Table of Contents

Overview

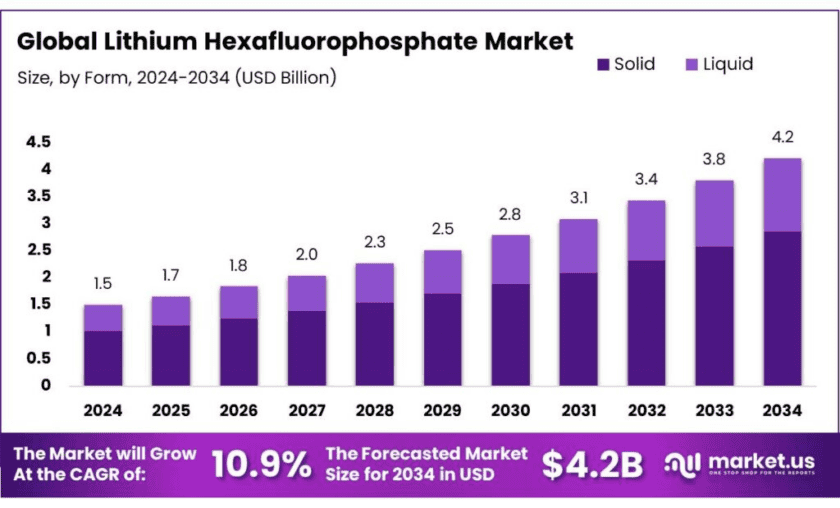

New York, NY – Dec 10, 2025 – The global Lithium Hexafluorophosphate (LiPF₆) market is projected to witness strong expansion, with market value expected to reach around USD 4.2 billion by 2034, up from USD 1.5 billion in 2024, registering a healthy CAGR of 10.9% during the 2025–2034 forecast period. In 2024, Europe held a leading position in the global market, accounting for more than 39.6% of total demand and generating approximately USD 1.4 billion in revenue, supported by rapid electric vehicle adoption, battery manufacturing investments, and energy storage deployment across the region.

Lithium hexafluorophosphate is a critical lithium salt extensively used as an electrolyte component in lithium-ion batteries, where it enables high ionic conductivity and helps form stable passivation layers on electrode surfaces. Its stability and compatibility with commonly used carbonate solvents make it the preferred electrolyte salt for commercial lithium-ion cells. As battery technologies advance, demand has shifted toward higher-purity LiPF₆ grades, prompting producers to optimize manufacturing processes to minimize impurities such as hydrogen fluoride (HF), PF₅ by-products, and moisture sensitivity, which directly affect battery performance and safety.

Market dynamics are largely shaped by the rapid growth of electric vehicles, portable electronics, and grid-scale energy storage systems, along with supply-chain concentration in Asia and ongoing material substitution risks. Rising lithium demand for clean-energy applications has translated into higher downstream demand for electrolyte salts. Industry data indicated a sharp increase in LiPF₆ production during 2024, with reported output reaching roughly 187,000 tonnes, reflecting a 45% year-on-year increase, although this expansion was accompanied by notable spot-price declines, highlighting the market’s sensitivity to upstream lithium availability and battery demand fluctuations.

Key growth drivers include sustained EV and energy-storage rollouts, increasing electrolyte usage per battery pack due to higher energy densities, and government-backed supply-chain localization initiatives that support domestic electrolyte and precursor production. Additionally, declining battery pack prices—reported at around USD 115 per kWh in late-2024—have broadened market accessibility and boosted battery demand volumes, even as intensified competition has placed pressure on pricing and margins across the lithium-ion battery value chain.

Key Takeaways

- Lithium Hexafluorophosphate market size is expected to be worth around USD 4.2 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 10.9%.

- Solid held a dominant market position, capturing more than a 67.8% share in the global lithium hexafluorophosphate (LiPF₆) market.

- Pitch-based held a dominant market position, capturing more than a 57.6% share in the global lithium hexafluorophosphate (LiPF₆) market.

