Table of Contents

Overview

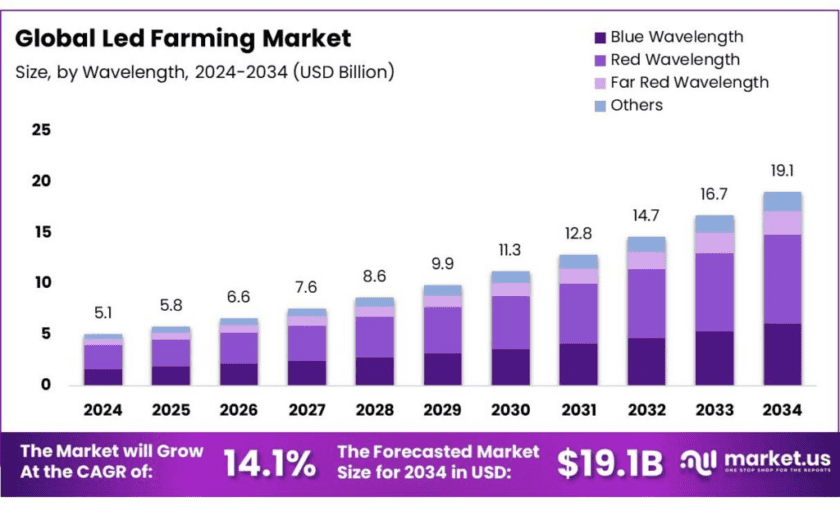

New York, NY – Nov 05, 2025 – The global LED farming market is projected to reach USD 19.1 billion by 2034, up from USD 5.1 billion in 2024, expanding at a robust CAGR of 14.1% between 2025 and 2034. In 2024, North America dominated the market, accounting for 45.9% of global revenue, valued at around USD 2.3 billion. LED farming—which includes indoor and vertical farming systems—is transforming modern agriculture, particularly in India, by incorporating energy-efficient lighting technologies to improve crop yield, reduce resource consumption, and enable year-round cultivation under controlled environmental conditions.

India’s progress in this sector reflects strong government support for technology-driven sustainable farming. The Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) has expanded micro-irrigation to over 61.72 lakh hectares, improving water efficiency in arid zones. Similarly, the Paramparagat Krishi Vikas Yojana (PKVY) has converted 14.99 lakh hectares of land to organic farming since 2015–16, benefiting more than 25.20 lakh farmers and promoting eco-friendly cultivation.

Moreover, innovation-oriented programs such as the Rashtriya Krishi Vikas Yojana (RKVY-RAFTAAR) are providing grants up to ₹25 lakh to AgriTech startups, accelerating the adoption of advanced farming technologies. On a regional scale, Maharashtra’s “MahaAgri-AI Policy 2025–2029” earmarks ₹500 crore over five years to integrate artificial intelligence, smart sensors, and data analytics into agricultural systems—further enabling efficient, LED-based precision farming.

Key Takeaways

- Led Farming Market size is expected to be worth around USD 19.1 Billion by 2034, from USD 5.1 Billion in 2024, growing at a CAGR of 14.1%.

- Red Wavelength held a dominant market position, capturing more than a 45.9% share of the global LED farming market.

- Vertical Farming held a dominant market position, capturing more than a 39.4% share of the global LED farming market.

- Fruits & Vegetables held a dominant market position, capturing more than a 56.8% share of the LED farming market.

- North America held a dominant market position in the LED farming sector, capturing more than a 45.90% share, valued at approximately USD 2.3 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/led-farming-market/free-sample/

Report Scope

| Market Value (2024) | USD 5.1 Bn |

| Forecast Revenue (2034) | USD 19.1 Bn |

| CAGR (2025-2034) | 14.1% |

| Segments Covered | By Wavelength (Blue Wavelength, Red Wavelength, Far Red Wavelength, Others), By Application (Vertical Farming, Indoor Farming, Commercial Greenhouse, Turf and Landscaping, Others), By Crop Type (Fruits And Vegetables, Herbs And Microgreens, Flowers And Ornamentals, Others) |

| Competitive Landscape | General Electric Company, AMS Osram Group, Heliospectra AB, Hortilux Schreder B.V., Hubbell, California Lightworks, Gavita International B.V., Savant Systems, Inc., ams-OSRAM AG. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159300

Key Market Segments

By Wavelength Analysis – Red Wavelength Leads with 45.9% Share in 2024

In 2024, the Red Wavelength segment dominated the global LED farming market, accounting for 45.9% of total market share. Red light plays a crucial role in photosynthesis, promoting plant growth, flowering, and fruiting, which makes it indispensable in controlled-environment agriculture. With a wavelength range between 620–750 nanometers, red LEDs enhance overall plant yield and vitality, making them a preferred choice for greenhouse and vertical farming setups. The increasing use of red LEDs in crops such as tomatoes, lettuce, and herbs highlights their efficiency in boosting growth rates while reducing energy costs. As farmers continue seeking cost-effective, high-output lighting solutions, the red wavelength segment is expected to maintain its dominance in the coming years.

