Table of Contents

Overview

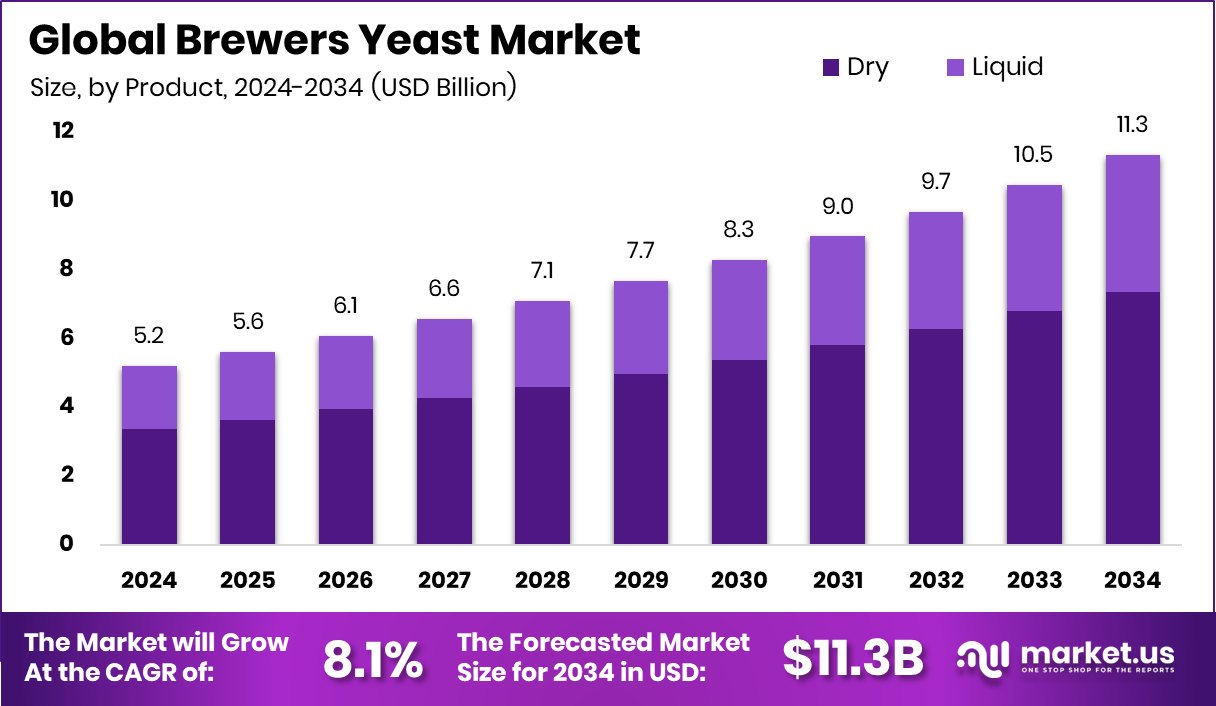

New York, NY – February 11, 2026 – The Brewers Yeast Market is set to reach USD 11.3 billion by 2034, rising from USD 5.2 billion in 2024, with a steady 8.1% CAGR through 2025–2034. Europe remains the leading region, holding 38.80% of the market and generating nearly USD 2.0 billion in value. Brewers yeast, a nutrient-rich byproduct of beer production, is increasingly repurposed for food, supplements, and functional ingredients due to its clean-label appeal and high protein, fiber, and B-vitamin content.

The market’s expansion is strongly fueled by sustainability goals and innovations in upcycling. A notable example is Yeastup’s £9 million industrial facility that converts spent yeast into valuable food ingredients, reinforcing confidence in circular production systems. Investment momentum continues to accelerate: Yeastup also raised €9.47 million to redesign a former dairy site for yeast upcycling, while a Swiss startup secured $10 million for a similar conversion focused on beer-waste proteins.

Demand is rising for yeast-based egg and protein alternatives, supported by Revyve’s $28 million Series B and earlier €24 million raise to scale yeast-derived proteins. Additional opportunities are highlighted by Yeasty securing €1.4 million for alternative proteins and FUMI Ingredients receiving €500,000 to develop egg whites from upcycled yeast.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-brewers-yeast-market/request-sample/

Key Takeaways

- The Global Brewers Yeast Market is expected to be worth around USD 11.3 billion by 2034, up from USD 5.2 billion in 2024, and is projected to grow at a CAGR of 8.1% from 2025 to 2034.

