Table of Contents

Overview

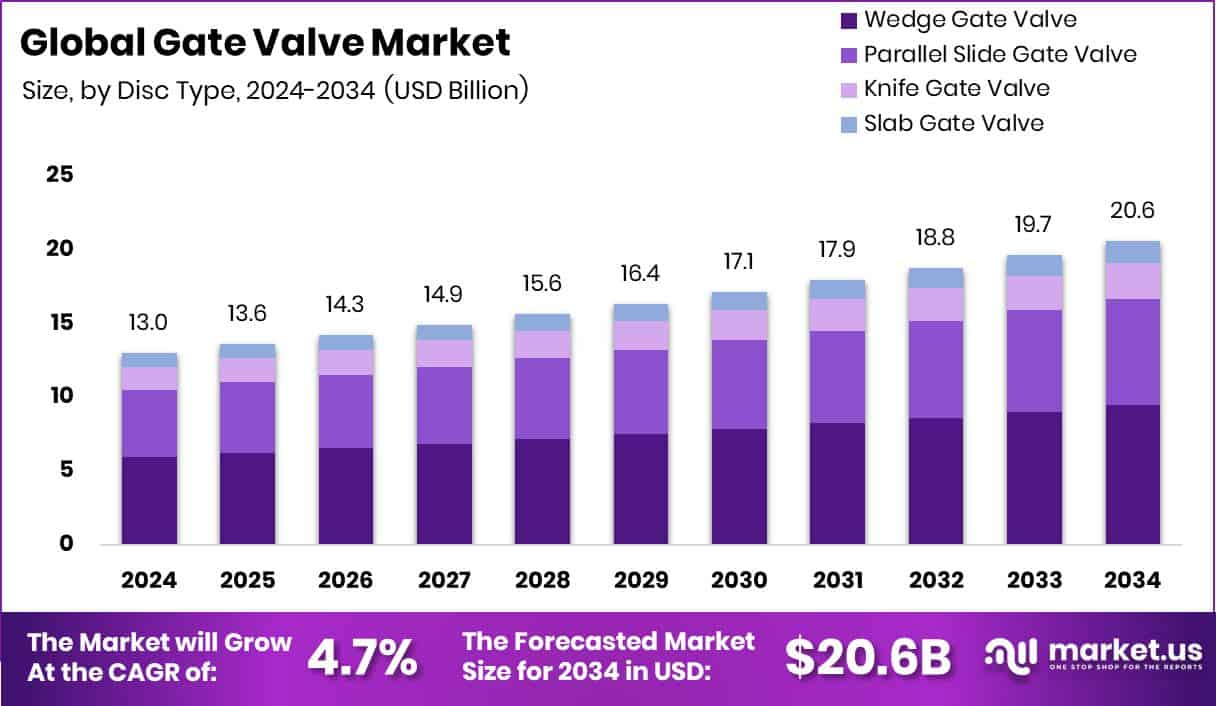

New York, NY – Dec 04, 2025 – The global gate valve market is on a steady growth path, expected to reach USD 20.6 billion by 2034, rising from USD 13.0 billion in 2024, with a projected CAGR of 4.7% between 2025 and 2034. North America leads the market with a 43.90% share, supported by a strong focus on pipeline reliability, safety standards, and long-term system performance across energy, water, and industrial infrastructure.

Gate valves are essential flow-control devices used to fully start or stop the movement of liquids, gases, or steam within pipelines. Their simple shut-off design and low flow resistance make them suitable for water distribution networks, oil and gas pipelines, chemical facilities, and manufacturing systems where durability and precise isolation are critical.

Market momentum is closely linked to industrial growth, infrastructure modernisation, and investments in energy and water systems. Industries are increasingly upgrading pipelines with stainless steel and alloy gate valves that can withstand high temperatures, pressure, and corrosive operating conditions.

Financial activity across related industrial supply chains continues to support demand. Key developments include a £26 million export finance package for a stainless-steel manufacturer, €2.25 million allocated to additive manufacturing solutions, and a ¥450 million seed investment for modular pod systems.

Additional stimulus comes from major material and construction projects, such as India’s ₹34,000-crore PVC project backed by an SBI-led consortium, EUR 3 million in support for PVC manufacturing, and EUR 60 million dedicated to green steel development in Spain. Despite a 24.4% drop in Spanish rolled steel exports, domestic investments remain strong, sustaining future demand for gate valves across energy, construction, and water infrastructure projects.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-gate-valve-market/request-sample/

Key Takeaways

- The Global Gate Valve Market is expected to be worth around USD 20.6 billion by 2034, up from USD 13.0 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- In 2024, the Gate Valve Market saw Wedge Gate Valve hold 45.9%, driven by durability and sealing reliability.

