Table of Contents

Overview

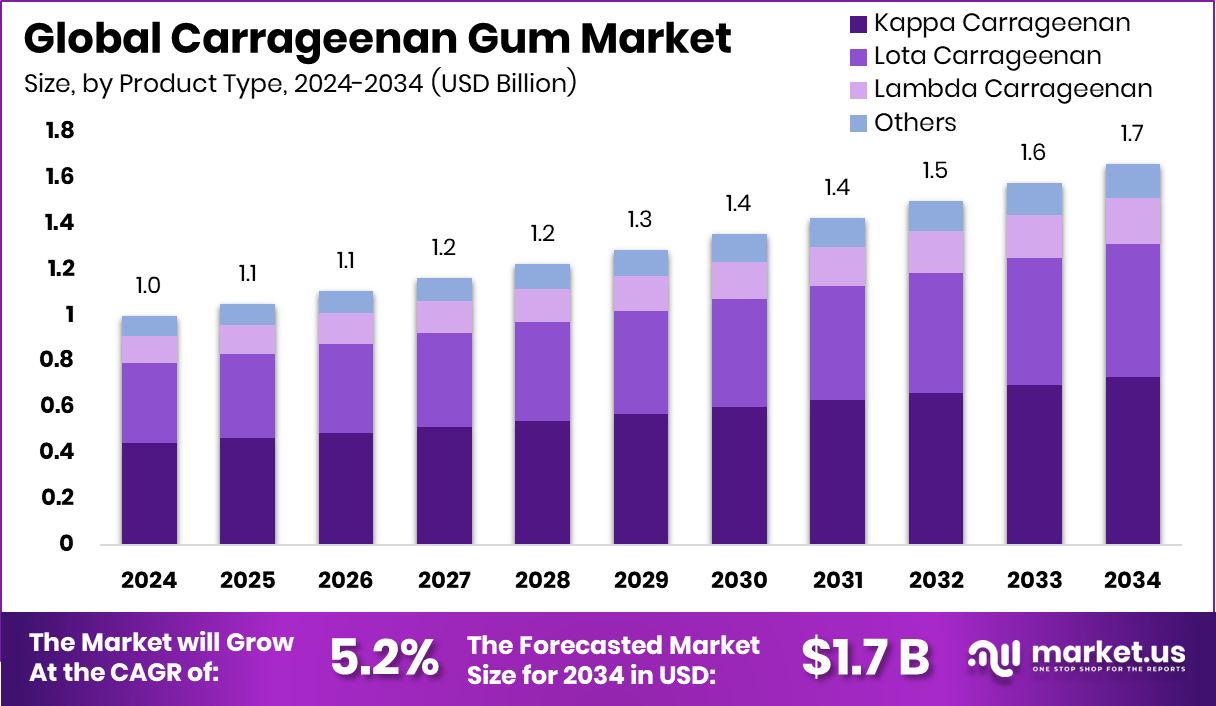

New York, NY – February 12, 2026 – The global carrageenan gum market is projected to reach about USD 1.7 billion by 2034, rising from USD 1.0 billion in 2024, with steady growth ahead. Europe currently holds a strong position, accounting for 48.20% of the market and generating around USD 0.4 billion in revenue. Carrageenan gum, derived from red seaweed, is widely used as a natural thickener and stabilizer in food, beverages, and personal care products. Its plant-based origin supports clean-label trends and growing consumer preference for recognizable, naturally sourced ingredients.

Market expansion is closely tied to the shift away from synthetic additives toward sustainable materials. A notable example is Bioweg securing USD 19 million in Series A funding to develop bio-based alternatives to microplastics, highlighting broader investment interest in seaweed-derived and biodegradable ingredients like carrageenan. Regulatory and policy changes are also shaping demand. Proposals such as a 6% alcohol tax and policy adjustments potentially costing over USD 225 million are encouraging manufacturers to reformulate products for better cost control and shelf stability.

Meanwhile, public sector actions—including USD 54,000 in alcohol control grants to Menlo Park Police Department, nearly USD 14 million raised in Anchorage through alcohol sales tax, and USD 3.3 million allocated by Nunavut for substance abuse prevention—reflect increasing oversight, indirectly supporting demand for stable, compliant product formulations.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-carrageenan-gum-market/request-sample/

Key Takeaways

- The Global Carrageenan Gum Market is expected to be worth around USD 1.7 billion by 2034, up from USD 1.0 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- In Carrageenan Gum Market, Kappa carrageenan dominates product types, holding 44.2% share globally today.

- Alkali treatment process leads processing technologies in Carrageenan Gum Market with 39.8% adoption worldwide.

- Thickening agent functionality accounts for 39.1% usage within the expanding Carrageenan Gum Market segment.

- Food and beverages remain the primary application, representing 63.5% of demand in the Carrageenan Gum Market globally.

- The European carrageenan gum industry reached USD 0.4 Bn, holding a strong 48.20% market share.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=172564

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.0 Billion |

| Forecast Revenue (2034) | USD 1.7 Billion |

| CAGR (2025-2034) | 5.2% |

| Segments Covered | By Product Type (Kappa Carrageenan, Lota Carrageenan, Lambda Carrageenan, Others), By Processing Technology (Alkali Treatment Process, Alcohol Precipitation, Gel-Press Filtration Process, Others), By Functionality (Thickening Agent, Gelling Agent, Stabilizer/Emulsifier, Texturizing Agent, Others), By Application (Food and Beverages, Personal Care and Toiletries, Pharmaceuticals, Others) |

| Competitive Landscape | Ingredion Incorporated, FMC Corporation, Ashland Global Holdings Inc., Meron Group, Macel Carrageenan Corporation, Cargill, Incorporated, W Hydrocolloids, Inc, Others |

Key Market Segments

By Product Type

In 2024, kappa carrageenan led the market with a 44.2% share, driven by its strong gelling performance and broad use in processed foods. It is widely applied in dairy products such as cheese, flavored milk, and desserts, where firm gel formation and product stability are essential. Its ability to react with potassium salts to create stable, consistent textures makes it highly reliable during storage and transportation.

