Table of Contents

Overview

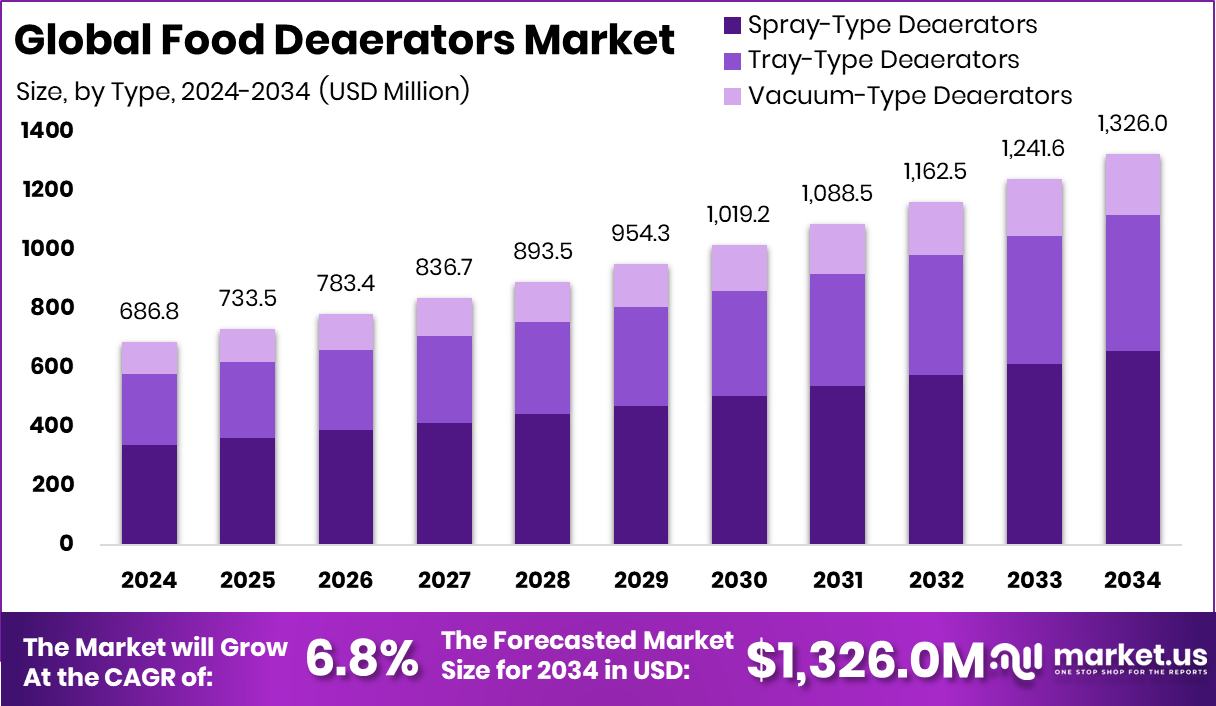

New York, NY – February 02, 2026 – The Global Food Deaerators Market is projected to grow from USD 686.8 million in 2024 to USD 1,326.0 million by 2034, advancing at a steady 6.8% CAGR. North America remains the leading regional contributor, generating USD 296.6 million, or 43.2%, driven by strong processing volumes and higher quality-control standards. Food deaerators play a crucial role in removing dissolved oxygen and unwanted gases from beverages, dairy liquids, sauces, and confectionery mixtures—helping manufacturers protect freshness, flavor stability, and shelf life.

Market momentum is reinforced by rising investments across bakery and confectionery operations. Key examples include Gaja Capital’s Rs 60 crore funding in Bakers Circle, the £20,000 boost for Bakery Mazowsze, and the PBGC’s USD 3.4 billion support for the bakery union pension plan. These signals of sector resilience encourage upgrading to advanced deaeration systems for liquid mixes and fillings.

