Table of Contents

Overview

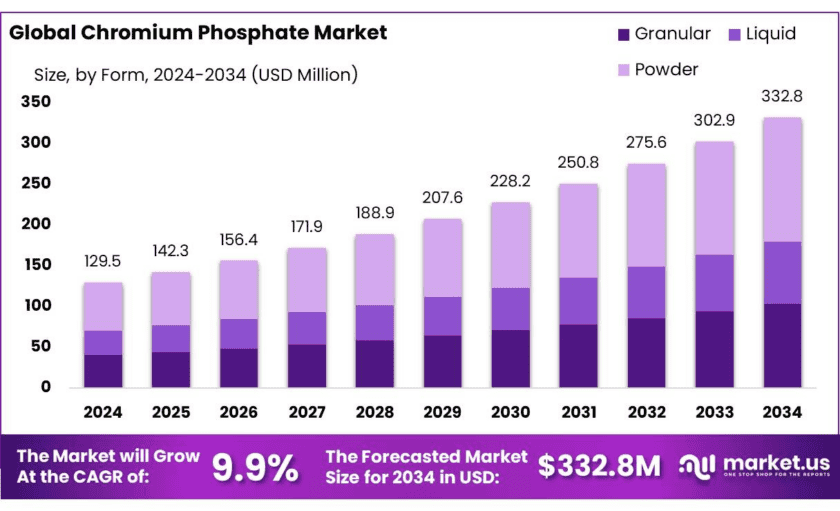

New York, NY – Oct 22, 2025 – The global Chromium Phosphate market is expanding rapidly, with its size expected to rise from USD 129.5 million in 2024 to USD 332.8 million by 2034, at a robust CAGR of 9.9% from 2025 to 2034. This growth is driven by increasing demand for corrosion-resistant coatings in construction, automotive, aerospace, and industrial sectors. Chromium phosphate’s ability to enhance durability, protect metal surfaces, and improve adhesion makes it a popular additive in paints, primers, and plating processes.

Market expansion is supported by urbanization and infrastructure development in regions such as Asia-Pacific, where architectural coatings and industrial coatings applications are surging. Opportunities also exist in emerging areas like medical coatings and catalyst usage in chemical manufacturing. As regulatory standards push for eco-friendlier, long-lasting materials, Chromium Phosphate remains a key ingredient in next-generation formulations. With broad applicability and growing market acceptance, this sector is well-positioned for sustained growth and new product innovation across diverse industries.

In 2024, Hexa-hydrated Chromium Phosphate led the market by type with a 43.2% share, while Industrial Grade dominated by grade with a 56.3% share. By product form, Powder held the largest share at 47.4%, and by application, Coatings & Paints accounted for 39.1% of the global chromium phosphate market. In 2024, the Asia Pacific (APAC) region led the global chromium phosphate market with a 45.8% share, valued at approximately USD 59.3 million.

How Growth is Impacting the Economy

The growth of the chromium phosphate market is positively impacting global economies by supporting high-value industries like automotive, aerospace, and infrastructure. As manufacturers seek durable, corrosion-resistant materials, chromium phosphate is widely used in protective coatings, metal treatment, and pigment applications. Its effectiveness in reducing maintenance costs and improving product longevity contributes to increased productivity and operational efficiency. In developing economies, especially in Asia-Pacific, rising industrial activity and infrastructure projects are creating local demand and encouraging investment in coating and material science technologies.

Additionally, growth in environmentally compliant manufacturing has opened doors for water-based systems using chromium phosphate, reducing harmful emissions and aligning with green regulations. These trends are enhancing competitiveness and driving innovation across supply chains. The economic impact is further amplified through job creation in chemical processing, packaging, and application services. As demand for industrial coatings rises globally, the chromium phosphate market contributes to both economic resilience and environmental responsibility.

Key Takeaways

- Chromium Phosphate Market size is expected to be worth around USD 332.8 Million by 2034, from USD 129.5 Million in 2024, growing at a CAGR of 9.9%.

- Hexa-hydrated Chromium Phosphate held a dominant market position, capturing more than a 43.2% share of the global chromium phosphate market.

- Industrial Grade held a dominant market position, capturing more than a 56.3% share of the global chromium phosphate market.

- Powder held a dominant market position, capturing more than a 47.4% share in the global chromium phosphate market.

- Coatings & Paints held a dominant market position, capturing more than a 39.1% share of the global chromium phosphate market.

- Asia Pacific (APAC) region emerged as the dominant force in the global chromium phosphate market, securing a substantial 45.8% market share, equivalent to approximately USD 59.3 million.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-chromium-phosphate-market/free-sample/

Experts Review

To stay competitive, companies should invest in R&D focused on eco-friendly and high-performance formulations of chromium phosphate, particularly for water-based systems. Expanding production of Hexa-hydrated and Industrial Grade variants can help meet rising demand in protective coatings. Businesses should also enhance supply chain efficiency by localizing distribution in high-growth regions like Asia-Pacific.

