Table of Contents

Overview

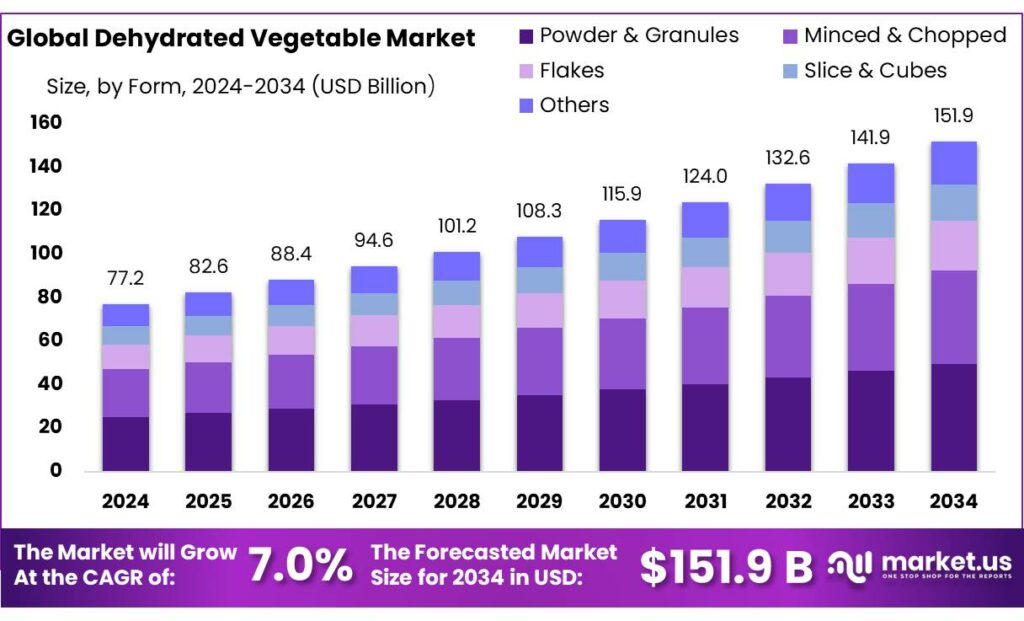

New York, NY – September 16, 2025 – The Global Dehydrated Vegetable Market is projected to grow significantly, reaching an estimated value of USD 151.9 billion by 2034 from USD 77.2 billion in 2024, with a robust CAGR of 7.0% during the forecast period from 2025 to 2034. In 2024, the Asia-Pacific region dominated the market, capturing a 42.9% share and generating USD 33.1 billion in revenue.

In India, the dehydrated vegetable industry has become a vital component of the food processing sector, driven by advancements in preservation technologies and growing consumer demand for convenient, shelf-stable, and health-conscious food products. As the world’s second-largest vegetable producer, India faces challenges due to the perishable nature of its produce, which dehydration effectively addresses by extending shelf life and lowering transportation costs.

Commonly dehydrated vegetables include onions, garlic, tomatoes, carrots, okra, green peas, and spinach, which are widely used in ready-to-eat meals, soups, snacks, and seasoning blends. Despite India’s vast vegetable production, only 2.2% of its produce is processed, compared to 30% in Brazil and 70% in the USA, highlighting significant growth potential for the dehydration industry.

The Indian government’s Dhan-Dhaanya Krishi Yojana, launched in July 2025, supports this sector by allocating ₹24,000 crore annually from 2025–26 to improve crop yields, storage, irrigation, and diversification, thereby enhancing raw material availability for dehydration. Additionally, the National Centre for Cold-chain Development (NCCD) plays a crucial role in reducing post-harvest losses by improving cold chain infrastructure. Currently, only 15% of fruits and vegetables access cold storage, and less than 5% utilize precooling or cold-chain transport, indicating substantial opportunities for further development.

Key Takeaways

- Dehydrated Vegetable Market size is expected to be worth around USD 151.9 billion by 2034, from USD 77.2 billion in 2024, growing at a CAGR of 7.0%.

- Onions held a dominant market position, capturing more than a 21.2% share in the Dehydrated Vegetable Market.

- Powder & Granules held a dominant market position, capturing more than a 32.6% share in the Dehydrated Vegetable Market.

- Air Drying held a dominant market position, capturing more than a 38.4% share in the Dehydrated Vegetable Market.

- Food Manufacturers held a dominant market position, capturing more than a 59.7% share in the Dehydrated Vegetable Market.