Innovation-driven food categories also stimulate adoption. Funding rounds such as French Fermentation Firm’s USD 6M, Win-Win’s USD 4M, Awake Chocolate’s USD 5.8M, Wilde’s USD 20M, and Voyage Foods’ USD 52M Series A+ highlight the growing demand for high-quality processing technologies. Additionally, regional manufacturers expanding capacity—such as a Bristol-based firm securing £300,000—further support market growth as producers prioritize consistency, efficiency, and product stability.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-food-deaerators-market/request-sample/

Key Takeaways

- The Global Food Deaerators Market is expected to be worth around USD 1,326.0 million by 2034, up from USD 686.8 million in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034.

- Spray-type deaerators hold a strong 49.5% share, highlighting their dominance in the Food Deaerators Market.

- Oxygen removal represents 68.2% share, showing its critical role in extending food and beverage freshness.

- Beverages account for 45.4% share, confirming they remain the largest application in the Food Deaerators Market.

- In 2024, North America achieved 43.2% market dominance, totaling USD 296.6 Mn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=171872

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 686.8 Million |

| Forecast Revenue (2034) | USD 1,326.0 Million |

| CAGR (2025-2034) | 6.8% |

| Segments Covered | By Type (Spray-Type Deaerators, Tray-Type Deaerators, Vacuum-Type Deaerators), By Function (Oxygen Removal, Carbon Dioxide Removal, Others), By Application (Beverages, Dairy Products, Soups and Sauces, Bakery and Confectionery, Others) |

| Competitive Landscape | GEA Group, SPX FLOW, Krones AG, Alfa Laval, Bucher Unipektin AG, Tetra Pak, Meyer Industries, Inc, Sidel, JBT Corporation, Pall Corporation |

Key Market Segments

By Type Analysis

The Food Deaerators Market continues to expand, with Spray-Type Deaerators securing a strong 49.5% global share in 2024. Their dominance comes from their reliability in handling high liquid flow rates while ensuring consistent oxygen removal across diverse food and beverage applications. The spray mechanism enhances heat transfer efficiency and promotes uniform degassing, which helps processors maintain freshness, flavor stability, and shelf life. These systems are also preferred because they integrate easily into modern, automated production lines, supporting continuous operation without compromising product quality.

As manufacturers increasingly focus on operational efficiency, reduced maintenance, and better product consistency, spray-type deaerators have become a natural fit. Their ability to support rapid throughput and stable performance strengthens their position as the leading type in the market. With processing standards rising globally, spray-type deaerators are expected to retain their competitive edge and drive long-term adoption across food, beverage, and dairy industries.

By Function Analysis

In the Food Deaerators Market, Oxygen Removal dominated the function category with a 68.2% share in 2024, reaffirming its critical role in protecting product integrity. Removing dissolved oxygen remains essential for preventing oxidation, which can negatively affect flavor, color, aroma, and shelf stability in liquid foods.

As processors aim to maintain natural freshness and reduce reliance on additives, degassing solutions focused on oxygen removal have become more valuable. The strong performance of this segment also reflects growing industry awareness of how oxygen exposure accelerates product degradation and impacts clean-label requirements. Oxygen removal technologies support manufacturers in meeting stricter quality regulations and customer expectations for stable, high-quality packaged foods.

With increasing production of juices, dairy-based drinks, sauces, and ready-to-drink formulations, oxygen removal continues to be the most important functional requirement driving deaerator adoption. Its dominance is expected to persist as producers emphasize consistent taste, longer shelf life, and reduced spoilage.

By Application Analysis

The Beverages segment maintained its leadership in the Food Deaerators Market, capturing a 45.4% share in 2024. This strong position reflects the beverage industry’s significant need for consistent dissolved gas control to ensure stable, high-quality final products.

Deaeration is crucial in juices, carbonated drinks, functional beverages, energy drinks, and brewed formulations, where oxygen presence can lead to flavor loss, discoloration, and reduced shelf life. By minimizing foaming and oxidation, deaerators support smoother filling operations and enhance product clarity and taste consistency. Rising production volumes and the rapid expansion of ready-to-drink categories further reinforce this segment’s dominance.

