Table of Contents

Overview

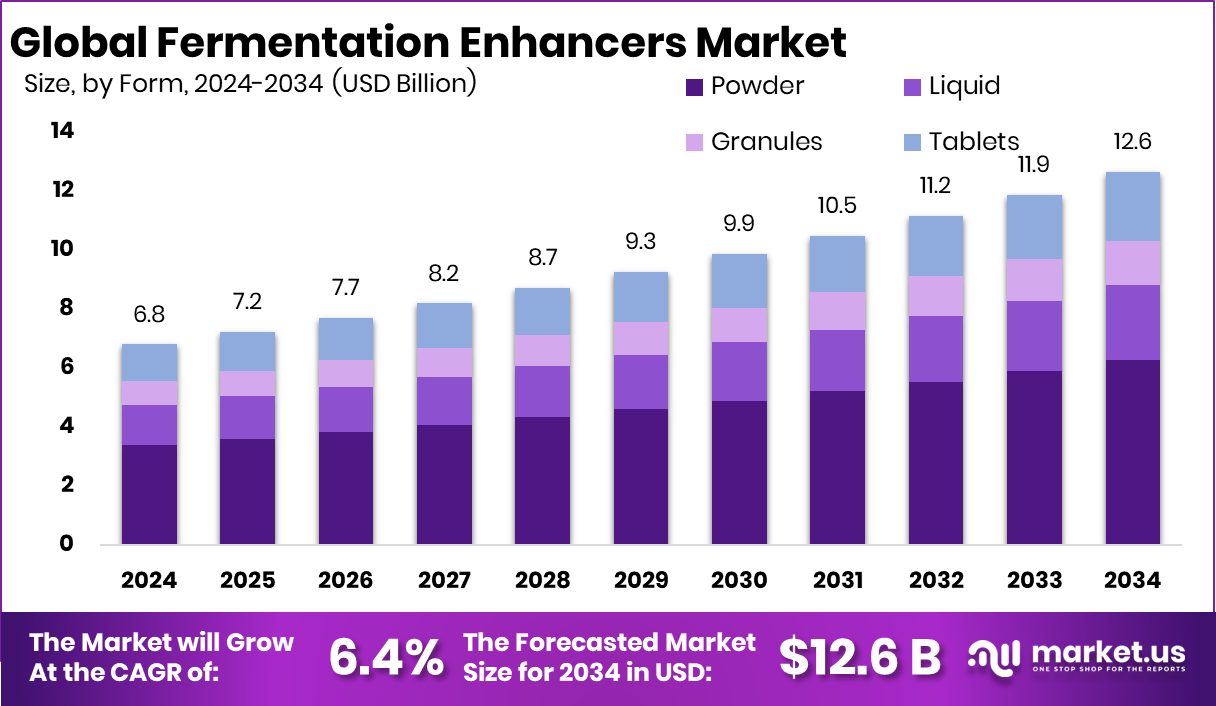

New York, NY – February 13, 2026 – Fermentation Enhancers Market is expected to be worth around USD 12.6 billion by 2034, up from USD 6.8 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034.

The global fermentation enhancers market is expanding steadily, driven by the growing industrial reliance on optimized microbial performance across food, beverage, nutrition, cosmetics, agriculture, and biotechnology sectors. Fermentation enhancers play a critical role in improving nutrient availability, microbial stability, stress resistance, and metabolic efficiency, resulting in faster, more consistent, and scalable fermentation outcomes. As fermentation evolves beyond traditional food processing into precision-driven applications such as functional proteins, bio-based ingredients, and sustainable alternatives, the need for reliable enhancer systems continues to strengthen.

Investment momentum highlights this shift. Revyve secured $28 million in Series B funding to advance yeast-based egg replacers, while Portugal’s PFx Biotech is raising €5 million, and Australia’s Eclipse Ingredients obtained $4.6 million to scale precision-fermented proteins—areas where enhancer performance directly influences yield and production economics. Sustainability-driven fermentation is also accelerating, supported by the Estonian government’s $1.1 million backing and ÄIO’s €1 million funding to scale yeast-based palm oil substitutes. Phytolon’s $14.5 million investment in biotech food colorants further reflects the importance of fermentation stability and quality control.

In nutrition, SuperYou’s ₹63 crore Series B funding and DSM-Firmenich’s €250,000 research grants in APAC underscore rising demand for optimized fermentation systems supporting gut health and functional food innovation.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-fermentation-enhancers-market/request-sample/

Key Takeaways

- The Global Fermentation Enhancers Market is expected to be worth around USD 12.6 billion by 2034, up from USD 6.8 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034.

