Table of Contents

Overview

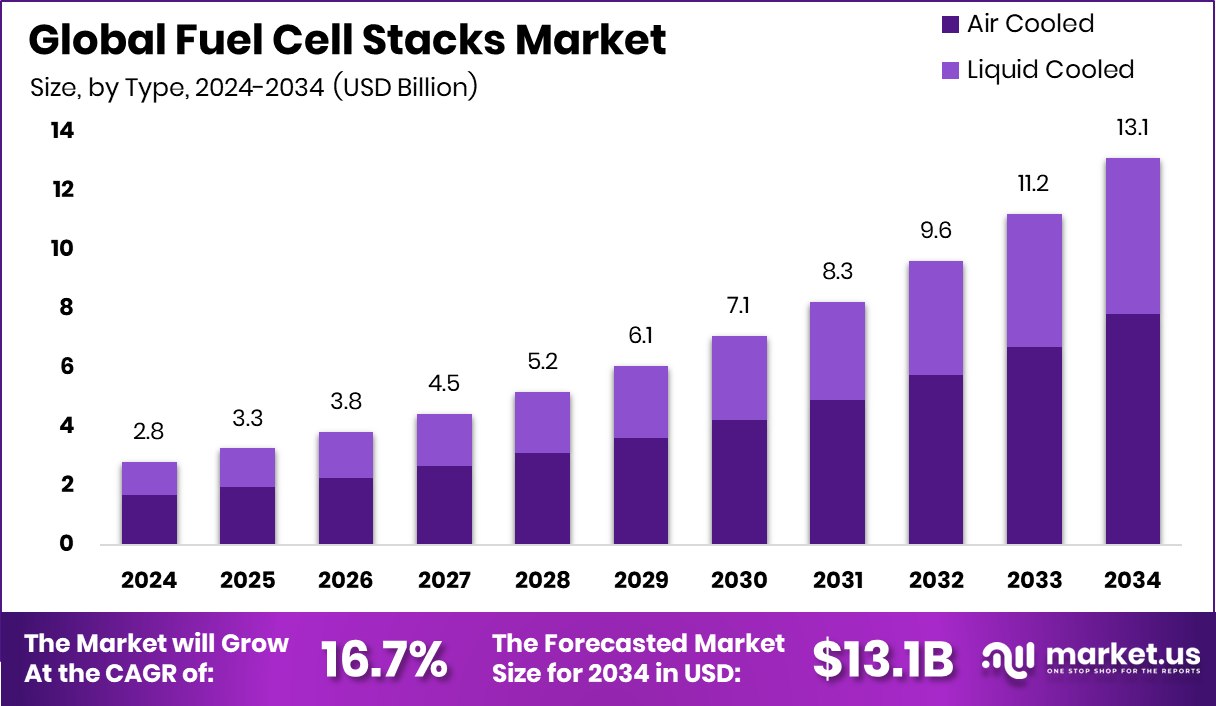

New York, NY – January 13, 2026 – The global fuel cell stacks market is on a strong growth path, rising from USD 2.8 billion in 2024 to an expected USD 13.1 billion by 2034, supported by a projected 16.7% CAGR from 2025 to 2034. Asia-Pacific plays a leading role, holding a 39.40% share, equivalent to about USD 1.2 billion, driven by active manufacturing expansion and clean-energy adoption.

Fuel cell stacks form the operational core of fuel cell systems. By stacking individual cells, they generate electricity through hydrogen-based electrochemical reactions, producing only water and heat as by-products. This makes them attractive for mobility, stationary power, and backup energy applications where efficiency and low emissions matter.

Market momentum is closely tied to sustained investment in performance improvement and scale-up. EKPO’s EUR 177 million funding supports high-performance stack refinement, while the 2Sky project secured €26.5 million to develop aviation-focused stacks. In the U.S., the Department of Energy committed $142 million to research programs, including $17.1 million dedicated to hydrogen and fuel cell projects, alongside a $40 million grant for an integrated fuel cell production facility in Texas and broader $750 million hydrogen spending.

Commercial readiness is advancing, highlighted by a completed 100 kW PEM fuel cell stack in Narvik. Looking ahead, aviation, heavy transport, and decentralized power systems present major opportunities, reinforced by capital injections such as ZeroAvia’s $30 million, Cemt’s $31.39 million, Shanghai Refire’s HK$78 million, TECO 2030’s NOK 50 million, and Bramble Energy’s £35 million.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-fuel-cell-stacks-market/request-sample/

Key Takeaways

- The Global Fuel Cell Stacks Market is expected to be worth around USD 13.1 billion by 2034, up from USD 2.8 billion in 2024, and is projected to grow at a CAGR of 16.7% from 2025 to 2034.

