Table of Contents

Overview

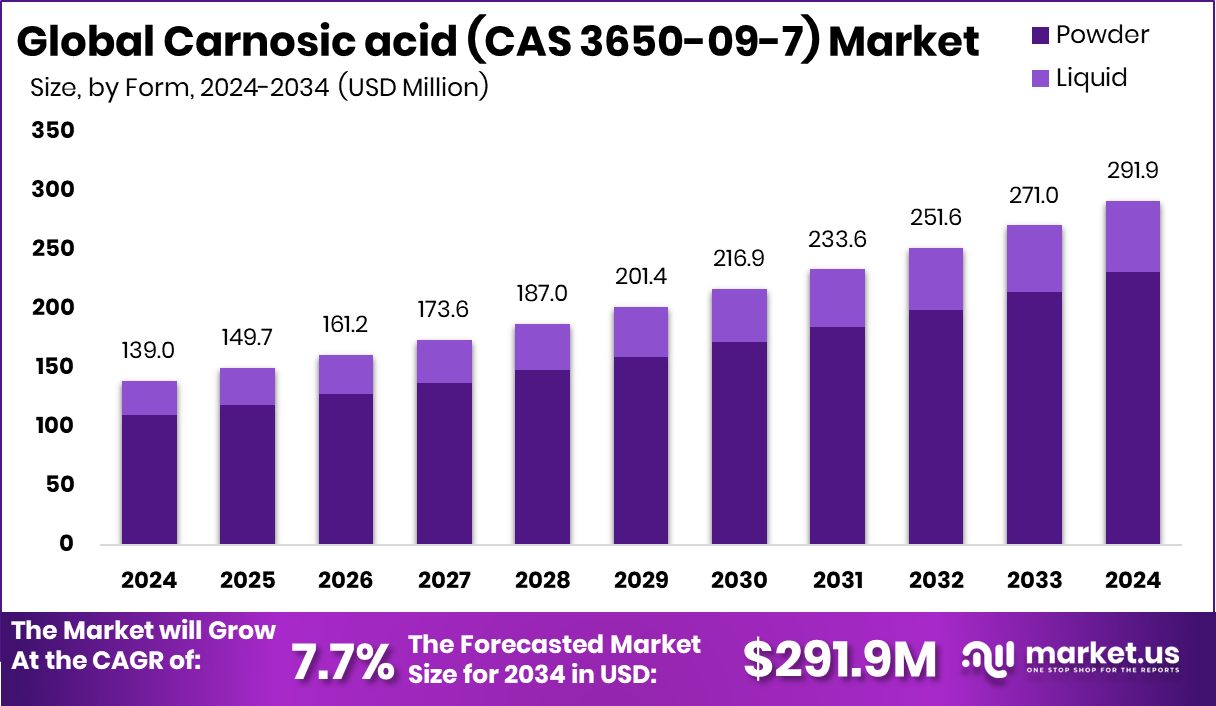

New York, NY – January 06, 2026 – The global Carnosic acid (CAS 3650-09-7) market is on a steady growth path, projected to reach USD 291.9 million by 2034, up from USD 139.0 million in 2024, registering a 7.7% CAGR between 2025 and 2034. The Asia-Pacific region plays a leading role, accounting for 43.8% of global demand, valued at USD 60.8 million, supported by strong growth in food, supplements, and wellness manufacturing.

Carnosic acid is a natural antioxidant extracted mainly from rosemary leaves. Its ability to protect products from oxidation makes it highly valuable in food preservation, dietary supplements, and clean-label wellness formulations. As brands increasingly replace synthetic additives with plant-based alternatives, carnosic acid is gaining importance for maintaining freshness, stability, and natural positioning.

Market demand is further strengthened by regulatory and public-health initiatives. The U.S. Food and Drug Administration has sought USD 7.2 billion to strengthen food safety, nutrition, and public-health systems, indirectly encouraging the use of safer, natural ingredients.

