Table of Contents

Overview

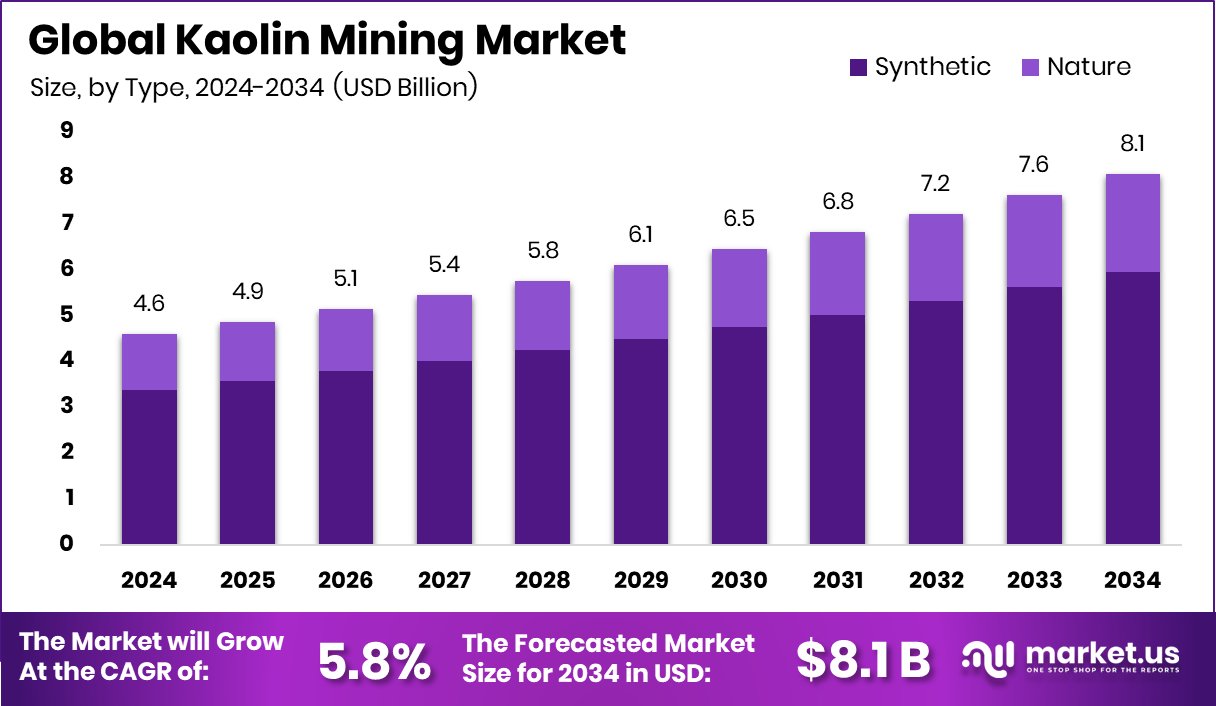

New York, NY – January 19, 2026 – The global kaolin mining market is on a steady growth path, projected to rise from USD 4.6 billion in 2024 to about USD 8.1 billion by 2034, supported by a CAGR of 5.8% during 2025–2034. Asia Pacific leads the market, accounting for 48.30% of total value, equal to roughly USD 2.2 billion, driven by strong industrial activity and expanding construction and manufacturing sectors.

Kaolin mining involves surface extraction of naturally occurring white clay, followed by washing and refining to achieve the desired brightness, purity, and particle size. These properties make kaolin an important input for paper, paints, ceramics, construction materials, and specialized industrial uses. Over time, the market has shifted from basic raw material supply toward processed and refined kaolin grades that deliver higher performance and consistency for end users.

Market momentum is closely linked to growth in paints, coatings, packaging, and decorative surface applications. This trend is reinforced by investments in advanced and sustainable coating technologies, such as Ecoat, raising €21 million to transform paint solutions. Additional funding activity, including RENEE Cosmetics securing $30 million and JSW Paints raising INR 3,300 crore for expansion, indirectly supports demand for high-quality mineral inputs like kaolin.

Looking ahead, opportunities are emerging in regulated and high-performance applications that require refined kaolin. Major capital commitments, such as JSW securing ₹9,300 crore for coatings expansion and Artbio’s $132 million Series B, highlight long-term confidence in advanced material usage and the underlying kaolin supply ecosystem.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-kaolin-mining-market/request-sample/

Key Takeaways

- The Global Kaolin Mining Market is expected to be worth around USD 8.1 billion by 2034, up from USD 4.6 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In the Kaolin Mining Market, natural kaolin dominates by nature type, holding 73.6% share globally.

- In the Kaolin Mining Market, calcined grade leads demand, capturing 31.2% share across applications worldwide.

- In the Kaolin Mining Market, paper applications dominate usage, accounting for 32.7% market share overall.