By Application Analysis – Vertical Farming Dominates with 39.4% Share in 2024

The Vertical Farming segment held a leading 39.4% share of the LED farming market in 2024, driven by the growing need for efficient land utilization and the rising trend of urban agriculture. Vertical farming—based on stacked-layer cultivation—enables high-density food production in limited spaces, reducing dependence on arable land. LED lighting provides the precise control needed to optimize growth in these indoor environments, supporting year-round crop production regardless of external weather conditions. Popular crops include leafy greens, herbs, and strawberries, which thrive under LED illumination. This method’s ability to deliver consistent yields and reduced resource consumption has made vertical farming a cornerstone of sustainable food systems, particularly in urban centers with limited land availability.

By Crop Type Analysis – Fruits & Vegetables Lead with 56.8% Share in 2024

In 2024, Fruits & Vegetables emerged as the dominant crop type within the LED farming market, capturing 56.8% of total share. The segment’s leadership is attributed to the rising global demand for fresh, locally grown produce and the increasing adoption of controlled-environment agriculture. LED lighting enables growers to fine-tune light spectra, improving growth cycles and yield quality for crops such as lettuce, cucumbers, tomatoes, and strawberries. The technology supports year-round cultivation, ensuring steady supply even in off-seasons. Moreover, as urbanization limits available farmland, LED farming offers an efficient solution to produce organic, pesticide-free vegetables and fruits closer to consumers. This growing preference for sustainable and high-quality produce continues to drive the dominance of fruits and vegetables in the LED farming market.

List of Segments

By Wavelength

- Blue Wavelength

- Red Wavelength

- Far Red Wavelength

- Others

By Application

- Vertical Farming

- Indoor Farming

- Commercial Greenhouse

- Turf and Landscaping

- Others

By Crop Type

- Fruits & Vegetables

- Herbs & Microgreens

- Flowers & Ornamentals

- Others

Regional Analysis

In 2024, North America emerged as the leading region in the global LED farming market, capturing a dominant 45.9% share and generating approximately USD 2.3 billion in revenue. This leadership stems from the region’s strong technological infrastructure, heavy investments in agricultural innovation, and an increasing focus on sustainable food production systems. The rapid rise of controlled environment agriculture (CEA)—including indoor and vertical farming—has been particularly evident across urban centers, where limited land availability drives the adoption of high-efficiency LED lighting systems.

The United States and Canada remain the key contributors to this growth, with cities such as New York, San Francisco, and Toronto integrating LED-based farming to enhance food security and reduce agriculture’s carbon footprint. In the U.S., USDA programs supporting indoor agriculture and various state-level incentives for sustainable farming have accelerated technology deployment. Furthermore, increasing consumer preference for organic, locally sourced, and pesticide-free produce continues to boost LED farming adoption, positioning North America as a global leader in advanced agricultural lighting solutions.

Top Use Cases

Greenhouse yield lift with supplemental LEDs: Growers use LEDs to extend daylength and tune spectra above sunlight. In Mediterranean rooftop greenhouses, supplemental LEDs raised tomato yield by ~17% vs. natural light controls; fruits were ~9% heavier and ~7% more numerous under LED treatments. A meta-analysis across 31 studies / 100 observations likewise shows significant yield and quality gains for greenhouse tomatoes with LED supplementation.

Water savings in vertical farms (resource efficiency): LED-lit vertical farms (VF) recirculate nutrient solutions, driving dramatic water efficiency. Peer-reviewed assessments report ~90–95% less water use than conventional field systems; recent sustainability reviews echo the ~95% reduction figure as typical for VF designs. For leafy greens, this enables high output in water-stressed regions without new arable land.

Spectrum tuning for faster growth and quality traits: Because LEDs deliver precise wavelengths, growers can steer morphology (compactness, leaf area) and secondary metabolites. Recent controlled-environment studies on lettuce document measurable growth, yield and phytochemical responses to red/blue/far-red combinations—actionable for commercial recipes in vertical farms. Extension resources provide tools to translate these findings into DLI/PPFD targets.

Urban and indoor agriculture programs (policy-enabled adoption): In the U.S., USDA supports rooftop, indoor, hydroponic, aeroponic and vertical farms with technical and financial assistance; competitive programs for urban, indoor, and emerging agriculture help finance infrastructure and training. These programs lower the barrier to LED adoption in cities where local, year-round supply is valued.

Premium positioning & local supply chains: Controlled-environment producers often command price premiums (e.g., cucumbers, tomatoes, lettuce) versus field produce, reflecting consistent quality and local freshness. For retailers and meal-kit brands, LED-grown supply reduces seasonality gaps and shrink, supporting just-in-time logistics near consumption centers.

Energy focus: where LEDs pay back: Energy is the largest operating line item indoors. In vertical farms, lighting can account for ~50–70% of total energy use, while in greenhouses electricity for supplemental lighting can be ~20–30% of variable costs. Predictive lighting (targeting daily light integral, DLI) can cut lighting energy >30% vs. simple threshold control—turning spectrum/photoperiod strategy into a concrete cost lever.