- Automotive held a dominant market position, capturing more than a 57.2% share in the global lithium hexafluorophosphate (LiPF₆) market.

- Asia-Pacific (APAC) region dominated the lithium hexafluorophosphate (LiPF₆) market, securing 47.40% share, equivalent to about USD 0.70 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-lithium-hexafluorophosphate-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.5 Billion |

| Forecast Revenue (2034) | USD 4.2 Billion |

| CAGR (2025-2034) | 10.9% |

| Segments Covered | By Form (Solid, Liquid), By Product Type (Pitch-based, PAN-based, Rayon-based), By Application (Automotive, Industrial Energy Storage Solutions, Consumer Electronics, Others) |

| Competitive Landscape | Anhui Meisenbao Technology Co., Ltd., Foosung Co., Ltd., lolitec Ionic Liquids Technologies GmbH, Kanto Denka Kogyo Co., Ltd., Morita New Energy Materials (Zhangjiagang) Co., Ltd., Stella Chemifa Corporation, Zhenjiang Poworks Co., Ltd, FUJIFILM Wako Pure Chemical Corporation, E-Lyte Innovations GmbH, Glentham Life Sciences Limited |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161429

Key Market Segments

By Form Analysis

In 2024, the solid form of lithium hexafluorophosphate (LiPF₆) held a dominant position in the global market, accounting for approximately 67.8% of total demand. Solid LiPF₆ continues to be the preferred choice for electrolyte manufacturers due to its higher chemical stability, longer shelf life, and safer handling compared with liquid alternatives. Its crystalline nature reduces the risk of hydrolysis and degradation, making it well suited for storage, transport, and large-scale electrolyte preparation. The strong expansion of electric vehicle and energy storage battery production further supported demand for solid LiPF₆, as manufacturers increasingly standardized its use to ensure consistent electrolyte quality and operational safety.

By Product Type Analysis

In 2024, pitch-based products led the lithium hexafluorophosphate market, capturing around 57.6% of the global share. This dominance is driven by the superior electrical conductivity, strong thermal stability, and uniform structural properties associated with pitch-based materials. These characteristics make them highly attractive for advanced lithium-ion battery systems that require high energy efficiency, fast-charging capability, and long service life. As battery makers continue to prioritize higher energy density and improved safety performance, pitch-based LiPF₆ products have gained widespread adoption across key battery manufacturing regions, particularly in Asia-Pacific and Europe.

By Application Analysis

The automotive sector remained the largest application area for lithium hexafluorophosphate in 2024, accounting for approximately 57.2% of overall market demand. This leadership was fueled by the rapid global rollout of electric vehicles, which significantly increased lithium-ion battery production volumes. LiPF₆ plays a critical role in EV batteries by enabling efficient lithium-ion transport and maintaining stable electrochemical performance across a wide temperature range. Growing EV manufacturing capacity in major automotive hubs, coupled with supportive government policies promoting zero-emission vehicles, further strengthened LiPF₆ demand in automotive applications and reinforced the sector’s market dominance.

List of Segments

By Form

- Solid

- Liquid

By Product Type

- Pitch-based

- PAN-based

- Rayon-based

By Application

- Automotive

- Industrial Energy Storage Solutions

- Consumer Electronics

- Others

Regional Analysis

In 2024, the Asia–Pacific (APAC) region emerged as the largest market for lithium hexafluorophosphate (LiPF₆), capturing around 47.40% of global demand and generating approximately USD 0.70 billion in revenue. This leading position was primarily supported by the region’s dominance in lithium-ion battery manufacturing, rapid expansion of electric vehicle adoption, and sustained growth in consumer electronics production. Major economies such as China, Japan, and South Korea continued to drive demand, benefiting from their strong presence across automotive batteries, stationary energy storage, and portable electronic applications.

