Table of Contents

Overview

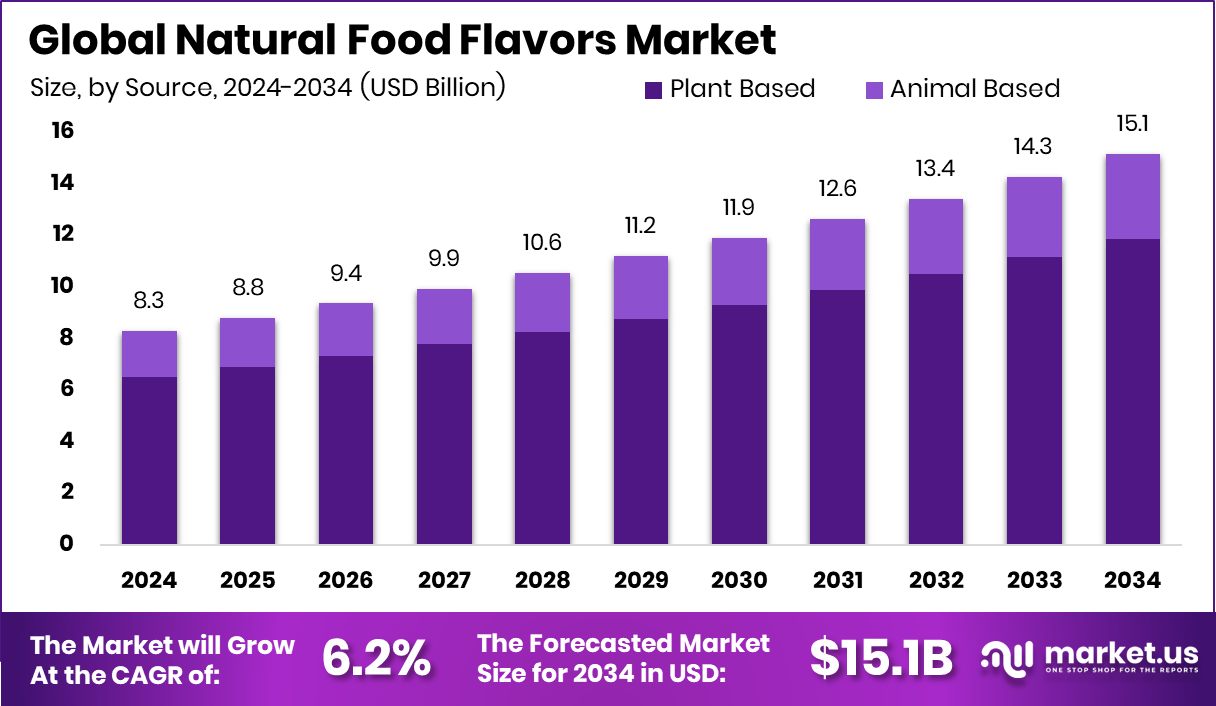

New York, NY – February 06, 2026 – The Global Natural Food Flavors Market is projected to reach USD 15.1 billion by 2034, rising from USD 8.3 billion in 2024 at a 6.2% CAGR (2025–2034). Europe leads the market with 43.90%, representing USD 3.6 billion in 2024. Natural food flavors are derived from plant, animal, or microbial sources and are processed through physical or enzymatic methods instead of chemical synthesis. They play a central role in helping brands shift toward clean-label formulations, as consumers increasingly seek recognizable, minimally processed ingredients.

The market encompasses the global network of producers, formulators, and users of natural flavors across categories such as beverages, dairy, bakery, confectionery, and snacks. Growth is propelled by rising health consciousness and the strong move away from artificial additives, prompting widespread product reformulation.

Investor activity further accelerates market momentum. Fireside Ventures’ INR 20 crore investment in Oroos Confectionery, alongside Go Desi’s USD 5 million fundraising, underscores confidence in natural flavor-driven product innovation. Premium snack and confectionery brands are also benefiting, with Doughlicious securing USD 5 million and Canada’s Awake Chocolate raising USD 8 million, signaling expanding demand for naturally flavored indulgent offerings.

These funding streams create opportunities for startups and established brands to enhance natural sourcing, scale production capabilities, and launch region-specific flavor profiles—reinforcing long-term market growth and adoption.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-natural-food-flavors-market/request-sample/

Key Takeaways

- The Global Natural Food Flavors Market is expected to be worth around USD 15.1 billion by 2034, up from USD 8.3 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- In 2024, plant-based flavors dominated the market with 78.2% share.

- Fruit and other natural flavors captured 34.6% in flavor type segment.

- Beverages remained the leading application, accounting for 35.% of consumption.

- Natural Food Flavors Market in Europe reached 43.90%, representing USD 3.6 Bn value.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=172233

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 8.3 Billion |

| Forecast Revenue (2034) | USD 15.1 Billion |

| CAGR (2025-2034) | 6.2% |

| Segments Covered | By Source (Plant Based, Animal Based), By Flavor Type (Fruit and Flavor, Vegetable Flavor, Herb and Spice Flavor, Diary Flavor, Others), By Application (Beverages, Dairy, Nutrition and Health, Savory, Bakery and Confectionery, Others) |

| Competitive Landscape | Givaudan, DSM-firmenich, Symrise, International Flavors & Fragrances (IFF), Kerry Group, Archer Daniels Midland (ADM), BASF, Sensient Technologies, Takasago International Corporation, Huabao International Holdings Limited |

Key Market Segments

By Source

Plant-based flavors remained the leading source in 2024, capturing 78.2% of the Natural Food Flavors market. This dominance reflects rising consumer preference for clean-label and naturally derived ingredients, along with a shift toward sustainable and health-focused choices. Food manufacturers increasingly rely on plant-based inputs such as herbs, fruits, spices, and botanicals to align with evolving dietary trends.

