Table of Contents

Overview

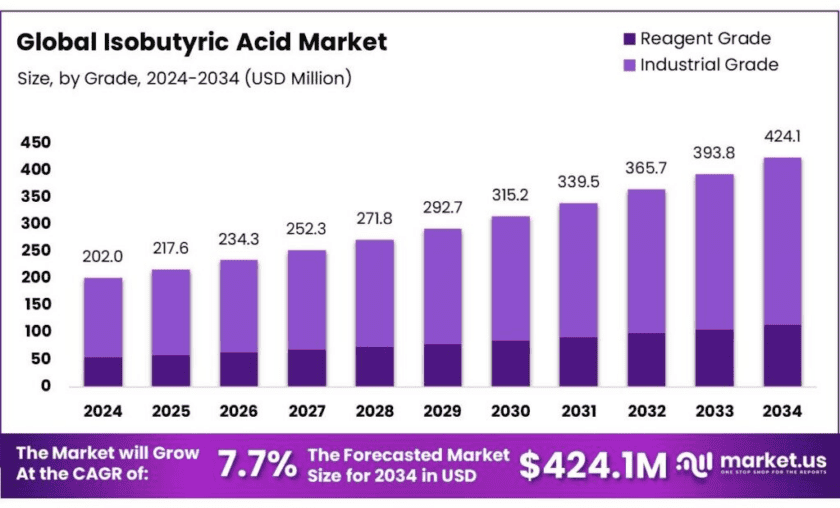

New York, NY – Dec 04, 2025 –The global isobutyric acid market is projected to reach USD 424.1 million in 2034, rising from USD 202.0 million in 2024 at a CAGR of 7.7% from 2025 to 2034. In 2024, North America led the market with a 24.70% share, generating USD 49.8 million in revenue. Isobutyric acid, a short-chain branched carboxylic acid, is widely used as an intermediate in esters, solvents, plasticizers, flavors, fragrances, pharmaceutical ingredients, and feed additives, supported by its favorable physicochemical properties.

Global production has remained modest, with output reported at approximately 145,000 tonnes in 2022, reflecting its position as a specialty chemical with established industrial uses. Market expansion continues to be driven by increasing demand in flavors and fragrances, pharmaceuticals, and specialty polymers, where isobutyric-based esters deliver specific performance benefits. In addition, rising emphasis on renewable and bio-based chemical routes has strengthened long-term prospects, supported by substantial public-sector programs.

The U.S. Department of Energy allocated USD 23 million for renewable chemicals and fuels R&D in 2025, while the U.S. Department of Agriculture extended loan guarantees of up to USD 250 million for biorefinery projects. Europe’s Circular Bio-based Europe initiative likewise committed multi-million-euro funding, including a €20 million award for bio-based organic acid development. These initiatives collectively signal increasing policy support for sustainable production pathways relevant to isobutyric acid.

For instance, in the United States, the price of isobutyric acid reached USD 1,573 per metric ton in the fourth quarter of 2024, influenced by disruptions in production and supply chains. In contrast, in China, prices were recorded at USD 1,360 per metric ton during the same period.

According to the European Bioplastics Association, the production capacity of bioplastics in Europe is expected to reach 2.42 million tonnes by 2025, indicating a robust growth trajectory. This trend presents a significant opportunity for isobutyric acid to be integrated into the production of bioplastics, catering to the growing demand for environmentally friendly alternatives.

Key Takeaways

- Isobutyric Acid Market size is expected to be worth around USD 424.1 Million by 2034, from USD 202.0 Million in 2024, growing at a CAGR of 7.7%.

- Industrial Grade held a dominant market position, capturing more than a 73.7% share.

- Synthetic held a dominant market position, capturing more than an 86.4% share of the global isobutyric acid market.

- Animal Feed held a dominant market position, capturing more than a 43.8% share of the global isobutyric acid market.

