Table of Contents

Overview

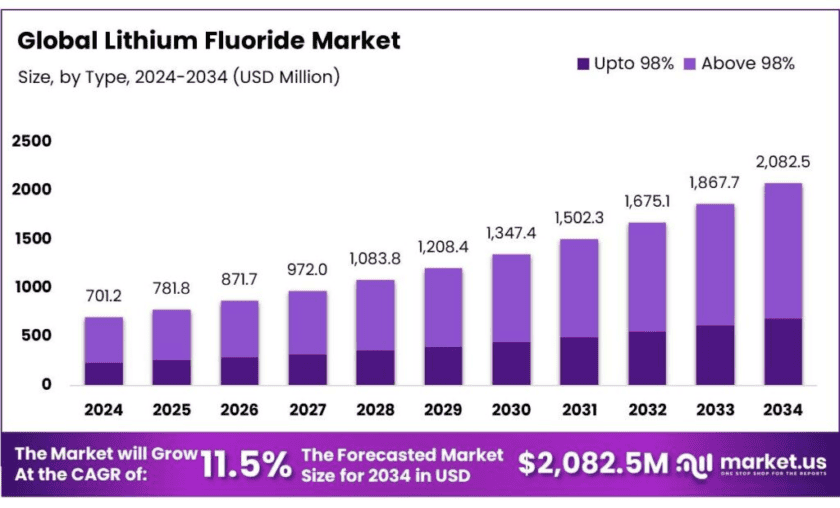

New York, NY – Dec 04, 2025 – The global lithium fluoride market is projected to reach approximately USD 2,082.5 million by 2034, rising from USD 701.2 million in 2024 and reflecting a CAGR of 11.5% from 2025 to 2034. In 2024, the Asia Pacific region accounted for 37.3% of total revenue, valued at USD 261.5 million, indicating its leading position in overall consumption.

Demand growth has been supported by the expanding role of lithium fluoride in nuclear energy systems, optical components, advanced metallurgy, and next-generation battery technologies. The rapid rise of electric mobility continues to drive consumption, as China contributed to more than 60% of global EV sales, strengthening the requirement for lithium-based battery materials.

Further momentum has been observed due to the increasing use of LiF in radiation detection and nuclear applications. According to the U.S. Department of Energy, lithium battery demand in the United States is expected to grow nearly sixfold by 2030, reinforcing the strategic need for a reliable and scalable lithium supply chain.

In the United States, the federal government has implemented substantial incentives to bolster EV adoption. The Inflation Reduction Act offers tax credits of up to $7,500 for new EV purchases and $4,000 for used ones, thereby stimulating consumer interest and accelerating the transition to electric mobility. This surge in EV sales directly correlates with an increased demand for high-purity lithium fluoride, as it is essential for manufacturing advanced battery electrolytes and cathode materials.

For instance, the U.S. Department of Energy’s $700 million conditional loan to Ioneer Ltd. for its lithium project in Nevada exemplifies efforts to strengthen the domestic supply chain for critical minerals. This initiative aims to support the production of lithium sufficient for approximately 370,000 EVs annually, highlighting the strategic importance of lithium and its compounds in the nation’s energy transition.

According to a report by NITI Aayog, India’s domestic capacity for producing lithium-ion batteries is expected to reach 100 GWh per annum by 2030. To support this, the demand for critical materials such as cathode active material, graphite, aluminum, copper, and electrolyte components is projected to be substantial. Specifically, the demand for lithium carbonate is estimated at 56,000 tons per annum, while lithium hydroxide demand is projected at 64,000 tons per annum.

In FY 2024-25, India witnessed a notable increase in EV sales, with over 2 million units sold, marking a 16.9% growth from the previous fiscal year. The two-wheeler segment dominated, accounting for 59% of total EV sales, followed by three-wheelers at 36%, and four-wheelers at 5%. This surge in EV adoption underscores the escalating demand for lithium-ion batteries and, consequently, for lithium fluoride.