- Steel remained the preferred choice in the Gate Valve Market, holding a 41.2% share for strength and corrosion resistance.

- Gate Valve Market demand was highest in the 3 to 12-inch category at 47.1%, supporting pipelines and infrastructure.

- The Oil and Gas sector led the Gate Valve Market with 34.4%, supported by expanding drilling and refining.

- Growing infrastructure upgrades push North America demand toward USD 5.7 Bn valuation.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=167290

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 13.0 Billion |

| Forecast Revenue (2034) | USD 20.6 Billion |

| CAGR (2025-2034) | 4.7% |

| Segments Covered | By Disc Type (Wedge Gate Valve, Parallel Slide Gate Valve, Knife Gate Valve, Slab Gate Valve), By Valve Material (Cast Iron, Steel (Carbon Steel, Stainless Steel, Alloy Steel, Cast Steel), Brass, Bronze, Plastic (PVC, CPVC, PP, Others)), By Size (0.25 inch to 2 inch, 3 to 12 inch, 14 to 30 inch, More Than 30 inch), By End Use (Oil and Gas, Water and Wastewater Treatment, Chemical and Petrochemical, Power Generation, Mining and Minerals, HVAC, Others) |

| Competitive Landscape | Emerson Electric Co., Flowserve Corporation, AVK Holding A/S, Velan Inc., DeZURIK Inc., Zhejiang Zhongcheng Valve Co. Ltd., Crane Co. Ltd, Tecofi, Weir Group PLC, Bray International |

Key Market Segments

By Disc Type Analysis

In 2024, wedge gate valves led the By Disc Type segment of the gate valve market, capturing a 45.9% share due to their dependable operation and strong sealing capability. These valves are widely valued for handling high-pressure and high-temperature conditions, making them a reliable choice in demanding environments. Sectors such as water treatment, chemical processing, and oil transmission increasingly adopted wedge gate valves because they maintain sealing efficiency even when pressure and flow levels change.

Their continued dominance was also supported by growing investments in steel production, PVC infrastructure, and modular system development, all of which require robust shut-off solutions to meet safety standards and regulatory requirements.

As global industries upgrade pipelines and expand capacity, operators favor wedge gate valves for their long service life, stable performance, and lower risk of leakage. Ongoing infrastructure modernization and industrial growth further reinforced their position as the preferred solution for long-term pipeline reliability and operational security.

By Valve Material Analysis

In 2024, steel dominated the By Valve Material segment of the gate valve market, accounting for a 41.2% share. Its leadership was driven by high mechanical strength, excellent temperature resistance, and proven performance in demanding industrial conditions. Steel valves are widely used where systems face high pressure, corrosion, or extreme operating environments.

The importance of steel increased alongside major investments in steel manufacturing, PVC infrastructure, modular production systems, and export-focused industries. Initiatives involving green steel development, export finance programs, and large-scale PVC capacity expansion helped accelerate demand for robust valve materials that can ensure stable flow control and operational safety.

As industries continue to strengthen infrastructure and modernize pipeline networks, steel gate valves remain the preferred option for projects requiring long service life, low failure risk, and dependable performance. These advantages support their continued use in both new installations and system upgrades where reliability and safety are critical.

By Size Analysis

In 2024, the 3 to 12 inches category led the By Size segment of the gate valve market, capturing a 47.1% share. This size range remains widely used across water supply systems, industrial pipelines, and construction networks because it provides an effective balance between flow capacity and installation convenience. Its adaptability makes it suitable for medium-scale distribution lines as well as on-site industrial operations.

Demand strengthened as industries and municipalities focused on pipeline upgrades to improve efficiency, reduce leakage, and enhance system safety. Valves in this size range also closely match the needs of utility and municipal projects, where standardisation, simple maintenance, and long-term reliability are critical.

Compatibility with existing infrastructure further supported preference for these sizes. As a result, 3 to 12 inch gate valves continued to see consistent adoption throughout 2024, reinforcing their dominant position in modern pipeline and distribution applications.

By End Use Analysis

In 2024, the oil and gas sector dominated the By End Use segment of the gate valve market, holding a 34.4% share. Gate valves remained critical in this industry for controlling high-pressure crude oil and gas flows, as well as for safe operation within refineries and processing facilities. Their ability to provide reliable shut-off made them essential across transportation, storage, and production systems.

