Table of Contents

Overview

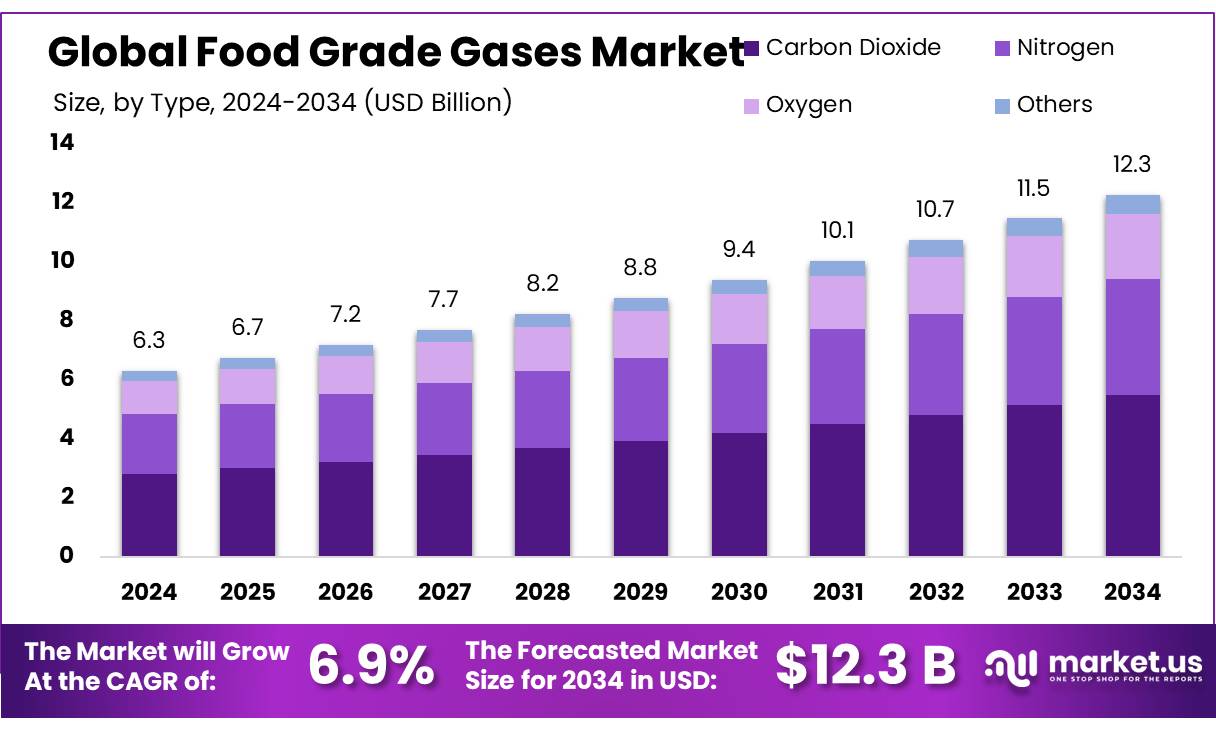

New York, NY – September 16, 2025 – The Global Food Grade Gases Market is projected to grow significantly, reaching an estimated value of USD 12.3 billion by 2034, up from USD 6.3 billion in 2024, with a compound annual growth rate (CAGR) of 6.9% during the forecast period from 2025 to 2034. In 2024, North America led the market, holding a dominant share of over 37.8%, equivalent to USD 2.3 billion in revenue.

This growth is driven by the critical role of high-purity gases such as nitrogen, carbon dioxide, and oxygen in modern food processing, where they are essential for preservation, modified atmosphere packaging (MAP), freezing, chilling, carbonation, and extending shelf life. These gases ensure microbiological safety and maintain sensory quality across a wide range of products, including dairy, beverages, meat, fruits, and convenience foods.

Technological advancements are a key driver of market growth. The adoption of cryogenic freezing technologies and on-site gas generation systems has improved efficiency and lowered operational costs. For instance, companies like INOX Air Products have expanded their capabilities, planning to increase liquid gas production capacity to 4,800 tonnes per day by 2024. These innovations enable more sustainable and cost-effective solutions for food processing, meeting the rising demand for high-quality, safe, and longer-lasting food products.