- In the Brewers Yeast Market, dry products dominate with 64.8% share due to stability advantages.

- Within the brewers’ yeast market, ale strains lead with 39.9%, reflecting widespread brewing versatility globally.

- In the Brewers Yeast Market, food supplement application holds 63.2%, driven by nutrition demand worldwide.

- Across the brewers’ yeast market, direct sales to breweries and wineries account for 56.3% channels.

- The brewer’s yeast market in Europe accounts for 38.80%, generating USD 2.0 Bn revenues.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=172515

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 5.2 Billion |

| Forecast Revenue (2034) | USD 11.3 Billion |

| CAGR (2025-2034) | 8.1% |

| Segments Covered | By Product (Dry, Liquid), By Functional Strain (High Gravity Strains, Lager Strains, Ale Strains, Specialty Strains), By Application (Food Supplements, Feed Supplements), By Distribution Channel (Direct Sales to Breweries and Wineries, Wholesale Distribution, Online Platforms, Others) |

| Competitive Landscape | AB Mauri India Pvt. Ltd., Alltech Inc., Angel Yeast Company, Archer Daniels Midland Company, Associated British Food Plc., Cargill Incorporated, Koninklijke DSM N.V., Kothari Fermentation and Biochem Ltd., Lallemand Inc., Leiber GmbH |

Key Market Segments

By Product Analysis

Dry products dominate the Brewers Yeast Market with a strong 64.8% share in 2024, reflecting their superior practicality and global acceptance. Dry brewers’ yeast remains the preferred choice because it offers a longer shelf life, lower transportation costs, and simplified storage without cold-chain dependency. These advantages make it highly attractive for large producers and exporters serving Asia-Pacific, Latin America, and emerging brewing regions. Brewers increasingly choose dry strains for their consistent fermentation behavior, which supports stable beer quality across batches, a key factor for both craft and commercial breweries.

Innovations in drying technologies are further strengthening this segment, allowing yeast suppliers to enhance strain stability, viability, and performance. As the brewing industry expands and supply chains modernize, manufacturers continue investing in scalable drying methods to meet rising demand. These combined benefits ensure that dry products maintain a leading position while supporting global market growth and operational efficiency.

By Functional Strain Analysis

Ale strains lead the functional strain segment with a 39.9% share in 2024, driven by their essential role in producing flavorful and aromatic ale-style beers. These strains are favored for their ability to ferment at warmer temperatures while offering rich, complex sensory notes that appeal to both craft brewers and traditional ale producers. With craft beer consumption rising across North America and Europe, ale yeast has become central to creating seasonal, specialty, and small-batch beers that emphasize uniqueness and character.

Brewers rely on ale strains to experiment with new styles, expand product portfolios, and differentiate in competitive markets. Ongoing R&D in yeast biotechnology is enabling the development of customized ale strains that improve mouthfeel, aroma, and fermentation efficiency. As consumer interest grows in artisanal, high-quality beers with distinct flavor identities, ale strains remain a cornerstone of innovation, supporting their continued dominance in the brewing yeast landscape.

By Application Analysis

Food Supplements represent the largest application segment, accounting for 63.2% of the Brewers Yeast Market in 2024. This dominance is driven by the rising integration of brewers’ yeast into nutraceuticals and functional foods due to its rich nutritional profile, including B-vitamins, proteins, minerals, amino acids, and immune-supporting beta-glucans. Consumers seeking natural, clean-label, and nutrient-dense ingredients are pushing manufacturers to incorporate brewers’ yeast into tablets, capsules, drink powders, fortified snacks, and wellness beverages.

Its role in supporting digestive health, energy metabolism, and immunity has expanded its appeal across the global health-conscious population. Nutraceutical companies are actively developing new formulations using encapsulation, flavor-masking, and controlled-release technology to improve taste and stability. As preventive health trends strengthen, and fortified foods gain traction, brewers’ yeast continues to penetrate mainstream dietary supplement categories, firmly holding its leadership in application-based market demand.

