Table of Contents

Overview

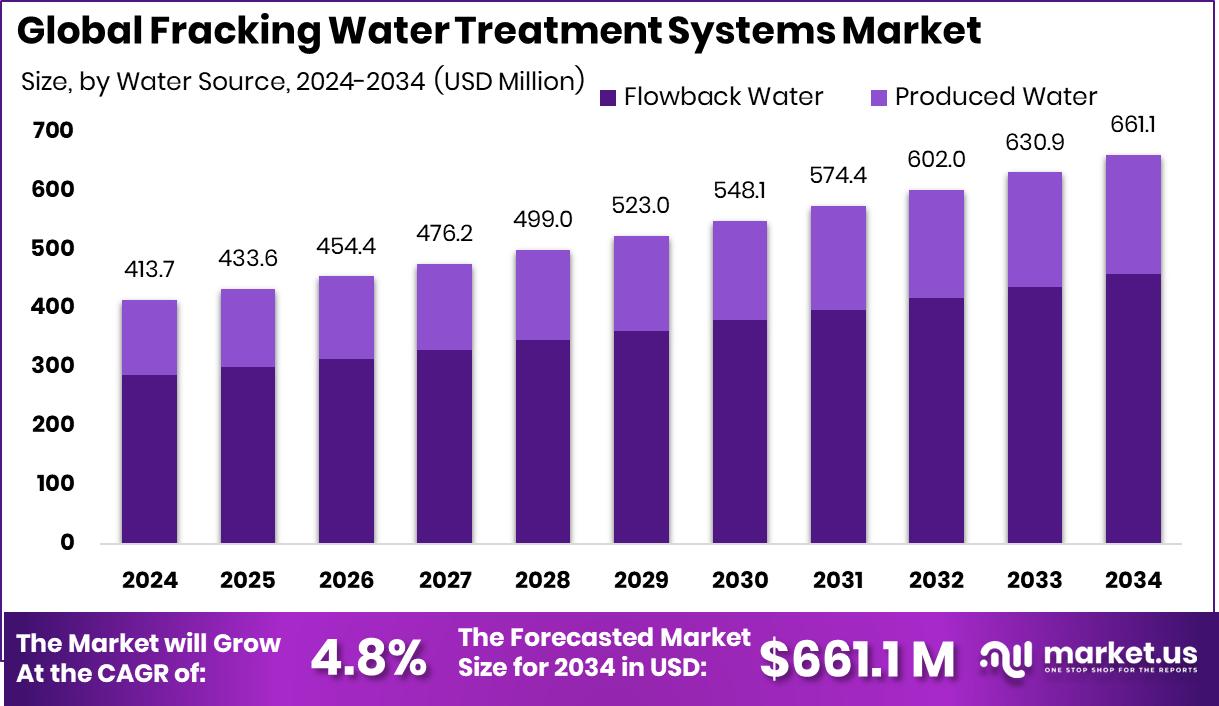

New York, NY – January 19, 2026 – The Global Fracking Water Treatment Systems Market is set to reach USD 661.1 million by 2034, rising from USD 413.7 million in 2024, with a steady 4.8% CAGR. North America leads with 43.60%, valued at USD 180.3 million, driven by its extensive shale operations and strict water-management requirements.

Fracking produces large volumes of wastewater, and treatment systems have become essential for removing salts, solids, and chemical residues so the water can be reused or disposed of safely. What was once optional equipment is now core infrastructure, as operators aim to cut freshwater consumption, reduce hauling costs, and meet regulatory expectations.

Growing emphasis on water reuse is accelerating innovation and investment. Public funding reflects this shift—Valley wastewater systems receiving $35 million show how governments are strengthening treatment capacity across industries. At the same time, poor infrastructure planning, such as Bengaluru’s demolition of 11 RO plants costing ₹15–20 lakh each, highlights the need for more durable and efficient solutions.

Private capital is also flowing into next-generation technologies. NALA Membranes raised $1.5 million to scale advanced membrane systems, while Flocean secured US$9 million for desalination technologies. Additionally, strong confidence in water-treatment scalability is seen through Blue Earth’s $19 million PFA funding and DrinkPrime’s ₹60 crore and $3 million rounds.

These investments create opportunities for advanced filtration and membrane technologies that boost recovery rates and reduce treatment footprints—supporting long-term, sustainable market growth.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-fracking-water-treatment-systems-market/request-sample/

Key Takeaways

- The Global Fracking Water Treatment Systems Market is expected to be worth around USD 661.1 million by 2034, up from USD 413.7 million in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034.

- Flowback water accounts for 69.3% share as shale operations generate large contaminated water volumes globally.

- Media filtration holds a 45.7% share due to low cost, reliability, and compatibility with reuse systems.

