Table of Contents

Overview

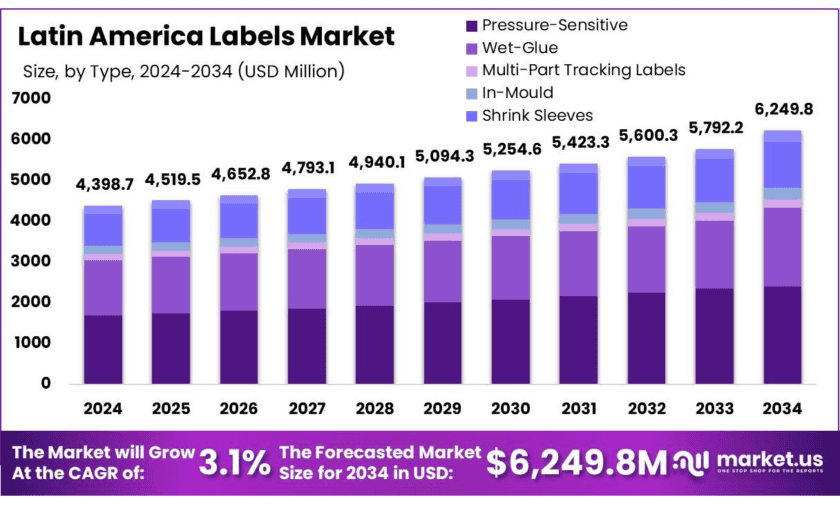

New York, NY – Oct 24, 2025 – The Latin America labels market is projected to grow steadily, reaching approximately USD 6,249.8 million by 2034, up from USD 4,398.7 million in 2024, reflecting a compound annual growth rate (CAGR) of 3.1% from 2025 to 2034. Labels play a vital role in packaging and branding, serving as a key communication tool that displays crucial product information such as brand name, ingredients, manufacturing details, pricing, and safety instructions.

Several trends are driving market growth in the region. The rising demand for personalized and visually appealing packaging is gaining traction, especially in the consumer goods and food sectors. Additionally, the rapid growth of the e-commerce sector has led to increased use of shipping and return labels, further fueling the demand for labeling solutions. Regulatory developments are also pushing manufacturers to adopt more advanced labeling technologies to ensure transparency and meet compliance standards across different industries.

In terms of environmental regulation, Latin America has taken progressive steps. Colombia led the way in the region by implementing Extended Producer Responsibility (EPR) regulations in 2005, followed by Mexico in 2006.

Meanwhile, Brazil has introduced a unique system involving reverse logistics certificates as part of its EPR strategy. This initiative was formalized in April 2023 with the passage of Decree No. 11,413, which mandates that producers establish structured reverse logistics systems for packaging waste—positioning Brazil as a regulatory leader in sustainable packaging practices.

Key Takeaways

- Latin America labels market is valued at USD 4,398.7 million in 2024 and is estimated to register a CAGR of 3.1%.

- Latin America labels market is projected to reach USD 5,792.2 million by 2034.

- In Latin America labels market, Pressure-Sensitive type labels held the majority of revenue share in 2024 of 38.5%.

- Among the materials, Paper accounted for the majority of the market share, with 34.4%.

- Between printing technologies, Flexographic Printing accounted for the largest market share in 2024, with 32.9%.

- Among end-uses, Food and Beverages accounted for the majority of the market share, with 60.6%.

- In Latin America, Brazil accounted for the largest market share with 43.9% among other countries.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/latin-america-labels-market/free-sample/

Report Scope

| Market Value (2024) | USD 4,398.7 Mn |

| Forecast Revenue (2034) | USD 6249.8 Mn |

| CAGR (2025-2034) | 3.1% |

| Segments Covered | By Type (Pressure-Sensitive , Wet-Glue , Multi-Part Tracking Labels, In-Mould, Shrink Sleeves, and Others), By Material (Paper, Polypropylene , Polyester, Polyvinyl Chloride, Polycarbonate, and Others), By Printing Technology (Flexographic Printing, Offset Printing, Digital Printing, Gravure Printing, Screen Printing, Letterpress Printing, and Others) By End-use (Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Consumer Durables, Industrial, and Others) |

| Competitive Landscape | All4Labels Global Packaging Group, CCL Industries, Multi-Color Corporation, Mondi, Beontag, Fuji Seal International, Inc., Amcor plc, Diacel Corporation, Taghleef Industries, UPM, DRG Technologies, PCM, Nissha Co Ltd., Westrock, Others |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145252

Key Market Segments

Type Analysis – Pressure-Sensitive Labels Lead the Market

In the Latin America labels market, pressure-sensitive labels held the largest share in 2024, accounting for 38.5% of the total market. These labels are self-adhesive and do not require heat, water, or solvents, making them convenient and cost-effective for a wide range of applications. Their versatility and ease of use have made them popular across industries such as food and beverages, pharmaceuticals, consumer goods, and logistics. Furthermore, pressure-sensitive labels offer excellent durability, design flexibility, and print quality—key attributes for modern branding and regulatory compliance. The rise of e-commerce and demand for efficient, attractive packaging further support their market dominance.

