Table of Contents

Overview

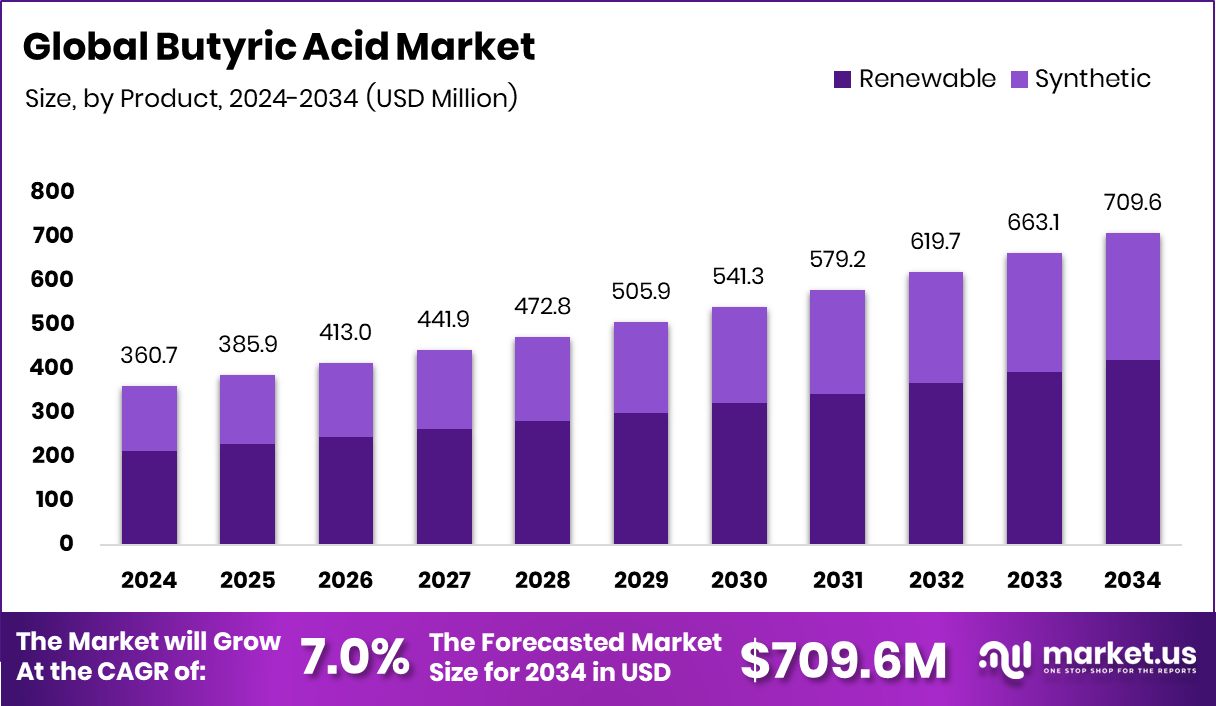

New York, NY – November 11, 2025 – The global butyric acid market, valued at USD 360.7 million in 2024, is projected to reach USD 709.6 million by 2034, growing at a 7.0% CAGR, with the Asia-Pacific region holding a 43.8% share, driven by strong livestock and sustainable feed programs. Butyric acid, found in butter and fermented foods, supports gut health and is widely used in food flavorings, coatings, pharmaceuticals, and animal feed additives.

Sustainability is reshaping production as bio-based and circular approaches gain traction. The rising demand for antibiotic-free and clean-label feed has made butyric acid an essential additive, improving animal digestion and nutrient uptake. In 2024, Wastelink raised USD 3 million to strengthen circular animal-feed supply chains, reflecting the market’s green shift. Similarly, Full Circle Biotechnology’s new 7,000-ton low-carbon facility emphasizes eco-efficient ingredient sourcing.

Government-backed initiatives are also fueling innovation. IIM Kashipur’s FIED funding for agri-startups and the Asian Development Bank’s USD 40 billion program for food security have boosted biotechnology and bio-feed development. Together, these investments create fertile ground for bio-based butyric acid manufacturers, integrating renewable chemistry, sustainable livestock nutrition, and circular-economy principles into future growth.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-butyric-acid-market/request-sample/

Key Takeaways

- The Global Butyric Acid Market is expected to be worth around USD 709.6 million by 2034, up from USD 360.7 million in 2024, and is projected to grow at a CAGR of 7.0% from 2025 to 2034.

- Renewable-based butyric acid market dominates with a 59.3% share, driven by bio-manufacturing and sustainable production growth.

- Sodium butyrate holds a 49.5% share in the butyric acid market and is mainly used in animal nutrition.

- Animal feed dominates the butyric acid market, accounting for a 45.2% share, driven by initiatives aimed at improving livestock health.

- The Asia-Pacific market value reached around USD 157.9 million, driven by demand.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=164604

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 360.7 Million |

| Forecast Revenue (2034) | USD 709.6 Million |

| CAGR (2025-2034) | 7.0% |

| Segments Covered | By Product (Renewable, Synthetic), By Derivatives (Sodium Butyrate, Calcium Butyrate, Others), By Application (Animal Feed, Chemical Intermediates, Pharmaceuticals, Perfumes, Food and Flavors, Others) |

| Competitive Landscape | Eastman Chemical Company, Oxea GmbH, Tokyo Chemical Industry Co. Ltd., Perstorp Holding AB, Axxence Aromatic GmbH, BASF, Celanese Corporation, Kemin Industries, Inc., OXEA GmbH |

Key Market Segments

By Product Analysis

In 2024, the Renewable segment dominated the By-Product category of the Butyric Acid Market, securing a 59.3% share. This strong lead reflects the accelerating move toward bio-based production using renewable raw materials like agricultural waste and fermentation feedstocks.