Key Takeaways

- Lithium Fluoride Market size is expected to be worth around USD 2082.5 Million by 2034, from USD 701.2 Million in 2024, growing at a CAGR of 11.5%.

- Above 98% held a dominant market position, capturing more than a 67.9% share of the global lithium fluoride market.

- Powder held a dominant market position, capturing more than a 68.4% share of the global lithium fluoride market.

- Lithium-ion Batteries held a dominant market position, capturing more than a 49.2% share of the lithium fluoride market.

- Asia Pacific region held a dominant position in the global lithium fluoride market, accounting for 37.3% of the total market share, valued at approximately USD 261.5 million.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-lithium-fluoride-market/free-sample/

Report Scope

| Market Value (2024) | USD 701.2 Mn |

| Forecast Revenue (2034) | USD 2082.5 Mn |

| CAGR (2025-2034) | 11.5% |

| Segments Covered | By Type (Upto 98%, Above 98%), By Product Type (Powder, Granule), By Application (Fluorescent Materials, Lithium-ion Batteries, Radiation Measurement, Optical Materials, Others) |

| Competitive Landscape | Crystran Ltd, FMC, American Elements, Leverton, Axiom Chemicals, Ganfeng Lithium Group Co., Ltd, Harshil Fluoride Brivo Lithium, Eagle Picher Technologies, Axiom Chemicals Pvt. Ltd., Alpha Chemika |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161266

Key Market Segments

By Type Analysis

In 2024, Lithium Fluoride Above 98% accounted for 67.9% of total market share, reflecting its dominant position in the global market. Demand for this high-purity category has been supported by its suitability for critical industrial uses, including lithium-ion battery production, advanced optical manufacturing, and nuclear technology. The elevated purity level minimizes contamination risks, which is essential for processes requiring high performance and safety standards. Strong uptake was observed in energy storage applications, where Above 98% purity lithium fluoride is used as a key precursor for lithium hexafluorophosphate. Continued reliance on precision-grade materials is expected to reinforce its leading position through 2025.

By Product Type Analysis

In 2024, the Powder form represented 68.4% of the market, emerging as the leading product type in lithium fluoride consumption. Its fine particle structure and high surface area enabled efficient integration into industrial processes, particularly in the manufacturing of lithium-ion batteries. The powder form supported consistent reaction rates and precise formulation requirements. Its adoption has also been strengthened by its utility in optical and nuclear applications, where uniform blending into advanced ceramics and optical components is essential. This preference for easily processable and versatile material forms is expected to sustain Powder’s leading share into 2025.

By Application Analysis

In 2024, Lithium-ion Batteries accounted for 49.2% of the total market, establishing this segment as the primary application area for lithium fluoride. Growth in electric vehicles and renewable energy storage created substantial demand for battery-grade lithium fluoride, as it serves as a crucial precursor for lithium hexafluorophosphate used in electrolytes. Additional consumption stemmed from consumer electronics such as smartphones and laptops, where consistent battery performance is required. The continuing global transition toward electrification and expanded energy storage capacity is anticipated to preserve the segment’s dominant share in 2025.

List of Segments

By Type

- Upto 98%

- Above 98%

By Product Type

- Powder

- Granule

By Application

- Fluorescent Materials

- Lithium-ion Batteries

- Radiation Measurement

- Optical Materials

- Others

Regional Analysis

In 2024, the Asia Pacific region secured a leading position in the global lithium fluoride market, representing 37.3% of total market share, equivalent to USD 261.5 million in value. This dominance resulted from the region’s strong industrial capabilities, continued investments in electric vehicle manufacturing, and progress in advanced battery technologies.

China played a central role in shaping regional demand through its extensive glass production industry and its position as a key hub for EV manufacturing. The country’s influence was further reinforced by its leadership in the LFP battery segment, where major producers such as BYD accounted for nearly 50% of total demand, thereby strengthening Asia Pacific’s overall contribution to the lithium fluoride market.