Material Analysis – Paper Remains the Most Preferred Labeling Material

When analyzed by material, paper emerged as the most widely used substrate in 2024, capturing 34.4% of the market share. Its dominant position stems from its affordability, versatility, and eco-friendly nature. Paper is extensively used in packaging and labeling across various industries, with its biodegradable properties aligning well with growing environmental awareness in the region. Compared to synthetic alternatives like polypropylene or polycarbonate, paper offers a more sustainable option. Its compatibility with most printing technologies and consumer preference for recyclable packaging materials reinforce paper’s continued leadership in the labels market.

Printing Technology Analysis – Flexographic Printing Dominates

In terms of printing technologies, flexographic printing held the largest market share in 2024, contributing 32.9% due to its high efficiency, speed, and adaptability. Flexographic printing supports a wide variety of substrates—such as plastic, paper, and foil—making it ideal for packaging applications like labels, flexible films, and corrugated boxes. Its ability to deliver high-volume print runs with quick setup times is especially valuable in industries requiring fast production cycles, including food, beverage, and consumer goods. Continuous innovation in inks and plates has also improved print quality, further reinforcing flexographic printing as a cost-effective and widely adopted solution in the region.

End-Use Analysis – Food & Beverages Hold a Majority Share

By end-use, the food and beverage sector accounted for the largest portion of the Latin America labels market in 2024, with a significant 60.6% share. This dominance is driven by the sector’s heavy reliance on clear, appealing, and regulation-compliant labeling for packaging and branding. As demand for packaged foods and drinks increases, so does the need for high-quality labels that enhance shelf appeal and communicate essential product information. Flexographic printing is commonly used in this segment for its speed and versatility on various packaging materials. Additionally, the industry’s shift toward sustainable packaging has led to increased adoption of eco-friendly label solutions, reinforcing its lead in the market.

List of Segments

By Type

- Pressure-Sensitive

- Wet-Glue

- Multi-Part Tracking Labels

- In-Mould

- Shrink Sleeves

- Others

By Material

- Paper

- Polypropylene

- Polyester

- Polyvinyl Chloride

- Polycarbonate

- Others

By Printing Technology

- Flexographic Printing

- Offset Printing

- Digital Printing

- Gravure Printing

- Screen Printing

- Letterpress Printing

- Others

By End-Use

- Food and Beverages

- Pharmaceuticals

- Personal Care and Cosmetics

- Consumer Durables

- Industrial

- Others

Top Use Cases

Enhanced Product Packaging & Branding: Labels are essential in communicating a product’s identity—listing brand, ingredients, manufacturing info, pricing, and safety instructions. In 2024, the Latin America labels market was valued at approximately USD 4,398.7 million, with a projected rise to around USD 6,249.8 million by 2034, signaling durable expansion across consumer goods sectors.

E-commerce Shipping & Return Management: The booming Latin American e-commerce scene is pushing demand for transit and return labels. The region’s e-commerce sales hit roughly USD 272 billion in 2023, and are expected to grow to over USD 769 billion by 2025—a 21% year-over-year increase. This surge in online shopping naturally fuels the need for reliable labelling, particularly in logistics.

Cross-Border Trade Support: Latin American businesses are heavily involved in cross-border e-commerce: about one-third of online sales in the region come from international sales—higher than in North America (~25%). Labels play a significant role in organizing shipments, customs documentation, and meeting foreign regulations.

Supporting Regulatory Compliance & Transparency: Governments across Latin America are increasingly mandating transparency. Brands must display ingredient lists, expiration dates, and safety information. Labels—especially advanced pressure-sensitive and high-quality print types—enable adherence to these regulations while maintaining branding clarity.

Recent Developments

In 2024, All4Labels earned recognition from the Carbon Disclosure Project (CDP) for its environmental efforts—securing a B rating for Climate and B‑ for Water & Forests across 50+ production sites, including Latin America. The company strengthened its position in the region via targeted expansion and partnerships, notably in Brazil and South America, enhancing its sustainable labeling solutions. From a market analyst’s perspective, All4Labels is aligning environmental performance with regional growth—leveraging eco‑friendly technologies like recycled-content pressure-sensitive labels to meet rising demand.

In 2024, CCL Industries delivered outstanding results: annual sales rose 9% to USD 7,245 million, with operating income up 13% to USD 1,142 million, and net earnings climbing 15.5% to USD 769.8 million. In Latin America, CCL operates 16 plants, including eight in Mexico, six in Brazil, one in Argentina, and one in Chile. As a market research analyst, I’d say CCL’s growing profitability and extensive local infrastructure underscore its leadership in delivering innovative label solutions across multiple sectors in Latin America.

In 2024, Multi-Color Corporation (MCC) strengthened its footprint in Latin America by acquiring Flexcoat’s Brazil operations, integrating local production into its global label solutions network. MCC, a label market leader with roughly USD 3 billion in annual revenue, now brings Flexcoat’s expertise in self-adhesive and specialty labels under its umbrella, expanding offerings to sectors like food, beverage, and home care across the region. From an analyst’s perspective, this move anchors MCC’s regional growth strategy, combining local agility with international label innovation and technology.