Although APAC’s market valuation had previously been higher—estimated near USD 1.14 billion—market normalization and shifting global supply-demand dynamics led to a recalibrated regional value of about USD 0.78 billion in 2024. Despite this adjustment, APAC maintained its dominant position in global LiPF₆ consumption, closely aligning with its 47.40% share. The region’s competitive advantages include cost-efficient manufacturing, integrated supply chains for lithium and fluorine-based raw materials, and favorable government policies focused on strengthening domestic battery material production, all of which continue to support APAC’s leadership in the LiPF₆ market.

Top Use Cases

Electrolyte Salt for Lithium-Ion Batteries: LiPF₆ is the most commonly used lithium salt in battery electrolytes because it dissolves well in organic solvents and provides high ionic conductivity, which ensures efficient transport of lithium ions between the cathode and anode. It supports a wide electrochemical stability window and is compatible with many lithium-ion battery chemistries (e.g. NMC, LFP, etc.), making it suitable for electric vehicles (EVs), consumer electronics (smartphones, laptops), and grid / home energy storage systems.

Enabling High Energy Density & Stable Battery Performance: Because of its chemical properties, LiPF₆ helps formulate electrolytes that support high energy density, stable cycling, and efficient charge/discharge behavior. This makes LiPF₆-based cells a foundation for batteries with higher capacity and longer lifespan — characteristics that are especially important for EV batteries and large-scale storage where performance and durability matter.

Widely Used in Portable Electronics and Consumer Devices: Beyond EVs and storage, LiPF₆-based electrolytes power the lithium-ion batteries used in a vast array of portable electronics — from smartphones and tablets to laptops and wearable devices. Because LiPF₆ supports stable battery performance and high conductivity, device manufacturers can deliver reliable, compact, and energy-dense power sources for everyday consumer applications.

Energy Storage Systems and Renewable Energy Integration: LiPF₆ is also critical in stationary and grid-scale energy storage systems (ESS), which store electricity from renewable sources (solar, wind) for later use. The demand surge in renewable energy infrastructure and battery-based storage makes LiPF₆ indispensable for large-capacity, long-life storage modules. As global policies push toward decarbonization and clean energy, LiPF₆-based battery systems support these goals by enabling scalable, efficient energy storage.

Research & Advanced Battery Development: LiPF₆ remains widely used in research and development of advanced battery technologies — including improved lithium-ion cells and gel / polymer electrolyte systems. Its solubility in organic solvents and ability to support ion conduction make it useful when testing new cell chemistries or optimizing electrolyte formulations for better safety, performance, or adaptability to high-voltage / high-density battery designs.

Recent Developments

Anhui Meisenbao Technology Co., Ltd. — In 2024, Anhui Meisenbao expanded its footprint as a key supplier of high-purity Lithium Hexafluorophosphate (LiPF₆), marketing it alongside other battery-grade salts and solvents for lithium-ion battery production. Its LiPF₆ offering is crystalline, battery-grade quality, and exported globally to markets including India, Europe, and North America, indicating growing demand for stable electrolyte salts as EV and energy-storage deployments accelerate.

Foosung Co., Ltd. — In 2025, Foosung continued to supply ultra–high-purity LiPF₆ for rechargeable lithium-ion batteries, achieving specifications of > 99.9% purity, moisture under 10 ppm and HF under 20 ppm — quality standards required for automotive and energy-storage battery cells. As a South Korea–based chemical and specialty-gas firm, Foosung leverages established fluorine-chemical infrastructure to meet growing demand from EV and electronic-device battery manufacturers globally.

Iolitec Ionic Liquids Technologies GmbH — In 2025, Iolitec offered battery-grade Lithium hexafluorophosphate under the product name IOLILYTE LBE 0200, supplying crystalline LiPF₆ suitable for lithium-ion battery electrolytes. Their product is available in bulk and small-volume formats, reflecting demand from both large-scale battery manufacturers and smaller R&D or pilot-scale producers. As a specialized chemical supplier, Iolitec supports stable electrolyte supply for EV, energy-storage and consumer-battery markets, underlining its role in the global LiPF₆ supply chain.