- Asia-Pacific (APAC) emerged as the dominant region in the Dehydrated Vegetable Market, capturing 42.9% of the global share with a market value of USD 33.1 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/dehydrated-vegetable-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 77.2 Billion |

| Forecast Revenue (2034) | USD 151.9 Billion |

| CAGR (2025-2034) | 7.0% |

| Segments Covered | By Product Type (Carrot, Onions, Potatoes, Broccoli, Beans, Peas, Cabbage, Mushrooms, Tomatoes, Others), By Form (Powder and Granules, Minced and Chopped, Flakes, Slice and Cubes, Others), By Drying Method (Air Drying, Spray Drying, Freeze Drying, Drum Drying, Vacuum Drying), By End Use (Food Manufacturers, Foodservice, Retail), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Food and Drink Specialty Stores, Online, Others) |

| Competitive Landscape | Olam International, Symrise AG, BC Foods, Inc., Natural Dehydrated Vegetables Pvt. Ltd, Real Dehydrated Pvt Ltd, Green Rootz, Silva International, Inc, Van Drunen Farms, Rosun Groups, Mevive International Food Ingredients |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156424

Key Market Segments

By Product Type Analysis

Onions Lead with 21.2% Market Share in 2024

In 2024, onions commanded a leading 21.2% share of the Dehydrated Vegetable Market, driven by their widespread use in food processing, ready-to-eat meals, soups, and spice blends. Their popularity stems from a long shelf life, consistent flavor, and cost-effectiveness compared to fresh onions, making them a staple for both consumers and food producers. The growing demand for convenience foods, fueled by busy lifestyles, further solidifies their role across various cuisines.

Dehydrated onions are poised to maintain strong demand, supported by the global rise in packaged and instant food consumption. Their ability to minimize waste while ensuring year-round availability enhances their appeal. Foodservice chains and households favor onion flakes, powders, and granules for their ease of storage and use, reinforcing onions as the cornerstone of the dehydrated vegetable market through the coming year.

By Form Analysis

Powder & Granules Hold 32.6% Share in 2024

In 2024, powder and granules captured a dominant 32.6% share of the Dehydrated Vegetable Market, valued for their versatility in instant soups, snacks, seasonings, bakery products, and ready-to-cook meals. Food manufacturers prefer this form for its seamless integration into recipes, uniform flavor, and reduced preparation time, while consumers appreciate its convenience and extended shelf life.

By 2025, powders and granules are expected to maintain their lead, driven by the global surge in demand for processed and packaged foods. The rise of healthier snacking and quick-service restaurants further boosts their popularity. Offering consistent taste, easy storage, and cost efficiency, this form will continue to dominate the dehydrated vegetable market, sustaining its pivotal role in food processing.

By Drying Method Analysis

Air Drying Leads with 38.4% Share in 2024

In 2024, air drying held a commanding 38.4% share of the Dehydrated Vegetable Market, favored for its ability to preserve natural taste and texture while remaining cost-effective and scalable. Widely used in soups, sauces, ready meals, and snacks, air-dried vegetables strike a balance between quality, affordability, and production efficiency for food processors.

Air drying is expected to retain its dominance, driven by growing demand for convenient, long-lasting food ingredients. Its capacity to handle large-scale production without compromising shelf stability aligns with the expanding food processing industry. Additionally, consumer preference for natural, minimally processed ingredients further cements air drying’s position as the leading method, ensuring its continued prominence in dehydrated vegetable production.

By End Use Analysis

Food Manufacturers Dominate with 59.7% Share in 2024

In 2024, food manufacturers accounted for a substantial 59.7% share of the Dehydrated Vegetable Market, leveraging dehydrated vegetables in soups, sauces, ready meals, instant noodles, and snacks. Their preference is driven by the ingredients’ ability to retain flavor, extend shelf life, and lower storage costs, ensuring efficiency and consistency in large-scale production.

Food manufacturers are expected to sustain their dominance as the global demand for convenience foods grows with urbanization and evolving lifestyles. The versatility of dehydrated vegetable forms like flakes, powders, and granules supports their widespread use, enabling manufacturers to maintain quality while optimizing costs. This segment will remain the driving force behind the dehydrated vegetable market’s growth.

By Distribution Channel Analysis

Hypermarkets & Supermarkets Lead with 39.3% Share in 2024

In 2024, hypermarkets and supermarkets held a leading 39.3% share of the Dehydrated Vegetable Market, driven by their ability to offer a wide range of products, including flakes, powders, and granules, under one roof. Established retail chains, attractive packaging, and in-store promotions enhance consumer trust and accessibility, boosting sales in this channel.

