reagent use. Their product range supports applications in research labs, fine chemicals manufacturing, quality‑controlled industrial processes, and metal or textile treatment where consistency and traceability are critical. As a U.S.-based supplier with global reach across 70 countries, Spectrum plays a key role in ensuring reliable access to oxalic acid for regulated industries worldwide.

Conclusion

In conclusion, Oxalic acid continues to emerge as an essential industrial and chemical‑processing ingredient due to its versatility across multiple sectors. Its global demand remains underpinned by applications in metal cleaning and surface treatment, textile processing (bleaching and dyeing), pharmaceutical synthesis and purification, and increasingly in rare‑earth processing and specialty chemical production.

Industrial‑grade oxalic acid remains widely used for tasks like rust removal and metal maintenance — sectors in which oxalic acid enables efficient cleaning and corrosion prevention, a critical need in manufacturing, automotive, and metal‑working industries.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)