- In the Fermentation Enhancers Market, yeast nutrients lead product types with 29.3% share globally today.

- Powder form dominates the Fermentation Enhancers Market, accounting for 49.6% due to handling efficiency benefits.

- Synthetic sources hold prominence in the Fermentation Enhancers Market with 49.4% adoption worldwide across industries.

- Microbial optimization functionality leads the Fermentation Enhancers Market at 32.9%, improving process consistency and yields.

- Food and beverage fermentation applications dominate the Fermentation Enhancers Market with 36.2% share globally today.

- In North America, the fermentation enhancers market reached a 42.8% share, totaling USD 2.9 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=172679

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 6.8 Billion |

| Forecast Revenue (2034) | USD 12.6 Billion |

| CAGR (2025-2034) | 6.4% |

| Segments Covered | By Product Type (Enzyme-based Enhancers, Yeast Nutrients, pH Adjusters, Microbial Growth Promoters, Oxygen Scavengers and Redox Agents, Prebiotics and Carbohydrate Sources, Antifoaming Agents), By Form (Powder, Liquid, Granules, Tablets), By Source (Synthetic, Natural/Biobased), By Functionality (Nutritional Supplementation, PH Regulation, Oxygen Reduction, Microbial Optimization, Biomass Enhancement, Product Yield Boosting, Others), By Application (Food and Beverage Fermentation, Industrial Fermentation, Pharmaceutical/Biotech, Animal Feed Fermentation, Agricultural Fermentation, Others) |

| Competitive Landscape | AB Biotek, Aemetis, BASF, Corteva, Darling Ingredients, DSM-Firmenich, Evonik Industries, Fermentalg, Genomatica, Ginkgo BioWorks |

Key Market Segments

By Product Type

In 2024, yeast nutrients accounted for 29.3% of the fermentation enhancers market, reflecting their essential role in supporting efficient and stable fermentation. These nutrients provide critical elements such as nitrogen, vitamins, and minerals that strengthen yeast metabolism and ensure consistent microbial activity. Their strong adoption across brewing, winemaking, bioethanol production, and food fermentation has sustained steady demand.

Manufacturers rely on yeast nutrients to shorten fermentation cycles, improve yield, and minimize risks linked to nutrient deficiencies. As industrial fermentation scales up and precision control becomes more important, yeast nutrients remain a preferred solution for maintaining process stability and predictable output across both traditional and advanced fermentation applications.

By Form

Powdered fermentation enhancers dominated the market in 2024 with a 49.6% share, primarily due to their stability, ease of handling, and cost efficiency. Powders offer longer shelf life and reduced contamination risk compared to liquid formats, making them suitable for large-scale industrial operations. Their dry format allows accurate dosing and seamless blending with other ingredients used in fermentation workflows.

Food and beverage manufacturers particularly favor powdered products because they integrate easily into standardized production systems. Additionally, powders lower transportation and storage costs, supporting operational efficiency. The dominance of this form highlights industry preference for scalable, reliable, and logistics-friendly fermentation solutions.

By Source

Synthetic fermentation enhancers held a 49.4% market share in 2024, driven by their uniform composition and consistent performance. These products offer standardized nutrient profiles, enabling manufacturers to maintain batch-to-batch reliability in high-precision fermentation processes. Synthetic sources reduce variability commonly associated with natural inputs and allow better control over fermentation parameters.

Their adoption is especially strong in industrial biotechnology, brewing, and bio-based manufacturing, where stability and predictability are critical. Additionally, synthetic formulations often simplify regulatory compliance and large-scale production planning. The segment’s strong position reflects industry demand for dependable, performance-driven enhancer solutions that support optimized and scalable fermentation operations.

By Functionality

Microbial optimization emerged as the leading functionality segment in 2024, capturing 32.9% of the market. This segment focuses on enhancing microbial growth, resilience, and metabolic efficiency during fermentation. Products designed for microbial optimization help maintain balanced nutrient uptake and reduce stress on microorganisms, ensuring consistent productivity.

As fermentation processes become more yield-oriented and technologically advanced, manufacturers increasingly prioritize solutions that maximize microbial efficiency and minimize batch failures. The functionality is particularly critical in high-output applications such as enzyme production, probiotics, and fermented foods. Growing emphasis on process efficiency and improved fermentation performance continues to drive this segment’s expansion.