Hypermarkets and Supermarkets are expected to maintain their dominance as urbanization and busy lifestyles drive reliance on modern retail. Their capacity to provide bulk purchasing, consistent availability, and premium branded options ensures their edge. With rising demand for convenient meal solutions, these outlets will continue to lead, shaping consumer purchasing trends in the dehydrated vegetable market.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region dominated the Dehydrated Vegetable Market, holding a 42.9% share valued at USD 33.1 billion. This leadership is driven by the region’s robust agricultural foundation, increasing demand for convenience foods, and rapid growth in the food processing sector. Key contributors like China, India, and Japan benefit from expanding urban populations and rising disposable incomes, boosting the popularity of packaged and ready-to-eat foods.

Dehydrated onions, garlic, and leafy vegetables are particularly favored for their use in instant noodles, sauces, snacks, and traditional dishes. While North America sees steady growth due to health-conscious consumers and demand for plant-based, shelf-stable ingredients, and Europe benefits from regulatory support for natural and sustainably sourced foods, APAC’s combination of strong supply and high domestic consumption ensures its continued dominance.

Top Use Cases

- Convenience in Home Cooking: Dehydrated vegetables like onions and carrots make meal prep easy for busy families. Just add water to rehydrate them, and mix into soups, stews, or salads in minutes. They save time on chopping and keep flavor strong without spoiling quickly, helping households cut food waste while enjoying nutritious, quick dinners every day.

- Boosting Snacks and Healthy Bites: Food makers use dehydrated veggie powders in chips, bars, and trail mixes to create tasty, low-calorie snacks. These add crunch and natural taste without extra oils, appealing to health fans who want fiber and vitamins on the go. It’s a smart way to turn simple veggies into fun, portable treats that sell fast.

- Enhancing Processed Foods: In factories, dehydrated tomatoes and peppers go into sauces, canned goods, and instant meals for consistent flavor year-round. They lower costs by shrinking the weight for shipping and storage, while keeping nutrients intact. This helps big brands make reliable products that meet rising demand for easy, flavorful, ready-to-eat options worldwide.

- Supporting Outdoor and Travel Needs: Campers and hikers pack lightweight dehydrated veggies for backpacking meals, like adding flakes to rice or oatmeal. They rehydrate with minimal water, stay fresh for weeks, and provide essential vitamins without bulk. This makes them ideal for adventures, military use, or emergency kits, ensuring safe, simple nutrition far from home.

- Fighting Nutrient Shortfalls: Adding dehydrated greens like spinach to breads, dips, or baby foods helps tackle vitamin gaps in diets. They pack concentrated minerals and fiber into everyday eats, supporting heart health and digestion. For families in food-scarce areas, this affordable boost turns basic meals into powerful tools for better wellness and growth.

Recent Developments

1. Olam International

Olam Food Ingredients (OFI) is expanding its sustainable and traceable agricultural products. A key development is their AtSource platform, which provides detailed environmental and social impact data for their dehydrated vegetables and other products, catering to the growing demand for supply chain transparency. This allows clients to track products back to the farm level.

2. Symrise AG

Symrise AG continues to invest in natural, sustainable flavor solutions, including dehydrated vegetables. A recent focus is on expanding their product lines to meet clean-label demands in the EMEA and North American markets. They are leveraging advanced drying technologies to enhance the flavor profile and nutritional retention in their vegetable offerings for soups, snacks, and ready meals.

3. BC Foods, Inc.

BC Foods has recently emphasized expanding its organic dehydrated vegetable offerings. A significant development is the enhancement of their processing facilities to increase capacity for organic lines, directly responding to heightened market demand. They continue to focus on providing a wide range of conventional and organic dehydrated ingredients to global food manufacturers.

4. Natural Dehydrated Vegetables Pvt. Ltd

This India-based company has been focusing on infrastructure development. A key recent step is the modernization and expansion of their dehydration plant to increase production capacity and improve efficiency. This upgrade allows them to better serve both domestic and international markets with a wider range of high-quality dehydrated vegetables, including onion, garlic, and ginger.

5. Real Dehydrated Pvt Ltd

Real Dehydrated has recently strengthened its global export footprint, particularly in European and Middle Eastern markets. A core development is their increased focus on stringent quality control and certifications to meet international food safety standards. This ensures their dehydrated vegetables, like potatoes, tomatoes, and carrots, comply with the strict requirements of overseas buyers.

Conclusion

The Dehydrated Vegetables Sector is thriving amid fast-changing lifestyles and health priorities. Thanks to the demand for clean, plant-based snacks and convenient processing aids. Urban folks love their shelf life and nutrition punch, while innovations in drying tech keep quality high. Overall, this market promises steady gains, blending sustainability with tasty, everyday ease for global eaters.