Table of Contents

Overview

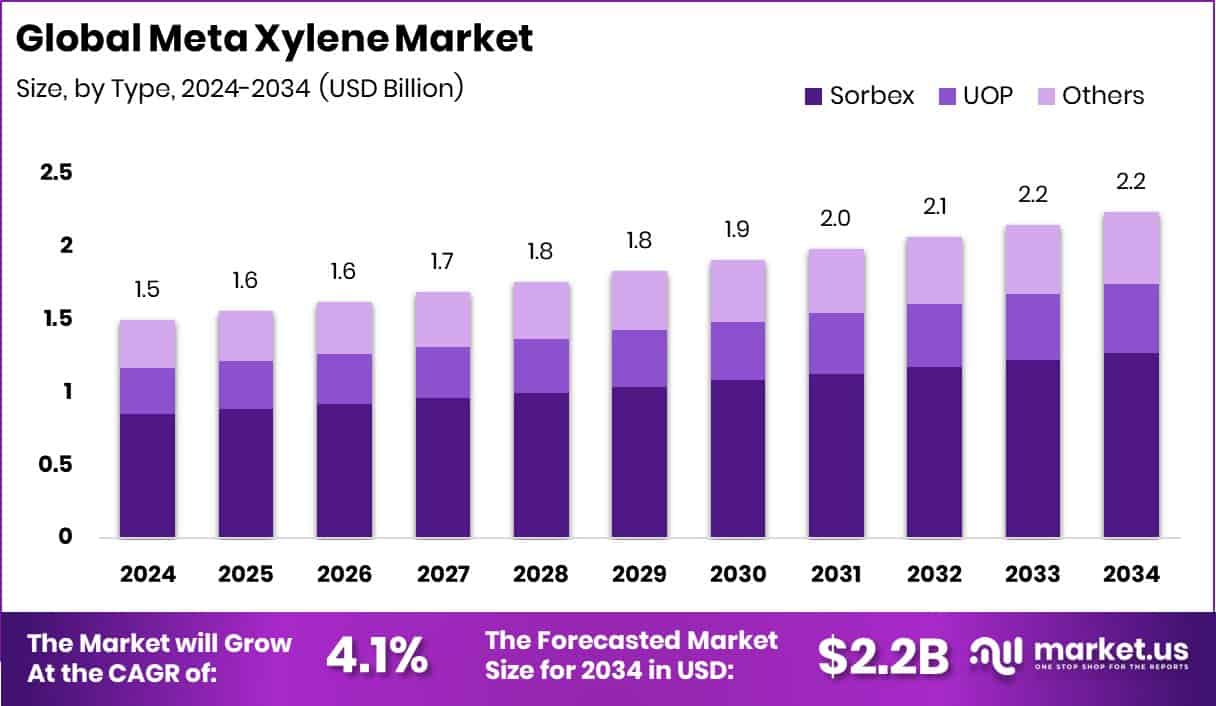

New York, NY – Dec 02, 2025 – The global meta-xylene market is on a steady growth path, rising from USD 1.5 billion in 2024 to about USD 2.2 billion by 2034, supported by a projected 4.1% CAGR between 2025 and 2034. Asia-Pacific remains the leading region, holding a strong 46.20% market share, equivalent to nearly USD 0.6 billion, driven by expanding industrial and manufacturing activity.

Meta-xylene is one of the three xylene isomers and is mainly used as a core raw material for producing isophthalic acid. This derivative is essential for making high-performance resins, coatings, and advanced packaging materials. Because of its chemical stability and effective solvent properties, meta-xylene also plays a role in adhesives, paints, plastics, and specialty material formulations.

Market expansion is closely linked to increasing demand for durable, heat-resistant polymers. Industries such as packaging, automotive, construction, and electronics are shifting toward lightweight materials that offer higher strength and longer service life, which supports greater use of isophthalic acid-based resins derived from meta-xylene.

An emerging opportunity lies in sustainability-driven innovation. For example, Bioeutectics recently secured USD 2.1 million to launch an eco-friendly solvent in the U.S. While not directly tied to meta-xylene, such funding highlights growing interest in cleaner chemical solutions, encouraging innovation in processing routes and the development of more sustainable meta-xylene-based derivatives.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-meta-xylene-market/request-sample/

Key Takeaways

- The Global Meta Xylene Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034.

- Sorbex dominates the Meta Xylene Market with 56.8%, driven by its strong separation efficiency.

- Isophthalic acid leads the Meta Xylene Market with 69.2%, supported by rising demand for durable resins.

- Packaging holds a 44.7% share in the meta-xylene market due to strong demand for performance materials.

- In the Asia-Pacific, rising manufacturing activity supported the 46.20% share worth USD 0.6 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=166718

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.5 Billion |

| Forecast Revenue (2034) | USD 2.2 Billion |

| CAGR (2025-2034) | 4.1% |

| Segments Covered | By Type (Sorbex, UOP, Others), By Application (Isophthalic Acid, 2,4- and 2,6-xylidine, Solvents, Others), By End User (Packaging, Construction, Automotive, Others) |

| Competitive Landscape | GS Caltex Corporation, Honeywell International Inc., Lotte Chemical Corporation, Mitsubishi Gas Chemical Company Inc., Parchem Fine & Specialty Chemicals, BASF SE, MITSUBISHI GAS CHEMICAL COMPANY, INC., LOTTE Chemical CORPORATION, Shell Plc, Chevron Phillips Chemical Company LLC, BP PLC |

Key Market Segments

By Type Analysis

In 2024, Sorbex dominated the By Type segment of the Meta Xylene Market, capturing a significant 56.8% share. This technology remained the preferred separation method because it consistently delivers high-purity meta-xylene, which is essential for downstream uses including resins, coatings, and other high-performance materials. Manufacturers that depend on uniform feedstock quality continued to favor Sorbex due to its stable output, operational efficiency, and proven performance in large-scale industrial settings.

