Table of Contents

Overview

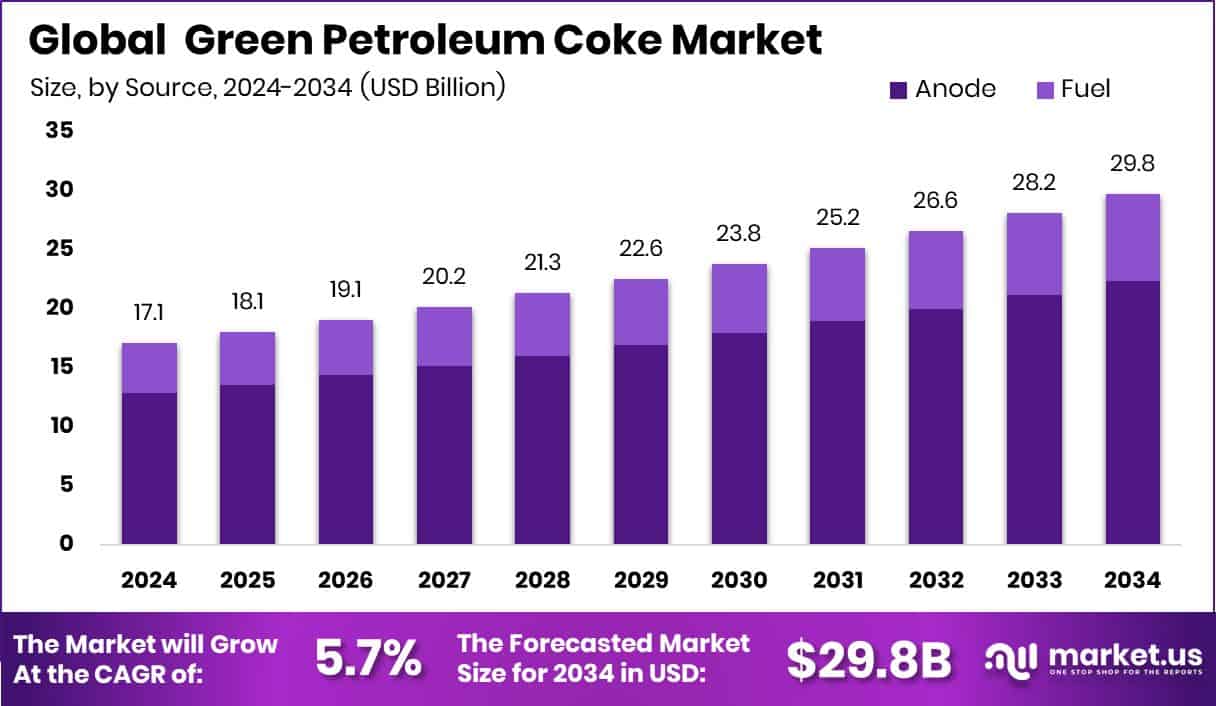

New York, NY – Dec 03, 2025 – The global Green Petroleum Coke Market is on a steady growth path, expected to reach USD 29.8 billion by 2034, rising from USD 17.1 billion in 2024, with a 5.7% CAGR from 2025 to 2034. Asia-Pacific, valued at USD 6.7 billion, continues to expand as industrial activity increases across key carbon-intensive sectors.

Green petroleum coke is a raw, carbon-rich solid generated during the thermal cracking of heavy oils in refineries. As an uncalcined material, it retains high carbon content with varying sulfur and metal impurities. These characteristics make it suitable for fuel use, anode production, graphite manufacturing, and industrial heating applications.

Market demand is largely driven by metallurgy, aluminum smelting, cement production, power generation, and graphite industries. Rising industrial output and the need for reliable carbon inputs are strengthening consumption, especially within aluminum and graphite value chains. This trend is reinforced by recent funding activity, including Golden Aluminum’s $22 million Nexcast project and $10 million Phase-1 funding for a green aluminum smelter, both pointing to higher future demand for carbon feedstocks such as green petroleum coke.

