Table of Contents

Overview

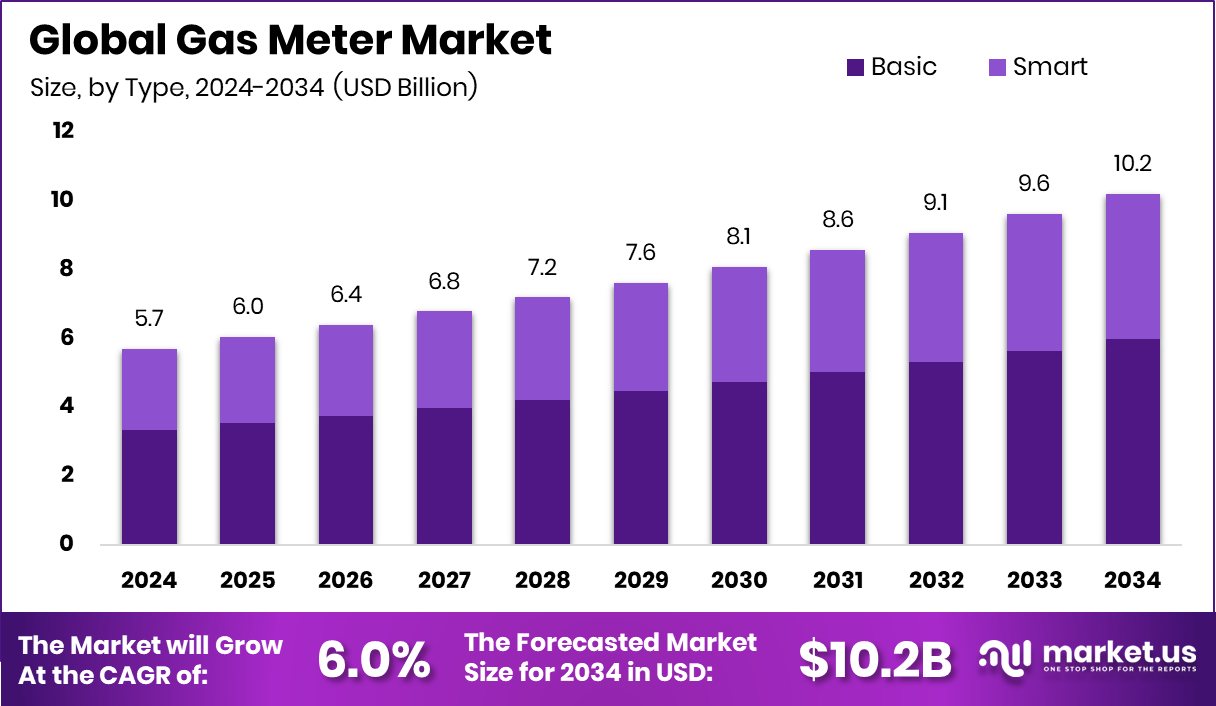

New York, NY – December 16, 2025 – The global gas meter market is on a steady growth path, expected to reach USD 10.2 billion by 2034, rising from USD 5.7 billion in 2024, with a projected 6.0% CAGR between 2025 and 2034. North America leads with a 38% share, valued at USD 2.1 billion, supported by advanced utility infrastructure and early adoption of smart metering systems.

Gas meters are essential devices that measure gas consumption in residential, commercial, and industrial settings. They enable accurate billing, help utilities monitor gas flow, and improve safety by identifying abnormal usage patterns. With digitalization, modern gas meters now support remote readings and real-time energy monitoring, making gas networks more efficient and transparent.

Market growth is closely tied to infrastructure investment and public safety initiatives. Allied Engineering’s ₹400 Cr IPO filing highlights strong industry confidence, aimed at expanding smart meter manufacturing capacity. In the U.S., a $24K grant enabled a New Mexico fire department to purchase new gas meters, underlining their role in safety and emergency response.

Rising energy affordability programs also support demand. The Dollar Energy Fund’s $500 heating aid grants and PECO’s $500 customer assistance grants emphasize the importance of accurate metering in managing household energy costs. Additionally, the UK Boiler Upgrade Scheme’s £295 million budget increase signals future opportunities for advanced gas and hybrid metering aligned with energy transition goals.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-gas-meter-market/request-sample/

Key Takeaways

- The Global Gas Meter Market is expected to be worth around USD 10.2 billion by 2034, up from USD 5.7 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034.

- In the Gas Meter Market, basic gas meters hold a 58.6% share due to affordability and widespread utility replacement programs.

- The residential segment dominates the Gas Meter Market with a 61.8% share, supported by gas network expansion and household connections.

