Table of Contents

Overview

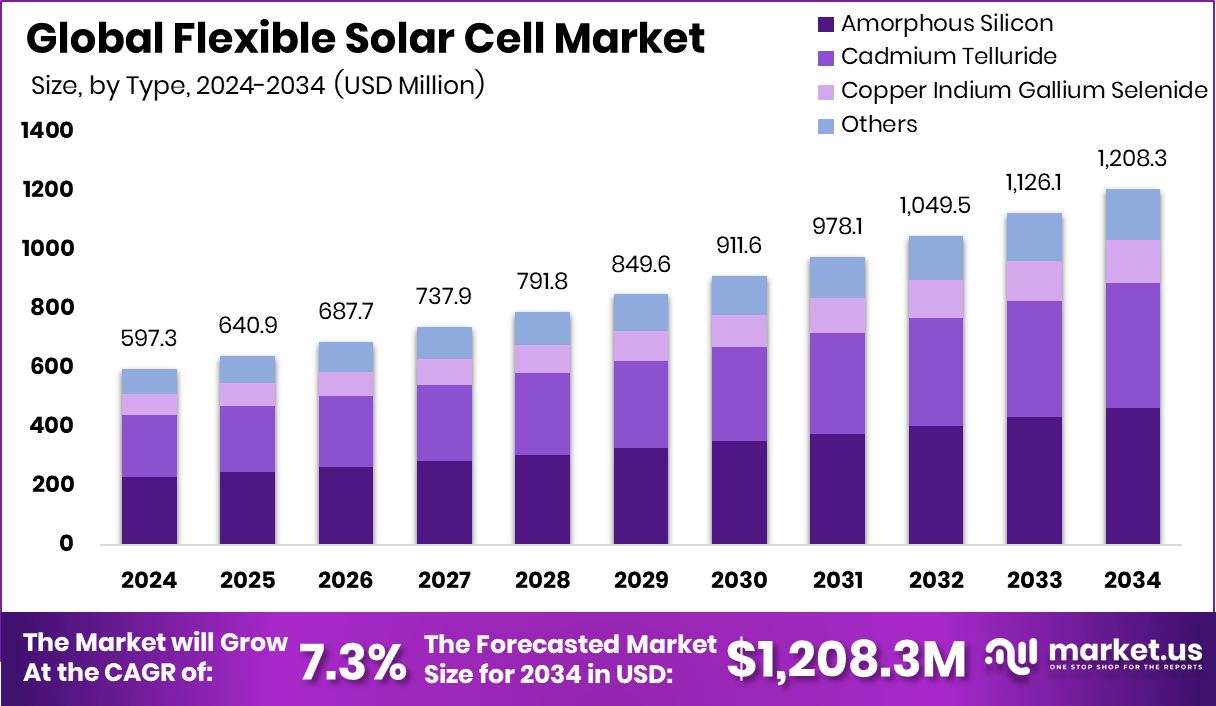

New York, NY – December 15, 2025 – The global flexible solar cell market is entering a strong growth phase, driven by rising demand for lightweight and adaptable energy solutions. The market is projected to grow from USD 597.3 million in 2024 to around USD 1,208.3 million by 2034, expanding at a steady CAGR of 7.3% between 2025 and 2034. Asia-Pacific leads this market with a 45.90% share, generating nearly USD 274.0 million in revenue, supported by rapid manufacturing adoption and electronics integration.

Flexible solar cells differ from traditional panels because they are thin, bendable, and lightweight. Built on plastic, metal foil, or flexible glass, these cells can curve or fold without damage. This flexibility allows solar power generation on buildings, vehicles, portable devices, and wearables, where rigid panels are impractical.

Government and institutional funding play a major role in accelerating this market. Art-PV secured a USD 10 million grant to develop high-efficiency tandem solar cells, while thin-film solar research received USD 2 million to advance flexible designs. These funds are helping technologies move faster from research to commercial production.

Further momentum comes from public support programs, including USD 52 million from the U.S. Department of Energy for solar manufacturing, recycling, grid resilience, and community solar deployment. On the materials front, the National Renewable Energy Laboratory awarded USD 1.8 million and an additional USD 2 million in separate contracts to improve cadmium telluride solar cells, creating new opportunities for durable, high-performance flexible solar products.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-flexible-solar-cell-market/request-sample/

Key Takeaways

- The Global Flexible Solar Cell Market is expected to be worth around USD 1,208.3 million by 2034, up from USD 597.3 million in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034.

