Table of Contents

Overview

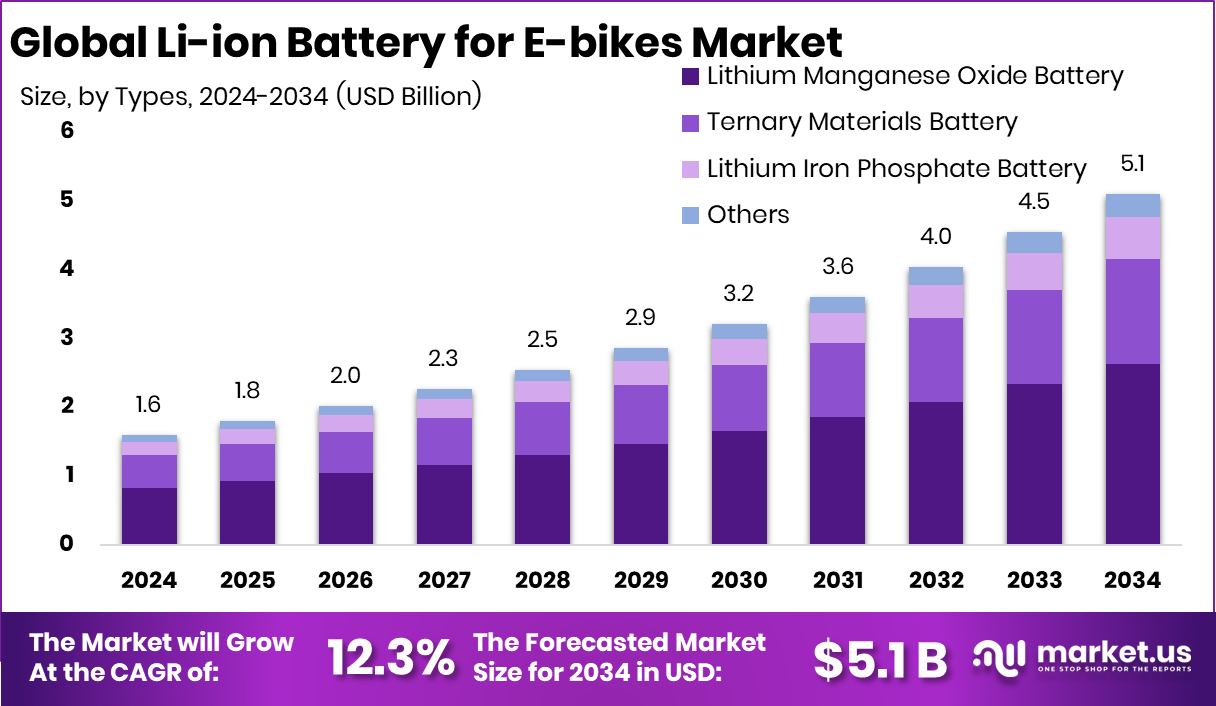

The Li-ion battery for e-bikes market is moving into a strong growth phase, rising from USD 1.6 billion in 2024 to an expected USD 5.1 billion by 2034, supported by a 12.3% CAGR. North America alone contributes USD 0.6 billion, holding a 39.80% share. These batteries remain the preferred choice for electric bicycles because they are lightweight, store high energy, charge quickly, and last through many riding cycles. Their role extends beyond powering daily commutes—they support safer, longer, and more efficient urban travel.

Government funding is building a stronger battery ecosystem. Over $4.2 million has been allocated to critical minerals research, while $3 billion is directed toward improving EV and grid-battery capacity. Another $3 billion is planned for 25 battery manufacturing projects, showing a clear long-term commitment. Europe is also pushing industrial capability, with Portugal positioned within a €2.9 billion clean-tech program.

Investment momentum reflects expanding industry confidence. A battery-recycling startup raising $3.7 million highlights the rising focus on circular solutions, while a non-lithium battery company securing $78 million in Series C funding signals growing interest in safer, more stable alternatives. Together, these moves show a market that is innovating across materials, manufacturing, and sustainability—strengthening the future of e-bike electrification.

Top Key Players in the Market

- Samsung SDI

- LG Chem

- A123 Systems

- BYD

- Toshiba

- Murata Manufacturing

- EVE Energy

- Amperex Technology

- Phylion Battery

- Lishen

1. Samsung SDI

Samsung SDI is a core battery manufacturer focused on EV, ESS, and small Li-ion cells for mobility applications. The company is recognized globally for its advanced cylindrical and prismatic battery platforms, engineered to support e-bikes, power tools, and premium mobility products. Samsung SDI emphasizes long cycle life and fast-charging technologies

that align with global electrification targets.