Improved extraction and processing technologies have further strengthened this segment by preserving natural sensory qualities while supporting regulatory compliance. As brands continue reformulating products with botanical flavor solutions, the plant-based segment is expected to remain central to innovation and sustainable sourcing strategies. Its strong market presence underscores a broader movement toward transparency, environmental responsibility, and natural ingredient integration across global food and beverage categories.

By Flavor Type

Fruit and natural flavors led the segment in 2024 with a 34.6% share, driven by strong consumer affinity for familiar, authentic taste experiences. Citrus, berry, and tropical fruit profiles remained especially popular due to their versatility across snacks, beverages, dairy alternatives, and confectionery. Advances in extraction and formulation allow manufacturers to retain characteristic aroma and flavor compounds, supporting clean-label product expansion.

The demand for natural fruit flavors is also fueled by broader wellness and lifestyle trends emphasizing freshness and recognizable ingredients. As flavor houses innovate with more region-specific and exotic fruit options, this segment is expected to remain a key driver of product differentiation and sensory enhancement in the global natural flavors market.

By Application

The beverages segment dominated applications in 2024, accounting for 35.7% of total market use. This leadership was driven by the rapid reformulation of drinks—from soft beverages to functional waters and RTD teas—toward natural flavor systems that remove artificial additives. Health-focused consumers increasingly expect transparency and natural taste experiences, prompting beverage manufacturers to integrate stable, clean-label flavor solutions.

Natural flavors play an essential role in enhancing both traditional and emerging beverage categories, especially functional drinks that rely on appealing taste profiles. As wellness, hydration, and low-sugar drink trends expand, the reliance on natural flavor innovations will continue to grow. This sustained demand positions beverages as a key market influencer, shaping flavor development priorities and accelerating global adoption of natural food flavor solutions.

Regional Analysis

The Natural Food Flavors Market displays distinct regional dynamics shaped by consumer awareness, regulations, and food industry maturity. Europe leads the market with 43.90% and USD 3.6 billion, supported by strong clean-label laws, high natural ingredient adoption, and advanced food manufacturing.

North America follows with a mature, health-focused consumer base that prioritizes plant-based and minimally processed foods. In the Asia Pacific, rapid urbanization, rising incomes, and increased consumption of packaged foods are accelerating demand for natural flavors.

The Middle East & Africa region is gradually expanding due to growing food imports, developing processing industries, and a shift toward cleaner formulations. Latin America also shows steady growth, driven by traditional flavored products, stronger use of natural flavors in beverages, and an expanding retail sector. Overall, Europe anchors market value, while other regions contribute through rising consumption and evolving dietary preferences.

Top Use Cases

- Enhancing Taste in Beverages: Natural flavors are added to drinks like juices, teas, and flavored waters to make them taste more vibrant and fruity without adding extra sugar or calories. These flavors come from real fruits, herbs, or spices and help make drinks more appealing.

- Baking and Desserts: Foods like cakes, cookies, ice cream, and pastries use natural flavor extracts such as vanilla, citrus, or berry to boost taste and aroma. This gives products a familiar and richer profile without changing their nutritional make-up.

- Snack Foods: Chips, crackers, and savory snacks often include natural plant-based flavors (like herb or spice extracts) to improve their taste and make them more enjoyable for consumers.

- Sauces and Dressings: Natural flavors from spices, herbs, or vegetables can be added to sauces, salad dressings, and marinades to enhance flavor without artificial additives, making them more appealing and closer to home-style cooking.

- Health-Focused Food Products: When foods are made with reduced sugar, fat, or salt (like diet or low-fat products), natural flavors help balance taste so consumers still enjoy the flavor even with fewer unhealthy ingredients.

Recent Developments

- In October 2024, Givaudan’s Taste & Wellbeing division started building a new production facility in Cikarang, Indonesia. This plant will help make more flavours and related products for customers in Southeast Asia and support local expansion.

- In February 2024, DSM-Firmenich finished a voluntary cash offer to buy most of DSM’s remaining shares. This strengthened the company’s ownership and support for its long-term strategy in nutrition, health, and flavors.

Conclusion

The Natural Food Flavors Market continues to strengthen as consumers increasingly choose products made with familiar and naturally sourced ingredients. Growing awareness around clean-label foods, healthier diets, and transparent formulations supports steady adoption across beverages, snacks, bakery, dairy, and convenience foods. Brands are moving toward plant-based and minimally processed flavor solutions to meet evolving expectations for authenticity and safety.

Innovation in extraction technologies and sustainable sourcing further enhances product quality and accessibility. With ongoing reformulation efforts and rising interest in natural taste experiences, the market remains well-positioned for consistent expansion, supported by both established manufacturers and emerging food innovators.