Table of Contents

Overview

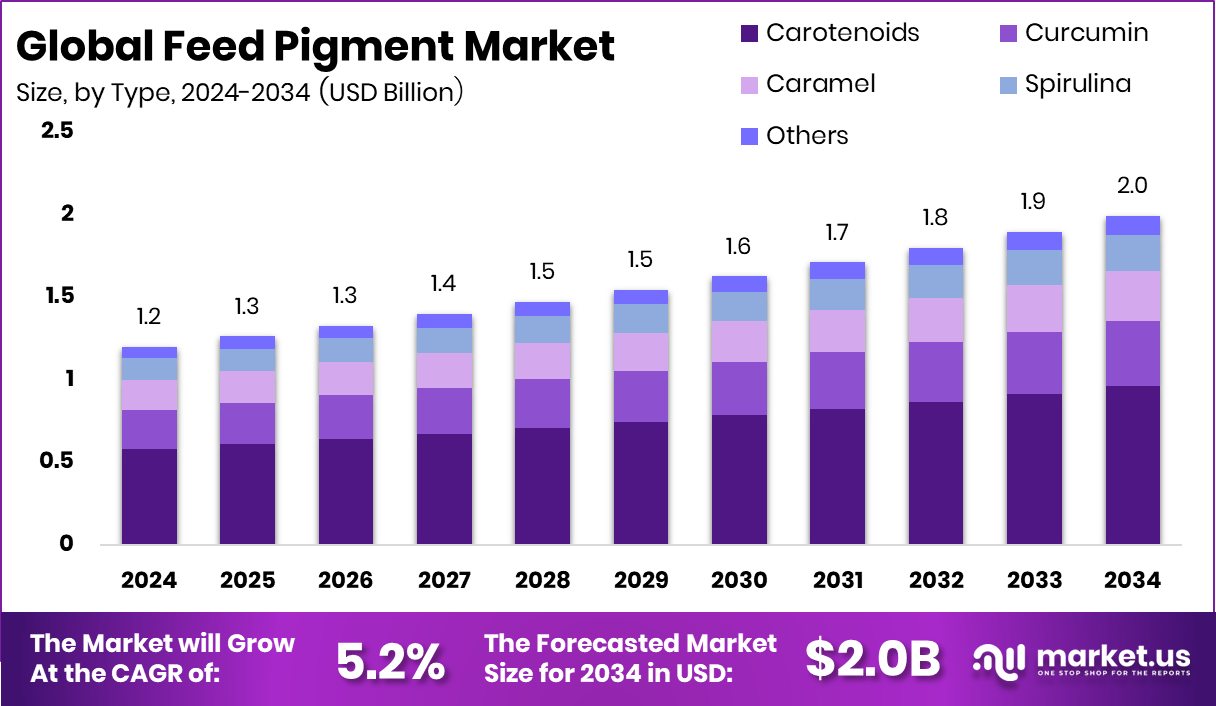

New York, NY – January 16, 2026 – The global feed pigment market is on a steady growth path, projected to reach around USD 2.0 billion by 2034, rising from USD 1.2 billion in 2024, and expanding at a CAGR of 5.2% between 2025 and 2034. North America currently dominates the market with a 45.80% share, valued at approximately USD 0.5 billion, reflecting strong adoption of quality-focused feed solutions.

Feed pigments are natural or synthetic additives used in animal feed to improve the color of eggs, meat, fish, and poultry skin. Consistent visual appearance plays a critical role in consumer acceptance and perceived product quality. As a result, pigments are no longer optional additives but essential inputs for uniform production across livestock, poultry, aquaculture, and pet nutrition.

Market expansion is closely linked to rising investments in animal health, food safety, and agricultural research. Public funding initiatives, including USD 286,000 for food safety education, USD 57,000 for horticulture research, and over USD 1.8 million for agricultural job creation projects, demonstrate strong institutional support that indirectly boosts demand for compliant feed ingredients, including pigments.

The growing pet food and specialty nutrition segment further strengthens demand. Notable investments include USD 60 million for Drools Pet Food, USD 19 million for Pure Pet Food, USD 4.5 million for Good Dog Food, USD 1.46 million for insect-based dog food, and USD 1.01 million for plant-based dog food. Additional opportunities are emerging through sustainability-focused funding, such as USD 250,000 for stock enhancement initiatives and £250,000 supporting English pet food development, signaling long-term growth potential.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-feed-pigment-market/request-sample/

Key Takeaways

- The Global Feed Pigment Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.2 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- Carotenoids dominate the Feed Pigment Market by type, holding 48.2% share due to strong pigmentation efficiency.

- Synthetic sources lead the Feed Pigment Market with 62.3% share, supported by consistent quality and scalability.

- Poultry dominates the Feed Pigment Market by livestock, accounting for 42.7% share, driven by egg demand.

- Egg yolk coloration leads the Feed Pigment Market by application with a 37.9% share globally across regions.