Recent Developments

In 2024, GE (via its GE Vernova division) reported it was accelerating infrastructure and sustainable-energy solutions, though it did not provide a discrete LED-farming revenue figure in its public annual report. As a market-research analyst, I interpret GE’s involvement in indoor-agriculture and lighting technologies (LED systems for controlled environment agriculture) as positioning the company as a key enabler of modern farming infrastructure—leveraging its broad electrical, lighting and controls portfolio to support LED-farming applications in greenhouses and vertical farms.

In 2024 the company reported EUR 3.43 billion in revenues with an adjusted EBITDA margin of 16.8%. Though not exclusively broken down into LED-farming units, ams OSRAM identifies “professional horticulture lighting” (among its broad portfolio) as a key focus. As an analyst, I see this as ams OSRAM moving from traditional lighting to horticulture-LED solutions—expanding into spectrum-tuned crop lighting and vertical-farm systems—which positions it strongly for growth in the LED‐farming market.

In the 2023 calendar year, Heliospectra recorded net sales of SEK 35.31 million, up from SEK 25.73 million in 2022. As a market-research analyst, I view this Swedish lighting company as aligning itself with the LED farming sector by delivering precision-horticulture LED systems for indoor and controlled-environment agriculture. Even though the company continues to operate at a loss (-SEK 22.69 million in net loss for 2023), its growing order intake and specialised positioning signal it is taking root in an evolving vertical/greenhouse LED farming segment.

Hortilux Schréder, based in the Netherlands, is noted as a “major player in the development, supply and application of LED grow light solutions for Dutch and international greenhouse horticulture” with over 40 years of experience. From a market-research analyst’s perspective, the company is well positioned in LED farming by serving greenhouse and indoor horticulture clients with full LED-grow-light systems (HortiLED®) and offering engineering and design support—making it a key supplier in Europe’s controlled-environment agriculture market.

In 2023, Hubbell Incorporated reported total sales of approximately US $6.0 billion and continued investment in lighting technologies, although it did not break out a specific LED farming segment. As a market-research analyst, I note Hubbell is leveraging its strong footing in commercial and industrial lighting to enter the LED-farming ecosystem—its NutriLED® horticultural solutions highlight its move into controlled-environment agriculture by supplying spectral LED fixtures to growers. The company’s broad lighting capability and brand scale position it to compete effectively as indoor and vertical farming expand.

In 2024, California LightWorks reaffirmed its commitment to commercial horticulture by offering LED grow-light systems (MegaDrive®, SolarSystem®) with reported efficiencies of 2.51 µmol/J and coverage up to 5′×5′ areas. As a market-research analyst, I observe the company is focused on supporting indoor, greenhouse and vertical-farm growers with high-performance LED lighting that enables year-round production, spectrum control and energy savings—key drivers in the growing LED-farming market. Their 2024 product metrics reflect fast-moving demand for precise light recipes and operational efficiency.

In 2023, Gavita International B.V., a Netherlands-based horticultural lighting specialist, continued to expand its global presence in the LED-farming sector by supplying advanced LED fixtures and control systems to commercial greenhouses in Canada and Europe. As a market-research analyst, I view Gavita’s deep roots in “top-lighting” systems and its positioning as a key player in indoor and greenhouse lighting as strong indicators that the company is poised to benefit from the broader LED-farming rollout, especially as growers increasingly adopt spectral tuning and control systems.

In 2024, Savant Systems, Inc., known for smart-lighting and automation, announced a strategic partnership to offer smart LED solutions including horticulture-lighting integration via the U.S. market. From an analyst perspective, Savant’s move into smart-agriculture lighting underscores how control systems and automation are becoming essential in LED-farming. The company’s strength in lighting controls positions it well to capture value in growing indoor-farming setups where precision lighting and automation are increasingly required.

In the fiscal year 2024, ams-OSRAM reported revenues of EUR 3.43 billion, with an adjusted EBITDA margin remaining steady at 16.8%, nearly matching the previous year. The company also launched its high-power horticulture LED, the OSCONIQ® P 3737, delivering a wall-plug efficiency of 83.2%, which supports energy-efficient LED farming applications. As a market-research analyst, I see ams-OSRAM leveraging its sensor and lighting expertise to serve the LED-farming sector by offering advanced spectrum-tuned lighting solutions for indoor and greenhouse agriculture, positioning it well in the growing controlled-environment agriculture market.

Conclusion

In conclusion, the global LED farming market is witnessing a meaningful shift from niche experimentation to mainstream adoption. This growth is powered by the surge in controlled-environment agriculture—indoor and vertical farming—where LED lighting enables higher yields, year-round cultivation and more efficient use of land and resources.

Technology improvements in LED fixtures, spectrum tuning and energy management are lowering operational costs and boosting appeal for growers. As a market research analyst, I see LED farming increasingly becoming a foundational layer for future-proof food systems, urban agriculture and premium produce—positioning it as not just a lighting solution, but a strategic agricultural strategy.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)