Table of Contents

Overview

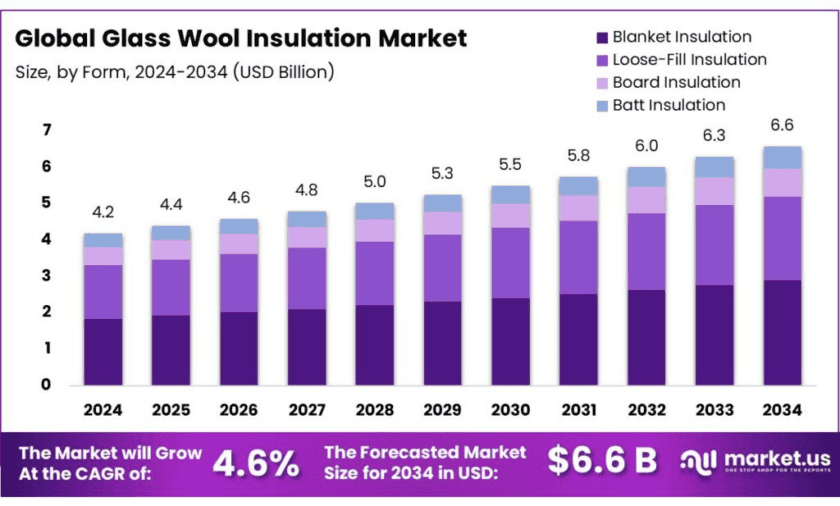

New York, NY – Nov 11, 2025 – The Global Glass Wool Insulation Market is projected to reach USD 6.6 billion by 2034, rising from USD 4.2 billion in 2024, and is expected to expand at a CAGR of 4.6% between 2025 and 2034. In 2024, North America dominated the global market, accounting for 42.3% of total revenue, valued at roughly USD 1.7 billion. This strong position is attributed to the region’s stringent building codes and growing emphasis on sustainable construction materials aimed at reducing carbon emissions and energy consumption in buildings.

A major factor driving this growth is the increasing number of government initiatives promoting energy efficiency. In the United States, the Environmental Protection Agency’s (EPA) ENERGY STAR program continues to encourage homeowners and businesses to upgrade insulation, which significantly lowers heating and cooling costs. Similarly, the Great British Insulation Scheme—with an allocated budget of £1 billion over three years—focuses on improving energy efficiency in residential properties through upgraded insulation systems. These efforts align with global climate goals to cut household energy use and reduce emissions.

The market is further strengthened by the presence of established manufacturers that are prioritizing innovation and sustainability. Leading companies such as Owens Corning, Knauf Insulation, and Saint-Gobain are expanding production capacities and investing in advanced manufacturing technologies to meet the surge in demand. For instance, Owens Corning reported total revenues of USD 10.98 billion in 2024, demonstrating strong financial performance and continued leadership in insulation materials. The industry’s shift toward energy-efficient, recyclable, and low-carbon insulation solutions ensures sustained momentum for glass wool insulation through the next decade.

Key Takeaways

- Glass Wool Insulation Market size is expected to be worth around USD 6.6 Billion by 2034, from USD 4.2 Billion in 2024, growing at a CAGR of 4.6%.

- Blanket Insulation held a dominant market position, capturing more than a 43.9% share of the glass wool insulation market.

- Thermal Insulation held a dominant market position, capturing more than a 56.2% share of the glass wool insulation market.

- Residential Buildings held a dominant market position, capturing more than a 38.6% share of the glass wool insulation market.

- New Construction held a dominant market position, capturing more than a 65.4% share of the glass wool insulation market.

- North America held a dominant position in the glass wool insulation market, capturing more than a 42.3% share, equating to approximately USD 1.7 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-glass-wool-insulation-market/free-sample/

Report Scope

| Market Value (2024) | USD 4.2 Bn |

| Forecast Revenue (2034) | USD 6.6 Bn |

| CAGR (2025-2034) | 4.6% |

| Segments Covered | By Form (Blanket Insulation, Loose-Fill Insulation, Board Insulation, Batt Insulation), By Property ( Thermal Insulation, Acoustic Insulation, Fire Resistance), By Application (Residential Buildings, Commercial Buildings, Industrial Buildings, Transportation, Others), By End-Use (New Construction, Renovation and Remodeling) |

| Competitive Landscape | Alghanim Industries, Armacell, BASF, Bradford Insulation Industries Ltd., Celotex, CertainTeed, Knauf Insulation SPRL, Saint-Gobain, Dow, DuPont, Johns Manville Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159936

Key Market Segments

By Form Analysis – Blanket Insulation Dominates with 43.9% Share in 2024

In 2024, Blanket Insulation led the global glass wool insulation market, accounting for over 43.9% of total revenue. Its popularity stems from its versatility, lightweight design, and ease of installation, making it the preferred choice for both residential and commercial buildings. Available in continuous rolls, blanket insulation is simple to cut and fit across walls, ceilings, and floors, significantly reducing labor costs and installation time. The rise in construction projects worldwide, coupled with a stronger emphasis on energy efficiency, has bolstered its demand.