Government initiatives and regulatory frameworks further support the food-grade gases sector. In India, the Make in India program has promoted domestic manufacturing, enhancing the availability and affordability of industrial gases. Additionally, the establishment of 1,222 Pressure Swing Adsorption (PSA) plants, funded by the central government, has boosted oxygen production to 1,750 metric tons daily, supporting various industrial applications, including food processing. Regulatory bodies like the Bureau of Indian Standards (BIS) enforce stringent quality standards, such as BIS standard IS 307 for carbon dioxide purity.

Key Takeaways

- Food Grade Gases Market size is expected to be worth around USD 12.3 Billion by 2034, from USD 6.3 Billion in 2024, growing at a CAGR of 6.9%.

- Carbon Dioxide held a dominant market position, capturing more than a 44.8% share of the food‑grade gases segment.

- Bulk supply held a dominant market position, capturing more than a 68.9% share in the food‑grade gases segment.

- Freezing & Chilling held a dominant market position, capturing more than a 44.7% share in the food‑grade gases market.

- Meat, Poultry & Seafood Industry held a dominant market position, capturing more than a 36.2% share of the food‑grade gases market.

- North America spotlighted its stronghold in the food‑grade gases market, holding a commanding 37.8% share, equivalent to approximately USD 2.3 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-food-grade-gases-market/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 6.3 Billion |

| Forecast Revenue (2034) | USD 12.3 Billion |

| CAGR (2025-2034) | 6.9% |

| Segments Covered | By Type (Carbon Dioxide, Nitrogen, Oxygen, Others), By Mode of Supply (Bulk, Cylinder), By Application (Freezing and Chilling, Packaging, Carbonation, Others), By End-use (Meat, Poultry and Seafood Industry, Dairy and Frozen Products Industry, Beverages Industry, Fruits and Vegetables Industry, Convenience Food Products Industry, Bakery and Confectionery Products Industry, Others) |

| Competitive Landscape | Linde PLC., Air Products & Chemicals, Inc., Air Liquide, The Messer Group GmbH, Taiyo Nippon Sanso Corporation, Wesfarmers Limited, Massy Group, Inc., Air Water Inc., Sol Group, Gulf Cryo |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155470

Key Market Segments

By Type Analysis

In 2024, Carbon Dioxide led the food-grade gases market with a 44.8% share, driven by its versatility in beverage carbonation and chilling/freezing in modified-atmosphere packaging (MAP). Used in gaseous or dry-ice form, CO₂ is essential for extending shelf life while preserving food taste and texture, making it a cornerstone of the industry.

CO₂’s dominance persists, supported by growing demand for packaged and convenience foods. Consumers’ preference for longer-lasting fresh products continues to drive the use of MAP and cryogenic methods, both heavily reliant on CO₂. While exact 2025 market-share data isn’t available, CO₂’s strong 2024 performance suggests it maintains or slightly increases its lead.

By Mode of Supply Analysis

In 2024, bulk supply accounted for 68.9% of the food-grade gases market, reflecting its critical role in meeting the needs of large-scale food processors. Bulk delivery systems, such as large storage tanks or piped gas, ensure a steady supply of gases like CO₂, nitrogen, and argon, reducing costs and minimizing disruptions for high-volume operations like packaging and chilling. This method is a favorite for industries with continuous production schedules.

In 2025, bulk supply remains the preferred choice, with trends indicating sustained or growing reliance due to economies of scale and rising demand for packaged and refrigerated foods. While precise 2025 data is unavailable, the ongoing need for cost-effective, reliable gas supply supports bulk delivery’s dominance.

By Application Analysis

In 2024, Freezing & Chilling held a 44.7% share of the food-grade gases market, underscoring its vital role in preserving perishable goods like meats, seafood, fruits, vegetables, and baked products. Using liquid nitrogen for cryogenic freezing or CO₂ for chilling, these methods slow microbial growth and maintain food quality, texture, and flavor, meeting consumer demand for fresh products.

Into 2025, Freezing & Chilling likely maintains or exceeds its 44.7% share, driven by the growing popularity of frozen and chilled convenience foods. Although specific 2025 data isn’t available, the rising demand for extended shelf life and quality preservation suggests continued reliance on these techniques across industries like ready-to-eat meals, dairy, and bakery.

By End-use Analysis

In 2024, the Meat, Poultry & Seafood industry led the food-grade gases market with a 36.2% share, driven by the need to preserve highly perishable proteins. Nitrogen, carbon dioxide, and oxygen play essential roles in cryogenic freezing and modified-atmosphere packaging (MAP), slowing spoilage and ensuring safety and quality from processing to consumption. This trend likely continues, as the industry’s reliance on gases to meet stringent safety and quality standards remains strong. The ongoing demand for fresh, high-quality proteins suggests the Meat, Poultry & Seafood sector maintains its significant market share.