Collaborating with automotive and construction sectors will support long-term contracts. Developing powdered formulations with improved dispersion characteristics can attract coating manufacturers seeking consistent quality. Marketing strategies should emphasize corrosion resistance, regulatory compliance, and product lifecycle benefits to position chromium phosphate as a critical ingredient in durable surface solutions.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=150153

Key Market Segments

By Type

- Hexa-hydrated Chromium Phosphate

- Mesoporous Phase

- Films

- Amorphous Phase

By Grade

- Agricultural Grade

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

By Product Form

- Granular

- Liquid

- Powder

By Application

- Coatings & Paints

- Agriculture

- Automotive

- Construction

- Electronics

- Others

Regional Analysis

In 2024, the Asia Pacific (APAC) region led the global chromium phosphate market, capturing 45.8% of the market share, equivalent to around USD 59.3 million. This dominance is fueled by rapid urbanization, industrial expansion, and demand from high-growth sectors such as automotive, construction, and electronics. China, India, Japan, and South Korea are the key contributors, utilizing chromium phosphate in paints, metal treatment, and specialty coatings. Regional manufacturers benefit from cost-effective production, growing export opportunities, and strong domestic consumption. With continued infrastructure spending and evolving environmental regulations, APAC is expected to remain the leading market through the forecast period.

Top Use Cases

Anti-Corrosive Coatings: Chromium phosphate is widely used as a key ingredient in protective coatings for metals like steel, aluminum, and zinc. It helps create a tightly bonded, corrosion-resistant layer that improves primer adhesion and prolongs painted surfaces—ideal for automotive, marine, and industrial machinery applications.

Pigments in Decorative Finishes: Chromium phosphate serves as a pigment in inks, paints, and architectural coatings. These formulations offer strong color stability and environmental resistance, making them suitable for outdoor facades, interior decorative walls, and furniture finishes.

Wash Primers for Metal Pre-Treatment: Used as a wash primer, especially with acidic solutions, chromium phosphate preps metal surfaces before painting or plating. It enhances adhesion, prevents flash rust, and creates a reliable base for long-lasting coatings.

Catalyst in Chemical Reactions: Chromium phosphate acts as a catalyst in polymer and chemical manufacturing, such as in the alkylation of aromatic hydrocarbons. Its stability and performance help improve yields and process efficiency in specialty chemical production.

Conversion Coatings with Phosphates: In metal finishing, chromium phosphate helps form conversion coatings that enhance corrosion resistance and wear protection. These coatings serve as a durable base for lubricants, oils, or subsequent surface treatments.

Recent Developments

American Elements continues to expand its chromium phosphate portfolio, offering high-purity, submicron, and nanopowder grades designed for advanced industrial applications. These versatile forms—ranging from standard powder to ultrafine specialty compounds—aim to meet demand from high-performance coatings, catalysts, and battery sectors. The company emphasizes custom batch production and scalable availability to support evolving material science needs.

Brenntag SE has strengthened its role in chromium phosphate distribution and broader specialty chemicals through its recent acquisition of mcePharma (Czech Republic). Although focused on life sciences, this move enhances Brenntag’s logistics and formulation capabilities, which can be leveraged to distribute chromium phosphate-containing coatings and industrial products more effectively across Central Europe.

Chemetall continues to lead in surface treatment innovations by supplying chromium phosphate-based conversion and wash primers for diverse metals. Their product line includes advanced Al-activated pretreatments and “Chrome-free” alternatives that match or exceed traditional chromium phosphate performance—improving corrosion resistance while meeting stricter environmental standards.

CHEMOS remains a key global player in chromium phosphate reagents for analytical and industrial purposes. The company produces ready-to-use standards and specialty-grade compounds suitable for coating technologies, life-science research, and surface treatment processes. Their cleanroom-compatible products support precision applications requiring tight quality control.

While Merck’s recent announcements focus on microphysiological systems (MPS) for biomedical research, the company continues to supply analytical-grade chromium phosphate reagents for laboratories. Its materials support assay development and analytical workflows, particularly in environmental and water testing contexts. Merck maintains regulatory listings for phosphate and chromate testing, useful for compliance and quality control in coatings production.

Conclusion

The chromium phosphate market shows robust promise, driven by its strong performance in protective coatings, industrial applications, and environmentally compliant systems. As infrastructure, automotive, and aerospace sectors expand—and regulation favors greener solutions—chromium phosphate will remain a crucial component in material innovation and protective technologies, supporting both performance and environmental goals.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)