Table of Contents

Overview

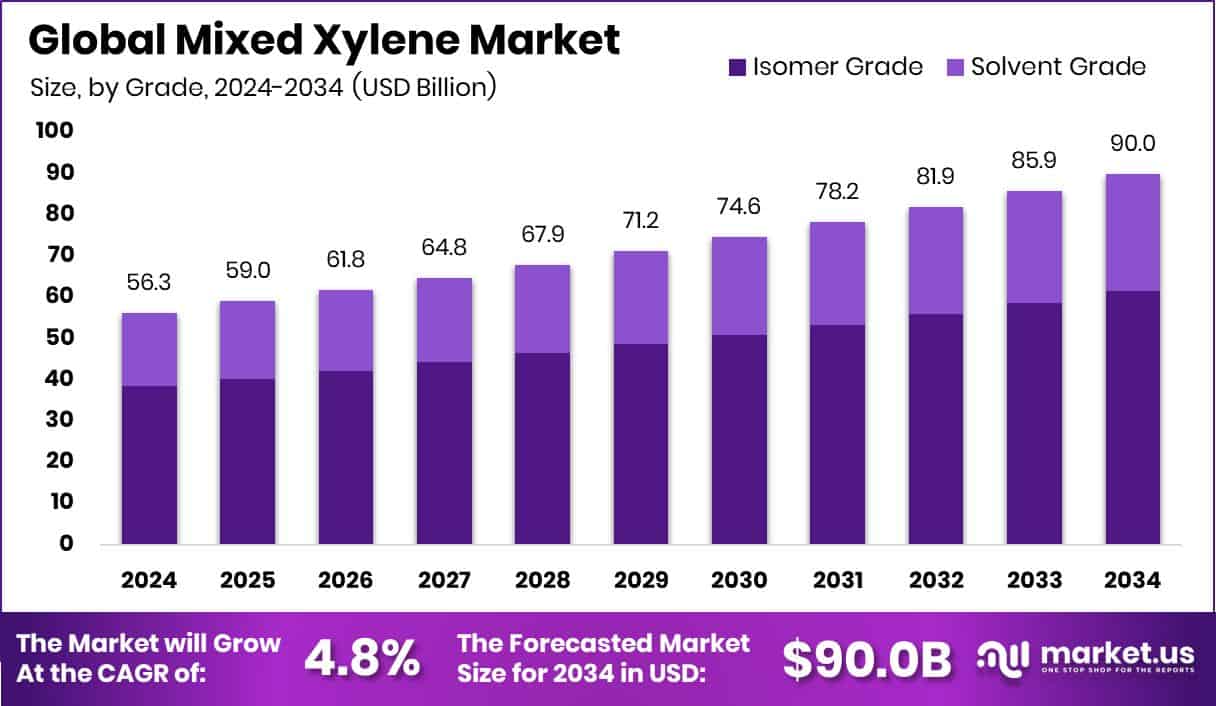

New York, NY – Dec 03, 2025 –The global mixed xylene market is on a steady growth path, supported by rising industrial activity and strong demand from coatings and solvent applications. Market value is projected to increase from USD 56.3 billion in 2024 to around USD 90.0 billion by 2034, reflecting consistent expansion over the next decade. Asia-Pacific continues to lead the market, holding 44.90% share valued at USD 25.2 billion, largely driven by rapid construction growth and expanding coatings consumption.

Mixed xylene is a clear, sweet-smelling solvent made from different xylene isomers with minor ethylbenzene content. It is widely used in paints, coatings, adhesives, and printing inks due to its balanced evaporation rate and strong resin-dissolving ability. Beyond solvents, it plays a role as a feedstock for producing chemical intermediates used in plastics and fibres, linking its demand closely to manufacturing performance.

Growth momentum is reinforced by increased building activity, automotive refinishing, and maintenance coatings worldwide. Innovation in paint technologies is also supporting demand, highlighted by Ecoat’s €21 million funding, which underscores the importance of solvent performance even in modern formulations.