Opportunities are further supported by recycling initiatives. Grants enabling 31 million aluminum cans to be recovered each year are boosting aluminum production, indirectly increasing carbon demand. In parallel, graphite expansion plans—such as HEG’s ₹3,500-crore project and Graphite India’s ₹50-crore acquisition of a 31% stake in Godi—highlight strong long-term prospects for the green petroleum coke market.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-green-petroleum-coke-market/request-sample/

Key Takeaways

- The Global Green Petroleum Coke Market is expected to be worth around USD 29.8 billion by 2034, up from USD 17.1 billion in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034.

- The green petroleum coke market was dominated by the anode source with a 75.2% share.

- The green petroleum coke market was dominated by spongy coke, holding a 39.5% share.

- The green petroleum coke market was dominated by aluminum applications with a 43.7% share.

- The Asia-Pacific records a strong market value of USD 6.7 Bn in 2024.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=166877

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 17.1 Billion |

| Forecast Revenue (2034) | USD 29.8 Billion |

| CAGR (2025-2034) | 5.7% |

| Segments Covered | By Source (Anode, Fuel), By Form (Spongy Coke, Honeycomb Coke, Purge Coke, Shot Coke, Needle Coke), By Application (Aluminum, Graphite Electrode, Cement, Power Station, Calcined Coke, Others) |

| Competitive Landscape | Rain Carbon Inc., Oxbow Corporation, AMINCO RESOURCES LLC., Weifang Lianxing New Material Technology Co., Ltd., Atha Group, Asbury Carbons, Aluminium Bahrain (Alba) |

Key Market Segments

By Source Analysis

In 2024, the Anode segment dominated the By Source segment of the Green Petroleum Coke Market, accounting for a 75.2% share, highlighting its critical importance in industrial carbon applications. This leadership is driven by its role as a key carbon feedstock for anode manufacturing, particularly in energy-intensive metallurgical operations where reliable carbon quality is essential.

Anode-grade green petroleum coke is widely preferred for producing carbon blocks and electrodes used in high-temperature environments. Industries value this material for its thermal stability, long operating life, and consistent performance, which help ensure uninterrupted processing cycles. The segment’s strong position also reflects the continued dependence of downstream industries on proven carbon inputs that support efficiency and durability.

As metallurgical and materials-processing sectors expand capacity and modernize production systems, demand for anode-based carbon materials remains steady. Ongoing investments in industrial infrastructure and technology upgrades reinforce long-term consumption needs, allowing the anode segment to retain its dominant position within the green petroleum coke market.

By Form Analysis

In 2024, Spongy Coke emerged as the leading form in the By Form segment of the Green Petroleum Coke Market, securing a 39.5% market share. This strong position is largely attributed to its porous structure, which enhances carbon reactivity and supports efficient use in high-temperature industrial operations.

Industries favor spongy coke in applications that demand controlled combustion and stable energy release. Its structural properties help maintain consistent heat output, making it suitable for processes that operate over long production cycles. The material’s uniform carbon composition also improves operational reliability, reducing variability in performance across industrial systems.

The continued dominance of spongy coke reflects steady consumption in manufacturing sectors that require dependable carbon inputs. As industrial activity grows and plants prioritize process stability and efficiency, spongy coke remains a preferred form, driven by its functional advantages and proven suitability for sustained industrial use within the green petroleum coke market.

By Application Analysis

In 2024, the Aluminum application led the By Application segment of the Green Petroleum Coke Market, accounting for a 43.7% share, underscoring its central role in aluminum manufacturing. This dominance is driven by the use of green petroleum coke as a primary carbon input for anode production, which is essential for efficient aluminum smelting operations.

