Table of Contents

Overview

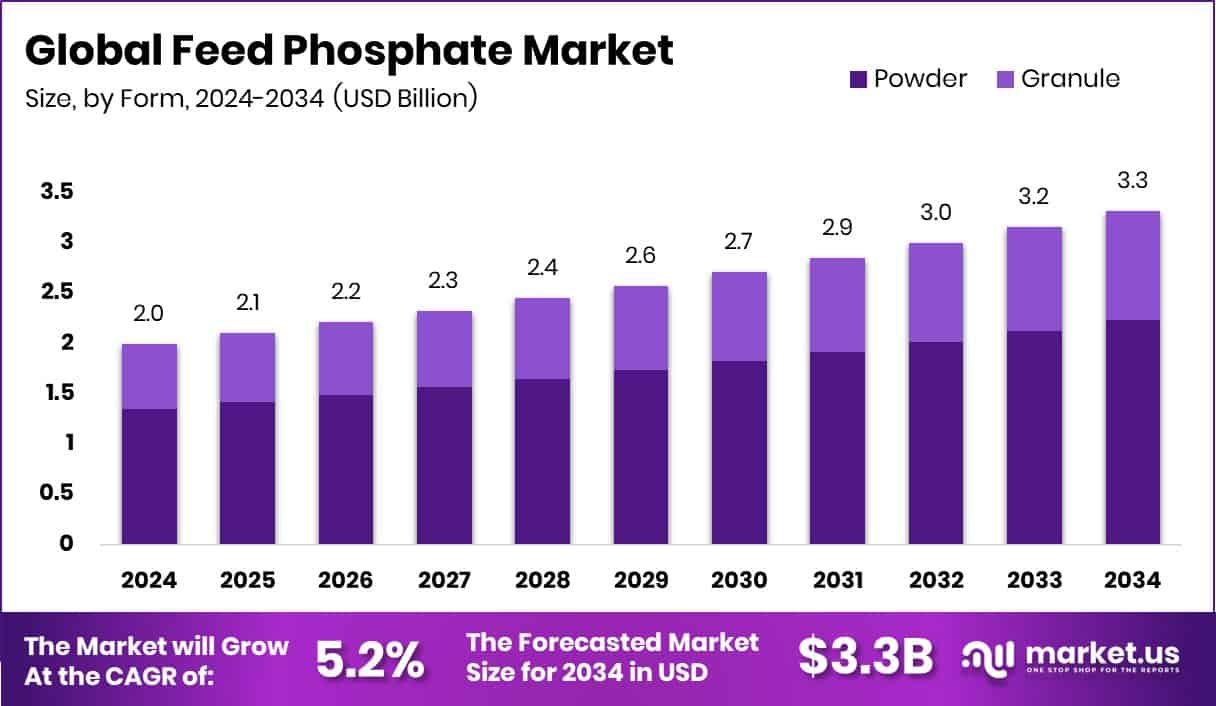

New York, NY – October 22, 2025 – The global feed phosphate market is projected to reach USD 3.3 billion by 2034, rising from USD 2.0 billion in 2024, growing at a CAGR of 5.2% (2025–2034).

Feed phosphates—mainly dicalcium and monocalcium phosphate—are vital feed additives that provide essential phosphorus for growth, bone strength, reproduction, and energy metabolism in livestock and poultry. Insufficient phosphorus leads to reduced fertility and productivity, making these additives indispensable in animal nutrition.

Market expansion is driven by the rising demand for meat, dairy, and aquaculture products, especially in the Asia-Pacific region, which holds a 34.8% share. Increasing awareness about animal health and efficient feed conversion has further boosted phosphate use in balanced formulations. Policy and funding support also sustain demand, such as the U.S. Senate’s $1 million approval for a poultry diagnostics lab and the USDA’s $1 billion aid for poultry farmers in disease-affected regions.

Moreover, a €3 million investment by a German poultry company in a mycelium-meat startup and a ₱20 million (P20 million) government fund for the livestock and poultry sectors signal continued innovation and feed modernization. These efforts, coupled with sustainable phosphate sourcing and digestible formulations, indicate robust long-term growth for feed phosphates worldwide.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-feed-phosphate-market/request-sample/

Key Takeaways

- The Global Feed Phosphate Market is expected to be worth around USD 3.3 billion by 2034, up from USD 2.0 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- In 2024, the Feed Phosphate Market saw powder form dominate, holding a 67.3% share.

- The Feed Phosphate Market was led by dicalcium phosphate, accounting for 39.4% of the total share.

- Poultry dominated the Feed Phosphate Market with a 43.8% share during the assessment year.

- The Asia-Pacific market value reached around USD 0.6 billion, reflecting strong livestock expansion.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161731

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.0 Billion |

| Forecast Revenue (2034) | USD 3.3 Billion |

| CAGR (2025-2034) | 5.2% |

| Segments Covered | By Form (Powder, Granule), By Feed Type (Dicalcium Phosphate, Monocalcium Phosphate, Mono-Dicalcium Phosphate, Tricalcium Phosphate, Defluorinated Phosphate, Others), By Livestock Type (Poultry, Swine, Cattle, Aquatic Animals, Others) |

| Competitive Landscape | OCP Group, The Mosaic Company, PhosAgro, Yara International ASA, Phosphea, J.R. Simplot Company, Israel Chemicals Ltd., Innophos Holdings Inc., Lomon Billions Group Co., Ltd. |

Key Market Segments

By Form Analysis

In 2024, the powder form dominated the By Form segment of the Feed Phosphate Market, holding a 67.3% share. This format is preferred for its easy blending in compound feeds and uniform nutrient distribution, which ensures optimal phosphorus intake for livestock and poultry. Its fine texture enhances digestibility and feed conversion efficiency, supporting better growth and bone strength.