Investment activity also supports growth. ARTAH Nutrition secured £2.85 million to expand its supplement business, increasing demand for natural antioxidants. A Long Island City-based nutrition startup raised USD 20 million in Series A funding to accelerate product development. In India, Earthful, backed by Shark Tank India, raised USD 3 million to scale women-focused plant-based nutrition, creating fresh opportunities for carnosic acid in modern wellness products.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-carnosic-acid-cas-3650-09-7-market/request-sample/

Key Takeaways

- The Global Carnosic acid (CAS 3650-09-7) Market is expected to be worth around USD 291.9 million by 2034, up from USD 139.0 million in 2024, and is projected to grow at a CAGR of 7.7% from 2025 to 2034.

- Carnosic acid market sees powder form dominate with 79.2% share, driven by stability, handling ease.

- The carnosic acid market food and beverages application holds 36.7%, supported by natural antioxidant demand globally.

- Carnosic acid market specialty stores lead distribution at 37.5%, benefiting from targeted sourcing and expertise.

- In the Asia-Pacific, carnosic acid demand reached 43.8%, generating USD 60.8 Mn revenue regionally.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=170189

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 139.0 Million |

| Forecast Revenue (2034) | USD 291.9 Million |

| CAGR (2025-2034) | 7.7% |

| Segments Covered | By Form (Powder, Liquid), By Application (Food and Beverages, Pharmaceuticals, Cosmetics, Dietary Supplements, Others), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Specialty Stores, Others) |

| Competitive Landscape | Kemin Industries, Inc., Kalsec Inc., FLAVEX Naturextrakte GmbH, Monteloeder S.L., Geneham Pharmaceutical Co., Ltd., Shaanxi Kingsci Biotechnology Co., Ltd., Shaanxi Hongda Phytochemistry Co., Ltd., Changsha Staherb Natural Ingredients Co., Ltd., Changsha Vigorous-Tech Co., Ltd., Shaanxi Undersun Biomedtech Co., Ltd. |

Key Market Segments

By Form Analysis

In 2024, the powder form dominated the Carnosic acid (CAS 3650-09-7) market with a 79.2% global share, reflecting its strong acceptance across industrial and commercial applications. Powdered carnosic acid is widely preferred due to its high handling stability, longer shelf life, and ease of storage and transportation. Manufacturers value this form because it allows accurate dosing and seamless integration into dry and semi-dry formulations, which is essential for maintaining consistent product quality.

The dominance of powder also highlights well-established supply chains and standardized production practices that favor this format. Its compatibility with large-scale manufacturing systems supports operational efficiency and minimizes formulation variability. As industries increasingly focus on reliability, uniformity, and cost-effective processing, the powder form continues to meet these expectations. Overall, its leading share shows that powder remains the most practical and trusted format, reinforcing its central role in sustaining market demand and performance standards.

By Application Analysis

The food and beverages segment led the Carnosic acid market in 2024, accounting for a 36.7% share, making it the largest application area. This dominance is driven by consistent demand for natural antioxidant solutions that help protect food and beverage products from oxidation and quality loss. Carnosic acid is widely used to extend shelf life while maintaining taste, color, and nutritional value, which is critical for processed foods and beverages.

Its plant-based origin strongly supports clean-label trends, as manufacturers seek alternatives to synthetic preservatives. The segment’s leadership also reflects growing consumer awareness around natural ingredients and transparency in food formulations. Food and beverage producers rely on carnosic acid for its proven functional reliability and formulation compatibility across a wide range of products. This steady utilization positions the segment as a key demand driver, reinforcing long-term stability and sustained consumption within the overall market.

By Distribution Channel Analysis

In 2024, specialty stores emerged as the leading distribution channel in the Carnosic acid market, holding a 37.5% share. Their dominance reflects strong buyer preference for focused distribution platforms that provide technical expertise, assured quality, and reliable sourcing. Specialty stores often cater to professional and industrial buyers who require consistent specifications and application-specific guidance.

The strength of this channel highlights the importance of trust, product knowledge, and service support in purchasing decisions. Buyers value curated product selections and the ability to access standardized, high-quality carnosic acid through specialized outlets rather than mass-market channels. This distribution model also supports closer relationships between suppliers and end users, ensuring better alignment with formulation needs. With a significant share, specialty stores continue to shape buying behavior and remain a critical route for market access, reinforcing stable demand and long-term market penetration.