By Property Analysis – Thermal Insulation Leads with 56.2% Share in 2024

Thermal Insulation dominated the glass wool insulation market in 2024, holding more than 56.2% market share. Its key advantage lies in its ability to minimize heat transfer, enhancing energy efficiency and reducing heating and cooling costs across residential, commercial, and industrial facilities. Governments’ tightening of energy-efficiency codes and the construction industry’s pivot toward sustainable materials have accelerated adoption. In 2025, this momentum is expected to continue, driven by growing demand for materials that ensure stable indoor temperatures and long-term energy savings.

By Application Analysis – Residential Buildings Lead with 38.6% Share in 2024

In 2024, Residential Buildings accounted for over 38.6% of the global glass wool insulation market, underlining the sector’s strong focus on energy-efficient housing. Homeowners and developers increasingly favor glass wool for its excellent thermal and acoustic properties, which enhance indoor comfort while reducing energy bills. The material’s cost-effectiveness, non-combustibility, and ease of installation further boost its appeal in residential walls, roofs, and floors.

By End-Use Analysis – New Construction Dominates with 65.4% Share in 2024

The New Construction segment led the glass wool insulation market in 2024, representing more than 65.4% market share. The dominance stems from expanding infrastructure development, urbanization, and the adoption of energy-efficient building standards. Glass wool’s properties—high thermal resistance, acoustic control, and fire safety—make it the preferred material for modern construction projects. In 2025, this trend is projected to remain strong as both public and private sectors prioritize sustainable construction and long-term cost reduction.

List of Segments

By Form

- Blanket Insulation

- Loose-Fill Insulation

- Board Insulation

- Batt Insulation

By Property

- Thermal Insulation

- Acoustic Insulation

- Fire Resistance

By Application

- Residential Buildings

- Commercial Buildings

- Industrial Buildings

- Transportation

- Others

By End-Use

- New Construction

- Renovation and Remodeling

Regional Analysis

North America Leads with 42.3% Share in 2024, Valued at USD 1.7 Billion

In 2024, North America emerged as the leading region in the global glass wool insulation market, commanding over 42.3% of total revenue, equivalent to around USD 1.7 billion. This strong regional presence is largely driven by stringent energy-efficiency regulations and robust construction activity across the United States and Canada. Building codes such as the International Energy Conservation Code (IECC) have accelerated the adoption of high-performance insulation materials in both residential and commercial projects, reinforcing the region’s leadership position.

The United States represents the largest market within North America, supported by a thriving construction industry and a growing emphasis on energy-efficient building practices. Glass wool insulation remains a preferred material due to its excellent thermal resistance, acoustic performance, and fire safety—qualities that meet modern construction standards.

- According to the U.S. Department of Energy, about 40% of the nation’s total energy consumption comes from residential and commercial buildings, highlighting the critical role of advanced insulation systems in reducing energy use.

Top Use Cases

Roof/attic retrofits to cut HVAC bills: Use glass wool batts/blankets when reroofing or adding attic insulation; pair with air-sealing. The U.S. EPA says sealing and insulating typical homes can save ~15% on heating/cooling (about 11% on total energy). Building operations remain a major load, so reducing envelope losses is high-impact.

Code-compliant envelopes in new commercial builds: Specify glass wool to meet insulation and air-leakage targets in modern codes/standards (e.g., ASHRAE 90.1 envelope provisions for insulation, air leakage, fenestration in alterations and new work). This supports documented energy-use reductions mandated by owners and authorities.

Whole-building energy reduction in public portfolios: City and campus portfolios use glass wool upgrades to trim operating costs and emissions. The IEA notes buildings account for ~33% of energy-system emissions when including 26% from operations and 7% embodied; operational emissions must fall ~50% by 2030 on a net-zero path—making insulation a priority lever.

Residential weatherization at scale: Utility or national programs (e.g., the Great British Insulation Scheme, budget £1 billion) target cavity/loft/wall insulation to lower bills. Glass wool’s cost-performance and easy install make it a common first measure in these schemes.

Thermal performance with known conductivity: Designers choose glass wool where low thermal conductivity is needed to hit U-value targets without excessive wall thickness. Peer-reviewed analysis places mineral wool λ ≈ 0.03–0.04 W/m·K, with typical glass/rock ranges 0.030–0.046 W/m·K, enabling efficient assemblies for walls, roofs and floors.

Acoustic control in multifamily, schools, healthcare: Glass wool delivers broadband sound absorption and transmission loss, improving comfort and productivity in occupied spaces. With U.S. buildings using ~75% of electricity and ~40% of total energy, better envelopes also reduce HVAC fan energy linked to noise control and ventilation.

Recent Developments

In 2023, Johns Manville reported global sales of over US$4 billion, reinforcing its position as a major player in building-insulation materials. The company, a subsidiary of Berkshire Hathaway, manufactures glass wool insulation among its broader portfolio of premium insulation and roofing products. From a market-research point of view, Johns Manville’s strong financial base, longstanding manufacturing footprint, and focus on energy-efficient building materials provide a solid platform to capture growth in retrofit and new-construction markets globally.