Renewable butyric acid is favored for its lower carbon footprint, biodegradability, and alignment with global sustainability goals. Key industries—including animal nutrition, food additives, and bioplastics—are increasingly adopting renewable variants to achieve green certification and regulatory compliance.

Supported by bioeconomy initiatives and the expansion of sustainable supply chains, companies are steadily shifting from petrochemical-derived to eco-friendly processes. This transition positions the renewable segment to retain its dominance in the coming years, reinforcing its role in promoting environmentally responsible chemical manufacturing.

By Derivatives Analysis

In 2024, Sodium Butyrate dominated the By Derivatives segment of the Butyric Acid Market, capturing a 49.5% share. Its leadership stems from its widespread application in animal feed, where it enhances gut health, nutrient absorption, and growth performance.

Valued for its high stability, easy handling, and superior efficiency over liquid butyric acid, Sodium Butyrate has become a preferred choice across poultry, swine, and aquaculture nutrition systems. The growing emphasis on sustainable livestock farming and the global movement toward antibiotic-free feed formulations have further strengthened its market position.

As producers focus on performance-driven yet eco-friendly feed solutions, Sodium Butyrate continues to act as a core derivative driving profitability and innovation in the global butyric acid value chain, ensuring its continued dominance in the years ahead.

By Application Analysis

In 2024, the Animal Feed segment dominated the By Application category of the Butyric Acid Market, accounting for a 45.2% share. This leadership reflects the growing integration of butyric acid and its derivatives in feed formulations designed to improve gut health, nutrient absorption, and intestinal development.

Widely used in poultry, swine, and dairy feed, the compound enhances feed efficiency and overall animal performance. The surge in demand for high-quality meat and dairy products, along with the industry’s transition to antibiotic-free and sustainable nutrition, has amplified its adoption.

Supported by global efforts toward eco-friendly livestock production, butyric acid has become an essential ingredient in next-generation feed strategies, ensuring healthier livestock and improved productivity across the agricultural sector.

Regional Analysis

In 2024, Asia-Pacific led the Butyric Acid Market with a 43.80% share, valued at USD 157.9 million. This dominance stems from the region’s robust livestock production, rising focus on antibiotic-free feed, and strong adoption of sustainable farming in countries like China, India, and Japan.

Rapid industrialization and growing awareness of gut health have accelerated the use of butyric acid derivatives in feed and food applications. North America follows with steady growth supported by advanced feed technologies and renewable chemical developments, while Europe continues to expand bio-based production through green chemistry regulations.

Latin America is seeing wider use in poultry and swine feed, driven by improving exports, and the Middle East & Africa show emerging potential with dairy and livestock investments. Overall, Asia-Pacific remains the clear leader due to its large agricultural base, government-backed feed initiatives, and expanding industrial applications across multiple sectors.

Top Use Cases

- Animal gut health in feed: Butyric acid and its salts (e.g., sodium butyrate) are added to livestock diets (poultry, swine, aquaculture) to improve gut lining, boost nutrient absorption, and suppress harmful bacteria like Salmonella and E. coli.

- Human colon health & microbiome support: In humans, butyric acid acts as a key energy source for colon cells, strengthens the intestinal barrier, and plays a role in gut-immune regulation, which may help prevent inflammatory conditions.

- Food flavouring & aroma agent: The compound (and its esters) are used to produce “buttery” notes and fruity-aromas in foods, beverages and confectionery—adding characteristic taste or smell.

- Intermediate in coatings, plastics & specialty chemicals: Butyric acid is used to make cellulose acetate butyrate (CAB) plastics, coatings, and other specialty materials that require durability, weather resistance or film-forming properties.

- Platform chemical for renewable fuels & bio-chemicals: It serves as a bio-based precursor that can be catalytically converted into butanol, esters, or even diesel/jet-fuel components, leveraging renewable feedstocks instead of petro-derived routes.

- Antibiotic-free livestock production support: In a world shifting away from antibiotic-growth-promoters, butyric acid helps maintain animal performance and health via gut modulation—thus aligning with sustainable and clean-label feed strategies.

Recent Developments

- In June 2024, OQ Chemicals (previously Oxea GmbH) announced that its Bay City (Texas) site achieved the ISCC Plus certification for mass-balance traceability and sustainable feedstocks across its carboxylic acids portfolio. This certification supports its OxBalance line of renewable-feedstock products.

- In April 2024, Eastman Chemical Company announced an off-list price increase of USD 0.05 per lb (USD 0.11/kg) for glacial acetic acid (excluding food/USP grades) and dilute acetic acid in North and Latin America. The move reflects tightening cost dynamics in its acid chemicals segment.

Conclusion

The Butyric Acid market is moving toward a sustainable and innovation-driven future. Its applications in animal nutrition, food, and bioplastics are growing due to rising environmental awareness and demand for healthier products. Bio-based production methods and circular economy initiatives are transforming traditional supply chains.

Supported by technological advancements and government sustainability programs, manufacturers are focusing on renewable sourcing and efficiency improvements.

As industries continue transitioning toward eco-friendly practices, butyric acid stands out as a vital component in achieving cleaner, more responsible production systems, reinforcing its importance across agriculture, food processing, and specialty chemical industries worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)