Table of Contents

Overview

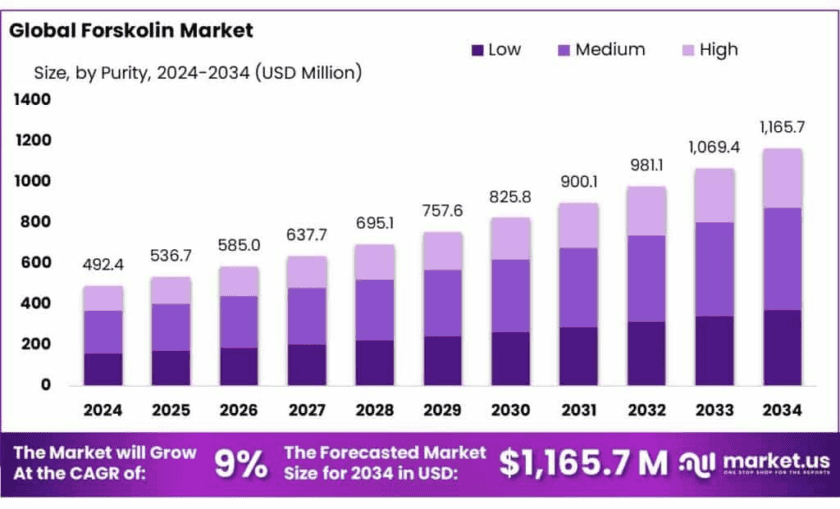

New York, NY – Nov 03, 2025 – The global Forskolin market is projected to reach USD 1,165.7 million by 2034, rising from USD 492.4 million in 2024, at a CAGR of 9.0% between 2025 and 2034. In 2024, Europe led the market with a 37.3% share, generating approximately USD 183.6 million in revenue. Forskolin, a bioactive compound derived from the roots of Coleus forskohlii, is increasingly valued for its therapeutic roles in weight management, cardiovascular health, and respiratory care.

Government initiatives such as the Production Linked Incentive (PLI) scheme, with a budget of ₹1.97 lakh crore (about USD 28 billion) across 13 key sectors, and the ‘Make in India’ program have strengthened domestic manufacturing and encouraged investment in herbal and pharmaceutical industries. The surge in demand for forskolin is also supported by the global shift toward natural and plant-based products, aligning with growing consumer health awareness.

In India, the pharmaceutical sector, valued at nearly USD 50 billion in FY 2023–24, has been instrumental in propelling the forskolin market’s expansion. Additionally, Gujarat remains the leading hub for India’s chemical exports, contributing 46.16% of total exports worth USD 28,699 million in FY 2024–25. The state’s strong industrial base and export infrastructure continue to provide a solid platform for international trade in herbal products such as forskolin.

Key Takeaways

- Forskolin Market size is expected to be worth around USD 1165.7 Million by 2034, from USD 492.4 Million in 2024, growing at a CAGR of 9.0%.

- Medium purity Forskolin held a dominant market position, capturing more than a 43.2% share of the market.

- Root Extract held a dominant market position, capturing more than 64.4% of the Forskolin market.

- Capsules held a dominant market position, capturing more than 43.9% of the Forskolin market.

- Weight Management held a dominant market position, capturing more than 34.5% of the Forskolin market.

- Dietary Supplements held a dominant market position, capturing more than 46.3% of the Forskolin market.

- Europe is poised for steady growth, holding a dominant share of 37.30%, valued at USD 183.6 million in 2024.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-forskolin-market/free-sample/

Report Scope

| Market Value (2024) | USD 492.4 Mn |

| Forecast Revenue (2034) | USD 1165.7 Mn |

| CAGR (2025-2034) | 9.0% |

| Segments Covered | By Purity (Low, Medium, High), By Product Type (Root Extract, Leaf Extract, Seed Extract), By Form (Capsules, Tablets, Powder, Liquid Extract), By Application (Allergy Treatment, Weight Management, Respiratory Problems, Cardiovascular Disorders, Glaucoma, Hypothyroidism, Psoriasis, Others), By End-use (Dietary Supplements, Food And Beverages, Cosmetics, Pharmaceuticals, Others) |

| Competitive Landscape | Alchem International Ltd, Nutra Green Biotechnology, Glentham Life Sciences, Flavour Trove, Alpspure Lifesciences Pvt. Ltd., Bioprex Labs, Natrol, Sabinsa Corporation, Jarrow Formulas |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159052

Key Market Segments

By Purity Analysis – Medium Purity Forskolin Dominates with 43.2% Share in 2024

In 2024, medium purity Forskolin emerged as the leading segment, capturing 43.2% of the total market share. Its dominance is attributed to the ideal balance it offers between cost and effectiveness, making it a preferred option for both manufacturers and consumers. This purity level is widely utilized in dietary supplements and weight management formulations, delivering effective results at a more affordable price compared to higher-purity alternatives. The increasing consumer preference for natural, budget-friendly weight-loss products has further strengthened the position of this segment.