- In the Fuel Cell Stacks Market, air-cooled systems lead with 59.7% share due to compact design.

- 5 kW–100 kW capacity dominates the Fuel Cell Stacks Market with 47.2% share, supporting distributed power needs.

- Polymer Electrolyte Membrane fuel cell stacks hold a 49.1% share in the Fuel Cell Stacks Market, driven by efficiency.

- Backup power applications account for a 33.4% share of the Fuel Cell Stacks Market, ensuring reliable power continuity.

- Strong adoption across Asia-Pacific supports Fuel Cell Stacks Market growth at 39.40%, reaching USD 1.2 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=170586

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.8 Billion |

| Forecast Revenue (2034) | USD 13.1 Billion |

| CAGR (2025-2034) | 16.7% |

| Segments Covered | By Type (Air Cooled, Liquid Cooled), By Capacity (5 kW, 5 kW-100 kW, 100 kW-200 kW, >200 kW), By Technology (Polymer Electrolyte Membrane (PEM) Fuel Cell Stacks, Solid Oxide Fuel Cell (SOFC) Stacks, Alkaline Fuel Cell (AFC) Stacks, Direct Methanol Fuel Cell (DMFC) Stacks), By Application (Portable Power, Backup Power, Motive Power, Material Handling Equipment, Others) |

| Competitive Landscape | Advent Technologies Holding, Ballard Power Systems, Commonwealth Automation Technologies, Dana Incorporated, ElringKlinger, FuelCell Energy Solutions, Freudenberg Group, Horizon Fuel Cell Technologies, Intelligent Energy Limited, Nedstack Fuel Cell Technology |

Key Market Segments

By Type Analysis

In 2024, air-cooled fuel cell stacks led the By Type segment with a 59.7% share, reflecting their wide acceptance across commercial and industrial deployments. Their dominance is mainly driven by a simpler system architecture that avoids complex liquid cooling circuits, reducing both component count and maintenance needs. This design advantage supports easier integration into compact and modular fuel cell systems, making air-cooled stacks attractive for manufacturers seeking reliable performance with lower operational complexity.

The segment’s strong position also highlights steady demand from applications where moderate thermal control is sufficient and long-term operational stability is critical. Air-cooled stacks perform consistently under variable loads, which is important for distributed and on-site power generation. Overall, their leading share confirms air-cooled systems as a dependable, scalable, and cost-conscious choice within the evolving fuel cell stacks market.

By Capacity Analysis

The 5 kW–100 kW capacity range dominated the market in 2024, accounting for a 47.2% share, underscoring its importance in mid-range power applications. This segment aligns closely with the rising demand for decentralized and distributed energy solutions, where moderate power output, efficiency, and flexibility are essential.

Fuel cell stacks in this range are widely used in stationary systems, portable units, and hybrid energy setups that require dependable output without the complexity of large-scale installations. Their popularity reflects a strong balance between system size, performance, and cost efficiency.

The leading share also indicates that this capacity range supports diverse operational environments, from commercial buildings to remote power needs. As energy users increasingly favor scalable and adaptable power systems, the 5 kW–100 kW segment continues to anchor overall market demand.

By Technology Analysis

In 2024, Polymer Electrolyte Membrane (PEM) fuel cell stacks held a dominant 49.1% share, confirming their central role in fuel cell technology adoption. PEM stacks are valued for their fast start-up capability, consistent power output, and operational stability, making them suitable for applications requiring responsiveness and reliability. Their compact structure further supports integration into space-constrained systems, including mobility and distributed power solutions.

The strong adoption rate reflects industry confidence in PEM technology as a mature and scalable solution for current deployments. It also highlights PEM’s ability to perform efficiently across varying operating conditions. With continued focus on performance optimization and durability, PEM fuel cell stacks remain a cornerstone technology driving progress across the broader fuel cell stacks market.

By Application Analysis

Backup power applications led the market in 2024 with a 33.4% share, emphasizing the growing role of fuel cell stacks in power continuity solutions. Increasing concerns around grid reliability and energy security have driven demand for dependable backup systems across critical infrastructure. Fuel cell stacks used in backup power deliver clean, stable electricity during outages, supporting uninterrupted operations. Their reliability under emergency conditions positions them as a strong alternative to traditional backup technologies.

