Table of Contents

Overview

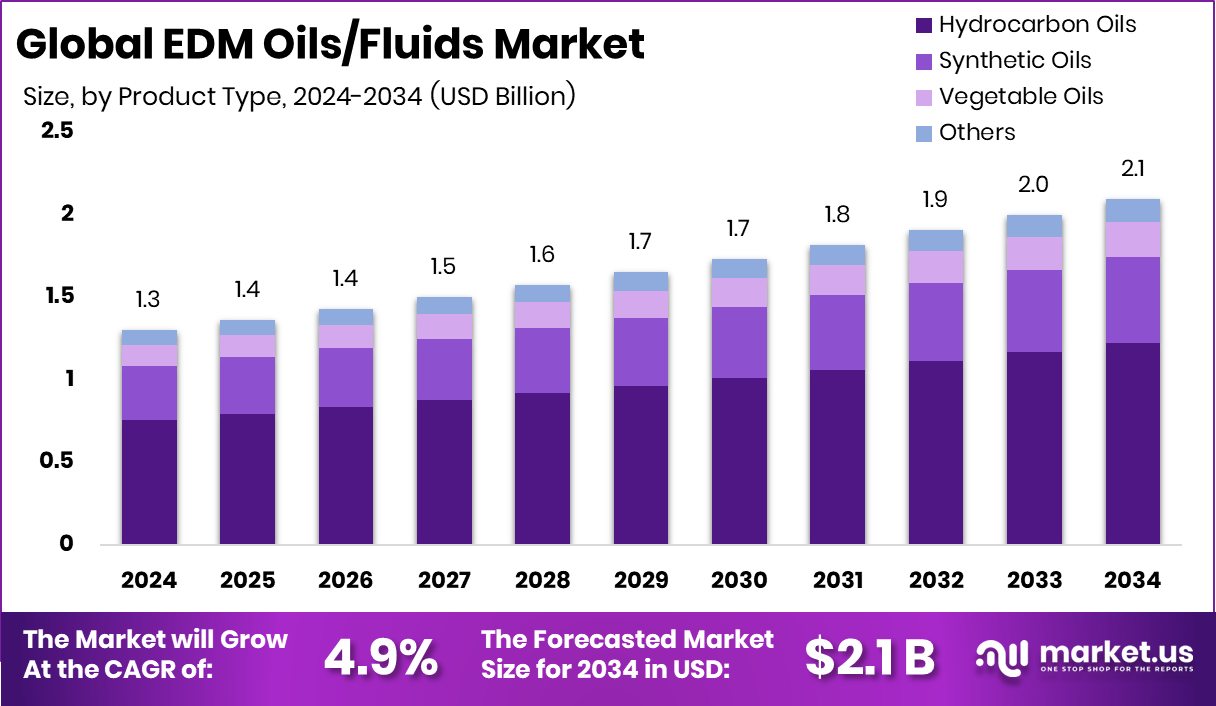

New York, NY – December 19, 2025 – The global EDM oils and fluids market is moving on a steady growth path, supported by expanding precision manufacturing needs. The market is projected to increase from USD 1.3 billion in 2024 to around USD 2.1 billion by 2034, registering a 4.9% CAGR between 2025 and 2034. Asia Pacific remains the leading regional market, accounting for 41.7% share, equivalent to nearly USD 0.5 billion, driven by strong automotive, tooling, and electronics manufacturing activity.

EDM oils and fluids are critical dielectric media used in electrical discharge machining. They insulate electrodes, flush away metal debris, and manage heat during machining. High flash point, stable oxidation behavior, and controlled viscosity make these fluids essential for maintaining dimensional accuracy when machining hard metals and alloys.

Market demand closely follows industrial investment cycles. Continued hydrocarbon development is supporting feedstock availability, highlighted by reports that Nigeria and other regions hold access to nearly USD 40 billion in oil reserves as foreign banks exit the sector. In parallel, higher allocations to strategic petroleum reserves in Budget 2025 and BPH Energy Ltd’s USD 2.25 million capital raise for hydrocarbon projects strengthen long-term supply confidence.

Additional momentum comes from Turkey securing rights to 90% of oil and gas output in Somalia, improving global supply visibility. On the innovation side, opportunities are forming through alternative feedstocks, including GrainCorp’s venture arm backing a synthetic palm oil startup with a USD 1.2 million pre-seed round, and resilience-focused funding such as First Brands gaining access to the final USD 600 million in emergency funds.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-edm-oils-fluids-market/request-sample/

Key Takeaways

- The Global EDM Oils/Fluids Market is expected to be worth around USD 2.1 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- In the EDM Oils/Fluids Market, hydrocarbon oils dominate with 58.3%, due to stability, cooling efficiency, and availability.

- Die sinking leads the EDM Oils/Fluids Market at 55.2%, driven by precision mold manufacturing and tooling demand.

- Automotive accounts for 44.7% of the EDM Oils/Fluids Market, supported by precision component machining needs.

- In the Asia Pacific, EDM Oils/Fluids demand reflects a 41.7% share reaching USD 0.5 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=168876

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.3 Billion |

| Forecast Revenue (2034) | USD 2.1 Billion |

| CAGR (2025-2034) | 4.9% |

| Segments Covered | By Product Type (Hydrocarbon Oils, Synthetic Oils, Vegetable Oils, Others), By Application (Die Sinking, Wire Cutting, Drilling, Others), By End-User (Automotive, Aerospace, Medical, Electronics, Others) |

| Competitive Landscape | ExxonMobil, Shell, TotalEnergies, Chevron, BP, Idemitsu Kosan, FUCHS Lubricants, Petro-Canada Lubricants, Castrol, Quaker Houghton |

Key Market Segments

By Product Type Analysis

In 2024, hydrocarbon oils held a dominant position in the By Product Type segment of the EDM oils and fluids market, accounting for a 58.3% share. Their leadership is driven by long-term industry trust and consistent performance in electrical discharge machining applications. These oils provide dependable electrical insulation, stable spark behavior, and efficient heat control, which are critical when machining hard and complex metals.