By Product Type Analysis – Root Extract Leads with 64.4% Market Share in 2024

In 2024, the Root Extract segment dominated the Forskolin market, securing a substantial 64.4% share. This form is derived directly from the roots of the Coleus forskohlii plant, providing a highly concentrated and potent source of Forskolin. Its natural composition and proven efficacy have made it a top choice in dietary supplements and weight management products. The rising global inclination toward plant-based and holistic wellness solutions continues to drive its demand.

By Form Analysis – Capsules Account for 43.9% Market Share in 2024

In 2024, capsules led the Forskolin market with a commanding 43.9% share. Their popularity stems from the ease of use, precise dosage control, and convenience they provide to consumers. Capsules are especially favored in weight management and general wellness formulations, allowing users to incorporate Forskolin seamlessly into daily health routines. The format’s growing preference is also driven by the rising demand for consistent and reliable supplement forms that support effective outcomes.

By Application Analysis – Weight Management Leads with 34.5% Share in 2024

The Weight Management application segment dominated the Forskolin market in 2024, accounting for over 34.5% of the global share. Forskolin’s ability to stimulate fat breakdown and enhance metabolic rate has made it one of the most sought-after ingredients in weight loss supplements. With the rising emphasis on natural, plant-based health solutions, consumers are increasingly integrating Forskolin products into their wellness routines. The segment’s growth is further supported by increasing awareness about obesity-related health risks and the preference for non-synthetic weight control supplements.

By End-use Analysis – Dietary Supplements Lead with 46.3% Market Share in 2024

In 2024, the Dietary Supplements segment dominated the Forskolin market, accounting for a notable 46.3% share. The rising interest in natural health enhancement, preventive care, and fitness-based nutrition has fueled the segment’s expansion. Forskolin is widely incorporated into supplements designed for fat reduction, energy improvement, and metabolic support, appealing to a broad base of health-conscious consumers. The ongoing shift toward plant-derived and chemical-free supplements continues to propel this segment forward.

List of Segments

By Purity

- Low

- Medium

- High

By Product Type

- Root Extract

- Leaf Extract

- Seed Extract

By Form

- Capsules

- Tablets

- Powder

- Liquid Extract

By Application

- Allergy Treatment

- Weight Management

- Respiratory Problems

- Cardiovascular Disorders

- Glaucoma

- Hypothyroidism

- Psoriasis

- Others

By End-use

- Dietary Supplements

- Food & Beverages

- Cosmetics

- Pharmaceuticals

- Others

Regional Analysis

In 2024, Europe dominated the global Forskolin market, accounting for a substantial 37.3% share, valued at approximately USD 183.6 million. This regional strength is driven by the growing consumer inclination toward natural and plant-based health supplements, particularly those aimed at weight management, metabolic enhancement, and overall wellness.

Among European nations, Germany, the United Kingdom, and France stand out as the key markets. The UK has witnessed a sharp rise in the consumption of dietary supplements, where Forskolin-based products are gaining traction for their perceived effectiveness in weight control. Germany, supported by its strong pharmaceutical and nutraceutical manufacturing base, continues to drive significant product demand, particularly within the fitness and wellness sectors.

Top Use Cases

Gold-standard research tool to raise intracellular cAMP: Forskolin directly activates adenylyl cyclase, making it a staple reagent to raise cAMP across many cell types. A widely cited pharmacology review notes its broad, direct activation of AC and discusses nuances often overlooked in lab use—helpful for assay design and dose selection. In practice, forskolin is used to probe cAMP/PKA/CREB pathways, modulate ion channels, and benchmark GPCR responses; newer work explores neuroprotection via AC/cAMP/CREB signaling. Researchers typically apply micromolar concentrations in vitro, reporting fast, titratable cAMP increases.

Glaucoma/ocular hypertension: adjunct to lower intraocular pressure (IOP): Clinical studies suggest forskolin can contribute to IOP reduction. In a multi-center, case-controlled study of 97 open-angle glaucoma patients awaiting surgery, adding an oral supplement to maximal topical therapy provided an additional ~10% IOP reduction overall (p<0.01) and ~15% in those with baseline IOP ≥ 21 mmHg; the control group remained stable over the same period. Separate topical studies also reported significant IOP decreases in open-angle glaucoma. While not a replacement for first-line drugs, these data support adjunct use cases under ophthalmic supervision.

Body composition/weight-management research: small RCT signals: Evidence is mixed, but one double-blind RCT in 30 overweight/obese men used 250 mg Coleus forskohlii extract (10% forskolin) twice daily for 12 weeks. The forskolin group had significant decreases in body-fat % and fat mass vs. placebo (DXA), plus a 16.77 ± 33.77% rise in serum total testosterone (placebo: −1.08 ± 18.35%); lean mass showed a positive trend (p=0.097). These findings inform hypothesis-generating use (e.g., body-composition programs), but replication and larger studies are still needed.

Respiratory use: bronchodilation in pharmacology; mixed clinical outcomes: Pharmacology studies show forskolin relaxes airway smooth muscle and can help reverse β2-agonist tachyphylaxis via cAMP elevation. However, a single-blind study in 60 adults with mild/moderate persistent asthma comparing oral forskolin (10 mg/day) to inhaled beclomethasone over 2 months found no significant lung-function improvement in the forskolin group, underscoring that clinical benefits are not established for asthma control. Net takeaway: mechanistic promise, but limited clinical utility so far.

