Table of Contents

Overview

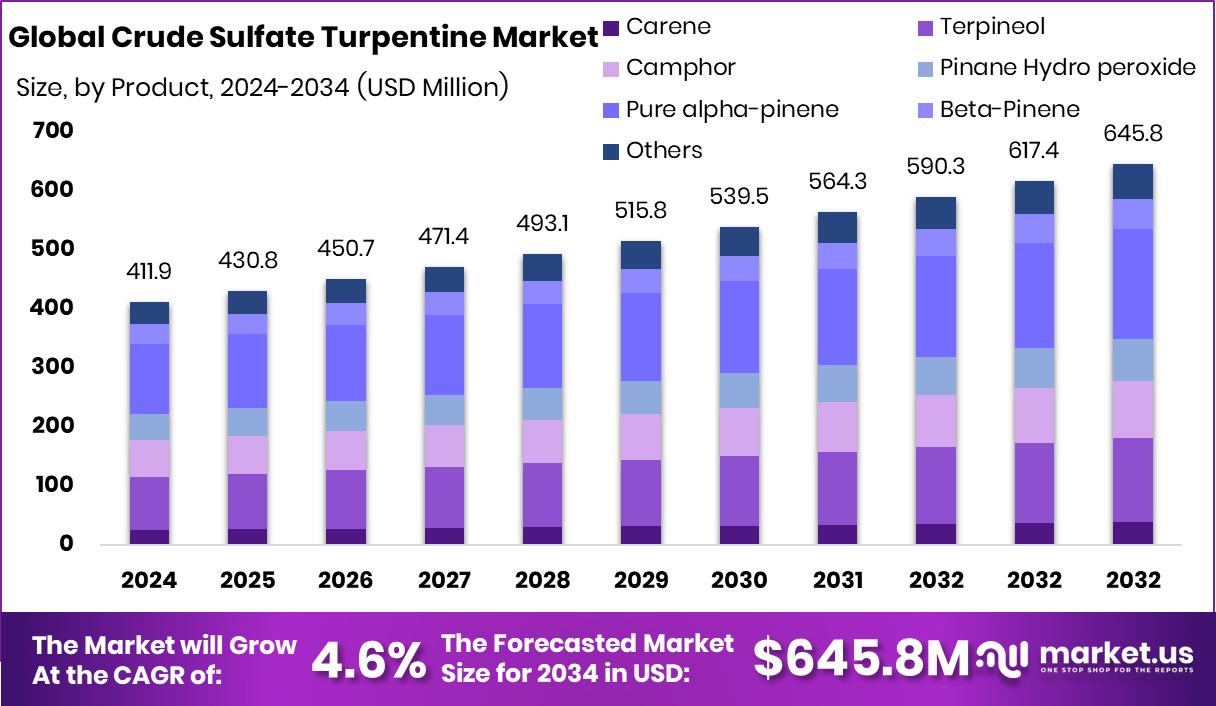

New York, NY – January 29, 2026 – The Global Crude Sulfate Turpentine (CST) Market is set to rise from USD 411.9 million in 2024 to USD 645.8 million by 2034, advancing at a steady 4.6% CAGR, with North America contributing a dominant USD 180.8 million and 43.90% share. CST remains an important renewable by-product of kraft pulping, valued for its alpha-pinene and beta-pinene content, which supports fragrances, solvents, resins, and several chemical intermediates. Its appeal continues to grow as industries prefer natural, biomass-based feedstocks over petroleum-derived inputs.

The broader innovation landscape is also uplifting CST demand. Material-focused and chemical ecosystem investments — such as Molekule’s $58M Series C, RISE’s $1M initiative, America Makes’ $4.5M award, Carbon’s $60M support, Alloyed’s £37M raise, and Australia’s $271M funding boost — indicate strong confidence in advanced material and manufacturing technologies. These expanding sectors rely on stable natural inputs, indirectly reinforcing CST’s relevance.

Growth opportunities also emerge from consumer-facing segments. New resin-rich product launches, such as Good Supply’s Monsters 1,000mg THC vapes, reflect rising formulation demand where CST-derived intermediates often contribute. Additional capital flows — €100M raised by Carne, Rs 31 crore secured by SK Minerals, and $300,000 raised through Coppin State University’s gala — signal active investment momentum, supporting the long-term development of CST-linked specialty material chains.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-crude-sulfate-turpentine-market/request-sample/

Key Takeaways

- The Global Crude Sulfate Turpentine Market is expected to be worth around USD 645.8 million by 2034, up from USD 411.9 million in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034.

- Pure alpha-pinene holds a 28.9% share, driving strong demand in the Crude Sulfate Turpentine Market.

- Aroma chemicals dominate with a 32.7% share, shaping value creation in the crude sulfate turpentine market.

