Table of Contents

Overview

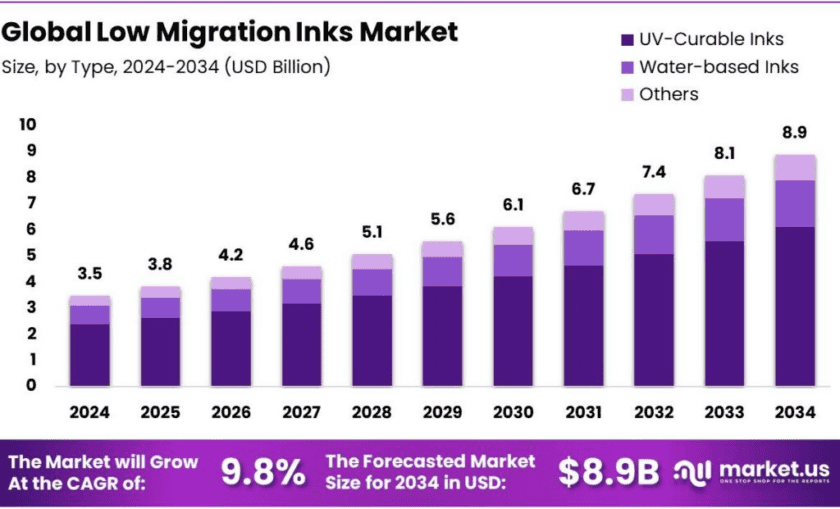

New York, NY – Dec 08, 2025 – The global Low Migration Inks market is projected to witness strong growth over the coming decade, with its value expected to reach USD 8.9 billion by 2034, rising from USD 3.5 billion in 2024. This expansion reflects a robust CAGR of 9.8% across the forecast period from 2025 to 2034. In 2024, Europe emerged as the leading regional market, accounting for over 39.6% of total demand and generating approximately USD 1.4 billion in revenue.

Low migration inks are specially engineered printing inks developed to limit the transfer of chemical components into sensitive products such as food, beverages, and pharmaceuticals. These inks are essential for food-contact packaging applications, as they rely on carefully selected raw materials and pigments that reduce the risk of ink substances leaching into packaged contents. By incorporating higher-molecular-weight components that are less mobile, low migration inks help safeguard consumer health and maintain regulatory compliance. As awareness around food safety grows and regulatory standards become more stringent, demand for these inks continues to strengthen worldwide.

Market growth is further supported by rising investments in research and development, with manufacturers expanding the application scope of low migration inks across flexible packaging, labels, and pharmaceutical packaging. In parallel, the global shift toward sustainability is driving interest in environmentally responsible ink formulations, including low-VOC and bio-based alternatives. However, the market still faces certain challenges, particularly related to higher production costs and occasional adhesion performance issues on specific substrates.

Regulatory data reinforces the importance of low migration inks in modern packaging. According to the European Food Safety Authority (EFSA), low-migration inks can reduce harmful substance transfer by more than 80% compared to conventional inks, significantly lowering potential health risks. Furthermore, data from the EU’s Rapid Alert System for Food and Feed (RASFF) showed that 34% of packaged food contamination cases in 2022 were linked to ink migration, highlighting the critical role of compliant ink technologies in food safety.

Key Takeaways

- The global low migration inks market was valued at USD 3.5 billion in 2024.

- The global low migration inks market is projected to grow at a CAGR of 9.8% and is estimated to reach USD 8.9 billion by 2034.

- Based on the types of low migration inks, UV-cured inks dominated the market, with around 68.9% of the total global market.

- Among the substrates, plastic is the most utilized in the low migration inks market, with 52.4% of the market share.

- Based on printing processes, mainly low migration inks are used for the flexography process, approximately 44.5%.

- Based on the applications of the low migration inks, flexible packaging held the majority of revenue share in 2024 at 56.2%.

- Among the end-uses of the low migration inks, the food & beverage industry accounted for the largest revenue share, which is 61.7%, in the market.

- Europe was at the forefront of the low migration inks market, accounting for around 39.6% of the total global consumption.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/low-migration-inks-market/free-sample/

Report Scope

| Market Value (2024) | USD 3.5 Bn |

| Forecast Revenue (2034) | USD 8.9 Bn |

| CAGR (2025-2034) | 9.8% |

| Segments Covered | By Type (UV-Curable Inks, Water-based Inks, Others), By Printing Process (Flexography, Digital, Offset, Gravure, Others), By Substrate (Paper and Paperboard, Plastic, Others), By Application (Rigid Packaging, Flexible Packaging), By End-use (Food & Beverage, Pharmaceutical, Cosmetic & Personal Care, Tobacco, Others |

| Competitive Landscape | Sun Chemical, INX International Ink, Flint Group, Hubergroup, Siegwerk Druckfarben, Altana, Epple Druckfarben, Marabu, Artience, Encres Dubuit, Kao Collins, Rucoinx, Huizhou ZhongZhiXing Color Technology, Zeller+Gmelin Corporation, and Other Players. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161477

