Table of Contents

Overview

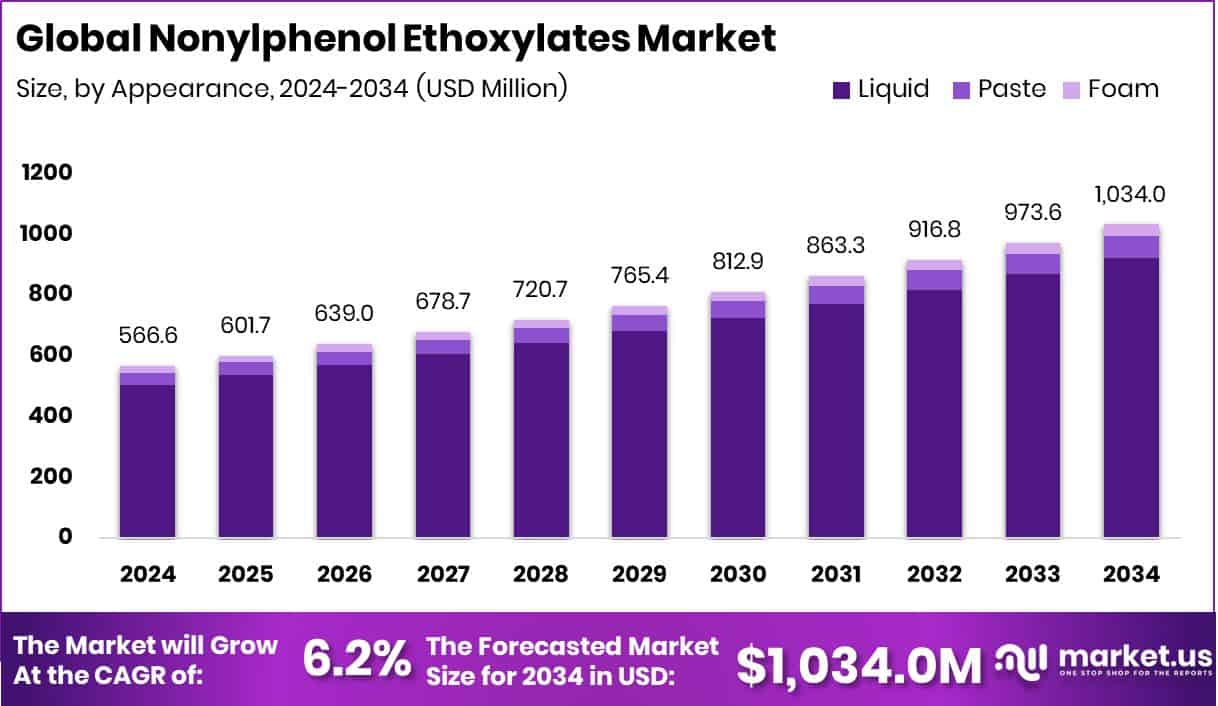

New York, NY – October 24, 2025 – The global market for nonylphenol ethoxylates (NPEs) is projected to grow from approximately USD 566.6 million in 2024 to around USD 1,034.0 million by 2034, representing a compound annual growth rate of 6.2% between 2025 and 2034. The Asia-Pacific region leads with about 46.2% market share, driven by strong industrial cleaning and textile sectors.

NPEs—non-ionic surfactants formed via ethoxylation of nonylphenol—are used as detergents, emulsifiers, wetting agents, and degreasers across industrial and consumer applications, including cleaning formulations, paints, textiles, and metal-treatment fluids. One key driver is rising industrial demand for high-performance surfactants in textile processing, metal cleaning, coatings, gas, and institutional cleaning operations.

At the same time, expanding hygiene and cleaning awareness (in households, institutions, and industry) is boosting demand for surfactants, aided by formulation innovations delivering stronger cleaning performance. An opportunity exists in emerging regions with less stringent regulatory restrictions on NPEs and industries still transitioning to alternatives.

Companies that position themselves to supply surfactant solutions or formulate cleaning products stand to capture share. Moreover, investment moves in cleaning technology bolster this momentum: Sironix Renewables, which converts soybeans and coconuts into cleaning ingredients, raised USD 3.5 million to expand manufacturing.

Koparo, a D2C home-cleaning brand, raised USD 1.5 million in a pre-Series A round led by Saama Capital. Also, Avidbots secured USD 70 million to deploy autonomous robots for commercial cleaning, and Batmaid raised €23 million to expand its cleaner-booking platform across 21 cities globally. These funding events underscore the convergence of surfactant demand and cleaning-technology innovation.

➤ Click the sample report link for complete industry insights: https://market.us/report/nonylphenol-ethoxylates-market/request-sample/

Key Takeaways

- The Global Nonylphenol Ethoxylates Market is expected to be worth around USD 1,034.0 million by 2034, up from USD 566.6 million in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- In 2024, the Nonylphenol Ethoxylates Market was dominated by the liquid form, holding an 89.3% share.

- Industrial Cleaning Agents led the Nonylphenol Ethoxylates Market with a 39.8% share in 2024.

