Table of Contents

Overview

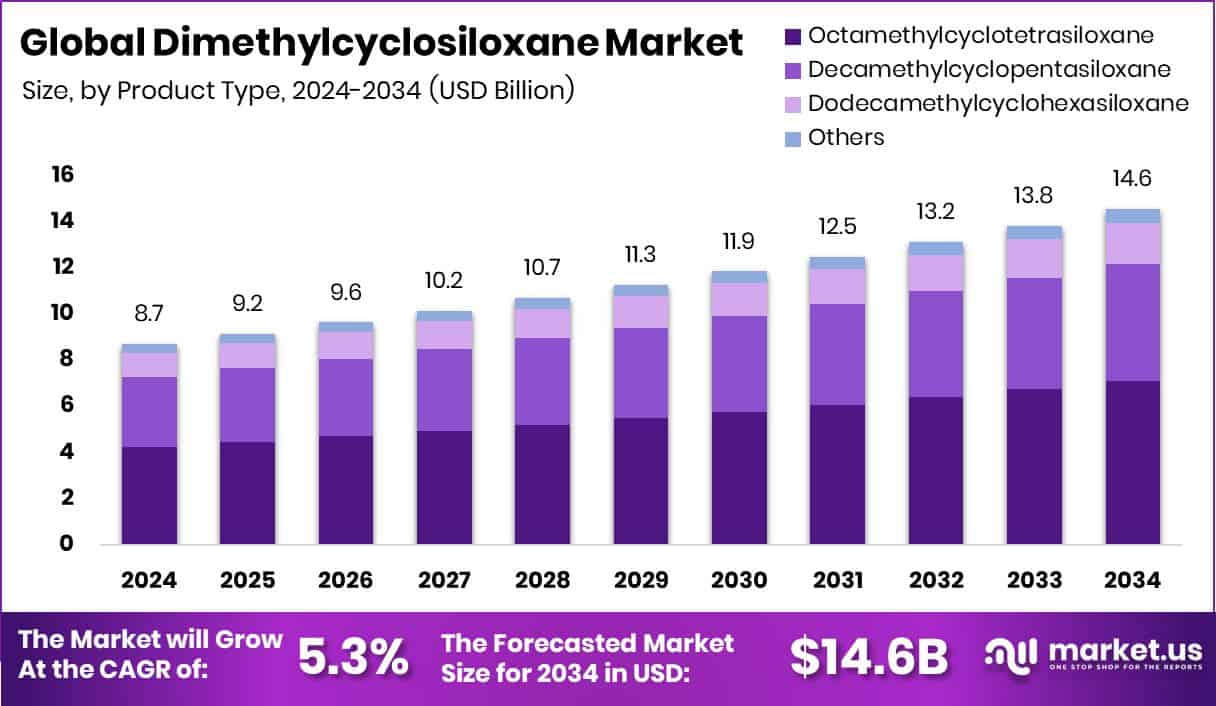

New York, NY – October 14, 2025 – The global dimethylcyclosiloxane (DMC) market is poised to climb from roughly USD 8.7 billion in 2024 to about USD 14.6 billion by 2034, reflecting a CAGR of 5.3% over 2025–2034. Growth is underpinned by rising silicone-based manufacturing across the Asia-Pacific region, where demand continues to surge.

Functioning as a key intermediate, DMC feeds into the production of high-performance polymers and functional silicones used across personal care, electronics, aerospace, and industrial coatings. Its trajectory is closely linked to downstream sectors: expansion in electronics, cosmetics, automotive, and construction fuels adoption, while downturns in consumer goods or infrastructure can dampen use. Cost pressures stem from fluctuations in raw silicon inputs, competitive supply dynamics among major silicone producers, and evolving regulations targeting volatile cyclic siloxanes for health or environmental concerns.

A standout opportunity is the development of cleaner, low-emission production routes or recycled DMC variants. In Europe, for example, Elkem received EUR 1.8 million to explore CO₂-free silicon manufacture, potentially lowering the upstream footprint of the silicone chain.

Meanwhile, capital allocation toward advanced materials is growing—Cottonwood Technology Fund raised €25 million for hard-tech startups, and General Catalyst’s acquisition of Venture Highway signals plans to deploy $1 billion into Indian tech innovation. These funding streams may catalyze breakthroughs in siloxane recycling, alternative chemistries, or eco-friendly DMC offerings.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-dimethylcyclosiloxane-market/

Key Takeaways

- The Global Dimethylcyclosiloxane Market is expected to be worth around USD 14.6 billion by 2034, up from USD 8.7 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- In 2024, Octamethylcyclotetrasiloxane held a 48.7% share in the dimethylcyclosiloxane market, showcasing dominance.

- In 2024, silicone oils captured 44.1% of the Dimethylcyclosiloxane Market, driving substantial consumption.

- Cosmetics and personal care dominated the dimethylcyclosiloxane market with a 49.2% share in 2024.

