Table of Contents

Overview

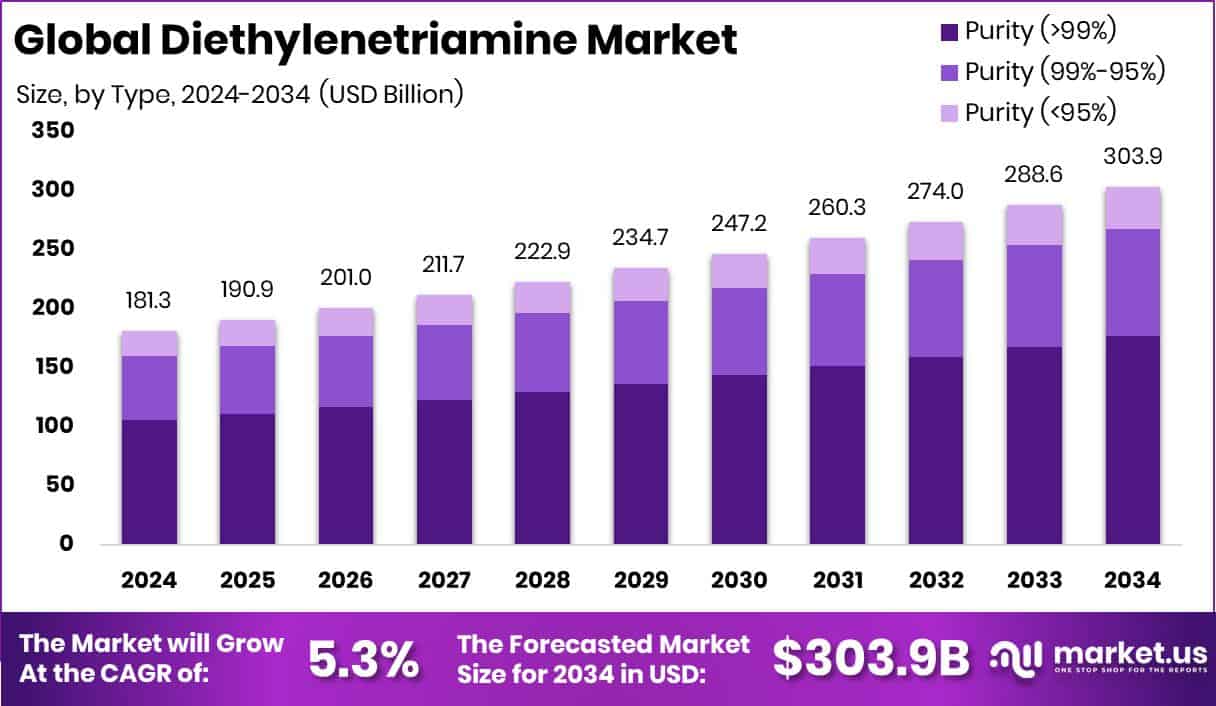

New York, NY – Dec 02, 2025 – The global Diethylenetriamine market is on a steady upward path, projected to reach USD 303.9 billion by 2034, rising from USD 181.3 billion in 2024, with a 5.3% CAGR between 2025 and 2034. Asia Pacific leads demand with a 43.90% share, valued at USD 79.5 billion, supported by strong industrial manufacturing and energy-related activity.

Diethylenetriamine is a clear, strongly alkaline compound widely used as an intermediate in resins, adhesives, lubricants, surfactants, fuel additives, and corrosion-control chemicals. Its high reactivity with acids and epoxies makes it essential in epoxy curing agents, paper wet-strength resins, and coatings, helping industries enhance durability and chemical performance.

Market growth is closely linked to expanding use in epoxy systems, fuel-treatment solutions, and advanced lubricants. Broader industrial innovation also reinforces demand. For example, Quantica’s €19.7 million Series A funding strengthens additive manufacturing ecosystems that rely on high-performance chemical inputs.

Energy-linked funding continues to support market stability. FuelGems’ USD 900K raise and Sinopec’s USD 690 million fund highlight ongoing investments in performance-enhancing additives. On the policy side, the U.S. allocation of USD 40 billion in fossil-fuel subsidies and USD 73 billion in continued bank financing, alongside Norway’s €1.7 trillion oil fund allocation challenges, underline sustained activity in sectors where specialty amines like diethylenetriamine remain critical.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-diethylenetriamine-market/request-sample/

Key Takeaways

- The Global Diethylenetriamine Market is expected to be worth around USD 303.9 billion by 2034, up from USD 181.3 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- The Diethylenetriamine Market is dominated by Purity (>99%), holding a 58.2% share in 2024.

- The Diethylenetriamine Market is dominated by Polyamide Resins applications, capturing a 28.9% share globally.

- The Diethylenetriamine Market is dominated by the Oil and Gas sector, securing a strong 31.7% share.

- The Asia Pacific records a substantial market value of USD 79.5 Bn today.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=166766

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 181.3 Billion |

| Forecast Revenue (2034) | USD 303.9 Billion |

| CAGR (2025-2034) | 5.3% |

| Segments Covered | By Type (Purity (>99%), Purity (99%-95%), Purity (<95%)), By Application (Polyamide Resins, Lube Oil Additives, Fuel Additives, Corrosion Inhibitors, Chelating Agents, Additives, Wet-Strength Resins, Surfactants, Epoxy Curing Agents, Ion Exchange Resins, Others), By End-Use Industry (Oil and Gas, Personal Care and Cosmetics, Building and Construction, Paper and Pulp, Marine, Adhesives and Sealants, Automotive, Textiles, Others) |

| Competitive Landscape | BASF SE, Delamine, Diamines and Chemicals Ltd., The Dow Chemical Company, Tosoh Corporation, Huntsman Corporation, Arabian Amines Company, AkzoNobel N.V |

Key Market Segments

By Type Analysis

In 2024, the Purity (>99%) category led the By Type segment of the Diethylenetriamine Market, accounting for a 58.2% market share. This dominance reflects strong industry preference for high-purity materials where consistent chemical behavior is critical. Manufacturers rely on this grade to achieve stable reactions and predictable performance, particularly in resins, surfactants, and fuel additive formulations, where even minor impurities can affect product quality.