By Application

Food and beverage fermentation led the market in 2024 with a 36.2% share, supported by increasing production of fermented products such as beer, wine, dairy, bakery goods, and functional foods. Fermentation enhancers improve flavor stability, fermentation speed, and overall product consistency, making them essential in large-scale food processing.

Rising consumer demand for fermented and functional foods has further strengthened this application area. Producers are also adopting enhancers to scale operations while maintaining quality and uniformity. As fermentation remains central to modern food manufacturing and innovation, this segment continues to play a dominant role in overall market growth.

Regional Analysis

North America leads the Fermentation Enhancers Market with a 42.8% share valued at USD 2.9 billion, supported by its well-established food and beverage fermentation industry and strong adoption of industrial biotechnology. Mature brewing, dairy, and processed food sectors consistently utilize fermentation enhancers to improve yield reliability and operational efficiency.

Europe represents a structurally stable market, driven by deep-rooted fermentation traditions in bakery, dairy, and alcoholic beverages, along with strict quality regulations that encourage controlled and standardized fermentation inputs.

Asia Pacific is witnessing steady growth due to rising consumption of fermented foods and beverages, expanding urban populations, and increasing industrial fermentation activities.

Meanwhile, the Middle East & Africa market is gradually developing as food processors focus on improving shelf life and strengthening domestic production capabilities. Latin America is progressing at a moderate pace, supported by growing beverage manufacturing and broader adoption of fermentation-based food processes, while North America remains the dominant regional contributor.

Top Use Cases

- Improving Food Flavor and Texture: Fermentation enhancers help microbes work better to produce acids and aroma compounds that make foods taste and feel better. For example, in dairy, vegetable, or cereal fermentation, microbes break down sugars and proteins, creating pleasant flavors and softer or more appealing textures. This is why foods like yogurt, sourdough bread, kimchi, and soy sauce have rich tastes and textures.

- Boosting Nutritional Value and Digestibility: When fermentation is enhanced, microbes can break down complex nutrients into forms easier for humans to digest and absorb. This can also increase vitamin levels and other beneficial nutrients in foods, making them healthier. Fermentation can also reduce substances that are hard to digest.

- Extending Shelf Life Naturally: Fermentation products such as organic acids and other antimicrobial compounds created with the help of enhancers can slow spoilage and improve food preservation. They act as natural protectors against harmful bacteria and mold, improving freshness.

- Producing Alcoholic Beverages: In wine, beer, and cider production, fermentation enhancers (often specific yeasts or nutrients) help yeast convert sugars into alcohol more efficiently and consistently. This improves taste, alcohol content, and consistency of the final product.

- Boosting Probiotic and Gut Health Benefits: In products like yogurt, kefir, and kombucha, fermentation enhancers support beneficial bacteria that become probiotics—helpful microbes that can support digestion and gut health when eaten. These microbes thrive better when fermentation conditions are optimized.

- Improving Plant-based and Alternative Foods: Fermentation enhancers are used in modern food innovation to improve plant-based proteins and alternative foods by increasing their nutritional quality, flavor, and digestibility. For example, fermented plant materials can taste better, be easier to digest, and have more usable protein.

Recent Developments

- In February 2025, AB Biotek unveiled a new fermentation product designed to alter malic acid in grape juice, improving wine fermentation outcomes. The innovation, referenced as Pinnacle™ MLF, helps winemakers manage acidity and fermentation behaviour more precisely.

- In December 2024, Aemetis India (a subsidiary of Aemetis) finished $103 million of biodiesel deliveries to government oil companies. They also received a $58 million contract allocation for biodiesel supplies in 2025, meaning more production and shipments are planned this year. This expansion supports the Indian government’s goals for higher biodiesel use.

Conclusion

Fermentation enhancers play a vital role in improving the efficiency, stability, and consistency of modern fermentation processes. By supporting microbial health and optimizing nutrient balance, these solutions help industries achieve better yields, improved product quality, and more predictable outcomes. Their importance continues to grow as fermentation expands beyond traditional food and beverage applications into biotechnology, nutrition, sustainable ingredients, and bio-based production.

As manufacturers focus on process optimization and scalable production, fermentation enhancers remain essential tools for innovation and operational reliability. Overall, they contribute significantly to advancing sustainable manufacturing and meeting evolving consumer and industrial demands worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)