By Distribution Channel Analysis

Direct Sales to Breweries and Wineries dominated the distribution landscape with a 56.3% share in 2024, reflecting the importance of direct supplier relationships in fermentation-driven industries. Manufacturers selling directly can tailor yeast strains, provide technical guidance, and ensure reliable, bulk-scale supply — essential for maintaining consistent beer or wine quality. This channel is especially critical for large commercial breweries and wineries that require dependable sourcing, traceability, and strain customization. Direct sales also improve responsiveness, enabling suppliers to adjust inventory, production, or strain availability based on real-time customer needs.

Long-term contracts, consulting support, and integrated quality-control programs strengthen these partnerships. Alongside this, digital procurement platforms and predictive analytics are modernizing the direct-sales model, offering smoother ordering, faster logistics, and better planning visibility. These advantages ensure that the direct sales channel remains the most efficient and trusted route for breweries and wineries worldwide.

Regional Analysis

Europe leads the Brewers Yeast Market with a 38.80% share valued at USD 2.0 billion, driven by its strong brewing heritage, dense brewery presence, and consistent demand from both large and craft producers. North America follows as a key contributor, supported by a thriving craft beer sector and a mature supplements industry that widely incorporates brewer’s yeast.

The Asia Pacific region is steadily expanding due to rising local brewing capacity, changing consumer preferences, and improved access to standardized yeast formats. In the Middle East & Africa, demand remains selective, shaped by localized production, import dependency, and strict quality assurance needs.

Latin America continues growing as breweries diversify portfolios and focus on maintaining flavor consistency through reliable yeast inputs. Overall, regional trends reflect differences in brewing maturity, supply chain stability, and adoption of standardized fermentation practices, with Europe maintaining clear leadership in both value and share.

Top Use Cases

- Digestive & Gut Health Support: Many people use brewer’s yeast to help with digestion and gut comfort. It contains fibre and is considered a probiotic, which may help in cases of constipation, diarrhea, IBS and lactose intolerance by supporting healthy gut flora and regular bowel movements.

- Nutritional Supplement for Vitamins & Minerals: Brewer’s yeast is rich in B-group vitamins, protein and essential minerals like chromium. This makes it useful as a supplement to add nutrients to daily food or drinks for general health support.

- Blood Sugar & Heart Support (Specific Use): Some research suggests that brewer’s yeast may help improve insulin response, lower fasting blood sugar, and even reduce systolic and diastolic blood pressure in people with type 2 diabetes.

- Natural Flavor Enhancer in Food: Brewer’s yeast contains compounds that can give dishes a rich, savory, “umami” taste — useful in soups, sauces, snacks, and vegetarian cooking as a natural flavor booster.

- Pet Nutrition Additive: Brewer’s yeast is used in dog food and pet supplements because it can make food tastier and provides extra protein, amino acids, and vitamins that support coat quality, digestion and overall health.

- Support for Hair & Skin Health: Its high B-vitamin and protein content can support skin health and hair strength when included in the diet or taken as a supplement, helping with keratin production and overall nutrient supply to tissues.

Recent Developments

- In October 2025, Angel Yeast’s subsidiary Xizang Angel Zhufeng Biotechnology started operations at a one-of-a-kind high-altitude probiotic production facility on the Qing-Zang Plateau. This plant produces probiotic powders and fermentation cultures that can be used in food and microbial cultures — expanding the company’s fermentation portfolio beyond traditional yeast.

- In April 2025, Alltech published its 2025 Agri-Food Outlook, which includes global feed production insights. While not a product launch, this resource highlights trends and Alltech’s thought leadership around feed ingredients and nutrition science — areas connected to yeast-based fermentation and specialty additives.

Conclusion

The Brewers Yeast Market continues to grow steadily as more industries recognize the value of yeast as a nutrient-rich and versatile ingredient. Its use now extends far beyond brewing, moving into food supplements, functional nutrition, animal feed, and innovative protein alternatives. Sustainability efforts and upcycling practices are helping producers turn brewing byproducts into high-value ingredients, making the market increasingly future-focused.

Rising interest in natural, clean-label solutions also supports broader adoption across global applications. With expanding innovation, stronger processing capabilities, and continued investment from key players, the market is set to remain resilient and full of long-term opportunity.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)