In 2024, Dow Inc. reported full-year net sales of approximately US$42,964 million, down from US$44,622 million in 2023. The company’s Building & Construction-related segment highlights “customisable insulation solutions” aimed at energy-efficient buildings. From a market-research analyst’s view, although Dow does not isolate glass-wool insulation revenue, its materials science portfolio—including binders and polyurethane insulation systems—positions it as a strategic upstream supplier in the glass-wool insulation value chain, benefiting from tighter construction codes and insulation uptake.

For the full year 2023, DuPont reported net sales of US$12,100 million, a 7% decrease year-on-year. Its building-solutions division emphasises high-performance insulation products to meet moisture control and thermal efficiency needs. As a market-research analyst, DuPont’s public data does not specifically carve out glass-wool insulation, its strong positioning in insulation systems and building envelope materials gives it a meaningful presence in the broader insulation market, especially as energy codes and sustainability demands rise.

In 2024, Knauf Insulation SPRL reported turnover exceeding €2.5 billion, highlighting steady financial health amidst a challenging construction market. The company focuses on glass-wool batt and blanket insulation, aiming to improve recycled content and circular economy credentials. As a market-research analyst, I see Knauf leveraging its scale in Europe and expansion in North America to meet increasing demand for energy-efficient insulation, positioning its glass wool lines as core to retrofit and new-build projects.

In 2024, Saint‑Gobain achieved a record operating margin of 11.4% and generated free cash flow of €4.0 billion. Its insulation arm — including glass wool products via brands like Isover — gained traction under renovation-led markets and stricter building codes. From a market-research perspective, Saint-Gobain’s global footprint and investment in doubling insulation capacity in India. Underline its strategic strength in glass wool insulation growth worldwide.

Celotex, now under the umbrella of Saint‑Gobain in the UK, continues to focus on building-insulation products including glass-wool and related systems. While standalone 2023-24 revenue figures are not publicly isolated, recent corporate filings show Saint-Gobain is restructuring Celotex’s operations—regarding production sites in Hadleigh and Eggborough—in a transfer to a new firm owned 75% by Soprema as of December 2023. From an analyst’s viewpoint, Celotex remains a specialist brand in high-performance insulation boards catering to residential and commercial renovation demand, especially where glass-wool solutions or upgrade insulation systems are required.

CertainTeed, a major North American building-products company owned by Saint-Gobain, offers insulation systems—including glass wool insulation—among its roofing, siding and interior product lines. In 2024, the firm published its U.S. Industry Trend Report showing that 20% of homeowners prioritise insulation upgrades when improving their homes. Though not all of this refers solely to glass-wool, the data illustrates market interest in insulation. From a market-research view, CertainTeed’s broad channel reach in the U.S. and Canada, combined with its integrated building-material systems, position it to capture growth in glass-wool demand driven by energy-efficiency renovation cycles and tighter building codes.

BASF SE reported total sales of €68.9 billion in 2023, with a portfolio that includes insulation-related binders and specialty additives for glass wool and other building materials. While the company doesn’t isolate glass wool revenue, its construction-solutions unit highlights formaldehyde-free acrylic binders and support for energy-efficient envelopes. As a market-research analyst, I observe BASF’s material-science strength and global scale give it a strategic position in the glass wool value chain—especially as building codes demand higher insulation and sustainability compliance.

Bradford Insulation Industries Ltd. (Australia) produces glass wool, rock wool and foil insulation products for residential, commercial and industrial sectors. While specific 2023-24 revenue for the company’s glass wool line isn’t publicly released, its Extended Product Declaration (EPD) from April 2025 confirms its glass wool portfolio and commitment to recycled content. From an analyst’s perspective, Bradford’s longstanding presence in the Asia-Pacific insulation market and product diversification suggest it is well-set to capture growth in retrofit and energy-efficient construction sectors.

Armacell International S.A. is a global insulation materials provider whose 2023 net sales reached €836.1 million, up 3.7% versus 2022 (€806.2 million). While Armacell’s core strength is industrial and equipment insulation, its expansion into building-insulation solutions reflects broader insulation market growth—including glass wool. From a market-research analyst’s view, Armacell’s rising volumes, improved margin (adjusted EBITDA margin ~18.5 %) and strategic positioning in insulation make it a credible player within the glass-wool insulation ecosystem, especially where technical performance and energy efficiency matter.

Conclusion

In conclusion, glass wool insulation stands out as a practical and high-impact solution for today’s buildings. Its core strength lies in delivering reliable thermal resistance, helping maintain comfortable indoor temperatures and reduce HVAC energy use. For example, technical data show that applying 100 mm of glass wool with a thermal conductivity of ~0.032 W/m·K can lower interior roof surface temperatures by up to 8 °C, enhancing comfort and efficiency. With buildings accounting for approximately 33% of energy-system emissions, any measure that improves the building envelope—such as glass wool insulation—is critical.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)