Dermatology & photobiology: pigmentation and UV protection: By elevating cAMP in skin cells, forskolin can increase melanogenesis markers and protect keratinocytes from UVB-induced apoptosis in experimental models—an avenue explored for photoprotection or pigment modulation. Reviews highlight topical forskolin as an effective way to upregulate epidermal eumelanin in preclinical settings; translation to approved therapies will require more clinical trials.

Recent Developments

Alchem International Ltd.: In the context of the forskolin sector, Alchem International offers high-purity extracts of Forskolin (notably “Coleus Forskohlin 10–97%”) for nutraceutical and cosmetic applications, citing its GMP-approved extraction capacity across its Indian sites. Although I did not locate a published year-wise revenue for 2023/24 specific to forskolin, the company asserts a global manufacturing footprint of “3 manufacturing sites across 62 acres… over 10,000 metric ton annual extraction capacity” as of 2024.

Nutra Green Biotechnology: In the forskolin domain, Nutra Green Biotechnology markets botanical extracts including Coleus Forskohlii root extract powder tailored to the health-and-wellness industry. While specific financials for 2023/24 are not publicly detailed, industry reports flag Nutra Green among “key players” in the global forskolin market in 2024.

Glentham Life Sciences: This UK-based fine chemical supplier lists high-purity Forskolin (CAS 66575-29-9, ≥ 98% assay) under its catalogue code “GP2059” for research-use. While no publicly released year-wise revenue or market share specific to 2023/24 is available, the company posted quality certifications and public customer reviews in late 2023 indicating growing demand for its phytochemical portfolio.

Flavour Trove: This Karnataka-based Indian manufacturer and exporter of botanical and herbal extracts offers standardized Coleus Forskohlii root extracts (10–40% forskolin by HPLC) targeting nutraceutical applications. The company, established in 2009, reports strong B2B aftermarket growth in 2023–24, especially in weight-management and dietary-supplement formulations, though detailed fiscal data is not publicly disclosed.

Alpspure Lifesciences Pvt. Ltd.: In the forskolin sector, Alpspure offers standardized Forskolin extracts (10 %, 20 %, 40 % & 98 % HPLC) from Coleus forskohlii and markets dietary-supplement capsules (e.g., 100 mg extract with 10 % forskolin) in India. For 2023–24 the company highlights its export-oriented supply capability but does not publish a breakdown of revenues specific to forskolin; it lists the product as part of its phytochemicals portfolio supplying “100 % natural” active ingredients globally.

Bioprex Labs: In the forskolin domain, Bioprex manufactures standardized Coleus forskohlii root extract products—stating capacity of “Forskohlin 10 % HPLC … Rs 6,200/Kg” and “Coleus Forskolin Extract … Rs 5,000/Kg” in 2023. While it reports an annual turnover range (“₹ 5-25 Cr”) per its 2023 firm profile, no separate 2023–24 sales number dedicated to forskolin is disclosed.

Natrol: Natrol is a US-based dietary supplement brand chiefly known for sleep and mood products; its published catalogue in 2024 lists vitamins, melatonin blends, magnesium chelates, but does not clearly segment any dedicated Forskolin-based offering. As of early 2024 the brand’s website highlights premium sleep-aid launches (e.g., 5 mg melatonin gummies) but no specific 2023 or 2024 revenue or market share figure for forskolin products publicly disclosed.

Sabinsa Corporation: Sabinsa supplies standardized phyto-extracts including a 95 % forskolin root extract for nutraceuticals and cosmeceuticals. In 2023 the Sami-Sabinsa Group was named a “Top 10 Food Ingredient & Additive Manufacturer” by Industry Outlook. Public data still lacks discrete 2023-2024 revenue specifically for its forskolin line.

Jarrow Formulas: Jarrow Formulas is a U.S.-based dietary supplement manufacturer that offers a broad portfolio of health-and-wellness products, although I found no specific 2023 or 2024 financial figures tied exclusively to its use of Forskolin. According to company information, it sells “400+ dietary supplements sold domestically and worldwide” as of 2018. A financial snapshot lists its 2023 estimated revenue between US$100-500 million. While it doesn’t highlight a dedicated forskolin line, its catalogue and positioning suggest potential inclusion of bio-active herbal extracts.

Conclusion

In conclusion, the global market for Forskolin—a bioactive compound derived from the root of Coleus forskohlii—is gaining steady momentum as consumers increasingly favour natural, plant-based ingredients for health, wellness and beauty. Key drivers include rising obesity and metabolic-health concerns, growth of the nutraceutical and cosmeceutical segments, and regulatory shifts favouring herbal extracts.

Challenges remain—namely raw-material sourcing, standardisation of extract purity, regulatory scrutiny and evidentiary robustness of claims. For suppliers and ingredients companies, success will depend on delivering high-quality, transparent, standardised offerings, targeting the weight-management and wellness niches, while also pursuing novel delivery formats and regional expansion.