Manufacturers also favor kappa carrageenan for its cost advantage compared to other hydrocolloids. Growing demand for convenience foods and plant-based formulations has further strengthened its position, especially as food companies look for natural, clean-label texturizing solutions. Its consistent functional performance across both mature and developing markets continues to support its dominance in the product type segment.

By Processing Technology

The alkali treatment process accounted for 39.8% of the market in 2024, making it the leading processing technology. This method is valued for enhancing gel strength and improving overall carrageenan quality. By converting precursor compounds into refined carrageenan, alkali treatment ensures higher purity and better functionality in food applications. Producers prefer this process because it delivers consistent viscosity and reliable performance in end-use products.

It also supports large-scale manufacturing while meeting strict food safety and quality standards. As food and beverage companies demand uniform specifications and dependable supply chains, investment in advanced alkali processing facilities has increased. This has reinforced the technology’s importance, particularly among suppliers serving global brands that require stable, high-quality ingredients.

By Functionality

Thickening functionality captured 39.1% of the market in 2024, highlighting carrageenan’s core role in texture enhancement. It is widely used to thicken sauces, soups, dairy drinks, and plant-based beverages without affecting taste. Even at low concentrations, it delivers effective viscosity control, helping manufacturers manage formulation costs while maintaining clean labels. As consumers increasingly expect smooth textures and consistent mouthfeel, natural thickeners like carrageenan have gained steady demand.

It also plays a valuable role in reduced-fat and reduced-sugar products by restoring texture lost during reformulation. This makes it especially important for brands targeting health-conscious buyers. Its multifunctional properties and formulation flexibility continue to make thickening the most significant functionality segment.

By Application

Food and beverages dominated the market in 2024 with a 63.5% share, reflecting carrageenan’s extensive use across dairy, meat, confectionery, and beverage products. It helps prevent ingredient separation, improve shelf life, and maintain uniform texture in processed foods. Its plant-based origin aligns well with growing demand for vegan and vegetarian options, particularly in dairy alternatives.

Rising consumption of packaged foods, urbanization, and expansion of food service channels have further supported demand. Additionally, broad regulatory acceptance in multiple countries ensures continued usage across mainstream food categories. With its strong performance, versatility, and alignment with clean-label trends, the food and beverage segment remains the primary revenue driver for carrageenan gum.

Regional Analysis

The Carrageenan Gum Market displays noticeable regional differences, with Europe leading at 48.20% share and a value of USD 0.4 billion. The region’s dominance is supported by strong demand from processed food, dairy, and plant-based product manufacturers that rely on carrageenan for texture stability and extended shelf life. Strict regulatory standards and consistent use of approved additives further strengthen Europe’s well-established market position.

North America remains stable, driven by regular consumption of convenience foods, flavored dairy items, and processed meat products, though growth is relatively moderate due to market maturity. Asia Pacific is experiencing expanding demand as urbanization and packaged food consumption rise, particularly in developing economies seeking cost-effective formulation solutions.

Meanwhile, the Middle East & Africa represent emerging markets, supported by gradual growth in food processing and imports of stabilizers. Latin America contributes steadily through processed meat, dessert, and beverage production, although overall penetration remains below Europe’s dominant level.

Top Use Cases

- Thickener in Foods: Carrageenan makes foods like sauces, dressings, and dairy drinks thicker so they feel smooth and rich. It helps liquids hold together instead of separating.

- Stabilizer in Dairy and Plant Milks: In products like yogurt, chocolate milk, and non-dairy milks, carrageenan stops ingredients from settling, keeping everything evenly mixed for a creamy feel.

- Moisture & Texture Enhancer in Meat Products: It is added to processed meats to hold water, improve bite and texture, and prevent dryness in items like cold cuts or pâtés.

- Thickener in Personal Care: Beyond food, carrageenan is used in products like shampoos, lotions, and creams to thicken and stabilize them so ingredients don’t separate and application feels better.

Recent Developments

- In June 2025, Ingredion and Univar Solutions extended their long-standing partnership to bring Ingredion’s plant-based and clean-label products (like Novation® starches and stevia sweeteners) into the Benelux region (Belgium, the Netherlands, and Luxembourg), reaching thousands of food producers.

- In February 2025, FMC reported financial results showing growth in sales volume and increased revenue from products launched over the past five years, including new active ingredients like fluindapyr and Isoflex™ active.

Conclusion

The carrageenan gum market continues to show steady progress, supported by growing demand for natural and plant-based ingredients across food, beverage, and personal care industries. Its strong ability to thicken, stabilize, and improve texture makes it a preferred choice for manufacturers seeking clean-label and cost-effective solutions.

Expanding use in dairy alternatives, processed foods, and convenience products further strengthens its position. Ongoing innovation in processing technologies and quality standards is enhancing product performance and reliability. As consumers increasingly value transparency and sustainability, carrageenan gum remains a trusted functional ingredient with stable long-term growth potential across global markets.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)