Table of Contents

Overview

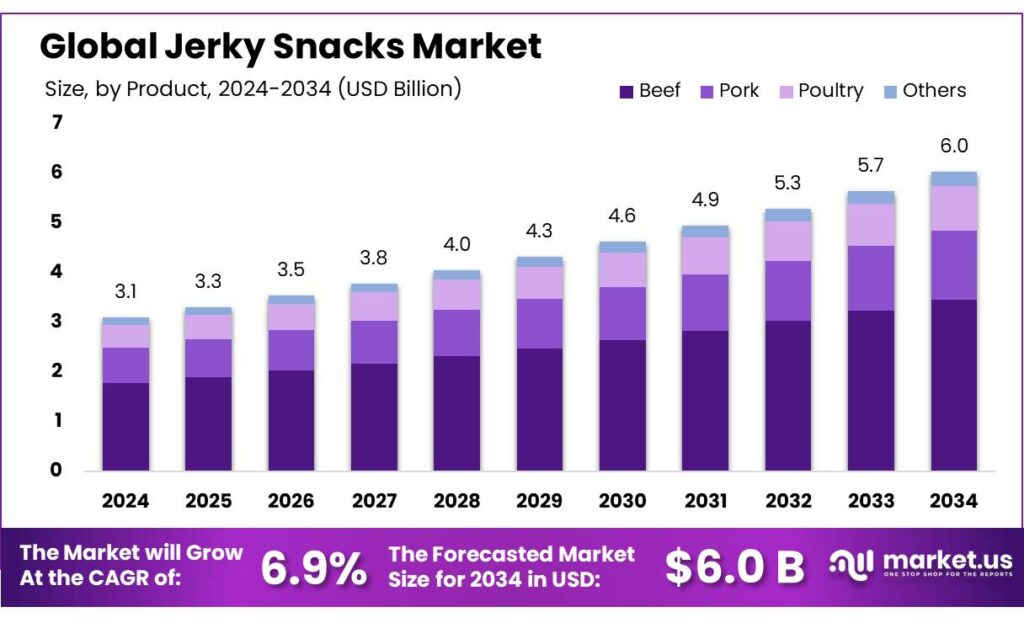

New York, NY – October 08, 2025 – The Global Jerky Snacks Market is projected to reach around USD 6.0 billion by 2034, up from USD 3.1 billion in 2024, growing at a CAGR of 6.9% from 2025 to 2034. In 2024, North America led the global market, capturing a 48.9% share worth USD 1.5 billion. This dominance reflects strong consumer preference for high-protein, low-fat, and convenient snack options, supported by a well-established retail and e-commerce network across the region.

Jerky snacks have become increasingly popular among health-conscious consumers seeking portable, nutritious alternatives to conventional snacks. The demand is driven by growing awareness of protein-rich diets and lifestyle shifts toward on-the-go consumption. These products combine taste and functionality, appealing to both fitness-oriented individuals and busy professionals looking for wholesome snacks. Additionally, the rise of e-commerce has enabled direct-to-consumer models, helping brands personalize offerings and expand their reach to niche audiences.

The growth of the jerky snacks market is further supported by favorable government initiatives in emerging economies. In India, for example, the food processing industry—covering meat and marine products—is expected to reach USD 535 billion by FY26. Programs like the Pradhan Mantri Kisan Sampada Yojana and the Food Processing Industries Development Scheme have strengthened infrastructure, reduced wastage, and promoted value-added products such as jerky snacks.

Moreover, the Indian government’s reduction of the Goods and Services Tax (GST) on snacks to 5% has made these products more affordable and accessible. The Ministry of Food Processing Industries is also promoting clean-label snack production, aligning with the growing consumer demand for transparency, natural ingredients, and minimally processed food choices. These combined efforts are creating a favorable environment for the expansion of the jerky snacks market globally.

Key Takeaways

- The Global Jerky Snacks Market size is expected to be worth around USD 6.0 billion by 2034, from USD 3.1 billion in 2024, growing at a CAGR of 6.9%.

- Beef jerky dominated the Indian jerky snacks market, accounting for a substantial 55.4% of the total revenue.

- Conventional jerky snacks held a commanding 83.6% share of the Indian jerky snacks market.

- Original flavor jerky snacks held a dominant position in the Indian market, capturing more than a 38.2% share.

- North America led the global jerky snacks market, capturing a dominant 48.9% share, valued at approximately USD 1.5 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/jerky-snacks-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.1 Billion |

| Forecast Revenue (2034) | USD 6.0 Billion |

| CAGR (2025-2034) | 6.9% |

| Segments Covered | By Product (Beef, Pork, Poultry, Others), By Source (Conventional, Organic), By Flavor (Original, Teriyaki, Peppered, Others) |

| Competitive Landscape | LINK SNACKS, INC., Old Trapper Smoked Products, Oberto Snacks Inc., The Hershey Company, General Mills Inc., Chef’s Cut Real Jerky Co., Frito-Lay North America, Inc., Tillamook Country Smoker, Conagra Brands |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157795

Key Market Segments

Product Analysis

Beef Jerky Commands 55.4% Market Share in 2024

In 2024, beef jerky led the Indian jerky snacks market, securing a dominant 55.4% of total revenue. Its popularity stems from a strong consumer preference for its rich flavor and high protein content. The convenience and long shelf life of beef jerky further enhance its appeal, making it a top choice for health-conscious and on-the-go consumers in India.