Industry investments and consolidation further strengthen the outlook. BASF’s €6 billion coatings division sale, Distil’s $7.7 million funding, and Nippon Paint Holdings’ $2.3 billion agreement with AOC reflect active capital flow. These developments open opportunities for improved formulations, efficient solvent use, and higher-value mixed xylene applications.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-mixed-xylene-market/request-sample/

Key Takeaways

- The Global Mixed Xylene Market is expected to be worth around USD 90.0 billion by 2034, up from USD 56.3 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034.

- In the mixed xylene market, isomer grade holds a 68.3% share due to high purity.

- In the mixed xylene market, solvents dominate with a 55.2% share across major industries.

- In the mixed xylene market, paints and coatings lead with a 34.9% end-use share.

- Strong industrial growth in Asia-Pacific supports its 44.90% share worth USD 25.2 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=166995

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 56.3 Billion |

| Forecast Revenue (2034) | USD 90.0 Billion |

| CAGR (2025-2034) | 4.8% |

| Segments Covered | By Grade (Isomer Grade, Solvent Grade), By Application (Fuel Blending, Solvents, Thinners, Raw Material, Others), By End Use (Paints and Coatings, Pesticides, Chemicals, Gasoline, Printing, Rubber and Leather, Others) |

| Competitive Landscape | ExxonMobil Corporation, Shell plc, Reliance Industries Ltd., Total Energies SE, BASF SE, Chevron Phillips Chemical Company LLC, China National Petroleum Corporation (CNPC), Formosa Chemicals & Fibre Corp., Sinopec Corporation, Idemitsu Kosan Co., Ltd. |

Key Market Segments

By Grade Analysis

In 2024, Isomer Grade held a clear leadership position in the By Grade segment of the Mixed Xylene Market, accounting for a 68.3% share. This dominance is closely linked to its critical role in large-scale production of downstream chemicals widely used in coatings, plastics, and industrial intermediates.

Isomer Grade is valued for its consistent purity and dependable behavior in solvent formulations. Its stable performance supports efficient high-volume manufacturing, making it a trusted aromatic feedstock for industries that require uniform quality and predictable processing outcomes. Manufacturers continue to favour this grade as it reduces variability and improves operational reliability across production lines.

The segment’s strong position also reflects increased activity in advanced coatings and the expansion of speciality chemical production. As more industries upgrade formulations and invest in higher-performance products, demand for reliable inputs has grown. These trends have reinforced Isomer Grade’s role as the primary contributor to market growth, ensuring its continued dominance within the Mixed Xylene Market.

By Application Analysis

In 2024, the Solvents application segment dominated the Mixed Xylene Market, capturing a 55.2% share. This strong position is driven by the widespread use of mixed xylene as an essential solvent in paints, coatings, printing inks, and industrial cleaning products. Its strong resin-dissolving capacity and balanced evaporation rate make it highly suitable for formulations that demand uniformity, stability, and high performance.

The leadership of this segment is closely connected to ongoing growth in construction activity, automotive refinishing, and packaging production. These industries continue to depend on solvent-based systems for surface protection, finishing quality, and process efficiency. Manufacturers value mixed xylene for delivering consistent blending behaviour and reliable results across large-scale operations.

As producers prioritize dependable aromatic solvents to maintain formulation integrity and operational consistency, demand within the Solvents segment has remained strong. This sustained reliance has reinforced the segment’s dominant position, keeping it the largest contributor to overall mixed xylene market demand.

By End Use Analysis

In 2024, Paints and Coatings emerged as the leading end-use segment in the Mixed Xylene Market, holding a 34.9% share. This dominance reflects the continued dependence on mixed xylene as a core solvent in coating formulations, where it supports smooth film formation, controlled drying, and strong resin compatibility.

Rising construction activity, ongoing infrastructure renovation, and steady industrial maintenance needs played an important role in sustaining demand across both decorative and protective coatings. Mixed xylene remains widely preferred by manufacturers due to its reliable performance in achieving uniform finishes and consistent coating quality.