Top Use Cases

Lithium-ion battery production — electrolyte precursor and SEI modifier: Lithium fluoride is used in battery manufacturing both indirectly (as a reagent in routes to lithium hexafluorophosphate, LiPF₆, the most common commercial Li-salt for liquid electrolytes) and directly as a surface/SEI modifier (LiF-rich interphases improve cycle life and thermal stability). Growth in battery deployment is a primary demand driver: U.S. battery deployment is projected to increase roughly six-fold over the coming decade in DOE assessments, and global battery capacity is expected to rise several-fold by 2030 — underpinning rising requirements for battery-grade lithium compounds.

Solid-state / surface coatings in advanced cells: LiF is applied as a thin coating or as an SEI component on electrodes to reduce side reactions and suppress dendrite growth in high-voltage and solid-state cells. Experimental studies have shown LiF coatings can materially increase cycle stability for NMC and Li-metal systems, making LiF important for next-generation battery chemistries where long life and safety are required.

Radiation dosimetry and medical/industrial dosimeters: LiF (including doped forms such as LiF:Mg,Ti) is a standard thermoluminescent dosimeter (TLD) material used in medical, personnel and industrial radiation monitoring because of its wide dose range, tissue-equivalent response and stable readout characteristics. LiF TLDs remain widely used in clinical and industrial dosimetry programs and are cited repeatedly in dosimetry standards and validation studies.

Optics and UV/IR window materials: High-purity LiF crystals and polished windows are used in specialized optics for ultraviolet (UV) and certain infrared (IR) applications because LiF transmits deep UV and has low absorption in targeted bands. Typical physical properties supporting these uses include a high melting point (~845 °C) and optical refractive characteristics that permit low-loss transmission in selected wavelength ranges. High-purity forms (≥98%) are preferred for precision optical components.

Molten-salt coolants / high-temperature heat transfer: LiF forms part of eutectic fluoride mixtures (e.g., LiF–NaF–KF, known as FLiNaK) that have been studied as high-temperature heat transfer fluids and primary/secondary coolants for molten-salt reactors and concentrated solar thermal storage. FLiNaK is characterized by favorable heat capacity and thermal stability at 400–800 °C; however, impurity control and corrosion of structural alloys are identified technical challenges. Publications quantify impurity reductions and thermophysical properties relevant for engineering design.

Recent Developments

Crystran Ltd — In 2024 Crystran continued to be positioned as a specialist supplier of precision optical materials, supplying lithium fluoride (LiF) in forms suitable for deep-UV and VUV optics and X-ray monochromators. The company’s product pages and technical datasheets indicate LiF is stocked and manufactured for windows, prisms and precision components used in research and industrial optics. Crystran is a UK-registered optics manufacturer with accounts filed to 31 October 2024, reflecting ongoing production capacity for high-purity optical LiF.

FMC — FMC Corporation ceased operating an integrated lithium chemicals business after the separation of its lithium unit into Livent in 2019; FMC’s current operations are focused on agricultural chemicals. As a result, FMC was not an active producer of lithium fluoride in 2024; lithium-chemical production and reporting have been carried out by the spun-off entity (Livent) and successor lithium companies, which reported combined lithium product revenues in 2024 (lithium hydroxide/carbonate lines referenced in Arcadium/Livent disclosures).

American Elements is positioned as a commercial supplier of high-purity lithium fluoride (LiF), offering powder, foil and transparent window forms with certified purities up to 99.99% (4N) and technical datasheets listing melting point near 870 °C. In 2024 the company’s LiF SKUs and ultra-dry grades were reported as stocked for immediate delivery, supporting optical, coating and research markets that require low-impurity material. Product specifications and packaging options were published on the company website and accompanying datasheets.