Ongoing pipeline upgrading and routine maintenance activities further supported stable demand, especially in upstream and midstream operations where effective flow isolation is a safety requirement.

Oil and gas infrastructure is typically designed for long service life and operated under strict regulatory and safety frameworks, which favours the continued use of robust valve solutions. As a result, gate valves maintained a strong presence in the oil and gas sector throughout 2024, reflecting the industry’s focus on reliability, durability, and operational safety.

Regional Analysis

In 2024, North America dominated the gate valve market with a 43.90% share, valued at USD 5.7 billion. Strong investment in pipeline maintenance, refinery upgrades, water distribution systems, and industrial infrastructure continued across the United States and Canada. Demand remained particularly high in oil and natural gas networks, where gate valves are vital for high-pressure flow control and safe shut-off operations.

Europe recorded stable demand, supported by ongoing industrial activity, energy network management, and chemical plant modernisation. While growth was moderate, consistent replacement of ageing pipelines sustained valve purchases.

Asia Pacific showed a developing trajectory, driven by industrial construction, petrochemical capacity growth, refining projects, and expanding water infrastructure. Although no specific values are stated, active manufacturing and energy development supported steady demand.

The Middle East & Africa maintained registration due to refinery operations and long-distance oil and gas pipelines. Latin America experienced selective demand linked to new and upgraded industrial facilities.

Top Use Cases

- Water supply & distribution systems: Gate valves are widely used in municipal water supply networks and wastewater treatment plants. They allow sections of water pipelines to be fully shut off when maintenance or repairs are needed, without disrupting the rest of the network. Because they open fully with minimal obstruction, they let water flow freely when needed and minimize pressure drop.

- Oil & natural gas pipelines and refineries: In the oil and gas industry — including extraction, transport, storage, and refining — gate valves are essential for controlling high-pressure oil or gas flow. Their strong sealing prevents leaks, which is critical for safety and environmental protection. They are also used to isolate pipeline sections during repair, shutdown, or emergencies.

- Chemical and petrochemical processing: Chemical plants often handle corrosive or high-pressure fluids. Gate valves (especially those made from stainless steel or alloys) are used to start or stop flow in pipelines carrying reactive chemicals or solvents. Their reliable sealing and durability make them well-suited for hazardous or corrosive media.

- Power generation (steam, cooling, boiler feed water systems): In power plants — whether thermal, nuclear, or other — gate valves manage flows of steam, feedwater, or cooling fluids. Their ability to cope with high temperature and pressure makes them ideal for boiler, steam-line, and cooling circuits, ensuring safe operations and preventing leakages.

- Industrial manufacturing and utility pipelines (e.g. metal plants, chemical factories): Factories and industrial plants use gate valves in various processes — transporting water, cooling fluids, chemicals, or other industrial media. Their simple design, robust construction, and reliable shut-off make them a trusted choice in plants where durability and safety matter.

- Long-distance pipelines and large-diameter flow systems: For pipelines that carry fluids over long distances — like water mains, oil/gas trunk lines, or large industrial supply lines — gate valves are preferred because they allow a “full bore” flow: when open, the flow path is roughly the same as the pipe diameter. This means minimal pressure drop and efficient fluid transport. Their design also helps reduce energy loss in long pipelines.

Recent Developments

- In October 2024, Flowserve completed the acquisition of MOGAS Industries, a firm specialised in “severe-service” valves used in demanding conditions. This deal broadened Flowserve’s valve portfolio — especially valves designed for tough environments like mining, mineral processing, and heavy-duty industrial operations.

- In April 2024, AVK released new variants of gate valves featuring an ISO top flange and PE ends for water supply systems. These newer valve designs enhance compatibility with polyethylene-pipe networks and offer easier connection and installation — especially useful for modern municipal or water-distribution infrastructure.

Conclusion

The gate valve market continues to show steady relevance as industries focus on reliable flow control and long-term infrastructure performance. These valves remain widely used because of their simple design, strong shut-off capability, and ability to handle demanding operating conditions.

Ongoing upgrades in water networks, energy systems, and industrial pipelines are reinforcing the need for durable valve solutions that support safety and operational stability. Manufacturers are also improving materials, coatings, and design features to extend service life and reduce maintenance requirements.

As infrastructure projects expand and older systems are modernized, gate valves are expected to remain a preferred choice for applications where dependable isolation and system integrity are essential.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)