The firm continues expanding capacity in Europe, the U.S., and South Korea through strategic partnerships with automotive and energy companies. Its investments in solid-state technologies and high-nickel chemistries strengthen its competitiveness in next-generation cell production. Samsung SDI maintains a strong R&D focus and a diversified global battery supply chain.

| Category | Details |

|---|---|

| CEO | Yoon-Ho Choi |

| Founded | 1970 |

| Headquarters | Yongin, South Korea |

| Parent Group | Samsung Group |

| Key Products | Li-ion batteries, ESS batteries, EV batteries |

| Global Rank | Top 5 globally |

| 2023 Revenue | Approx. USD 17.3B |

| Manufacturing Sites | Korea, Hungary, China |

| Key Technology | High-nickel NCA & NCM cells |

| R&D Centers | Korea, Europe |

| Employees | 23,000+ |

2. LG Chem / LG Energy Solution

LG Chem delivers advanced battery materials and operates its battery division via LG Energy Solution, a global leader in EV and mobility batteries. The company produces cylindrical, pouch, and prismatic cells used in e-bikes, scooters, and energy storage solutions. Its global manufacturing footprint helps strengthen long-term supply reliability for

mobility customers.

R&D efforts are centered on cobalt-reduced chemistries, silicon-enhanced anodes, and next-gen solid-state technologies. LG Chem continues to expand investment across North America, Korea, and Europe to build a globally competitive and sustainable battery supply chain capable of meeting rising lightweight mobility demand.

| Category | Details |

|---|---|

| CEO | Shin Hak-cheol / J.H. Kim |

| Founded | 1947 |

| Headquarters | Seoul, South Korea |

| Battery Business | LG Energy Solution |

| 2023 Revenue | USD 25B+ |

| Global Rank | Top 3 battery manufacturer |

| Key Products | Cylindrical & pouch Li-ion cells |

| Global Plants | Korea, Poland, U.S., China |

| R&D Centers | Korea, U.S., Europe |

| Employees | 30,000+ |

| Specialty | Cobalt-reduced chemistries |

3. A123 Systems

A123 Systems specializes in LiFePO4 (LFP) lithium-ion cells known for long life, thermal stability, and high-power capability. The company supplies batteries for e-bikes, industrial equipment, grid systems, and transportation fleets. Its chemistry is valued for safety and durability across high-temperature or high-load environments.

A123 focuses heavily on power-dense cells and engineering customization for mobility manufacturers. It operates through global engineering centers and manufacturing sites, continuing to invest in improved fast-charge capabilities and stronger supply chain resilience.

| Category | Details |

|---|---|

| CEO | Joe Kit Chu Lam |

| Founded | 2001 |

| Headquarters | Michigan, USA |

| Parent | Wanxiang Group |

| Key Chemistry | LFP (LiFePO4) |

| Products | Cylindrical & prismatic Li-ion cells |

| Manufacturing | U.S., China |

| Use Cases | E-bikes, buses, grid storage |

| Employees | 2,000+ |

| Technology | High-power cells |

| R&D Focus | Thermal-safe batteries |

4. BYD

BYD is a global leader in electric mobility and battery manufacturing, producing the Blade Battery based on LFP chemistry. The company integrates batteries into e-bikes, electric cars, buses, and commercial vehicles. Its vertically integrated model strengthens cost efficiency and supply security. BYD continues expanding manufacturing capabilities across China, Europe, and Latin America. Its battery safety, long cycle life, and cost-optimized chemistries make it a major technology provider for personal and commercial mobility markets.

| Category | Details |

|---|---|

| CEO | Wang Chuanfu |

| Founded | 1995 |

| Headquarters | Shenzhen, China |

| Global Rank | Top 3 EV battery maker |

| Chemistry | LFP (Blade Battery) |

| Key Products | Mobility batteries, EVs |

| Revenue 2023 | USD 80B+ |

| Manufacturing | China, Brazil, Hungary |

| Employees | 600,000+ |

| R&D | China, U.S. |

| Specialty | Blade safety structure |

5. Toshiba

Toshiba is known for its SCiB (Super Charge Ion Battery) technology, designed for high-safety, long-life, and fast-charging performance. SCiB cells are used in electric bicycles, rail systems, and industrial applications where reliability is critical. Toshiba’s battery R&D focuses on enhancing cycle life and optimizing titanium-based anodes. It maintains a strong manufacturing base in Japan and collaborates with mobility companies for high-durability cell adoption.