Key Market Segments

Type Analysis – UV-Curable Inks

The low migration inks market is categorized by type into UV-curable inks, water-based inks, and other variants. Among these, UV-curable inks clearly dominate, accounting for nearly 68.9% of the total market share. Their leadership is driven by rapid curing speed, strong adhesion, and a significantly lower risk of ink migration. Unlike water-based inks, which require extended drying times and face limitations on non-porous surfaces such as plastics and foils, UV-curable inks harden instantly under ultraviolet light, enabling seamless use in high-speed packaging operations. They also deliver excellent chemical resistance and long-lasting print quality, making them well-suited for food, pharmaceutical, and cosmetic packaging. In addition, their solvent-free nature supports lower VOC emissions and compliance with strict environmental and safety regulations.

Printing Process Analysis – Flexography

By printing process, the low migration inks market is segmented into flexography, digital, offset, gravure, and others. Flexography leads this segment, generating approximately 44.5% of total market revenue. The dominance of flexographic printing is largely due to its compatibility with diverse packaging substrates, particularly flexible and non-porous materials. This process utilizes fast-drying, low-viscosity inks that perform effectively on plastic films, foils, and laminates. Flexography supports high-volume production at fast speeds while maintaining consistent print quality and regulatory compliance. Compared with digital printing, which is less economical for long runs, and gravure or offset printing, which involve higher setup costs and limited flexibility, flexography offers an optimal balance for low migration ink applications.

Substrate Analysis – Plastic

Based on substrate type, the low migration inks market is divided into paper and paperboard, plastic, and others. Plastic substrates dominate this segment, holding a market share of about 52.4%. Plastics are widely used in food, pharmaceutical, and cosmetic packaging, where stringent migration control is essential. Materials such as polyethylene, polypropylene, and PET provide strong barriers against moisture, oxygen, and contaminants, helping preserve product quality. Although plastics are non-porous, which can increase the risk of ink component transfer, low migration inks are specifically formulated to reduce chemical mobility. Their compatibility with flexible packaging formats such as pouches, blister packs, and wraps further strengthens the demand for plastic substrates in this market.

Application Analysis – Flexible Packaging

In terms of application, the low migration inks market is segmented into rigid packaging and flexible packaging. Flexible packaging emerged as the dominant application in 2024, capturing more than 56.2% of the market share. Low migration inks are more extensively used in flexible packaging because materials such as films, foils, and laminates often come into direct or indirect contact with food and pharmaceutical products. These applications require strict compliance with safety regulations to prevent contamination. Flexible packaging is lightweight, adaptable, and widely used for snacks, fresh foods, and medical products, driving strong demand for specialized inks. In contrast, rigid packaging materials such as glass and metal are less prone to migration due to their inert surfaces, reducing reliance on low migration inks.

End-Use Analysis – Food and Beverage Industry

By end use, the low migration inks market is segmented into food and beverage, pharmaceutical, cosmetic and personal care, tobacco, and others. The food and beverage industry held a leading position in 2024, accounting for over 61.7% of total market demand. This dominance is attributed to the direct interaction between packaging materials and consumable products, where ink migration poses serious health risks. The sector faces strict global regulations to protect consumers, particularly vulnerable populations such as children and the elderly. While pharmaceuticals, cosmetics, and tobacco products also require safe packaging, they often include additional protective layers that reduce direct ink contact. As a result, regulatory pressure and consumer safety concerns make the food and beverage industry the largest adopter of low migration inks.

List of Segments

By Type

- UV-Curable Inks

- Water-based Inks

- Others

By Printing Process

- Flexography

- Digital

- Offset

- Gravure

- Others

By Substrate

- Paper & Paperboard

- Plastic

- Others

By Application

- Rigid Packaging

- Flexible Packaging

By End-Use

- Food & Beverage

- Bakery & Confectionery

- Dairy Products

- Beverages

- Frozen & Processed Foods

- Others

- Pharmaceutical

- Cosmetic & Personal Care

- Tobacco

- Others

Regional Analysis

Europe Market Analysis

In 2024, Europe emerged as the leading region in the global low migration inks market, accounting for approximately 39.6% of total market share and generating around USD 1.4 billion in revenue. This strong regional position is primarily supported by Europe’s strict regulatory framework, a well-established packaging industry, and high consumer awareness regarding food safety. The region has been at the forefront of adopting safer printing solutions to prevent chemical contamination in packaged food and pharmaceutical products.