- North America accounted for approximately 24.70% of the isobutyric acid market, corresponding to a value of about USD 49.8 million.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-isobutyric-acid-market/free-sample/

Report Scope

| Market Value (2024) | USD 202.0 Million |

| Forecast Revenue (2034) | USD 424.1 Million |

| CAGR (2025-2034) | 7.7% |

| Segments Covered | By Grade (Reagent Grade, Industrial Grade), By Type (Synthetic, Renewable), By End-use (Animal Feed, Food and Flavor, Chemical Intermediate, Pharmaceutical, Others) |

| Competitive Landscape | OQ Chemicals GmbH, Eastman Chemical Company, Evonik, AFYREN, Nanjing Chemical Material Corp., Yufeng International Group Co., Ltd., Glentham Life Sciences Limited, Central Drug House, Others |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161264

Key Market Segments

By Grade Analysis – Industrial Grade

In 2024, Industrial Grade accounted for approximately 73.7% of total demand, reflecting its extensive use across bulk chemical and manufacturing processes. The segment’s dominance was supported by its suitability for high-volume applications where operational efficiency and steady supply are prioritized over stringent purity levels. Well-established production capacities and optimized logistics networks further strengthened its position. By 2025, Industrial Grade continued to maintain its lead, aided by consistent demand from large-scale end users and its role as a cost-effective feedstock in diversified industrial operations.

By Type Analysis – Synthetic Type

In 2024, the Synthetic segment held close to 86.4% of the market, reinforced by its established production routes, uniform quality, and dependable feedstock availability. The segment benefited from controlled manufacturing processes that ensured consistent purity levels required in coatings, plastics, and solvent formulations. In 2025, the Synthetic Type continued to dominate as industries favored its reliability and price stability despite fluctuations in bio-based raw materials. Strong scalability and alignment with existing industrial systems ensured that the synthetic route remained the preferred option across major applications.

By End-use Analysis – Animal Feed

In 2024, the Animal Feed segment captured around 43.8% of global consumption, driven by its expanding use as an additive for improving gut function, nutrient uptake, and overall livestock performance. Rising meat and dairy production supported this demand, encouraging feed manufacturers to adopt organic acids to enhance feed quality and safety. In 2025, the segment retained its leading position as government programs promoting sustainable livestock practices and higher-value feed formulations continued to stimulate uptake. Growing livestock populations and increasing focus on productivity ensured sustained momentum for this segment.

List of Segments

By Grade

- Reagent Grade

- Industrial Grade

By Type

- Synthetic

- Renewable

By End-use

- Animal Feed

- Food & Flavor

- Chemical Intermediate

- Pharmaceutical

- Others

Regional Analysis

In 2024, North America held nearly 24.70% of the isobutyric acid market, representing a value of around USD 49.8 million. The region’s strong position has been supported by sustained demand from pharmaceuticals, flavor and fragrance producers, and the animal nutrition sector, all of which rely on high-quality chemical intermediates.

The United States remained the primary contributor, where a stable regulatory environment, advanced research capabilities, and a well-developed chemical ecosystem supported consistent consumption. The presence of established chemical and biotechnology companies further strengthened regional uptake across both synthetic and emerging bio-based production pathways.

Top Use Cases

Flavors & fragrances — ester precursor and aroma component: Isobutyric acid is widely used to make fruity esters that provide apple, banana and pear notes in food flavors and perfumes. Esterification yields and selection of alcohol partners determine aroma profile and solvent properties; commercial ester grades are specified by % purity and residual acid levels in supplier datasheets.

Animal nutrition & silage/feed additives — gut health and silage preservation: Isobutyric acid and its salts are applied as feed additives and silage treatments to improve gut health, feed palatability and fermentation stability. Recent in-vivo and in-vitro studies report measurable improvements in intestinal barrier markers and growth performance in weaned piglets and ruminant silages when isobutyric or iso-acid levels are optimised, supporting its commercial uptake in animal feed formulations.

Chemical intermediate — esters, solvents, plasticizers and specialty polymers: The acid is an intermediate for producing solvents, plasticizers, surfactants and specialty monomers. Typical industrial practice uses isobutyric acid in esterification reactions at controlled temperatures; product applications include coatings, adhesives and polymer additives where branched-acid esters deliver desired solvency and plasticising performance. Supplier technical notes describe typical product purities and recommended process conditions.

Pharmaceutical intermediates — building block for active ingredient synthesis: Isobutyric acid is employed as a C-4 building block or acid component in API syntheses and related derivatives. Patent literature and synthetic reports demonstrate its use in preparing substituted isobutyric frameworks and esters that appear in drug candidates and specialty intermediates. Reaction stoichiometries and protecting-group strategies are well documented in patents and synthetic protocols.

Agrochemical & seed/silage protection — preservative formulations: Aqueous solutions and ammonium/isobutyrate mixtures have been patented for preventing rot and mildew on seeds and silages; these applications exploit acidification and antimicrobial effects at low concentrations. Patents provide formulation ranges and crystallization/handling data for field use.