- The North America Fracking Water Treatment Systems Market holds 43.60% share, reaching USD 180.3 Mn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=170864

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 413.7 Million |

| Forecast Revenue (2034) | USD 661.1 Million |

| CAGR (2025-2034) | 4.8% |

| Segments Covered | By Water Source (Flowback Water, Produced Water), By Treatment Process (Media Filtration, Electrocoagulation, Reverse Osmosis, Microbial Treatment, Others) |

| Competitive Landscape | Schlumberger Limited, Halliburton Company, Veolia Environnement S.A, Baker Hughes, Weatherford International plc, Nuverra Environmental Solutions, FTS International, Select Energy Services, Xylem Inc, Aquatech International |

Key Market Segments

By Water Source Analysis

Flowback water dominates the global fracking water treatment systems market with a 69.3% share, underscoring its central role in hydraulic fracturing operations. After injection, a significant volume of water resurfaces carrying sand, chemicals, and dissolved solids, making its treatment essential for maintaining drilling efficiency and enabling reuse.

Because managing this stream directly influences operational continuity and water availability, flowback treatment systems have become core infrastructure rather than optional equipment. Their strong market share reflects the industry’s reliance on technologies capable of handling fluctuating water quality while ensuring consistent performance. As fracking activity expands, operators prioritise solutions tailored for flowback management, reinforcing long-term demand and stable deployment across active shale fields.

By Treatment Process Analysis

Media filtration leads the treatment process segment with a 45.7% adoption rate, demonstrating its importance in managing suspended solids in fracking wastewater. Its popularity stems from its simplicity, reliability, and compatibility with diverse treatment configurations. By efficiently removing particulate matter, media filtration helps stabilize downstream processes and ensures consistent water quality, making it a foundational step in most treatment trains.

Its strong share highlights operators’ preference for technologies that deliver predictable results without adding operational complexity. The process’s scalability and low-maintenance design further strengthen its position as the most widely used treatment approach in fracking environments.

Regional Analysis

North America leads the Fracking Water Treatment Systems Market with a 43.60% share valued at USD 180.3 million, driven by extensive shale activity and strict water-management regulations that make treatment systems essential infrastructure. Europe maintains a more controlled market, where adoption is shaped by regulated resource development and strong compliance requirements.

Asia Pacific is steadily expanding as interest in unconventional drilling grows, creating a rising demand for adaptable treatment solutions. In the Middle East & Africa, water treatment is increasingly recognised as a technical necessity within broader energy strategies.

Latin America shows gradual potential, supported by ongoing exploration and improving awareness of responsible water handling. Overall, regional demand depends on drilling intensity, water-reuse priorities, and regulatory standards, with North America remaining the core centre of market activity.

Top Use Cases

- Reusing Flowback Water for New Fracturing: After fracking, a lot of water comes back up mixed with sand and chemicals. Treating this water lets operators reuse it for new wells instead of using fresh water, which saves water and reduces costs.

- Minimizing Disposal Needs: Cleaned fracking water doesn’t have to be disposed of in deep wells or storage ponds as much, reducing environmental risks and hauling costs.

- Supporting Secondary Uses (Other Industries): Treated fracking water sometimes gets reused outside fracking, such as for industrial purposes or pilot agriculture reuse, especially in dry regions where water is scarce.

- Improving Oil Recovery: When flowback water is treated and reused in specific ways, it can help extract more oil or gas from a reservoir compared with using fresh water alone.

- Environmental Protection and Compliance: Treating fracking water before release reduces harmful contaminants and helps companies comply with environmental regulations, thereby protecting groundwater and nearby ecosystems.

Recent Developments

- In September 2024, Halliburton launched the OCTIV® Auto Frac service, a new automated system that helps run fracturing jobs with much less manual action. It uses intelligent automation to make fracture pumping more consistent and efficient, improving control in hydraulic fracturing operations. This technology works as part of Halliburton’s ZEUS platform, helping operators manage high-pressure frac fleets more safely and accurately.

- In April 2024, SLB announced that it would buy ChampionX, a company known for production chemicals and equipment that help optimise oil and gas operations. This deal aims to combine SLB’s technology with ChampionX’s expertise to provide stronger solutions across production systems, which include handling fluids such as water in oilfield settings. The acquisition was agreed in an all-stock transaction, strengthening SLB’s overall production portfolio.

Conclusion

The Fracking Water Treatment Systems Market is reaching a stable and essential stage of development as water management becomes a core part of hydraulic fracturing operations. Growing pressure to reduce freshwater use, control operating costs, and meet environmental requirements is driving steady adoption of treatment systems across shale regions. Operators increasingly rely on reliable filtration and reuse technologies to support continuous drilling activity and improve overall efficiency.

Innovation in treatment processes and growing investment in water infrastructure are strengthening long-term market confidence. As fracking activity continues and water reuse expectations rise, treatment systems will remain critical operational infrastructure rather than optional support equipment.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)