The European Union enforces some of the world’s most comprehensive packaging safety regulations, including Regulation (EC) No 1935/2004 and the Swiss Ordinance SR 817.023.21, which set stringent limits on the migration of chemical substances from packaging materials into food. These regulations have significantly increased the adoption of low migration inks, particularly across key markets such as Germany, France, and Switzerland, where regulatory compliance is closely monitored and strictly enforced.

In addition, major food and beverage manufacturers in Europe have implemented internal packaging safety standards that go beyond regulatory requirements. Leading companies such as Nestlé and Danone actively prioritize safe and compliant printing materials, further strengthening demand for low migration inks. Europe’s strong focus on sustainable packaging has also encouraged the use of UV-curable and water-based low migration inks, which support both environmental goals and consumer safety.

Top Use Cases

Food & Beverage Flexible Packaging

- Low-migration inks are widely used for printing on flexible films or pouches that contain foods and beverages. Because these packaging materials often come into direct contact with the food product (or are separated only by a thin plastic/film), there is a real risk of ink components migrating into the food. Using low-migration inks helps prevent such migration — protecting product safety and compliance with food-contact regulations.

- In many cases, low-migration inks are used with plastic or laminated film substrates (e.g. polyethylene, polypropylene, PET) that act as moisture/oxygen barriers but are non-porous. The non-porous nature makes migration risk higher compared to porous materials; hence low-migration inks become critical.

Pharmaceutical Packaging & Labels

- Low-migration inks are also highly relevant for pharmaceutical packaging and labelling, where chemical safety and regulatory compliance are critical. Since pharmaceuticals (tablets, powders, liquids) may be sensitive to contamination, inks used on blister packs, sachets, or flexible pouches must minimise the possibility of harmful substances migrating into or altering the contents.

- Using low-migration inks in pharmaceutical applications ensures that the packaging meets stringent safety standards, especially when packaging touches medicines directly or when packaging layers are thin films without strong barrier layers. This reduces risks of contamination, off-odour or off-taste, and ensures patient safety.

Labels & Narrow-Web Packaging

- For products such as candy wrappers, snack packs, chocolate bars, or other processed foods, low-migration inks are used on thin film/foil labels and wrappers. Because these are frequently made of flexible films or laminates with limited barrier properties, migration risk must be controlled.

- In such cases, ink formulations often use high-molecular-weight resins, polymeric photoinitiators, or fatty-acid-ester based solvents instead of conventional mineral or vegetable oils, reducing the chance that ink components will migrate into the food.

Multi-Material / Composite Packaging with Low-Barrier Layers

- In packaging constructions where multiple layers (plastic film + paperboard + barrier coatings) are used, if the innermost layer (the one in contact with food) offers limited barrier properties, low-migration inks become vital even if the outer layers are robust. According to packaging-industry guidance, low-migration inks are recommended when thin film substrates or paper materials with weak barrier properties are used for the primary packaging material.

- In such multi-layer or composite packaging formats (e.g. laminates for snacks, ready-to-eat meals, confectionery, etc.), low-migration ink use helps assure that no unsafe substances migrate through weak barrier layers — essential for compliance and food safety.

Recent Developments

INX International Ink Co.: In April 2025, INX International introduced DuraInx HRC, a sustainable low-migration ink line with up to 40% renewable content, tailored for sensitive food-safe packaging applications. Their broader low-migration portfolio — including UV flexo, offset, coatings and energy-curable products — addresses flexible film, labels and rigid containers, offering tested compliance with EU and FDA food-contact regulations. INX thereby reinforces its market-leader status, blending regulatory safety, sustainability and broad substrate compatibility.

Flint Group — In 2025, Flint Group rolled out its Flexocure LEAP ink line, a next-generation UV-curable low-migration solution specially designed for food-contact packaging. The new inks use a novel resin system that drastically reduces photoinitiator migration — helping converters meet evolving regulatory safety standards while maintaining high-speed UV flexo printing performance with strong adhesion and vibrant color.

hubergroup — In mid-2025, hubergroup opened a new facility in Silvassa (India) to manufacture its “DFC” low-migration inks for direct food-contact printing, marking a significant expansion in its global food-safe packaging capabilities. These inks, produced under stringent GMP practices, meet major international safety standards and enable printing on paper or cardboard packaging for food products such as chocolates, fruits, and fast foods — supporting more sustainable, paper-based packaging solutions.

Siegwerk Druckfarben AG & Co. KGaA — In 2025, Siegwerk expanded its low-migration ink offerings by promoting its optimized UV and UV/LED ink series for food-contact packaging, suitable for labels, shrink sleeves, aluminium lids, foils and plastic-tube printing. Their “Migration Optimized UV” inks rely on high-molecular-weight photoinitiators and acrylates to minimize chemical migration while preserving print quality — appealing to converters serving food, beverage and sensitive-product packaging markets.