Leverton (trading as LevertonHELM) was identified in 2024 as an established UK supplier of inorganic lithium chemicals, marketing a Lithium Fluoride Technical Powder (product code 4420) supplied in 20 kg sacks for industrial use. The business focus on lithium chemistry and supply-chain reliability has been emphasised, and in 2025 the LevertonHELM group (HELM AG subsidiary) announced capacity expansion in lithium processing—illustrating ongoing investment in lithium chemical production and distribution infrastructure.

Axiom Chemicals was positioned in 2024 as an active Indian manufacturer and exporter of lithium fluoride (LiF), supplying powdered LiF (industrial grades) with reported purities around 99.9% and packaged in bag formats for domestic and international customers. The company’s Vadodara facility was presented as the primary production base and product listings indicated readiness for orders serving optical, ceramic and chemical process users. Export sales and catalogue SKUs were reported on company pages and trade portals in 2024.

Ganfeng Lithium’s 2024 operations were characterized by global project expansion and upstream integration, including the May 2024 agreement to operate the Goulamina spodumene asset in Mali. The company’s 2024 annual reporting (published in 2025) documented continued investment in processing capacity and new project starts; in early 2025 Ganfeng commenced production at the Mariana brine project with 20,000 tpa lithium chloride capacity, underscoring rapid scale-up into 2025. These developments were cited in company disclosures and Reuters coverage.

In 2024 Harshil Fluoride (Harshil Industries) was identified as an India-based manufacturer and trader of fluoride chemicals, listing lithium fluoride among its exported products; the business is reported to operate from Sarigam (Gujarat) and to have been established in 1995, supplying industrial-grade LiF in bagged formats for ceramics, glass and chemical uses. Market activity in 2024 showed continued export listings and catalogue SKUs on trade portals, supporting regional supply for low-to-medium purity LiF applications.

In 2024 EaglePicher Technologies was active as a specialist battery manufacturer supplying primary and secondary lithium chemistries, including lithium-carbon monofluoride (Li/CFx) cells where LiF formation is central to cell chemistry. The company’s product portfolio and technical pages indicate ongoing delivery to aerospace, defense and medical sectors, with stated operational metrics such as multi-billion cumulative cell hours in space and bespoke Li-battery programs in 2024. EaglePicher’s role links market demand for lithium chemistries to specialty LiF-related applications.

Axiom Chemicals is presented in 2024 as an India-based manufacturer and exporter of lithium fluoride (LiF), supplying powdered LiF with reported purities around 99.9% and bagged packaging for industrial use. The company operates production and R&D facilities in Vadodara with stated monthly capacity figures (reported production capacity ~45 tonnes/month for lithium compounds), supporting optical, ceramic and battery-grade applications and export markets. Corporate registrations and product pages confirm active sales listings and readiness for order fulfilment in 2024.

Alpha Chemika is recorded in 2024 as a long-standing Indian speciality chemical and laboratory reagent manufacturer offering an “Extra Pure” LiF product (98% purity) with accompanying MSDS and COA; retail pack sizes and catalogue pricing were published for 2022–2024 product listings. The company is ISO-certified and supplies lab and industrial buyers, positioning LiF for research, optics and small-scale production uses. Product datasheets indicate typical physical properties (melting point ≈ 845 °C) and shelf life specifications used by buyers in procurement decisions.

Conclusion

In conclusion, lithium fluoride (LiF) is positioned as a strategic, multi-application specialty chemical whose demand is expected to rise in line with global energy-storage and high-technology trends. Its physical properties — notably a melting point near 845–848 °C — support use in high-temperature and optical applications, while its chemistry underpins critical battery and nuclear uses.

LiF serves as an important precursor and interphase former in lithium-ion battery electrolytes (contributing to LiPF₆ chemistry and Li-rich SEI formation), which links its outlook directly to projected large increases in battery deployment over the coming decade. Further, LiF’s role in molten-salt mixtures (e.g., FLiNaK/FLiBe) and in precision optics and dosimetry creates diversified demand channels that reduce dependence on any single end-use.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)