Kanto Denka Kogyo Co., Ltd. — As of 2024–2025, Kanto Denka remains a major global producer of lithium hexafluorophosphate, supplying LiPF₆ for batteries used in smartphones, laptops, and electric vehicles. The company’s LiPF₆ is recognized for high purity and reliable supply, and in 2023 they licensed their LiPF₆ technology to a North American producer to help meet growing battery demand outside Asia.

Morita New Energy Materials — In 2025, Morita New Energy Materials (Zhangjiagang) continued to operate as a dedicated producer of battery-grade Lithium hexafluorophosphate (LiPF₆), with a manufacturing capacity of roughly 3,700 tons per year, supplying this critical electrolyte salt to lithium-ion battery makers globally. Their role underscores the importance of reliable LiPF₆ supply amid rising electric-vehicle and energy-storage demand, helping maintain stable production of high-performance batteries worldwide.

Stella Chemifa Corporation — In 2025, Stella Chemifa remained a key supplier of high-purity LiPF₆ for lithium-ion batteries, actively expanding its production capacity to meet growing demand from the EV and energy storage sectors. As battery producers increasingly seek crystalline, high-stability electrolyte salts, Stella Chemifa’s LiPF₆ offerings gained traction — reinforcing its reputation among major battery-component suppliers worldwide.

Zhenjiang Poworks Co., Ltd. — In 2025, Zhenjiang Poworks remained a recognized manufacturer and supplier of battery-grade Lithium Hexafluorophosphate (LiPF₆), supporting global lithium-ion battery producers with crystalline LiPF₆ suited for EV, grid storage and electronics applications. Their offerings help ensure high ionic conductivity and stable electrolyte performance, supporting the ongoing growth in battery demand driven by electrification and energy-storage trends.

FUJIFILM Wako Pure Chemical Corporation — As of 2025, Fujifilm Wako supplies battery-grade LiPF₆ with high purity (≥ 99.0%) in crystalline powder form, ensuring low water and impurity content—critical for reliable lithium-ion battery electrolytes. Their product supports manufacturers and researchers alike in producing high-performance, stable batteries for EVs, consumer electronics, and energy storage systems.

E-Lyte Innovations GmbH — In 2024, E-Lyte opened a major electrolytes production plant in Kaiserslautern, Germany with an annual capacity of 20,000 tonnes, enabling the company to supply high-quality, battery-grade electrolytes (including salts such as Lithium Hexafluorophosphate, LiPF₆) for lithium-ion batteries, sodium-ion batteries and supercapacitors. Their customizable “ready-to-use” electrolyte solutions foreground their role as a full-service supplier for EV, energy-storage, and electronics battery manufacturers — supporting Europe’s push toward localized battery supply chains.

Glentham Life Sciences Limited — As of 2025, Glentham supplies LiPF₆ (CAS 21324-40-3) with a listed purity of ≥ 98.0%, offered in small laboratory quantities (e.g., grams to bulk) — catering to research labs, small-scale battery developers, and quality-control applications. Their global shipping network and chemical-supply infrastructure help ensure reliable access to this critical electrolyte salt for academia, industrial R&D, and early-stage battery innovation projects worldwide.

Conclusion

In conclusion, lithium hexafluorophosphate (LiPF₆) remains a cornerstone material in the lithium-ion battery ecosystem due to its excellent ionic conductivity, compatibility with common electrolyte solvents, and ability to form stable passivation layers on electrodes. Scientific literature confirms that LiPF₆ is still the most widely used electrolyte salt in commercial lithium-ion batteries, despite ongoing research into alternatives, because it offers a balanced combination of performance, cost, and manufacturability.

With global growth in electric vehicles, consumer electronics, and energy storage systems, demand for LiPF₆ continues to rise alongside battery production capacity. Although challenges such as moisture sensitivity and HF formation remain, continued improvements in purification and formulation, along with strong clean-energy deployment worldwide, position LiPF₆ as a critical enabler of battery performance and the broader electrification transition.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)