Large-scale beverage manufacturers rely on deaerators to maintain uniform quality across high-throughput operations, meeting both regulatory standards and consumer expectations. As beverage innovation expands into low-sugar, functional, and specialty categories, the demand for advanced deaeration systems will continue to support the segment’s leading position in the global market.

Regional Analysis

In 2024, North America led the Food Deaerators Market with a 43.2% share, reaching USD 296.6 million, supported by advanced processing facilities and strong reliance on deaeration for maintaining flavor, shelf stability, and overall product uniformity. The U.S. and Canada continue to prioritize oxidation control and high-quality standards, reinforcing the region’s dominant role.

Europe followed with consistent demand driven by its mature beverage, dairy, and processed food industries, where deaerators remain essential for meeting strict quality regulations. Asia Pacific experienced rapid expansion as rising consumption and increasing production capacities across emerging economies boosted the adoption of modern processing technologies.

Middle East & Africa saw gradual, selective adoption correlated with growing food and beverage manufacturing activities, while Latin America recorded steady progress supported by the expansion of its packaged food sector. Overall, regional growth reflects rising production volumes and the industry’s continued shift toward enhanced quality control.

Top Use Cases

- Removing Air to Prevent Oxidation: Food deaerators are used to take out dissolved air (especially oxygen) from liquids such as juices, sauces, and dairy drinks. Oxygen can make food spoil faster, change flavors, and affect color. Removing this air keeps products tasting fresh and looking good for longer.

- Improving Beverage Quality: In making beverages like fruit juices, soft drinks, or teas, deaerators stop unwanted gases that can ruin taste or clarity. Less oxygen means the drink keeps its original flavor and doesn’t turn cloudy or develop off-tastes.

- Extending Shelf Life of Liquid Foods: When oxygen and other gases are removed, liquid foods such as soups or sauces don’t break down as quickly. This extends shelf life so products stay good during storage, transport, and on store shelves.

- Helping Accurate Filling and Packaging: Air bubbles in liquids can affect how much product gets filled into a bottle or pouch. By removing these bubbles, deaerators help ensure consistent and correct fill volumes and reduce packaging issues.

- Enhancing Dairy Processing: Milk and dairy products often contain air from handling and pumping. Removing this air helps with accurate measurement, prevents foam, and improves processing performance like pasteurization or standardization.

- Preparing Liquids Before Thermal Processing: Before heating or sterilizing, deaeration removes air that could interfere with heat transfer. This helps heat evenly and reduces quality problems during pasteurization or other heat treatments.

Recent Developments

- In January 2025, SPX FLOW’s APV brand, known for processing equipment used in dairy, beverages, UHT, and liquid food production, won the SEAL Business Sustainability Award for the APV Seamless Infusion Vessel. This special vessel helps food producers reduce cleaning cycles, save water, and run longer without stopping—improving efficiency and sustainability.

- In March 2024, GEA launched InsightPartner, a cloud-based digital platform for food and beverage processing equipment. This tool lets producers view real-time machine data, reduce unplanned slowdowns, and improve productivity. Although it is not a physical deaerator, it supports processing lines where deaerators are installed by improving overall performance and uptime.

- In March 2024, Krones finalized its acquisition of 100% of Netstal Maschinen AG, a Swiss maker of injection-molding machines used to produce PET preforms and closure parts for bottles. This adds new technology to Krones’ portfolio in beverage and food packaging, helping the company cover PET container production from start to finish.

Conclusion

The Food Deaerators Market continues to strengthen as food and beverage producers focus more on product quality, cleaner labels, and extended freshness. Deaeration remains a key processing step because it helps reduce oxidation, improve flavor stability, and support smooth filling operations. Ongoing innovations in beverages, dairy, sauces, and ready-to-drink categories further increase the need for reliable degassing systems.

Growing investments in processing technology and the expansion of regional manufacturing also support the steady adoption of advanced solutions. As producers aim for efficiency, consistency, and better shelf life, food deaerators are expected to remain an essential part of modern production lines.