Hydrocarbon oils also feature balanced viscosity, allowing smooth removal of eroded particles and helping preserve surface finish and dimensional accuracy. Their compatibility with existing EDM equipment reduces operational disruptions, as most machines are already optimized for these fluids. This avoids additional costs linked to system modifications or process redesigns.

Manufacturers continue to favor hydrocarbon oils because they deliver predictable results across different workloads, from precision tooling to large-scale production. As EDM processes become more demanding, their proven stability and ease of use sustain their strong market position within this segment.

By Application Analysis

In 2024, die sinking dominated the By Application segment of the EDM oils and fluids market, holding a 44.7% share. This leading position is driven by the widespread use of die-sinking EDM for manufacturing complex cavities, fine edges, and intricate shapes that conventional machining methods cannot easily produce.

EDM oils and fluids are essential in die-sinking operations, as they support stable spark formation and effective flushing of eroded metal from narrow machining areas. Consistent dielectric behavior is critical to maintaining dimensional precision and surface quality, particularly in mold making and high-accuracy tooling applications.

Rising demand for detailed, tight-tolerance components across automotive, aerospace, and industrial tooling sectors continues to reinforce the importance of die sinking. As part complexity increases, this application remains a key contributor to steady EDM oil and fluid consumption within the market.

By End-User Analysis

In 2024, the automotive sector led the end-user segment of the EDM oils and fluids market, capturing a 44.7% share. This dominance reflects the industry’s heavy dependence on EDM for producing high-precision components, including gears, fuel system parts, molds, and specialized tooling.

EDM oils and fluids play a vital role in automotive manufacturing by enabling controlled spark behavior, accurate material removal, and uniform surface finishes, particularly when working with hardened steels and advanced alloys. High-volume production lines require stable and repeatable machining conditions, which strengthens demand for reliable dielectric fluids.

As modern vehicle designs adopt tighter tolerances and more complex geometries, EDM remains a critical manufacturing process. This ongoing shift continues to position the automotive industry as a major contributor to sustained consumption of EDM oils within the end-user segment.

Regional Analysis

Asia Pacific dominates the EDM oils and fluids market with a 41.7% share, valued at USD 0.5 Bn. This leadership is driven by a strong manufacturing ecosystem spanning automotive components, electronics, tooling, and industrial machinery. Widespread use of electrical discharge machining for high-precision production supports steady consumption of EDM oils, while expanding industrial clusters and investments in advanced manufacturing reinforce regional growth.

North America represents a mature, technology-focused market, where EDM fluids are essential in aerospace, medical devices, and precision engineering. High automation levels and strict quality standards sustain stable demand.

Europe follows closely, supported by established mold-making and industrial equipment sectors. Focusing on accuracy and surface finish keeps EDM fluids relevant.

The Middle East & Africa are gradually expanding as metal fabrication and industrial workshops grow.

Latin America exhibits emerging potential, driven by increasing automotive and tooling activities that boost EDM oil usage.

Top Use Cases

- Spark Control and Insulation: EDM oils act as a dielectric fluid between the tool and workpiece, allowing controlled electrical sparks that remove material without direct contact. They prevent unintended arcing and protect the part during machining.

- Cooling Hot Zones: During EDM, intense heat is created by electrical discharges. EDM fluids absorb and carry away this heat, preventing overheating and helping maintain accurate dimensions and stable machining.

- Debris Removal (Flushing): As material erodes, tiny particles form in the gap. EDM oils help flush these eroded particles away so they don’t interfere with the spark process, improving surface quality.

- Precision Finishing for Complex Shapes: EDM, when combined with the right fluids, can machine sharp corners, deep cavities, and fine details that traditional cutting tools struggle to achieve—making it useful in molds, dies, and aerospace parts.

- Manufacturing Aerospace Components: In aerospace, EDM fluids support making high-precision engine parts, turbine components, and structurally complex elements from hard alloys that resist conventional machining.

- Automotive and Electronics Part Production: EDM—with the right dielectric fluids—is widely used to make automotive parts (like fuel components and gears) and intricate electronic connectors and micro parts, where tight tolerances are essential.

Recent Developments

- In June 2025, BP started the formal sale process for its Castrol lubricants unit, a major move that may change product ownership and direction for lubricant and specialty fluids.

- In April 2025, Idemitsu completed the expansion of its pilot production of solid electrolytes (materials used in next-generation batteries), and plans further mass-production development.

Conclusion

The EDM oils and fluids market shows steady progress, supported by growing demand for precision machining across automotive, aerospace, tooling, and electronics industries. These fluids remain essential for maintaining spark stability, heat control, and surface quality when machining hard and complex materials. Ongoing industrial expansion, especially in manufacturing-focused regions, continues to sustain consumption.

At the same time, innovation in base oils, synthetic formulations, and cleaner fluid technologies is improving performance and operational safety. As machining requirements become more complex and quality standards rise, reliable EDM oils and fluids will remain a critical input, reinforcing the market’s long-term relevance and stable growth outlook.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)