Recent Developments

OQ Chemicals continues to rank among the leading global producers of Isobutyric Acid, manufacturing the acid at its German facilities. In May 2024 the company lifted a prior force‑majeure on production, indicating full resumption of output capacity for isobutyric acid and related carboxylic acids. OQ’s product range includes isobutyric acid used for flavors, solvents, coatings, and other industrial intermediates, supporting diverse end‑use sectors.

Eastman Chemical Company remains a prominent supplier of isobutyric acid globally. Its product offering is listed under “Isobutyric Acid” for use in flavorings, fragrances, coatings, food‑chemical intermediates, agrochemical intermediates, and other applications as of 2025. The company leverages its broad manufacturing and distribution network to supply multiple regions including North America, Asia Pacific, and Europe, enabling global customer reach and supporting demand in specialty chemical markets.

By 2024, Evonik reported overall revenues of about €15.2 billion, operating across global sites in Germany, the U.S., China, and beyond. While the company is recognized for specialty additives, polymers, and life‑science chemicals, published public information does not explicitly confirm active production or supply of isobutyric acid in 2024. In October 2024, Evonik announced restructuring in its keto-/pharma‑amino acid business and intentions to cease certain acid productions by end‑2025. As a result, Evonik’s role in the isobutyric acid sector appears limited or indirect during this period.

AFYREN operates a biorefinery model converting non‑food biomass into a suite of organic acids; by end‑2024 it listed isobutyric acid among its 100% biobased acid products. In the second half of 2024 the company produced and sold several dozen tons of biobased acids, with quality validated by customers in food, feed, flavors & fragrances and nutraceutical sectors. In mid‑2025 AFYREN achieved continuous production at its plant and began delivering hundreds of tons, aiming for breakeven and expanded commercialization.

Nanjing Chemical Material Corp. (NCMC) offers isobutyric acid (CAS 79‑31‑2) with a listed purity of ≥99.0%, density ≈ 0.95 g/cm³, and boiling point around 148 °C, according to its product data sheet. As of 2024, NCMC remains one of the largest chemical suppliers in Jiangsu province with heavy‑chemicals licensing and an annual trade volume reportedly exceeding RMB 600 million, underpinned by manufacturing, storage and logistic assets. Its integrated capabilities — from production to R&D to export — support global supply of isobutyric acid for intermediates, solvents, and specialty chemical applications.

In 2024, Yufeng International Group listed isobutyric acid (CAS 79‑31‑2) among its core fine‑chemical offerings, with a molecular weight of 88.11 g/mol and typical grade purity of 99%. The company, operating three production sites in China and offices in the US and India, has more than four decades of experience and uses an ISO 9001:2015 quality‑management system to ensure product consistency and global shipping reliability. Its broad downstream reach — including agrochemicals, food flavor & fragrance, coatings and pharmaceutical intermediates — positions Yufeng as a relevant global supplier for isobutyric acid in 2024.

Glentham Life Sciences lists Isobutyric acid (CAS 79‑31‑2) in its 2024 catalogue under product code GL6777, with assay purity ≥ 99.0 % and ready‑stock availability for research and specialty‑chemical customers. This positions the UK‑based supplier as a niche provider of fine chemicals for laboratories, flavor & fragrance developers, and custom synthesis workflows, enabling small‑volume orders up to metric tonnes globally.

Central Drug House (CDH) continues in 2024 as a longstanding Indian distributor of pharmaceutical raw materials and fine chemicals. While its public product listing does not specifically name isobutyric acid, CDH markets thousands of organic and fine‑chemical items, serving domestic and export customers across APIs, solvents, reagents and chemical intermediates — indicating that supply of isobutyric acid to Indian manufacturers remains feasible via its broad distribution network.

Conclusion

In conclusion, isobutyric acid is positioned as a specialty intermediate with a clear growth trajectory. The chemical’s physical profile (MW 88.11 g·mol⁻¹, bp ≈154.4 °C, pKa ≈4.84) and reactivity make it well suited for esterification and for producing flavor esters, solvents, plasticizers and pharmaceutical intermediates—applications that underpin steady industrial demand.

Global production was modest but meaningful for a specialty acid, indicating a supply base concentrated among specialty and integrated producers. Policy support for bio-based chemicals is increasing and is expected to alter supply pathways; for example, the U.S. DOE’s Bioenergy Technologies Office announced up to USD 23 million in funding for renewable chemicals and fuels R&D, which may accelerate commercial bio-based routes for isobutyric acid.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)