ALTANA — In mid-2025, ALTANA (through its pigment/chemicals division) won its Innovation Award for a novel UV-curing printing-ink formulation that uses PVD-produced effect pigments and alcohol-based silver-dollar pigments, designed for food-packaging printing. This new ink line combines strong technical performance (high gloss, stable ink transfer, good overprintability) with compliance for indirect food contact applications — reflecting ALTANA’s focus on sustainability, regulatory safety, and advanced packaging-ink technology.

Epple Druckfarben AG — In 2025, Epple continues to supply specialized low-migration inks tailored for food-contact packaging, offering solutions designed for labels, wrappers, and direct food-stuff printing that meet strict migration-control requirements. Their low-migration line emphasises safety for food applications while maintaining print quality and compliance, supporting converters and brand-owners seeking reliable and regulatory-compliant packaging inks.

Marabu GmbH — In 2025, Marabu markets its “UltraPack UVFP,” a UV-curable, low-migration screen-printing ink approved for PE/PP plastic packaging, aimed at food-safe and compliant packaging applications. Thanks to this product, Marabu strengthens its role among key players supplying migration-controlled inks for flexible packaging materials, offering high adhesion, durability, and certification-grade safety for food-contact use.

artience Co., Ltd. — As of 2025, artience (formerly part of a major ink group) continues to expand its low-energy, low-migration ink portfolio for packaging and labels. Their UV, LED and EB-curable inks comply with strict migration-safety regulations (e.g. Swiss Ordinance, EuPIA standards), making them suitable for food-contact or food-outer packaging. By offering globally compliant low-migration solutions, artience supports brand-owners and converters seeking both regulatory safety and efficient production.

Encres DUBUIT — In 2025, Encres DUBUIT maintained its role as a specialist in industrial inks, supplying UV and solvent-based screen, pad, and digital printing inks for packaging, including plastic containers and rigid/flexible packaging. Their inks are formulated without CMR (carcinogenic, mutagenic, reprotoxic) substances and designed for strong adhesion, durability, and regulatory compliance for food, cosmetics, and pharma packaging. Through this, Encres DUBUIT provides safe, high-performance marking and printing solutions for packaging applications worldwide.

Kao Collins Corporation — As of 2025, Kao Collins offers a full range of food-safe and packaging-grade inkjet inks, including UV/LED-curable, EB-curable, water-based and solvent-based formulations designed for plastics, films, glass, metal, cartons and more. Their “low-migration UV/LED-curable inks” and water-based inks like “LUNAJET” support food- and pharmaceutical-packaging printing, enabling clear barcodes, high-resolution graphics, and coding while aiming to minimize chemical migration risks.

RUCO INX — By 2024–2025, RUCO INX has been active in the low-migration/UV-curable inks market, offering sustainable, food-contact-compliant ink sets tailored for packaging and plastic decoration. Their inks appeal to packaging converters seeking low-migration solutions that meet regulatory and environmental demands, combining good print quality with reduced risk of ink migration into food or sensitive products.

Huizhou ZhongZhiXing Color Technology Co., Ltd. — As of 2024–2025, Huizhou ZhongZhiXing has emerged as a notable Asian manufacturer of food-grade, low-migration water-based and UV inks. Their inks are designed for flexographic and gravure printing on food packaging, meet US FDA and EU food-safety standards, and are marketed as eco-friendly (low-VOC) while delivering good adhesion and vibrant print quality for films, cartons, and labels.

Zeller+Gmelin Corporation — In 2025, Zeller + Gmelin broadened its UV/LED ink portfolio with a new low-migration ink line (e.g., its 16 Series UV/LED and Dry-Offset 77/78 Series), tailored for pharmaceutical and indirect food-contact packaging. These inks comply with major food-safety regulations (including EU and major brand standards), offering high-quality color and print performance for shrink sleeves, labels, and packaging substrates while ensuring migration safety and regulatory compliance.

Conclusion

In conclusion, low migration inks play a critical and growing role in modern packaging — especially for food, beverages, pharmaceuticals, and other sensitive products. They are formulated to drastically reduce the transfer of potentially harmful substances from printed packaging into consumables, helping ensure compliance with food-contact regulations, safeguarding consumer health, and protecting product integrity.

Regulatory frameworks such as Regulation (EC) No 1935/2004 and Commission Regulation (EU) No 10/2011 set strict requirements on migration limits and mandate Good Manufacturing Practices (GMP) for inks intended for food-contact packaging. Because of such rules and rising consumer awareness of food safety, demand for low migration inks — especially in food-grade packaging — is increasingly widespread.