- In Flexible Solar Cell Market, Amorphous Silicon leads by type, holding 38.5% share globally.

- In Flexible Solar Cell Market, Thin Film dominates the technology segment with 57.2% adoption globally.

- Flexible Solar Cell Market sees Flat form factor leading installations, capturing 66.6% share overall.

- In Flexible Solar Cell Market, 100-250 kW power range dominates deployments with 41.4% share.

- Flexible Solar Cell Market demand remains strongest in Industrial applications, accounting for 38.6% usage.

- Asia-Pacific region holds 45.90% of Flexible Solar Cell Market, reaching USD 274.0 Mn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=168487

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 597.3 Million |

| Forecast Revenue (2034) | USD 1,208.3 Million |

| CAGR (2025-2034) | 7.3% |

| Segments Covered | By Type (Amorphous Silicon, Cadmium Telluride, Copper Indium Gallium Selenide, Others), By Technology (Monocrystalline Silicon, Polycrystalline Silicon, Thin Film), By Form Factor (Flat, Curved, Freeform), By Power Range (100 kW, 100-250 kW, 250-500 kW, >500 kW), By Application (Residential, Industrial, Aerospace, Automobile, Others) |

| Competitive Landscape | ENECOM, MIASOLE, GLOBAL SOLAR ENERGY, INC., POWERFILM SOLAR, INC., SOLOPOWER SYSTEM, SOLBIAN, SUNPOWER CORPORATION, Others |

Key Market Segments

By Type Analysis

In 2024, amorphous silicon led the By Type segment of the Flexible Solar Cell Market with a 38.5% share, reflecting its strong alignment with flexible solar design requirements. Its lightweight structure and stable material properties make it highly suitable for bendable and surface-mounted solar applications.

Amorphous silicon performs consistently in low-light and diffused lighting environments, supporting demand from portable electronics, indoor energy systems, and building-integrated surfaces. The technology allows large-area coating on flexible substrates through relatively simple manufacturing processes, helping manufacturers achieve uniform output across different form factors.

The 38.5% market share also indicates preference for reliability and durability over peak conversion efficiency. Many flexible solar applications prioritize steady energy generation, mechanical flexibility, and ease of integration. As these performance characteristics remained central purchasing criteria in 2024, amorphous silicon sustained its dominant role within the flexible solar cell type segment.

By Technology Analysis

In 2024, thin film technology dominated the By Technology segment of the Flexible Solar Cell Market, holding a 57.2% share. This strong position reflects thin film’s inherent suitability for flexible and lightweight solar designs that require mechanical adaptability without sacrificing operational reliability.

Thin film solar cells can be deposited directly onto plastics, metal foils, and curved substrates, enabling use in portable electronics, building-integrated systems, and mobility-focused applications. The 57.2% market share highlights its ability to deliver broad surface coverage while maintaining stable and predictable power generation.

The technology’s structural flexibility simplifies integration into non-flat and unconventional surfaces, reducing design constraints for manufacturers and end users. As demand continued to grow for solar solutions that combine ease of installation, adaptability, and consistent output, thin film technology remained the preferred choice for flexible solar cell applications throughout 2024.

By Form Factor Analysis

In 2024, the flat form factor led the By Form Factor segment of the Flexible Solar Cell Market with a 57.2% share, highlighting its practical advantages in real-world deployment. This leadership reflects how flat flexible solar cells combine bendability with ease of installation on wide, even surfaces.

Flat designs allow straightforward layering, secure mounting, and uniform light exposure across the entire surface, supporting stable and predictable energy generation. The 57.2% market share shows a clear preference for solutions that reduce handling complexity while maintaining lightweight and flexible characteristics.

These formats are easier to transport, position, and integrate into structures such as rooftops, facades, portable systems, and vehicle surfaces. By balancing mechanical flexibility with surface stability, flat form factor solutions met both technical and operational requirements. As simplicity, reliability, and deployment efficiency remained important decision factors, flat flexible solar cells continued to dominate the market landscape throughout 2024.

By Power Range Analysis

In 2024, the 100–250 kW category dominated the By Power Range segment of the Flexible Solar Cell Market, accounting for a 57.2% share. This strong position reflects growing adoption of flexible solar systems that offer a balanced mix of output capacity and structural adaptability.