- In the Asia Pacific, the Kaolin Mining Market generated USD 2.2 Bn, accounting 48.30% globally.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=171052

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 4.6 Billion |

| Forecast Revenue (2034) | USD 8.1 Billion |

| CAGR (2025-2034) | 5.8% |

| Segments Covered | By Type (Synthetic, Natural), By Grade (Calcined, Hydrous, Delaminated, Surface Treated, Others), By Application (Paper, Ceramics, Paint and Coatings, Fiberglass, Plastic, Rubber, Pharmaceuticals and Medical, Cosmetics, Others) |

| Competitive Landscape | BASF SE, EICL Ltd, Imerys S.A., I-Minerals Inc., KaMin LLC, LB Minerals Ltd., Quazwerke GmbH, Sibelco, Thiele Kaolin Company |

Key Market Segments

By Type Analysis

Natural kaolin continues to dominate the global Kaolin Mining Market, holding a strong 73.6% share in 2024. This leadership reflects the long-standing dependence of multiple industries on naturally occurring kaolin due to its reliable mineral composition and proven performance characteristics. Natural kaolin benefits from well-established mining infrastructure, mature extraction techniques, and predictable supply chains, which together reduce operational risks and production costs.

Industries such as paper, ceramics, construction, and paints prefer natural kaolin because it integrates easily into existing processing systems without extensive modification. The dominance of this segment also highlights steady demand from cost-sensitive applications where naturally sourced materials offer both functional adequacy and economic advantages.

Overall, the strong position of natural kaolin emphasizes its foundational role in shaping global production volumes, trade flows, and investment priorities across the kaolin mining industry, making it a cornerstone of market stability.

By Grade Analysis

Calcined kaolin emerged as the leading grade in the Kaolin Mining Market in 2024, capturing a 31.2% share. This segment’s strength lies in the enhanced properties achieved through controlled thermal processing, which improves brightness, opacity, and performance consistency. Calcined kaolin is widely used in applications that demand higher functional efficiency, such as coatings, plastics, rubber, and specialty construction materials.

Its leadership reflects sustained demand for value-added mineral grades that deliver better performance compared to raw alternatives. The segment’s share also indicates balanced production economics, where processing costs are offset by higher market acceptance and pricing stability.

In 2024, calcined kaolin played a key role in influencing capacity utilization and investment decisions, reinforcing its importance as a commercially attractive grade within the broader kaolin mining value chain.

By Application Analysis

Paper remained the largest application segment in the Kaolin Mining Market in 2024, accounting for 32.7% of total consumption. Kaolin is a critical input in paper manufacturing, where it enhances brightness, smoothness, and print quality. The segment’s dominance reflects the continued reliance of paper producers on kaolin as a coating and filler material, even as digitalization reshapes communication channels.

Strong integration between paper mills and kaolin suppliers ensures steady demand and predictable offtake volumes. This application also provides long-term demand visibility for miners, supporting stable production planning.

In 2024, the paper segment continued to anchor overall kaolin consumption, reinforcing its influence on output allocation, logistics planning, and long-term supply agreements within the global kaolin mining ecosystem.

Regional Analysis

The Kaolin Mining Market displays distinct regional dynamics driven by resource availability and industrial demand. Asia Pacific leads with a dominant 48.30% share valued at USD 2.2 billion, supported by extensive mining capacity and strong consumption across manufacturing-driven economies. Its robust extraction base and consistent downstream demand make it the central hub of global kaolin supply. North America remains a mature and stable market, sustained by established mining operations and long-standing industrial applications.

Europe follows closely with steady demand, guided by regulated extraction practices and well-developed processing industries. In the Middle East & Africa, selective mining activities contribute to regional needs and export-linked flows, reflecting the influence of localized deposits.

Latin America is gradually expanding its role, driven by emerging mining activities and increasing integration into international kaolin trade routes. Overall, each region’s position reflects its industrial structure and access to kaolin resources.

Top Use Cases

- Paper Production: Kaolin is widely used in making paper. It improves brightness, smoothness, and print quality when mixed into paper coatings or added as a filler. This makes printed pages look sharper and feel smoother.

- Ceramics & Pottery: Kaolin clay is essential in making ceramics, porcelain, tiles, and sanitaryware. It adds whiteness, strength, and helps shape the clay during manufacturing

- Paints & Coatings: In paints, kaolin acts as a pigment extender, helping to spread color evenly, improve surface finish, and reduce the need for more expensive pigments.

- Rubber & Plastics: Kaolin is added to rubber and plastic products as a filler that boosts durability, flexibility, and surface quality. This is useful in car tires and plastic parts.

- Construction Materials: In cement and concrete, kaolin improves texture, strength, and moisture resistance. It helps create better construction materials like mortar and specialty mixes.

- Agriculture & Horticulture: Kaolin is used in farming as a natural protective layer on crops to keep pests away and help retain soil moisture. It also works as a carrier for chemical treatments.

Recent Developments

- In May 2025, KaMin LLC announced a new partnership agreement with Omya, a global minerals distributor, to supply kaolin into the packaging and paper markets in Europe. This means KaMin will work with Omya to reach more customers in European industries that use kaolin in coatings, paper, and packaging materials.

- In 2025, LB Minerals’ operations remain part of the Lasselsberger Group, which stresses long-term environmental management and resource sustainability in clay and kaolin extraction. While not a single event, this ongoing position includes continual environmental improvements at mining and processing sites.

Conclusion

The kaolin mining industry continues to demonstrate steady resilience, supported by its essential role in ceramics, paper, paints, construction materials, and specialty applications. The sector benefits from ongoing improvements in processing methods, increased focus on refined grades, and rising demand from manufacturing-driven regions. Growth is further supported by expanding uses in sustainable coatings, advanced materials, and high-performance industrial products.

As companies invest in technology, product quality, and responsible mining practices, kaolin remains a dependable mineral for diverse industries. Overall, the market’s stability reflects strong end-user reliance and continuous innovation across extraction, processing, and application development.