As producers increasingly emphasise formulation stability and repeatable application results, the role of mixed xylene has stayed central to coating production. Its ability to deliver dependable outcomes across diverse paint systems reinforced its importance throughout the year. This sustained demand from the paints and coatings sector ensured the segment remained the largest contributor to overall mixed xylene consumption in 2024, maintaining its leading position within the market.

Regional Analysis

Asia-Pacific led the Mixed Xylene Market in 2024 with a dominant 44.90% share valued at USD 25.2 billion, driven by its expanding coatings industry, rising construction activity, and strong chemical manufacturing base. Continuous investment in downstream aromatic applications and steady industrial output have positioned the region as the main global growth center. High demand from paints, solvents, and resin processing continues to reinforce its leadership.

North America records stable consumption, supported by industrial maintenance operations, automotive refinishing, and ongoing use of advanced coating systems. Its well-established manufacturing structure ensures consistent demand for mixed xylene in specialised chemical production.

Europe follows with demand shaped by regulated solvent use, where manufacturers balance performance needs with environmental standards and modern coating technologies. The Middle East & Africa see moderate growth supported by petrochemical expansion and construction-related solvent demand, while Latin America maintains steady usage across industrial, agricultural, and coating applications.

Top Use Cases

- Solvent for Paints, Coatings, Varnishes, and Inks: Mixed xylene dissolves resins, pigments and binders efficiently — making it ideal as a thinner and carrier in paint, enamel, varnish, lacquer and ink formulations. Its balanced evaporation rate helps paints and coatings flow smoothly, dry evenly, and form high-quality films.

- Component in Adhesives, Sealants & Rubber Products: It is used in adhesives and sealants (e.g., contact cements), rubber-based applications, and sealant preparations because of its strong solvency: helping mixtures stay consistent and bonding performance remain reliable.

- Cleaning and Surface-Preparation Solvent: It is used for degreasing and cleaning metal, plastic or electronic parts (e.g., steel, silicon wafers, integrated circuits) to remove oils, greases, residues, or old coatings — preparing surfaces for painting, coating, or further processing.

- Use in Printing, Rubber, Leather, and Packaging Industries: Mixed xylene finds applications in printing inks, rubber processing, leather treatment, and packaging-coating processes — essentially wherever strong solvent action and resin dissolution are needed in industrial manufacturing.

- Use as a Petrochemical Blend Component / Fuel Additive (in Some Cases): In certain contexts, mixed xylene (or its isomers) are used to blend into gasoline or fuel streams — helping to adjust fuel properties (such as octane rating), although this is less central than its solvent and chemical-intermediate roles.

Recent Developments

- In October 2025, ExxonMobil unveiled a new liquid-phase isomerisation (LPI) process for paraxylene production at a conference. The company said that LPI offers better energy efficiency, higher yields, and lower xylene losses compared to conventional vapour-phase isomerisation.

- In January 2025, Shell, through its joint venture CNOOC and Shell Petrochemicals Company Limited (CSPC), confirmed a major expansion at its petrochemical complex in Daya Bay, Huizhou, south China. This expansion includes a third ethylene cracker with a capacity of 1.6 million tonnes/year and associated downstream units producing chemicals, including high-performance speciality chemicals (e.g. polycarbonates, solvents).

Conclusion

The mixed xylene market continues to hold an important position within the global chemical and solvents landscape. Its wide use in paints, coatings, adhesives, inks, and industrial cleaning supports steady demand across construction, manufacturing, and maintenance activities.

Mixed xylene also remains valuable as a feedstock for downstream chemical production, linking its performance to broader industrial growth. Ongoing innovation in coating formulations and speciality chemicals keeps solvent performance highly relevant.

At the same time, integrated petrochemical operations and supply chain investments help ensure stable availability. As industries focus on reliable processing, product consistency, and efficient formulations, mixed xylene is expected to remain a dependable and widely used material across diverse industrial applications.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)