Additionally, the powder form provides longer shelf life and simpler storage, making it ideal for large-scale feed manufacturers. With global livestock and poultry production consistently expanding, the powder form maintains its leading market position, driven by its efficiency, cost-effectiveness, and compatibility with diverse feed formulations.

By Feed Type Analysis

In 2024, Dicalcium Phosphate led the By Feed Type segment of the Feed Phosphate Market, accounting for a 39.4% share. Its dominance stems from its high phosphorus and calcium content, vital for bone development, metabolism, and animal growth. This compound is extensively used in poultry, cattle, and swine feed due to its excellent bioavailability and compatibility with other feed ingredients.

It effectively enhances feed efficiency, boosts fertility, and accelerates weight gain in livestock. Furthermore, its chemical stability and low reactivity make it ideal for mass feed production, ensuring consistent nutrient delivery. These advantages continue to strengthen Dicalcium Phosphate’s leading position in the global feed phosphate market, driven by rising demand for efficient, nutrient-rich feed formulations.

By Livestock Type Analysis

In 2024, the poultry segment dominated the By Livestock Type category of the feed phosphate market, capturing a 43.8% share. This leadership is fueled by rising global demand for poultry meat and eggs, which significantly increases feed consumption. Poultry requires optimal phosphorus nutrition for bone strength, eggshell formation, and growth efficiency, making feed phosphates indispensable. The segment’s momentum is further supported by government funding initiatives and disease control programs, which enhance flock health and productivity.

Continuous investments in nutrition optimization and poultry farming advancements sustain high phosphate usage, solidifying this segment’s leading position and underscoring its pivotal role in maintaining feed quality and overall production performance within the global feed phosphate market.

Regional Analysis

In 2024, Asia-Pacific led the Feed Phosphate Market with a 34.8% share, valued at USD 0.6 billion. The region’s dominance stems from its large livestock and poultry base, particularly in China, India, and Indonesia, where improving animal nutrition remains a priority. Growing urbanization and rising meat consumption continue to fuel phosphate demand across the region.

North America maintains steady growth through advanced feed formulations and robust animal health programs, while Europe experiences balanced expansion driven by sustainable livestock practices. Emerging regions like the Middle East & Africa and Latin America are also enhancing their feed infrastructure to meet nutritional needs.

With ongoing investments in feed quality and expanding livestock production, the Asia-Pacific region is expected to retain its leading role in the global feed phosphate market throughout the coming decade.

Top Use Cases

- Bone and skeletal development in poultry: Adequate inorganic feed-phosphates help birds build strong bones and support eggshell formation, because phosphorus and calcium combined serve structural and growth roles in the skeleton.

- Energy metabolism and cellular functions in livestock: Phosphorus supplied via feed phosphates is key in energy transfer (e.g., ATP), nucleic acid synthesis, and cell membranes—so adding feed phosphates helps animals convert feed into body mass and maintain health.

- Improving fertility, growth rate, and feed conversion: Using high bio-available phosphates (like dicalcium phosphate) in feeds means animals grow faster, convert feed into product more efficiently, and reproduce better.

- Supporting dairy cattle milk production: For lactating cows, extra calcium and phosphorus via feed phosphate supplements help maintain intake, nutrient digestibility, and milk output—and prevent mineral-deficiency issues.

- Ensuring nutrient availability when plant-based feed is low in usable phosphorus: Many grains contain phosphorus bound in phytate, which pigs or poultry cannot use well; supplementing with feed phosphates compensates for this gap and avoids deficiencies.

- Reducing environmental phosphorus loss through better utilization: Because feed phosphates are more digestible, animals excrete less unused phosphorus. That means less phosphorus pollution from manure and better sustainable feed practices.

Recent Developments

- In October 2025, Mosaic completed the sale of its idled Patos de Minas phosphate mining unit in Brazil to Fosfatados Centro SPE Ltda. The purchase price is US$111 million in cash (US$51 million at closing, balance over four years). Mosaic expects to record a book gain of US$80–90 million in Q4 2025. The move lets Mosaic exit an under-performing asset and redeploy resources.

- In February 2025, OCP increased its ownership in GlobalFeed S.L. by purchasing an additional 25% of the company’s share capital, bringing its total stake to 75%. GlobalFeed specialises in animal-nutrition products, including phosphate-based feed solutions. The acquisition strengthens OCP’s presence in the animal-nutrition/feed-phosphate segment.

- In April 2024, PhosAgro announced that its production of “phosphate-based fertilizers and feed phosphates” rose by 9.2% year-on-year to 2.260 million tonnes. The increase was driven by stronger output of phosphoric and sulphuric acids and a major production unit reaching full design capacity.

Conclusion

The feed phosphate market is steadily evolving with growing attention to animal health, sustainable farming, and efficient nutrition. Increasing awareness among livestock and poultry producers about the benefits of phosphorus supplementation is encouraging wider adoption of feed phosphates.

Companies are focusing on innovations that improve digestibility and reduce environmental impact, while governments continue supporting livestock productivity through funding and policy initiatives.

With ongoing advancements in feed formulation, the sector is expected to maintain a positive growth outlook, emphasizing balanced nutrition, production efficiency, and eco-friendly solutions that strengthen global livestock and aquaculture performance in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)