Aluminum smelters rely on consistent carbon quality to ensure high electrical conductivity and stable furnace conditions during electrolytic processes. Green petroleum coke supports continuous operations by delivering predictable performance, making it a preferred carbon material across refineries and smelting facilities. The segment’s strong position also reflects steady, long-term consumption, as aluminum production requires uninterrupted carbon supplies to maintain output efficiency.

With aluminum manufacturing remaining active across major industrial regions, demand for reliable anode-grade carbon remains firm. Ongoing reliance on proven carbon inputs allows the aluminum application to retain its leading position within the green petroleum coke market.

Regional Analysis

In 2024, Asia-Pacific led the Green Petroleum Coke Market with a 39.30% share, valued at USD 6.7 billion, highlighting its strong industrial base and sustained demand from heavy manufacturing sectors. The region’s large refining capacity and expanding carbon-based processing activities support steady consumption from industries that depend on high-carbon feedstocks for continuous operations.

North America follows with stable demand, supported by well-established industrial facilities and ongoing modernization of high-temperature processing systems. Its mature refining infrastructure ensures a reliable domestic supply for various industrial uses.

Europe maintains a steady market presence, driven by long-standing manufacturing activities that continue to require carbon materials for specialized processes. Despite environmental regulations influencing usage patterns, carbon inputs remain essential in select applications.

The Middle East & Africa region shows gradual growth as energy projects and industrial capacity expand. Latin America contributes through developing industrial sectors that increasingly adopt carbon-rich materials to support core manufacturing demands.

Top Use Cases

- Fuel for Cement Kilns & Lime Kilns: Green petcoke is widely used as a fuel in cement production. Its high carbon content and strong calorific value make it efficient for heating cement/clinker kilns, replacing or supplementing coal.

- Power Generation & Industrial Boilers: GPC serves as a solid fuel in power plants and large industrial boilers — e.g., steam generation for factories or chemical plants — thanks to its energy density.

- Anode Raw Material for Aluminum Smelting: When processed (calcined), GPC becomes a core input for producing carbon anodes used in aluminum smelters. These anodes are vital for the electrolytic reduction of alumina into aluminum metal.

- Carbon Additive / Recarburizer in Steel & Ferroalloy Production: In steelmaking, especially Electric Arc Furnace (EAF) or ferroalloy production, petcoke can function as a carbon source to raise carbon content in molten metal, improving strength and desired properties.

- Graphite Electrodes and Graphite-Based Products: After further processing — especially specialized “needle coke” grades — petroleum coke is used to manufacture graphite electrodes. These electrodes are needed in electric-furnace steelmaking and other high-heat, high-conductivity processes.

- Feedstock for Specialty Carbon and Chemical Processes (e.g. TiO₂, Chemical Industry): Petroleum coke can serve as a carbon source in producing other carbon-derived materials and chemicals. For instance, it can feed processes such as titanium dioxide (TiO₂) production or potentially be gasified into syngas for various chemical applications.

Recent Developments

- In August 2025, Rain Carbon published its CY2024 Sustainability Report, reviewing its activities during 2024. This shows enhanced transparency on its carbon operations, environmental practices, and business conduct.

- In June 2024, local courts in Weifang decided to convert enforcement procedures into bankruptcy reorganisation for Weifang Lianxing, due to serious financial distress. This affected its calcined petroleum coke operations, with reports of production lines being shut down and capacity losses.

Conclusion

The green petroleum coke market plays a vital role in supporting heavy industrial operations that depend on reliable carbon inputs. Its importance spans aluminum smelting, cement production, power generation, and graphite manufacturing, where consistent performance and thermal stability are essential. As industrial activity continues across major regions, demand remains closely tied to refinery output and downstream processing needs.

The market is shaped by long-term usage patterns rather than short-term shifts, making it largely demand driven by core manufacturing sectors. Environmental considerations are influencing handling and usage practices, but green petroleum coke remains a necessary feedstock for many applications. Overall, the market outlook reflects steady industrial reliance supported by ongoing operating requirements and established value chains.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)