- The Asia-Pacific market value reached approximately USD 2.8 billion, showcasing strong industrial demand.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=160954

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 8.7 Billion |

| Forecast Revenue (2034) | USD 14.6 Billion |

| CAGR (2025-2034) | 5.3% |

| Segments Covered | By Product Type (Octamethylcyclotetrasiloxane, Decamethylcyclopentasiloxane, Dodecamethylcyclohexasiloxane, Others), By Application (Silicone Oils, Silicone Rubbers, Silicone Resins), By End Use (Cosmetics and Personal Care, Pharmaceuticals, Electronics, Textiles, Automotive, Others) |

| Competitive Landscape | Hubei Shengbangfan International Trade Co., Ltd, Zhejiang Sucon Silicone Co., Ltd., ALSTONE INDUSTRIES PVT. LTD, Anhui Techchem Industrial Co., Ltd, Jiangxi Huahao Chemical Engineering Limited Corporation, Hubei Zhuoxuanyang International, Others |

Key Market Segments

By Product Type Analysis

In 2024, Octamethylcyclotetrasiloxane dominated the Dimethylcyclosiloxane Market by Product Type, capturing a 48.7% share. It functions as a vital intermediate for producing silicone fluids, resins, and elastomers widely applied in personal care, electronics, and industrial uses. Its excellent thermal stability, low surface tension, and high compatibility with organic materials have strengthened its position across performance-driven sectors.

The compound’s increasing integration into eco-friendly formulations and specialty coatings further reinforces its dominance. Moreover, its essential role in manufacturing low-emission silicone systems highlights its contribution to sustainable development within the siloxane industry. These attributes make Octamethylcyclotetrasiloxane indispensable in advancing both efficiency and environmental compliance across the global Dimethylcyclosiloxane value chain.

By Application Analysis

In 2024, Silicone Oils led the Dimethylcyclosiloxane Market by Application, securing a 44.1% share. Produced from dimethylcyclosiloxane, these oils are valued for their exceptional lubricating ability, thermal stability, and dielectric strength, making them vital across automotive, electronics, and cosmetics sectors. Their growing use as defoamers, release agents, and conditioning components in industrial and personal care formulations continues to fuel market growth.

The segment’s dominance is reinforced by the rising demand for high-performance, low-volatility materials that meet environmental safety standards. Additionally, advancements in sustainable production methods and the development of high-purity silicone oil grades further strengthen its leadership, ensuring continued relevance within the evolving Dimethylcyclosiloxane market ecosystem.

By End Use Analysis

In 2024, Cosmetics and Personal Care emerged as the leading end-use segment in the Dimethylcyclosiloxane Market, commanding a 49.2% share. The compound’s lightweight texture, smooth spreadability, and controlled volatility make it highly desirable for use in skin creams, serums, hair conditioners, and deodorants. Its capacity to deliver a silky, non-greasy finish while improving product stability and sensory appeal has driven its broad adoption by cosmetic manufacturers.

The segment’s strength is further supported by rising consumer demand for premium, durable personal care formulations and the growing trend toward high-performance, skin-friendly silicone ingredients. As beauty brands prioritize innovation and comfort, dimethylcyclosiloxane remains a crucial building block in next-generation cosmetic and grooming solutions.

Regional Analysis

In 2024, Asia-Pacific dominated the global Dimethylcyclosiloxane Market, holding a 32.8% share valued at USD 2.8 billion. The region’s leadership stems from rapid industrialization, expanding electronics manufacturing, and growing personal care consumption across China, Japan, South Korea, and India. Strong demand for silicone-based materials in automotive, construction, and skincare applications continues to propel growth, supported by government incentives for advanced material innovation and favorable manufacturing policies.

North America ranks next, driven by technological advancement and increased use of silicone intermediates in healthcare and industrial sectors. Europe retains a significant position through its focus on eco-friendly silicone production and strict environmental compliance.

Meanwhile, the Middle East & Africa benefit from rising infrastructure investment, and Latin America sees steady progress in personal care and industrial uses. Collectively, these dynamics reaffirm Asia-Pacific’s commanding presence and balanced global market expansion.

Top Use Cases

- Silicone Polymer Precursor: DMC is used as a key building block in making silicone oils, rubbers, and resins—by ring-opening polymerization, it forms longer siloxane chains that get turned into flexible, heat-resistant materials used in many industries.

- Cosmetics & Skin/Hair Care: In lotions, creams, serums, and conditioners, DMC-derived silicones improve spreadability, give a non-greasy finish, and enhance the stability of the formula. They help deliver a smooth sensory feel in beauty products.

- Dielectric/Insulating Fluids in Electronics: Because DMC-based silicones have high electrical insulation and stability, they are used as dielectric fluids to protect and cool electronic devices and circuit boards without conducting electricity.

- Textile & Fabric Treatment: DMC-derived silicones can be used in fabrics as softening agents, imparting smoothness, water repellence, and a better feel to textiles.

- Rubber & Sealing Products (Packing & Elastomers): DMC is a precursor in making silicone rubber seals, gaskets, and elastomers, which are used for durable, temperature-resistant seals in machines, electronics, or medical devices.

Recent Developments

- In February 2025, CARE Ratings published a press release on Alstone Manufacturing Private Limited (an entity in the Alstone group) about its financial status, though it states nothing about launching a DMC product or an acquisition in the silicone segment.

- In January 2025, the U.S. FDA updated an import alert (45-02) that affects products from Anhui (potentially including its chemical lines), which could impact its export or supply chain operations.

Conclusion

The Dimethylcyclosiloxane market continues to evolve as a vital part of the global silicone value chain. Its wide use across personal care, automotive, construction, and electronics highlights its industrial importance. With increasing focus on sustainable materials, manufacturers are moving toward cleaner production and eco-friendly silicone solutions.

Growing innovation in low-emission silicones, improved processing efficiency, and advanced formulations are shaping the market’s future direction. Continuous investments in research, coupled with supportive environmental regulations, are driving product diversification and performance enhancement. Overall, the market remains strong, supported by technological progress and the steady demand for versatile, high-performance silicone intermediates.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)