| Category | Details |

|---|---|

| CEO | Taro Shimada |

| Founded | 1875 |

| Headquarters | Tokyo, Japan |

| Key Product | SCiB batteries |

| Chemistry | LTO (Lithium Titanate) |

| Revenue 2023 | USD 25B+ |

| Global Plants | Japan |

| Use Cases | E-bikes, buses, trains |

| Employees | 116,000+ |

| R&D | High-durability LTO chemistry |

| Strength | Ultra-fast charging |

6. Murata Manufacturing

Murata is a major producer of mobility lithium-ion cells, known for compact cylindrical batteries widely used in e-bikes, wearables, and portable electronics. It acquired Sony’s battery business, strengthening its mobility technology portfolio. Murata focuses on miniaturization, high energy density, and stable thermal performance. Its Japanese manufacturing ensures consistent quality and safety standards suited for premium lightweight mobility solutions.

| Category | Details |

|---|---|

| CEO | Norio Nakajima |

| Founded | 1944 |

| Headquarters | Kyoto, Japan |

| Key Acquisition | Sony Battery Division (2017) |

| Products | Cylindrical Li-ion cells |

| Revenue 2023 | USD 13B+ |

| Plants | Japan, China, Malaysia |

| Employees | 70,000+ |

| R&D | Japan |

| Specialty | Miniaturized cells |

| Technology | High-density designs |

7. EVE Energy

EVE Energy is one of China’s leading lithium-ion battery producers, supplying cylindrical and prismatic cells for mobility and energy storage. The company maintains a strong production capacity supported by advanced manufacturing processes. EVE’s growth is driven by investments in materials technology and automated production. It partners with mobility OEMs worldwide while maintaining strong export capabilities.

| Category | Details |

|---|---|

| CEO | Liu Jincheng |

| Founded | 2001 |

| Headquarters | Huizhou, China |

| Products | Cylindrical & prismatic Li-ion cells |

| Revenue 2023 | USD 5.8B+ |

| Global Rank | Top 10 battery manufacturer |

| Factories | China, Malaysia |

| Employees | 20,000+ |

| Technology | High-density cylindrical cells |

| R&D | China |

| Markets | Mobility, ESS |

8. Amperex Technology (ATL)

ATL is a leading manufacturer of high-performance lithium-ion polymer batteries used in mobility and lightweight vehicles. It delivers engineered battery packs with strong safety performance and customized solutions. Its strong R&D programs and partnerships with mobility firms make it a top supplier in the polymer battery category. ATL focuses on pack-level innovation and advanced cell design.

| Category | Details |

|---|---|

| CEO | Joe Kit Chu Lam |

| Founded | 1999 |

| Headquarters | Hong Kong |

| Parent Company | TDK Corporation |

| Products | Li-ion polymer batteries |

| Revenue | Not publicly disclosed |

| Plants | China |

| Markets | Mobility, consumer electronics |

| Employees | 20,000+ |

| Strength | Custom battery design |

| Specialty | High-energy polymer cells |

9. Phylion Battery

Phylion is a key supplier of LFP battery systems for electric bicycles and light mobility vehicles. It is one of the earliest companies to commercialize LFP technology for e-mobility markets. The company operates manufacturing bases in China and Europe, supplying OEMs globally with long-cycle and safety-focused battery systems.

| Category | Details |

|---|---|

| CEO | Shen Hui |

| Founded | 2003 |

| Headquarters | Jiangsu, China |

| Chemistry | LFP |

| Products | E-bike batteries |

| Facilities | China & Europe |

| Employees | 1,500+ |

| Technology | Long-cycle lithium batteries |

| Specialty | Europe OEM supply |

| R&D | China |

| Export Markets | EU, Asia |

10. Lishen

Lishen is a major Chinese lithium-ion battery manufacturer supplying cylindrical, prismatic, and pouch cells for e-bikes, ESS, and industrial mobility applications. The company runs multi-gigawatt production lines and serves global OEMs. Its research focuses on high-safety materials and long-term performance optimization.

| Category | Details |

|---|---|

| CEO | Qin Xingcai |

| Founded | 1997 |

| Headquarters | Tianjin, China |

| Products | Cylindrical, prismatic, pouch cells |

| Global Rank | Top 10 (China) |

| Revenue | USD 3B+ |

| Plants | Tianjin, Qingdao |

| Employees | 10,000+ |

| R&D | China |

| Specialty | High-safety mobility cells |

| Export | EU, Asia |

Conclusion

The Li-ion battery for e-bikes market is steadily strengthening as cities shift toward cleaner and more efficient mobility options. Rising interest in lightweight transportation, improvements in battery safety, and expanding investment in advanced cell technologies are shaping a healthier long-term outlook. Manufacturers are focusing on durability, fast charging, recycling, and alternative chemistries, which support wider adoption across commuting and leisure riding.

Government support for battery innovation and supply chain expansion further reinforces market confidence. As e-bikes become a preferred mobility choice worldwide, Li-ion batteries will remain at the center of design, performance, and sustainability improvements, ensuring consistent market growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)