- North America’s Gas Meter Market holds 38% share, reaching USD 2.1 Bn value.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=168565

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 5.7 Billion |

| Forecast Revenue (2034) | USD 10.2 Billion |

| CAGR (2025-2034) | 6.0% |

| Segments Covered | By Type (Basic, Smart), By Application (Residential, Commercial, Industrial) |

| Competitive Landscape | Honeywell International Inc., Itron Inc., Apator SA, Diehl Stiftung & Co. KG, Sensus Worldwide Holdings Limited, Aclara Technologies LLC, EDMI Limited, ABB, CGI, General Electric |

Key Market Segments

By Type Analysis

In 2024, the Basic segment dominated the By Type category of the Gas Meter Market, accounting for a 58.6% market share. This strong position reflects the ongoing dependence on basic gas meters in residential and small commercial settings, where affordability, simple operation, and reliable performance are key decision factors.

Basic gas meters remain widely used due to their mechanical accuracy, long service life, and low maintenance needs. Utilities favor these meters because they are easy to install, perform consistently in different weather conditions, and support stable billing without complex system integration.

The 58.6% share also indicates continuous replacement demand within existing gas networks. Many utilities upgrade infrastructure gradually, choosing proven basic meters rather than immediate full-scale smart transitions. As a result, the Basic segment continues to play a vital role in large-volume deployments, ensuring dependable gas usage measurement and consistent billing across well-established gas distribution systems.

By Application Analysis

In 2024, the Residential segment led the By Application category of the Gas Meter Market, capturing a 61.8% share. This dominance is mainly supported by the vast number of household gas connections used for everyday needs such as cooking, space heating, and water heating.

Residential gas meters are deployed in large quantities due to ongoing urban housing growth and the steady expansion of city and suburban piped gas networks. The 61.8% share also reflects regular replacement of older meters in existing homes to ensure accurate billing and meet safety standards.

Household gas usage follows stable and predictable patterns, which helps maintain consistent demand for residential metering. As gas continues to be a core energy source for domestic activities, residential applications remain the primary driver of overall gas meter installation volumes.

Regional Analysis

North America leads the Gas Meter Market with a 38% share, valued at USD 2.1 Bn, supported by a well-developed gas distribution network, high residential gas usage, and regular infrastructure upgrades. Strong regulations focused on safety and billing accuracy continue to sustain steady meter demand across the region.

Europe remains a mature and stable market, backed by long-established natural gas systems and a strong focus on energy efficiency in residential and commercial buildings. Ongoing meter replacements help utilities maintain compliance and operational reliability.

Asia Pacific shows rising growth due to expanding urban gas networks and rapid housing development. Increasing access to piped gas connections is driving higher residential meter installations.

The Middle East & Africa market benefits from ongoing gas infrastructure projects, particularly in urban residential developments aimed at improving supply management.

Latin America records gradual growth, supported by expanding city gas networks and increasing household gas adoption in developing urban areas.

Top Use Cases

- Accurate Billing for Homes and Businesses: Gas meters accurately record the amount of gas a household or business uses, allowing utility companies to bill only for actual consumption. This ensures fairness and prevents overcharging.

- Detecting Gas Leaks and Safety Alerts: Smart gas meters equipped with sensors can detect abnormal gas flow or pressure drops that may indicate leaks, and immediately alert homeowners or utility operators to prevent potential dangers.

- Improved Energy Management: With smart meters, both consumers and utilities can monitor gas usage patterns over time, helping people manage how much gas they use and make energy-saving decisions.

- Residential Consumption Tracking: In homes, gas meters measure gas used for cooking, heating, and hot water, helping families know exactly how much energy they use and plan budgets.

- Commercial and Industrial Usage Measurement: Gas meters are also installed in offices, factories, and plants to measure large-scale gas use for processes like manufacturing heat or power, ensuring correct billing and operational planning.

Recent Developments

- In March 2025, Honeywell introduced a new smart residential gas meter designed for North America. This meter includes advanced pressure sensing and an integrated controller to improve safety and allow remote automation for utilities and customers.

- In May 2025, Itron introduced a solar-powered access point to help utility networks connect devices like gas meters without needing costly poles or towers. This makes modern metering easier and cheaper for gas and water utilities.

- In August 2024, Apator SA announced its plan to merge its gas and instrumentation subsidiary FAP Pafal SA into the main company. This move is meant to simplify operations, strengthen manufacturing capability, and improve cost efficiency.

Conclusion

The gas meter market is moving steadily forward as utilities and governments focus on safer, more efficient energy distribution. Ongoing urban development, expansion of gas networks, and the need for accurate billing continue to support consistent demand across residential, commercial, and industrial users.

Traditional meters remain important in established networks, while smart and digital meters are gradually gaining attention for their monitoring and safety benefits. Public infrastructure investments and energy support programs further strengthen adoption. Overall, the market shows balanced growth, driven by reliability needs today and gradual modernization efforts shaping future gas metering systems worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)