Table of Contents

Overview

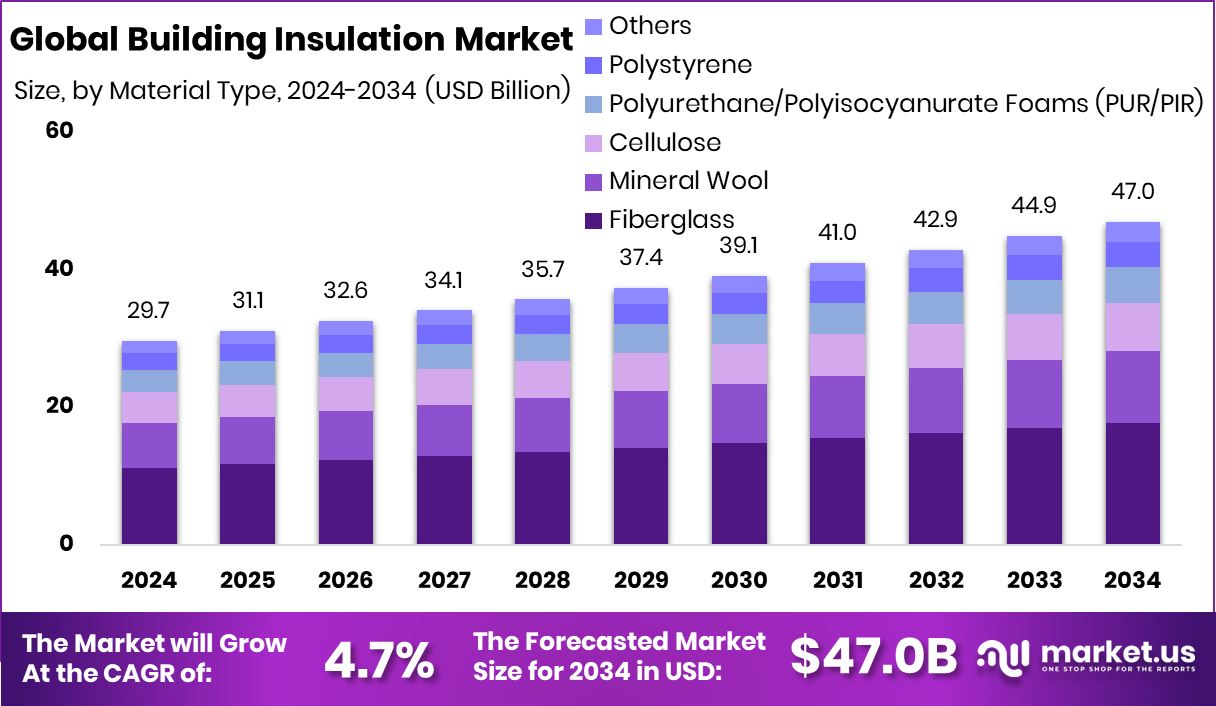

New York, NY – February 19, 2026 – The global building insulation market is on a steady growth path, projected to expand from USD 29.7 billion in 2024 to nearly USD 47.0 billion by 2034, advancing at a CAGR of 4.7%. Europe leads the sector with a 42.30% share, driven by strong energy-efficiency demand valued at USD 12.5 billion. Building insulation materials, installed in walls, roofs, floors, and ceilings, help reduce heat transfer, improve indoor comfort, lower energy bills, manage moisture, and reduce noise, making them essential in modern construction across residential, commercial, and industrial projects.

Market momentum is closely tied to sustainability goals and low-carbon building practices. The €20 million loan from the European Investment Bank to Aisti for bio-based tiles reflects growing institutional backing for greener construction materials that complement insulation systems. Innovation is also accelerating, as seen in the £300,000 secured by Wull Technologies to enhance sustainable insulation performance. Large-scale construction financing, including UT Financial Services’ $100 million capital raise, further strengthens demand for high-efficiency insulation solutions.

Emerging opportunities are linked to circular construction and advanced materials. Fiber Elements raised €2.6 million to scale basalt fiber manufacturing, supporting stronger and more sustainable insulation systems. Broader initiatives, such as Canada’s C$2 billion Critical Minerals Sovereign Fund and the U.S. Department of Energy’s $20 million recycling technology funding, reinforce the shift toward durable, recyclable insulation solutions.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-building-insulation-market/request-sample/

Key Takeaways

- The Global Building Insulation Market is expected to be worth around USD 47.0 billion by 2034, up from USD 29.7 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- In the Building Insulation Market, fiberglass dominates material types with a 37.8% share globally.

- Within the Building Insulation Market, wall applications lead demand, accounting for a 32.5% share.

- The Building Insulation Market sees residential end users leading consumption, holding a dominant 61.2%.

- Europe’s Building Insulation Market dominance at 42.30% reflects strong regulations and USD 12.5 Bn valuation.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=173044

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 29.7 Billion |

| Forecast Revenue (2034) | USD 47.0 Billion |

| CAGR (2025-2034) | 4.7% |

| Segments Covered | By Material Type (Fiberglass, Mineral Wool, Cellulose, Polyurethane/Polyisocyanurate Foams (PUR/PIR), Polystyrene, Others), By Application (Roof, Wall, Floor and Basement, Ceiling and Attic, Acoustic Partition and HVAC Duct, Others), By End-User (Residential, Non-Residential) |

| Competitive Landscape | Aspen Aerogels Inc., Atlas Roofing Corporation, BASF SE, Beijing New Building Materials Public Limited Company, Cellofoam North America Inc., Covestro AG, Dow, DuPont, GAF Materials LLC, Holcim |

Key Market Segments

By Material Type Analysis

In 2024, fiberglass led the Building Insulation Market with a 37.8% share, supported by its affordability and dependable performance. The material remains widely used across residential and light commercial projects because it offers balanced thermal insulation and sound absorption at a competitive cost. Its lightweight structure makes handling and installation easier, while its non-combustible properties and moisture resistance allow compliance with various building codes and climate conditions.