- In North America, the feed pigment market reached a 45.80% share with USD 0.5 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=170789

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.2 Billion |

| Forecast Revenue (2034) | USD 2.0 Billion |

| CAGR (2025-2034) | 5.2% |

| Segments Covered | By Type (Carotenoids, Curcumin, Caramel, Spirulina, Others), By Source (Natural, Synthetic), By Livestock (Swine, Poultry, Ruminants, Aquatic animals, Others), By Application (Egg Yolk Coloration, Poultry Skin Coloration, Fish Flesh Coloration, Pet Food Enhancement, Others) |

| Competitive Landscape | BASF SE, Royal DSM N.V, Kemin Industries, Inc., Behn Meyer Holding AG, Nutrex NV, Novus International, Inc., Biorigin, Phytobiotics Futterzusatzstoffe GmbH, Synthite Industries Ltd. |

Key Market Segments

By Type

Carotenoids dominate the Feed Pigment Market’s type segment, holding a strong 48.2% share in 2024. Their leadership reflects high acceptance across global feed formulations, especially where reliable and consistent pigmentation is essential. Carotenoids are preferred because they deliver stable coloring performance, helping producers maintain uniform quality in eggs, poultry skin, and aquaculture products.

Their significant share underscores their importance in large-scale feed production systems that rely on predictable results and standardized inputs. The demand for carotenoids continues to expand as visual quality becomes a key differentiator in livestock and poultry markets, reinforcing their pivotal role in commercial feed pigmentation strategies.

By Source

Synthetic pigments lead the market by source, capturing a dominant 62.3% share in 2024. This reflects their strong alignment with industrial feed manufacturing, which requires consistent quality, dependable supply, and cost efficiency. Synthetic pigments offer uniform coloration and stability, making them ideal for high-volume feed operations where precise outcomes are necessary. Their wide adoption indicates continued reliance on controlled, scalable pigment solutions that support performance predictability across diverse livestock and poultry sectors. As feed producers aim for standardized formulations and reliable market results, synthetic sources remain the backbone of global feed pigment sourcing.

By Livestock

Poultry stands as the leading livestock segment in the Feed Pigment Market, accounting for 42.7% share in 2024. This dominance stems from the strong connection between pigmentation and poultry product appeal, particularly in skin coloration and egg yolk quality. Poultry producers consistently rely on pigments to meet consumer expectations for visual uniformity and premium appearance.

he high share reflects the large production scale of the poultry industry, established feeding practices, and the sector’s strong commercial dependence on color consistency. As global poultry consumption rises, pigment demand in this segment remains structurally significant, reinforcing poultry’s role as the primary driver of feed pigment usage.

By Application

Egg yolk coloration leads applications in the Feed Pigment Market, holding a 37.9% share in 2024. This reflects the critical importance of yolk appearance in consumer buying decisions, as color is often perceived as an indicator of freshness and nutritional value. Feed pigments are widely utilized to achieve consistent and desirable yolk shades, making them essential for egg producers targeting premium-quality standards.

The strong share highlights a long-standing focus on visual attributes within egg production, supported by well-established nutritional strategies. With yolk color remaining a key quality benchmark in global markets, this application continues to anchor demand for feed pigments across commercial egg production systems.

Regional Analysis

North America leads the Feed Pigment Market with a 45.80% share, valued at USD 0.5 billion, supported by advanced feed manufacturing systems and strong demand for high-quality livestock and poultry products. Europe follows as a mature market, benefiting from strict feed standards and consistent pigment use to maintain product uniformity.

Asia Pacific is growing rapidly due to its large livestock population and rising focus on productivity, though the market remains more diverse and fragmented. The Middle East & Africa show steady progress as commercial farming expands and awareness of feed quality strengthens. Latin America maintains stable market participation, backed by its significant livestock sector and increasing emphasis on feed efficiency.

Top Use Case

- Improve Egg Yolk Color: Feed pigments like carotenoids are added to chicken feed so that laying hens produce eggs with rich yellow or orange yolks. This makes eggs look more appealing to people buying them, because color affects how consumers judge quality. Pigments are absorbed by the hen and deposited in the yolk.

- Enhance Poultry Skin and Fat Color: Adding pigments to broiler chicken feed helps deepen the yellow shade of skin and fat. A brighter skin color can increase the attractiveness of chicken meat to customers, supporting better market acceptance.

- Make Feed More Attractive to Animals: Pigments can improve the look of the feed itself. Better-looking feed may encourage animals to eat more consistently, which can support regular intake of nutrients.

Recent Developments

- In June 2025, DSM-Firmenich completed the sale of its stake in the Feed Enzymes Alliance to Novonesis for about €1.5 billion. This sale covers a business that supplies enzymes used in animal feed to improve digestion and nutrient uptake — a move that reshapes DSM’s feed ingredient operations.

- In December 2024, BASF signed an agreement to sell its Food and Health Performance Ingredients business, which included production facilities in Germany. While this deal mainly focuses on human nutrition products, it shows the company restructuring parts of its nutrition division, which also overlaps with feed-related ingredients and carotenoids that may support animal feed coloration.

Conclusion

The Feed Pigment Market continues to strengthen as producers prioritize consistent color quality in eggs, poultry, meat, and aquaculture products. Demand is supported by structured feed manufacturing, rising consumer expectations, and growing emphasis on visual appeal in animal-derived foods. Natural and synthetic pigments both play essential roles, helping farmers maintain uniformity and product value.

Expanding pet nutrition trends and ongoing innovation in feed additives further reinforce market relevance. As regions increase focus on food quality, safety, and standardized production, feed pigments remain an important component in modern animal nutrition systems, contributing to better market acceptance and improved product presentation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)