Flexible solar solutions in the 100–250 kW range are well suited for applications that require reliable energy generation while managing limitations related to space, surface design, or weight. The 57.2% market share indicates clear demand for power ranges that deliver consistent performance without depending on rigid panels or heavy support structures.

This capacity range supports practical installation across commercial sites, mobility platforms, and integrated energy systems. As decision-makers continued to emphasize deployment efficiency, flexibility, and dependable output, the 100–250 kW segment maintained its leading role in the flexible solar cell market throughout 2024.

By Application Analysis

In 2024, the industrial segment held a leading position in the Flexible Solar Cell Market with a 38.6% share, reflecting rising adoption across industrial facilities. This dominance is driven by the need for lightweight solar solutions that can adapt to complex and space-constrained industrial surfaces.

Industrial users increasingly prefer flexible solar cells because they can be installed on large structures, curved rooftops, and uneven areas without extensive structural modification. The 38.6% market share highlights consistent demand for energy systems that support on-site power generation while simplifying installation and maintenance.

Flexible formats allow integration into existing industrial layouts, reducing downtime and avoiding heavy mounting frameworks. By enabling smoother handling and better surface conformity, these solutions improve operational efficiency. As ease of integration, surface versatility, and reliable performance remained key decision factors, the industrial segment continued to lead the flexible solar cell market throughout 2024.

Regional Analysis

Asia-Pacific leads the Flexible Solar Cell Market with a 45.90% share, valued at USD 274.0 Mn, supported by strong manufacturing bases and expanding renewable adoption. The region benefits from large-scale production and growing use of lightweight solar solutions across buildings, transport, and portable systems, helping maintain its market leadership.

North America represents a technologically advanced and innovation-focused market. Growth is driven by demand for flexible solar cells in specialized applications that require lightweight designs and surface adaptability, supported by strong research and manufacturing capabilities.

Europe shows consistent growth due to sustainability goals and clean energy policies. Flexible solar cells align well with space-efficient and design-focused applications, encouraging adoption across construction and urban environments.

The Middle East & Africa region is gradually adopting flexible solar solutions, particularly in high-irradiation areas where lightweight systems overcome infrastructure limitations.

Latin America is emerging steadily, with flexible solar gaining traction in off-grid, mobile, and distributed energy applications due to ease of deployment and adaptability.

Top Use Cases

- Portable Power for Small Devices: Flexible solar cells can be used to charge portable electronics like phones, cameras, and GPS gear because they are lightweight and can bend to fit backpacks or tents.

- Wearable and Self-Powered Electronics: Flexible photovoltaics are ideal for wearable devices such as smart clothing or health monitors, supplying energy without bulky batteries and adapting to curves and movement.

- Building-Integrated Energy: These solar cells can be attached to building surfaces, windows, or facades where traditional rigid panels wouldn’t fit, turning walls and roofs into power generators.

- Off-Grid and Remote Use: Their lightweight and rollable form make them great for remote operations, camps, disaster relief, and military use where a quick and easy power setup is needed.

- Internet of Things (IoT) Sensor Power: Flexible photovoltaics can power small IoT sensors and wireless tags, eliminating the need for frequent battery changes in distributed sensor networks.

Recent Developments

- In November 2025, New Reinforced Flexible Solar Line: ENECOM launched the HF Strong series, a semi-rigid, reinforced flexible solar panel line designed for boating, off-grid, and mobility use with power options from 145 W to 205 W.

- In May 2025, New 400 W Flexible Panel: PowerFilm introduced a 400 W SuperFlex solar panel with integrated edge seal, improving durability and installation ease, especially for vehicles and fleet use.

Conclusion

The flexible solar cell market is steadily evolving as demand grows for lightweight, adaptable, and easy-to-install energy solutions. These technologies are expanding the reach of solar power beyond traditional rigid panels, enabling use on curved surfaces, portable systems, buildings, vehicles, and industrial structures. Ongoing improvements in materials, manufacturing techniques, and durability are strengthening performance and reliability.

As sustainability goals, design flexibility, and decentralized energy needs gain importance, flexible solar cells are becoming a practical complement to conventional solar systems. Their ability to integrate seamlessly into diverse environments positions the market for continued adoption across energy, mobility, construction, and consumer applications in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)