In 2023, Mondi Group—a global player in packaging and paper—reported group-wide revenue of €7.33 billion, with sustainability at its core through its MAP2030 strategy. While Mondi serves Latin America primarily via its pulp, paper, and packaging solutions, its emphasis on fibre-based, eco-friendly offerings is especially relevant to labels and packaging in the region, aligning with growing demand for sustainable materials and ethical design. As a market analyst, I view Mondi as a strategic partner for brands navigating regulatory and consumer pressures toward greener labeling.

In 2023, Beontag—a major Brazilian-founded producer of self-adhesive and smart label solutions—launched a new line of moisture-resistant, self-adhesive wine labels in Latin America, including the eco-conscious Grass Natural label made from up to 40% grass fiber and FSC-certified cellulose. The company, which reached about €550 million in global revenue in 2022, is expanding its footprint in Latin America through innovation and sustainable materials. As a market research analyst, it’s clear that Beontag is pushing the region’s label standards forward with technology, design, and environmental awareness.

In the fiscal year ending March 31, 2024, Fuji Seal International posted net sales of ¥196,624 million (about USD 1.4 billion), up from ¥184,035 million the previous year, supported strongly by its Americas segment. The company’s growing presence in Latin America is tied to its core offerings—shrink-sleeve and pressure-sensitive labels—where it is leveraging eco-friendly initiatives like recyclable materials and packaging machinery aligned with circular economy goals. From an analyst’s standpoint, Fuji Seal’s regional expansion and financial strength position it well to meet rising demand for innovative and sustainable labelling solutions.

Daicel Corporation, a Japanese chemical firm, reported total net sales of ¥558.1 billion (~USD 3.8 billion) in FY2024, with about 6.1% of its consolidated workforce (678 employees) based in North and Latin America. While specifically recognized more for specialty chemicals and advanced materials, Daicel’s presence in Latin America through its engineering plastics and sustainable cellulose products indirectly supports label manufacturing systems and packaging innovations. From an analyst’s viewpoint, Daicel’s technological capabilities and regional footprint position it as a more upstream, value-adding partner in label supply chains within Latin America.

In 2023–2024, Taghleef Industries expanded its presence in Latin America with key production sites in Colombia and Mexico, serving the region’s growing demand for pressure-sensitive and sustainable label films. They offer a suite of polypropylene-based labeling films—such as BoPP, CPP, and bio-based alternatives—that suit in-mold, roll-fed, and self-adhesive applications, while emphasizing eco-innovation through their Dynamic Cycle™ sustainability program. From a market analyst’s viewpoint, Taghleef combines cutting-edge film technology with regional footprint to power environmentally conscious labeling solutions across Latin America.

In 2023, UPM reported group sales of approximately EUR 10.34 billion, notably contributing through its UPM Raflatac labeling materials division that offers solutions for food, personal care, and pharmaceutical labels across Latin America. As a market analyst, I see UPM’s blend of financial stability, global reach, and specialized label product lines positioning the company as a leading supplier of high-quality, sustainable label materials in the region, ready to meet evolving regulatory and branding needs.

DRG Technologies is a U.S.-based durable label manufacturer that serves Latin America through its logistics and distribution facilities in Mexico. Though exact Latin America–specific financials aren’t publicly listed, the company is known for its high-end label offerings, including packaging, specialty, security, UL-certified, and high-temperature labels—plus services like vendor-managed inventory and JIT delivery. From a market research analyst’s perspective, DRG’s strategic positioning in Mexico and emphasis on advanced, customized label solutions make it a trusted regional supplier for demanding industrial and FMCG applications.

PCM, a fully Mexican-owned label manufacturer, operates one plant and four distribution centers across Mexico (Nuevo León, Tijuana, Mérida, CDMX, Guadalajara), serving markets throughout Latin America and the Caribbean. They offer diverse printing methods—flexographic up to eight colors for longer runs, and digital for short and mid-sized runs—tailoring solutions for industries like retail, automotive, textiles, pharmaceuticals, and logistics. As a market analyst, PCM stands out for its regional footprint, flexible production volumes, and integrated label-plus-ribbon solutions—helping clients reduce inventory and simplify procurement.

Conclusion

In conclusion, the Latin American labels market is poised for steady, multi-billion-dollar growth—from USD 4,398.7 million in 2024 to approximately USD 6,249.8 million by 2034, reflecting a CAGR of around 3.1%. This expansion is powered by several key forces: rising demand for personalized packaging, surging e‑commerce requiring efficient transit and return labels, and tightening regulatory norms—especially in front-of-package nutritional labeling—as seen across countries like Chile, Mexico, and Brazil. From a strategic analyst’s view, the region’s focus on blending branding, information transparency, and sustainability makes the labels sector essential to the evolving consumer and regulatory landscape in Latin America.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)