The segment’s leading share reflects consistent adoption where long-duration performance and low-emission operation are priorities. As organizations place greater importance on resilient energy systems, backup power applications continue to shape demand patterns and reinforce fuel cell stacks as a trusted solution for continuity planning.

Regional Analysis

Asia-Pacific leads the global Fuel Cell Stacks Market with a 39.40% share, valued at USD 1.2 billion, driven by strong deployment across transportation, stationary power, and industrial energy systems. The region benefits from expanding manufacturing capacity and a well-developed ecosystem of component suppliers and system integrators, enabling faster commercialization and large-scale adoption. This integrated supply chain positions Asia-Pacific as the primary growth engine shaping global market direction.

North America represents a mature, technology-focused market, with steady adoption of advanced fuel cell stack designs, particularly in backup power and mobility applications. The region emphasizes system efficiency, durability, and performance reliability rather than rapid volume expansion. Europe follows closely, supported by regulatory frameworks promoting clean and low-emission energy systems, which are accelerating the integration of fuel cell stacks into sustainable power solutions.

The Middle East & Africa remain in an early adoption phase, with gradual uptake linked to energy diversification strategies. Latin America shows emerging interest, mainly driven by energy security needs and selective adoption of alternative power technologies.

Top Use Cases

- Transportation – Cars, Buses & Trucks: Fuel cell stacks power vehicles by converting hydrogen into electricity that drives electric motors. This allows vehicles like hydrogen buses and trucks to run with zero tailpipe emissions, only releasing water. For example, Toyota’s hydrogen fuel cell buses have been used in city transit in Japan, showing how fuel cells work in public transport.

- Warehouse & Material Handling Vehicles: In places like large warehouses and distribution centers, fuel cell stacks power forklifts and pallet trucks. These vehicles benefit from quick refueling and continuous operation, helping improve productivity while cutting emissions inside indoor facilities.

- Backup Power for Buildings: Fuel cell stacks provide clean and reliable backup electricity during power outages for hospitals, data centers, offices, and telecom towers. They run quietly, produce no harmful smoke, and don’t rely on combustion, making them useful where uninterrupted power matters.

- Stationary Power Generation: Fuel cell stacks are used to generate steady electricity for homes, factories, or remote sites. These systems can replace or support traditional generators, producing power with low emissions and high efficiency. They’re also used for microgrids in off-grid areas.

- Renewable Energy & Grid Support: When paired with hydrogen production from renewables (like solar or wind), fuel cell stacks can store excess energy as hydrogen and then convert it back to electricity during high demand. This helps stabilize local power grids and store renewable energy for later use.

- Portable & Off-Grid Power: Small fuel cell stacks can power portable electronics and remote equipment where regular electricity isn’t available. They work as off-grid power for devices or small stations in isolated regions, providing reliable energy without needing a grid connection.

Recent Developments

- In April 2025, Advent officially started the RHyno Project with Greek partner Arxicon. This project is backed by a €34.5 million grant from the EU Innovation Fund. RHyno focuses on building a facility in Greece to manufacture advanced fuel cells, MEAs, and electrolysers at megawatt scale. It strengthens Advent’s role in clean fuel cell tech and expands into electrolyser production.

- In May 2024, Ballard launched its 9th-generation high-performance fuel cell engine, called FCmove®-XD, at the ACT Expo. This engine is built for heavy-duty vehicles like trucks and buses. It is stronger, more efficient, and designed to be more reliable and lower cost for fleet operators.

- In March 2024, Dana’s Neu-Ulm facility highlighted its latest bipolar plate innovations, which are key components inside fuel cell stacks, at industry events. These advanced plates help improve how stacks distribute gases and conduct electricity, and the showcase demonstrates Dana’s continued focus on enhancing fuel cell stack parts to support hydrogen power systems.

Conclusion

The fuel cell stacks market is steadily moving toward wider adoption as industries look for cleaner and more reliable power solutions. Fuel cell stacks have proven their value across transportation, backup power, and stationary energy systems due to their efficiency and low emissions. Ongoing improvements in stack design, durability, and manufacturing processes are helping reduce complexity and support broader deployment.

Strong interest from public programs and private companies continues to encourage innovation and real-world use. As energy security and sustainability gain importance, fuel cell stacks are expected to play a key role in supporting resilient power systems and accelerating the transition away from conventional combustion-based technologies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)