Sorbex’s leadership position also reflects the industry’s broader transition toward advanced processing solutions that reduce material losses while ensuring predictable supply. As demand grew for specialty polymers and durable coating systems, producers increasingly required technologies that could meet tighter quality standards without disrupting production flow.

By offering reliability and cleaner separation results, Sorbex remained well aligned with evolving manufacturing needs and stricter performance expectations across key end-use industries, reinforcing its strong market position during the year.

By Application Analysis

In 2024, isophthalic acid led the By Application segment of the Meta Xylene Market with a commanding 69.2% share. This dominance is rooted in its critical role as a key intermediate for high-performance resins widely used in packaging, coatings, and reinforced material systems. Manufacturers rely on isophthalic acid because it enhances mechanical strength, thermal stability, and overall durability, qualities that are increasingly important in advanced industrial applications.

Its broad use in packaging films, protective surface coatings, and specialty plastics supported consistent demand throughout the year. As industries moved away from conventional materials toward solutions offering longer life and better resistance to heat and stress, consumption of isophthalic acid remained steady.

This continued preference helped secure its strong position in the application mix, reinforcing its importance within the meta xylene value chain and sustaining its leadership across multiple end-use sectors.

By End User Analysis

In 2024, the packaging sector emerged as the leading By End User segment in the Meta Xylene Market, holding a notable 44.7% share. This dominance was supported by growing demand for packaging materials that are lightweight yet strong enough to protect products across food, beverage, and industrial supply chains. Meta xylene–derived materials play a key role in manufacturing high-performance resins that enhance barrier properties, improve shelf life, and safeguard products during storage and transport.

Packaging producers increasingly adopted these advanced resins to meet rising expectations for durability and quality. Consumer-facing brands also pushed for better packaging solutions to limit product damage and preserve freshness.

The steady demand from film producers and packaging converters reinforced the segment’s strong position. As a result, packaging remained the largest consumer of meta xylene, clearly shaping overall demand trends and maintaining its leadership throughout the year.

Regional Analysis

Asia-Pacific led the Meta Xylene Market with a strong 46.20% share, valued at USD 0.6 Bn, driven by active packaging, resin, and coatings industries. Robust manufacturing capacity, ongoing investment in advanced materials, and a large downstream chemical base helped the region retain its top position and ensured stable consumption of meta xylene.

North America showed steady demand, supported by a well-established chemicals sector. Consistent use in high-performance coatings and packaging applications, along with reliable production infrastructure, sustained its market presence.

Europe maintained stable consumption due to its emphasis on premium resins and specialty materials. Demand continued from industries seeking durable, heat-resistant formulations for advanced applications.

The Middle East & Africa experienced gradual growth, aided by developments in basic chemicals and rising interest in downstream processing activities, resulting in moderate but consistent demand.

Latin America reported stable usage, supported by improving manufacturing activity and growing adoption of performance-focused resins and coatings, relying on dependable supply to meet industrial needs.

Top Use Cases

- Feedstock for resin production (via Isophthalic Acid): Meta-xylene is oxidized to produce isophthalic acid, a key building block for high-performance polyester and alkyd resins. These resins are widely used in coatings, packaging, and reinforced plastics.

- Solvent in paints, varnishes and coatings: Meta-xylene serves as a solvent to dissolve resins, binders, and pigments — slowing drying, ensuring even spread, and helping paints, enamels, or varnishes finish with a smooth glossy look.

- Cleaning, degreasing, and surface preparation agent: Before painting or coating, meta-xylene helps clean and degrease metal, plastic or wood surfaces — removing oils and contaminants so coatings or adhesives stick better.

- Component in adhesives and sealants: It’s used in adhesive and sealant formulations to adjust viscosity and improve spreading, enabling strong, flexible bonds — useful in construction, packaging, and industrial sealing applications.

- Raw material for high-performance plastics and PET modifications: Through isophthalic acid and related routes, meta-xylene helps produce modified PET or other high-performance plastics — offering enhanced heat resistance, durability, and barrier properties for bottles, packaging films, and specialty mouldings.

Recent Developments

- In September 2024, Honeywell completed the acquisition of Air Products’ liquefied natural gas (LNG) process technology and equipment business for USD 1.81 billion cash.

- In April 2024, Lotte Chemical announced that Neste will supply renewable raw materials to some of its plants. The collaboration aims to produce chemicals and plastics with lower emissions.

Conclusion

The meta xylene market continues to show steady progress as industries rely on it for producing high-performance materials. Its importance as a core feedstock for resins, coatings, and specialty polymers keeps demand stable across packaging, construction, and industrial manufacturing.

Manufacturers value meta xylene for the strength, durability, and heat resistance it brings to end products. Ongoing advances in material science and processing methods are further supporting its role in modern applications.

At the same time, growing attention toward cleaner production and more efficient chemical processes is encouraging innovation within the value chain. Overall, the meta xylene market remains well positioned to support evolving industrial needs while adapting to changing expectations around performance and sustainability.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)