Regional Analysis

In 2024, North America dominated the food-grade gases market, capturing a substantial 37.8% share, valued at roughly USD 2.3 billion. This significant portion underscores the region’s robust industrial framework and strong demand for food preservation technologies.

The U.S. leads the charge, with its beef, poultry, and seafood industries heavily relying on cryogenic CO₂ and nitrogen systems to maintain quality and minimize spoilage. While specific market data for 2025 is not included here, the ongoing growth in the food processing and retail sectors suggests continued market expansion.

Top Use Cases

- Beverage Carbonation: This is the largest application, where carbon dioxide (CO₂) adds fizz to sodas, beer, and sparkling water. The global demand is massive and directly tied to beverage consumption trends. Any shortage in high-purity CO₂ supply can disrupt entire production lines, making supply security a top priority for manufacturers in this multi-billion-dollar segment.

- Modified Atmosphere Packaging (MAP): Here, nitrogen (N₂) and CO₂ replace air inside food packages. This drastically slows spoilage, extending the shelf life of products like chips, ready-to-eat meals, and fresh meat. This technology is a critical tool in reducing global food waste, allowing for longer distribution cycles and less frequent store deliveries.

- Quick Freezing & Chilling (Cryogenics): Liquid nitrogen (LIN) is used for instant freezing, creating smaller ice crystals that better preserve food’s texture, moisture, and taste. This is essential for high-quality frozen seafood, poultry, and premium ice cream. It enables faster production speeds and higher quality output compared to traditional mechanical freezing methods.

- Controlled Atmosphere Storage: Large-scale warehouses use nitrogen to control the oxygen levels around stored bulk fruits and vegetables like apples and pears. This process puts the produce into a dormant state, slowing ripening by months. It allows for seasonal produce to be available year-round, stabilizing market prices and reducing spoilage losses.

- Food Processing & Additive: Beyond packaging, gases are direct processing aids. Nitrogen is whipped into dairy products for a creamy texture without added fat. Specialized gases are used as propellants in aerosol whipped cream. Furthermore, high-purity gases like nitrogen are essential for blanketing tanks to prevent oxidation during brewing and oil processing.

Recent Developments

1. Linde PLC

Linde is expanding its high-purity food-grade carbon dioxide (CO₂) production and supply capabilities across North America. Enhancing supply security for the beverage industry. They focus on reliable, high-quality supply chains and advanced purification technologies to meet stringent food safety standards.

2. Air Products & Chemicals, Inc.

Air Products is innovating with its proprietary STARZON high-barrier modified atmosphere packaging (MAP) films. These films use the company’s food-grade gases to significantly extend the shelf life of fresh food products, reducing food waste. They are also investing in new CO₂ sourcing and distribution infrastructure to bolster supply reliability for customers in the beverage and food processing sectors.

3. Air Liquide

Air Liquide recently launched Food Guard, a new brand and digital platform ensuring full traceability and quality control for its food-grade gases. This initiative provides customers with digital access to certificates of analysis for each gas delivery, enhancing transparency and food safety. They continue to develop advanced gas mixtures for modified atmosphere packaging to improve freshness.

4. The Messer Group GmbH

Messer is focusing on sustainability by offering certified green carbon dioxide derived from bio-based sources, appealing to environmentally conscious food and beverage producers. Their recent developments include creating tailored gas mixtures for plant-based protein products and cultivated meat, addressing specific preservation needs in these rapidly growing market segments.

5. Taiyo Nippon Sanso Corporation (TNSC)

TNSC, part of Mitsubishi Chemical Group, is expanding its food-grade gas business across Asia. A key development is enhancing its production and logistics network for liquid nitrogen and CO₂ to serve the region’s growing frozen food and beverage sectors. They are also researching novel gas applications for seafood preservation and agricultural product storage.

Conclusion

The Food Grade Gases Market is experiencing steady growth, propelled by the global demand for extended shelf life, premium fresh-food quality, and reduced waste. Key drivers include the expansion of the packaged food industry and technological advancements in packaging and processing. While supply chain reliability for gases like CO₂ remains a concern, the critical role these gases play in modern food production ensures their long-term and expanding market relevance.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)