The >99% purity grade supports cleaner processing, minimizes contamination risks, and helps improve final product reliability. Its chemical stability makes it well suited for advanced material systems that demand tight formulation control and dependable outcomes. As industries place greater emphasis on efficiency, durability, and reduced production errors, demand continues to shift toward high-specification raw materials.

By Application Analysis

In 2024, Polyamide Resins dominated the By Application segment of the Diethylenetriamine Market, capturing a 28.9% share. This leading position is driven by the crucial role diethylenetriamine plays as a core intermediate in manufacturing high-performance polyamide resins. These resins are widely used in coatings, adhesives, and industrial protective layers, where strength and consistency are essential.

Industries value polyamide resins for their high durability, chemical resistance, and flexibility, making them suitable for demanding operating conditions. Diethylenetriamine enhances resin structure, helping improve bonding performance and long-term reliability. As manufacturers increasingly focus on materials that reduce maintenance and extend product life, this application remains highly attractive.

The sustained 28.9% market share highlights the continued importance of polyamide resin applications. Steady industrial demand and ongoing use across diverse processing environments ensure this segment remains a stable and essential contributor to overall diethylenetriamine consumption.

By End-Use Industry Analysis

In 2024, the Oil and Gas sector led the By End-Use Industry segment of the Diethylenetriamine Market, holding a 31.7% market share. This strong position is driven by the compound’s widespread use in corrosion inhibitors, chelating agents, and fuel-treatment formulations across drilling, refining, and pipeline systems.

Diethylenetriamine plays a vital role in protecting metal equipment, improving fluid stability, and supporting cleaner processing under harsh operating conditions. Its ability to perform reliably in high-pressure and corrosive environments makes it a preferred chemical input for both upstream and downstream activities. The sector depends on it to reduce maintenance risks and extend asset life.

The sustained 31.7% share underscores how closely integrated diethylenetriamine is within oil and gas operations. Ongoing energy production and infrastructure usage continue to secure its importance as a dependable support chemical in industrial and energy-focused applications.

Regional Analysis

Asia Pacific leads the Diethylenetriamine Market with a 43.90% share, valued at USD 79.5 billion, supported by its strong industrial foundation, large-scale manufacturing, and steady demand from resins, coatings, construction, and energy-related applications. Ongoing infrastructure development and high chemical production capacity continue to reinforce the region’s dominant position.

North America follows with stable consumption, driven by well-established chemical processing industries and consistent demand from end-use sectors that depend on performance-focused materials. Europe maintains balanced growth as regulatory frameworks encourage the adoption of efficient chemical intermediates in adhesives, coatings, and engineered material systems.

The Middle East & Africa market gains support from expanding energy operations and industrial activity, sustaining demand for chemicals that enhance operational reliability. Latin America shows gradual advancement, as manufacturers increasingly adopt materials that improve process stability, durability, and overall production performance, supporting steady market development across the region.

Top Use Cases

- Epoxy curing agent for coatings and adhesives: DETA is widely used as a hardener for epoxy resins. When mixed with epoxy, it reacts quickly to form a strong, cross-linked network — making coatings, adhesives, or industrial flooring hard, chemically resistant, and durable.

- Corrosion inhibitor and fuel/lubricant additive: In fuel, oil, and petrochemical applications, DETA helps prevent metal corrosion and stabilizes fluids. That protects pipelines, storage tanks, engines, and equipment — especially under harsh conditions.

- Chelating agent for water treatment and detergents: DETA is a precursor for chelating agents that bind unwanted metal ions (like calcium or magnesium). This makes it useful in water treatment or detergent formulations, improving water softening and cleaning efficiency.

- Surfactants and detergent/fabric-softener production: DETA is used to produce surfactants and fabric softeners, helping create cleaning agents and textile-care products that emulsify dirt, soften fabrics, and improve washing performance.

- Wet-strength resins for paper and packaging: In paper and packaging industries, DETA is used to make resins that reinforce paper products. These make paper items, like packaging materials or tissues, stronger — especially important when exposed to water or humidity.

- Intermediate for polyamide and other specialty resins / industrial materials: DETA serves as a building block in creating polyamide resins and other engineered polymers. These resins are used in coatings, adhesives, inks, and protective layers — giving final products toughness, flexibility, and chemical resistance.

Recent Developments

- In November 2025, BASF started production of the first products from the core of its new large-scale Verbund site in Zhanjiang, China — a major investment project with multiple downstream plants, aimed to serve high-growth markets in Asia Pacific.

- In August 2025, Tosoh reported its quarterly consolidated results—sales decreased, and production was partially affected by scheduled maintenance at its “Nanyo Complex.”

Conclusion

The Diethylenetriamine market continues to hold an important position across multiple industrial value chains due to its wide functional use and reliable chemical performance. Its role as a building block in resins, coatings, fuel additives, and corrosion-control applications keeps demand stable across energy, manufacturing, and specialty chemical sectors.

Industries value this compound for improving durability, efficiency, and operational reliability in demanding environments. Ongoing industrial activity, energy production needs, and materials innovation support long-term relevance for diethylenetriamine.

As manufacturers focus on performance consistency and process efficiency, the market remains resilient. Overall, the outlook reflects sustained industrial dependence on versatile amine chemistry rather than short-term shifts, ensuring steady application across traditional and emerging uses.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)