- The Asia Pacific market reached a total value of USD 261.7 million during the year.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=162165

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 566.6 Million |

| Forecast Revenue (2034) | USD 1,034.0 Million |

| CAGR (2025-2034) | 6.2% |

| Segments Covered | By Appearance (Liquid, Paste, Foam), By Application (Industrial Cleaning Agents, Paints, Agrochemicals, Textile, Oil and Gas, Others) |

| Competitive Landscape | LyondellBasell Industries, Borealis AG, Exxon Mobil Corporation, India Glycols Limited, Dow Inc., Oxiteno, Shree Vallabh Chemicals, Solvay, Stepan Company |

Key Market Segments

By Appearance Analysis

In 2024, the Liquid segment dominated the By Appearance category of the Nonylphenol Ethoxylates Market, accounting for an 89.3% share. This leadership stems from its superior solubility, blending ease, and compatibility with both industrial and household formulations. Liquid NPEs disperse efficiently in textile and cleaning processes, ensuring better product uniformity and performance consistency. Their quick dissolution in aqueous and non-aqueous systems enhances effectiveness in detergents, emulsifiers, and wetting agents.

Moreover, their stable viscosity and thermal resilience make them ideal for large-scale manufacturing operations. Such versatility supports their widespread application in industrial cleaning, coatings, and textile treatments.

The combination of processing convenience and dependable surfactant performance continues to position liquid NPEs as the dominant choice among manufacturers, sustaining their strong market presence and ensuring reliable results across diverse industrial formulations through 2024 and beyond.

By Application Analysis

In 2024, the Industrial Cleaning Agents segment led the By Application category of the Nonylphenol Ethoxylates Market, capturing a 39.8% share. This strong position reflects the widespread use of NPE-based surfactants in degreasing, emulsification, and heavy-duty surface-cleaning applications across industrial sectors. Their superior wetting and dispersing properties significantly boost cleaning efficiency in demanding environments such as manufacturing units, metal workshops, and chemical processing plants.

NPE-based formulations effectively remove oils, waxes, and stubborn residues, ensuring high hygiene and operational standards. The segment’s consistent dominance is supported by the growing need for reliable, cost-efficient surfactants that maintain cleaning performance across large-scale industrial systems.

With industries prioritizing maintenance quality and production efficiency, nonylphenol ethoxylates continue to serve as essential components in industrial cleaning formulations, reinforcing their leadership within the global surfactants market landscape.

Regional Analysis

In 2024, the Asia Pacific region led the Nonylphenol Ethoxylates Market with a 46.20% share, valued at USD 261.7 million. This dominance is driven by strong demand from textile processing, industrial cleaning, and manufacturing sectors across China, India, and Southeast Asia.

Rapid industrialization and expanding detergent and coatings industries have further increased surfactant consumption, reinforcing regional growth. North America ranked next, supported by its advanced chemical processing and cleaning product sectors that rely on high-performance surfactants.

Europe showed steady progress, influenced by sustainability regulations and innovation in environmentally friendly formulations. Meanwhile, Latin America and the Middle East & Africa are gradually gaining traction due to growing industrialization and urban expansion.

Overall, Asia Pacific remains the key growth hub, reflecting its dynamic manufacturing base, rising hygiene standards, and strong demand for effective surfactant solutions across multiple end-use industries.

Top Use Cases

- Industrial cleaning and degreasing agents: NPEs are widely used in industrial cleaners and degreasers to remove oils, waxes, and heavy contamination from machinery, metal workshops, and manufacturing floors. Their strong wetting and emulsifying action helps lift greasy residues and ensure surfaces are clean before operations.

- Textile processing auxiliary: In textile manufacturing, NPEs serve as wetting agents, emulsifiers, and cleaning aids during washing, scouring, dyeing, and finishing of fibers like cotton or wool. They allow chemicals and dyes to distribute evenly and help rinse out unwanted residues.

- Detergents and household cleaning products: NPEs are included in laundry detergents, all-purpose cleaners, and liquid household cleaning formulations because they help dissolve stains, disperse dirt, and work in both aqueous and non-aqueous systems.

- Paints, coatings, and surface treatment: These compounds function as dispersing agents, surfactants, and emulsifiers in coatings, adhesives, paints, and surface-treatment formulations, helping pigments, binders, and additives mix uniformly and adhere properly.

- Metal-working fluids and metal cleaning: In metal processing, NPEs are used in metal-working fluids, cleaning baths, and degreasing systems. They provide effective wetting and emulsification of soils, enabling the removal of oils and metal fines from workpieces.

- Agrochemical formulation additive: NPEs are used in agrochemical products (herbicides, insecticides, and fungicides) as emulsifiers and dispersants that improve the spread, penetration, and adhesion of the active ingredient on plant surfaces.

Recent Developments

- In August 2025, ExxonMobil announced that phase one of its “Proxxima™ systems” (polyolefin thermoset resin tech) is nearing completion. This has no direct reference to NPEs.

- In January 2024, Dow won six BIG Innovation Awards—among them recognition for EcoSense™ 2470 Surfactant, a sustainable surfactant from Dow.

Conclusion

The Nonylphenol Ethoxylates market continues to evolve as industries balance performance efficiency with environmental responsibility. These surfactants remain valued for their strong emulsifying, wetting, and cleaning properties across textiles, coatings, and industrial cleaning sectors. However, increasing regulatory attention toward eco-friendly and biodegradable alternatives is driving innovation in formulations.

Manufacturers are focusing on sustainable production methods and safer replacements that maintain cleaning strength while minimizing ecological impact. Growing awareness of hygiene, industrial efficiency, and cleaner technologies ensures continued relevance for high-performance surfactants.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)