Fiberglass is available in batts, rolls, and loose-fill formats, giving builders flexibility in both new construction and renovation projects. Continuous improvements, including higher recycled glass content and low-emission binders, have strengthened its sustainability profile, further supporting its strong market position.

By Application Analysis

Wall insulation accounted for 32.5% of the Building Insulation Market in 2024, making it the leading application segment. Walls are a major source of heat transfer in buildings, driving consistent demand for effective insulation systems. Both residential and mixed-use structures increasingly adopt cavity wall insulation and external wall solutions to comply with stricter energy-efficiency standards.

Proper wall insulation reduces heating and cooling loads, enhances indoor comfort, and minimizes outside noise. Builders are also integrating improved air-sealing methods, vapor barriers, and layered wall assemblies to boost overall thermal performance. As energy codes tighten and renovation activity increases, wall insulation continues to play a central role in improving building efficiency.

By End-User Analysis

The residential segment dominated the Building Insulation Market in 2024 with a 61.2% share, driven by housing development and retrofit demand. Homeowners are prioritizing insulation to manage rising energy costs and enhance indoor comfort. Single-family homes and low-rise apartment buildings rely heavily on insulation to meet building efficiency regulations and reduce long-term utility expenses.

Government-backed energy-efficiency programs and incentives have further encouraged insulation upgrades in existing homes. In addition, rapid urbanization and population growth continue to expand global housing requirements. As awareness of sustainability and energy savings increases, residential construction and renovation remain the primary demand drivers within the overall building insulation industry.

Regional Analysis

In 2024, Europe led the Building Insulation Market with a 42.30% share, valued at USD 12.5 billion, driven by strict energy-efficiency regulations and strong adoption of insulation in both new buildings and renovation projects. The region’s long-standing focus on reducing heat loss and improving indoor comfort has ensured high insulation penetration across residential and commercial sectors.

North America remains a mature and stable market, supported by steady residential retrofits and commercial construction where insulation is central to energy-efficient design. Asia Pacific is experiencing consistent growth due to rapid urbanization, expanding construction activity, and rising awareness of thermal comfort.

Meanwhile, the Middle East & Africa benefit from climate-driven demand, and Latin America shows gradual progress as construction standards strengthen.

Top Use Cases

- Lower Heating & Cooling Costs: Good insulation slows heat flow through walls, roofs, and floors, so buildings stay warmer in winter and cooler in summer. This reduces energy use for heaters and air conditioners, cutting utility costs for residents and businesses.

- Reduce Energy Waste: Insulated buildings can save a large part of wasted energy that otherwise escapes through the building envelope (roof and walls). Studies show that heat loss and gain without insulation makes air conditioners and heaters work much harder.

- Improved Indoor Comfort: Insulation keeps indoor temperatures more stable and comfortable by minimizing hot and cold spots. It also helps block outside noise and reduce humidity issues inside living spaces.

- Energy Savings in Hot Climates: In hot regions, insulating the exterior surfaces of buildings significantly lowers the cooling load on air-conditioning systems, leading to less energy use and costs over time.

- Supporting Energy-Efficient Design Decisions: Architects and engineers use computer simulation tools (like BIM based energy analysis) to decide the best insulation materials and thicknesses. This helps optimize energy use and reduce CO₂ emissions in new and existing buildings.

- Retrofit for Existing Buildings: Older buildings can be retrofitted with insulation panels (like vacuum panels) in walls or roofs to improve performance without major rebuilding. Case studies in Europe show this boosts energy efficiency and comfort.

Recent Developments

- In May 2025, Atlas Roofing completed the acquisition of Groupe Expan and its subsidiaries (Groupe Isolofoam, Le Groupe Légerlite, Foam Concept 2000). These companies make expanded polystyrene products used in insulation and packaging. This deal expands Atlas’s manufacturing reach in Eastern Canada and strengthens its insulation product portfolio.

- In March 2025, BASF worked with ABG Frankfurt Holding and Sto to use a new insulation board made from expandable polystyrene (EPS) that contains recycled material in a pilot project in Germany. This shows BASF is testing and applying more sustainable insulation materials in real buildings.

- In January 2025, Aspen Aerogels settled a patent dispute with AMA S.p.A. and AMA Composites S.r.l. in Italy. This agreement ended a legal case about unauthorized sales of insulation materials that copied Aspen’s aerogel technology. It shows Aspen protecting its intellectual property and keeping its high-performance insulation technology safe.

Conclusion

The building insulation market continues to grow as energy efficiency, sustainability, and indoor comfort remain top priorities in construction. Insulation plays a vital role in reducing heat loss, lowering energy consumption, and supporting environmentally responsible building practices. Rising awareness about climate impact and stricter building standards are encouraging wider adoption across residential, commercial, and industrial sectors.

Innovation in materials, including recyclable and bio-based options, is strengthening long-term demand. Renovation activities and urban development further support market expansion. As construction practices evolve toward low-carbon and energy-efficient designs, building insulation will remain a fundamental solution for improving performance, durability, and overall building value worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)