Source Analysis

Conventional Jerky Snacks Lead with 83.6% Market Share in 2024

Conventional jerky snacks dominated the Indian jerky snacks market in 2024, holding an impressive 83.6% share. Their widespread appeal lies in their affordability, familiarity, and availability, supported by efficient production processes and extended shelf life. These factors make conventional jerky a preferred option across both urban and rural markets in India.

Flavor Analysis

Original Flavor Jerky Snacks Hold 38.2% Market Share in 2024

In 2024, Original flavor jerky snacks captured a leading 38.2% share of the Indian market. The classic, unadulterated meat flavor resonates with Indian consumers, aligning with traditional taste preferences. Its simplicity and authenticity make Original flavor jerky a go-to choice for many.

Regional Analysis

North America Leads Global Jerky Snacks Market with 48.9% Share in 2024

North America dominated the global jerky snacks market in 2024, accounting for 48.9% of the market, valued at approximately USD 1.5 billion. The region’s strong demand for convenient, protein-rich snacks drives this growth, fueled by health-conscious dietary trends and the rise of on-the-go snacking. Expanded retail channels, including supermarkets, convenience stores, and e-commerce platforms, along with innovative flavors and packaging, further boost the market’s growth and cater to diverse consumer preferences.

Top Use Cases

- Outdoor activities: Jerky snacks serve as a lightweight, non-perishable energy source for hikers, campers, and bikers, providing quick protein to sustain long adventures without spoiling in remote areas. Their portability makes them ideal for trail mixes or standalone fuel during active pursuits in nature.

- Health and fitness: Fitness enthusiasts turn to jerky snacks for their high protein content, supporting muscle recovery and satiety during workouts or as meal replacements. They align with low-carb diets like keto or paleo, offering a convenient way to meet daily protein needs without heavy meals.

- On-the-go snacking: Busy professionals and travelers rely on jerky snacks for easy, mess-free bites during commutes, office breaks, or flights. Their long shelf life and compact packaging fit perfectly into bags or pockets, curbing hunger without refrigeration or preparation.

- Military and emergency rations: Jerky snacks are a staple in combat or survival kits due to their durability, nutritional density, and ability to stay fresh without cooling. They deliver essential protein and energy in demanding situations where reliable, lightweight food is crucial.

- Recipe enhancements: Home cooks chop jerky snacks into salads, soups, eggs, or pasta for added texture and flavor, boosting protein in everyday meals. This versatile ingredient transforms simple dishes into hearty options, appealing to those seeking creative, savory twists.

Recent Developments

1. LINK SNACKS, INC.

Link Snacks, famous for its Jack Link’s brand, is aggressively expanding into the plant-based protein sector. The company launched a full line of plant-based jerky under the “Plant-Based Jacked” line, catering to the growing flexitarian demographic. This move diversifies its core meat portfolio and taps into a significant new market trend for sustainable snacking.

2. Old Trapper Smoked Products

Old Trapper continues to focus on its core strength of value-sized, traditional smoked meats. A key recent development is the significant expansion of its production facilities in Texas. This multi-million dollar investment aims to increase manufacturing capacity to meet rising consumer demand, improve operational efficiency, and support the national distribution of its affordable, old-fashioned jerky products.

3. Oberto Snacks Inc.

Oberto has been innovating within the meat snack category by launching new product formats. A key development is the introduction of “Oberto Craft Meats Small Batch Bacon Jerky,” emphasizing premium ingredients and artisanal flavors. Additionally, they have expanded distribution for their “Oberto Beef Steak Strips” to meet demand for high-protein, low-sugar options, strengthening their position in the better-for-you segment.

4. The Hershey Company

Through its Krave brand, Hershey has focused on brand revitalization and flavor innovation. A recent development is the launch of new, chef-inspired recipes for Krave jerky, such as Chili Lime and Garlic Rosemary Beef. Hershey is leveraging its marketing power to reposition Krave as a premium, gourmet jerky option, targeting health-conscious adults seeking sophisticated flavor profiles and high-quality protein snacks.

5. General Mills Inc.

General Mills, via its EPIC brand, continues to champion its mission of regenerative agriculture and sustainable sourcing. A significant recent development is the launch of new EPIC venison and bison jerky, sourced from animals raised on restored grasslands. This directly aligns with consumer demand for transparency, ethical sourcing, and environmentally conscious products, differentiating EPIC in the competitive jerky aisle.

Conclusion

Jerky Snacks continue to thrive as a versatile protein option, fitting seamlessly into health-focused lifestyles and busy routines. Their convenience and appeal to active consumers drive steady demand, with innovations in flavors and clean ingredients broadening accessibility. As snacking trends evolve toward nutritious, portable choices, jerky positions itself as an enduring favorite in the competitive snack landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)