- In this period, North America maintained 43.90% dominance with a USD 180.8 Mn value

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=171713

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 411.9 Million |

| Forecast Revenue (2034) | USD 645.8 Million |

| CAGR (2025-2034) | 4.6% |

| Segments Covered | By Product (Carene, Terpineol, Camphor, Pinane Hydro peroxide, Pure alpha-pinene, Beta-Pinene, Terpene Resins, Limonene), By Application (Additives, Adhesives, Solvents, Rubber Processing, Aroma Chemicals, Personal and Home Care Products, Others) |

| Competitive Landscape | dsm-firmenich, Ingevity, Kraton Corporation, ORGKHIM Biochemical Holding, Pine Chemical Group, International Flavors & Fragrances, Inc. (IFF), Symrise, Stora Enso |

Key Market Segments

By Product Analysis

Pure alpha-pinene remained the leading product category in 2024, securing a 28.9% share of the Crude Sulfate Turpentine Market. Its dominance reflects strong, ongoing demand from industries that depend on high-purity CST-derived components for chemical synthesis, fragrance creation, and resin manufacturing. The compound’s consistency, stability, and efficient conversion rates make it a preferred building block for downstream applications that require predictable performance.

Manufacturers increasingly prioritize purity, and alpha-pinene continues to stand out as a dependable raw material that supports streamlined processing and reliable output quality. Its broad applicability reinforces its position as the most influential product in the segment, shaping buyer preferences and contributing significantly to overall CST market stability. As industries maintain their shift toward natural, terpene-based inputs, the prominence of pure alpha-pinene remains firmly rooted in both supply chain value and end-user demand.

By Application Analysis

Aroma chemicals dominated the CST market’s application landscape in 2024, capturing a substantial 32.7% share. This leadership reflects the strong dependence of fragrance, flavor, home care, and personal care industries on CST-derived terpene inputs that deliver stable, natural aromatic profiles. As consumer brands increasingly prefer naturally sourced aroma ingredients, CST-based intermediates continue to be integral to their production pipelines.

Manufacturers rely on these terpene routes because they support high-quality formulation outcomes while aligning with clean-label and bio-based product trends. The segment’s dominance also highlights its pivotal role in driving CST consumption, as aroma chemicals remain the most value-rich and commercially consistent outlet for CST feedstocks. Supported by continuous demand from perfumery, FMCG products, and specialty formulations, the aroma chemicals category anchors the market and reinforces its long-term growth trajectory.

Regional Analysis

North America led the Crude Sulfate Turpentine Market with a 43.90% share valued at USD 180.8 million, driven by strong chemical processing activity and well-established CST integration in industrial applications. This dominant position shapes overall global demand patterns.

Europe remains a stable and mature market, supported by long-standing use of CST in fragrance, adhesives, and resin-based sectors. Asia Pacific continues to expand its footprint, benefiting from rapid industrialization and rising utilization of CST-derived materials across manufacturing hubs. The Middle East & Africa region is gradually increasing adoption as local industries begin incorporating CST-based inputs into processing activities.

Meanwhile, Latin America maintains steady participation through established supply chains and ongoing production demand. Collectively, these regions create a balanced global market structure, with North America continuing to serve as the core demand center due to its solid industrial base and consistent reliance on CST-linked chemical pathways.

Top Use Cases

- Fragrances & Scents: CST is used to make aroma ingredients found in perfumes, soaps, and personal care items. Its natural terpenes help give a rich, lasting scent base for many products people smell daily.

- Solvents for Paints & Coatings: The chemicals in CST act as solvents in paints, varnishes, and coatings. This means CST helps dissolve other ingredients and makes the finish smooth and easy to apply.

- Soap & Detergent Enhancer: In soap making, CST helps spread and hold fragrance evenly and can improve texture and foaming. It also acts as a mild solvent that supports mixing oils and surfactants.

- Raw Material for Resins and Adhesives: CST provides building blocks (like alpha-pinene) used to create resins and sticky adhesives. These are used in packaging, woodworking, and surface coatings.

- Chemical Feedstock for Terpene Derivatives: The turpentine in CST contains chemicals like alpha-pinene and beta-pinene. These are processed further into useful intermediates — like pine oil or limonene — for use in many industrial formulas.

- Eco-friendly Ingredient Substitute: Because CST comes from wood and not petroleum, it’s often used when companies want a more natural or sustainable raw material in place of synthetic chemicals.

Recent Developments

- In July 2025, IFF introduced ENVIROCAP™, a new scent delivery technology for laundry and fabric care products.

- In March 2024, Symrise formed a joint venture with the Virchow Group to make personal care ingredients in India. The new company — Vizag Care Ingredients Private Limited — began making cosmetic raw materials to serve APAC and beyond.

Conclusion

The Crude Sulfate Turpentine Market continues to move forward as industries lean toward cleaner, renewable, and natural chemical inputs. CST remains valuable because it comes from pine-based biomass and supports many fragrance, resin, adhesive, and solvent applications. Its role as a dependable feedstock helps manufacturers lower reliance on petroleum materials while maintaining steady product quality.

Growing interest in sustainable chemistry, along with advancements in processing technologies, supports CST’s long-term relevance. As more companies explore bio-based ingredient pathways, CST stands positioned as a practical and well-integrated option across industrial and consumer-linked sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)