Regional Analysis

The Asia-Pacific region leads the Carnosic acid (CAS 3650-09-7) market with a 43.8% share, valued at USD 60.8 million, making it the most influential regional demand center globally. This dominance reflects strong adoption across food, supplements, and wellness applications, supported by expanding manufacturing capacity and growing preference for natural, plant-based ingredients. Asia-Pacific’s scale and momentum position it as the key reference market for suppliers, shaping pricing, sourcing, and volume strategies.

North America and Europe continue to play important roles in maintaining global market balance and regulatory credibility. However, based on current data, both regions trail Asia-Pacific in overall demand concentration, indicating comparatively moderate adoption levels.

Meanwhile, the Middle East & Africa and Latin America contribute as emerging and supportive markets. These regions help broaden geographic reach and application diversity, strengthening the global footprint while offering long-term growth potential beyond the leading Asia-Pacific market.

Top Use Cases

- Natural Antioxidant in Food & Oils: Carnosic acid is widely used to slow down oxidation in food and edible oils. It helps prevent fats and oils from going rancid, which keeps food fresher for longer without using synthetic chemicals. This makes it a cleaner and more natural preservative option in foods like sauces, baked goods, and packaged snacks.

- Ingredient in Dietary Supplements: Carnosic acid is added to health supplements because of its antioxidant effects, which can support the body’s defense against oxidative stress. Studies show carnosic acid may improve antioxidant status and benefit overall health when taken as a supplement.

- Neuroprotective Support: Research suggests carnosic acid has properties that may help protect brain cells and support nervous system health. This is why it’s being explored for its potential role in reducing neural stress and supporting cognitive functions.

- Anti-Inflammatory and Antimicrobial Use: Carnosic acid shows natural anti-inflammatory and antimicrobial actions, which means it can help reduce inflammation and inhibit harmful microbes. These features make it useful in formulations aimed at wellness or natural defense support.

- Cosmetic & Skin Protection: Because carnosic acid acts as an antioxidant, it is used in cosmetic products to help protect skin cells from environmental damage, such as UV stress and oxidative harm. It supports skin health by reducing oxidative damage at the cellular level.

- Animal Feed & Pet Food Additive: Carnosic acid can also be included in animal and pet food to help protect fats and oils from oxidation, improving the shelf life and nutritional stability of feed products.

Recent Developments

- In March 2025, Kemin Nutritional Solutions, part of Kemin Industries, showcased its latest nutrition ingredient lineup at SupplySide Connect 2025 in the U.S. While this event highlighted human nutrition ingredients, the company’s focus on science-backed solutions ties back to its broader work with functional botanical extracts like rosemary-derived antioxidants (which include carnosic acid).

- In December 2024, Kalsec Inc., known for natural food ingredients and protection systems (like herbal antioxidants), announced an expanded partnership with Connell Caldic to boost its presence in China’s food industry. This deal lets Kalsec use Caldic’s local network to reach more customers in the Asia-Pacific region, growing access to its natural ingredient range, including antioxidant extracts used for food protection and shelf life.

- In November 2024, FLAVEX Naturextrakte GmbH received the CrefoZert creditworthiness certificate for the fifth time in a row. This award shows that the company has strong financial stability and reliability. FLAVEX makes high-quality plant extracts (like rosemary CO₂ extracts) for food, cosmetics, and supplements. The award helps build trust with customers and partners.

Conclusion

The Carnosic acid (CAS 3650-09-7) market shows steady and healthy progress driven by rising demand for natural, plant-based antioxidants across food, supplements, cosmetics, and animal nutrition. Its strong antioxidant performance, clean-label appeal, and compatibility with multiple formulations make it a preferred choice over synthetic alternatives.

Growing awareness around food safety, wellness, and natural preservation continues to support long-term adoption. Expansion of nutrition brands, innovation in botanical extracts, and wider acceptance of rosemary-derived ingredients further strengthen market stability. Overall, the market is well positioned for sustainable growth, supported by regulatory alignment, consumer trust in natural ingredients, and continuous product innovation across end-use industries.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)