Table of Contents

Overview

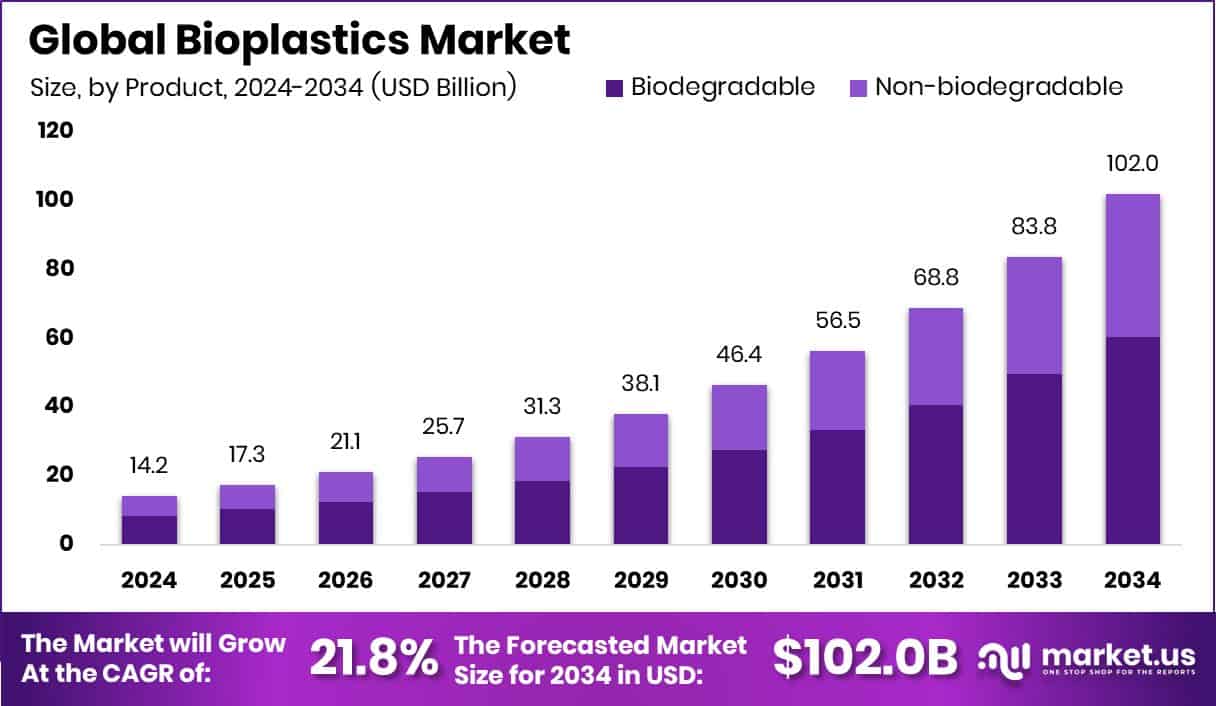

New York, NY – Dec 04, 2025 – The global bioplastics market is on a rapid growth path, expected to rise from USD 14.2 billion in 2024 to around USD 102.0 billion by 2034, growing at a 21.8% CAGR between 2025 and 2034. Europe currently leads the market with a 42.70% share, supported by a USD 6.0 billion market size, reflecting strong policy backing and early adoption of sustainable materials.

Bioplastics are produced from renewable sources such as corn, sugarcane, starch, algae, and food waste. These materials help reduce reliance on fossil-based plastics while supporting biodegradability and circular production models. As sustainability becomes central to packaging, consumer goods, automotive interiors, and textiles, bioplastics are increasingly seen as practical alternatives to conventional polymers.

Market expansion is being accelerated by both public policy and private funding. TripleW raised USD 16.5 million to convert food waste into lactic acid for bioplastics, while Floreon secured GBP 250 million to scale its bioplastic technologies. NatureWorks received a USD 350 million loan for its PLA facility in Thailand, and the U.S. Department of Energy committed USD 118 million toward biofuel-linked initiatives. Additional momentum comes from a USD 14 million U.S. pledge to fight plastic pollution and Rubi’s USD 1 million SBIR Phase II grant for bioplastic-based textile innovation.

Emerging economies are becoming key growth engines. India is drawing attention with Balrampur Chini Mills’ ₹2,850-crore PLA plant MoU and a planned ₹2,580-crore ethanol-based project by FY27, strengthening local supply chains and export potential.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-bioplastics-market/request-sample/

Key Takeaways

- The Global Bioplastics Market is expected to be worth around USD 102.0 billion by 2034, up from USD 14.2 billion in 2024, and is projected to grow at a CAGR of 21.8% from 2025 to 2034.

- The bioplastics market sees strong adoption of non-biodegradable products, capturing 59.3% due to broad industrial usage.

- Sugarcane and sugar beet feedstocks hold 34.1%, strengthening bio-based growth across the bioplastics market globally.

- Injection molding leads with 35.9%, improving processing efficiency and expanding applications within the bioplastics market.

- Packaging dominates at 44.4%, making it the largest and fastest-growing segment in the bioplastics market.

- The Europe region drives bioplastics adoption with its 42.70% share and USD 6.0 Bn value.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=167153

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 14.2 Billion |

| Forecast Revenue (2034) | USD 102.0 Billion |

| CAGR (2025-2034) | 21.8% |

| Segments Covered | By Product (Biodegradable (Polylactic Acid, Starch Blends, PBAT, PBS, Others), Non-biodegradable (Polyethylene, Polyethylene Terephthalate, Polyamide, Polytrimethylene Terephthalate, Others)), By Feedstock (Sugarcane / Sugar Beet, Corn, Cassava and Potato, Cellulosic and Wood Waste, Others), By Processing Technology (Extrusion, Injection Molding, 3 Blow Molding, 3D Printing, Others), By Application (Packaging, Agriculture, Automotive and Transportation, Electronics, Textile, Others) |

| Competitive Landscape | TEIJIN LIMITED, Toray Industries, Inc., Toyota Tsusho Corporation, Avantium, PTT MCC Biochem Co., Ltd., An Phat Holdings, NatureWorks LLC, SABIC, BASF, Futerro |

Key Market Segments

By Product Analysis

In 2024, the non-biodegradable category led the bioplastics market by product, holding a 59.3% share, reflecting strong industry preference for durable and high-performance bio-based materials. This segment remained dominant because these plastics can tolerate heat, mechanical stress, and long service life, making them suitable for demanding applications.

Non-biodegradable bioplastics are extensively used in packaging, consumer goods, and various industrial products where structural strength and material stability are critical. A major advantage is their ability to run on existing plastic processing and manufacturing lines. This allows manufacturers to switch from conventional plastics to bio-based alternatives without costly equipment changes or redesigns.

Rising investment in advanced bio-based polymers and the growing push for low-carbon materials further strengthened this segment’s market position. Continuous improvements in polymer performance and production efficiency are supporting wider adoption. As sustainability goals increase across industries, non-biodegradable bioplastics continue to play a key role in scaling bio-based solutions globally while maintaining performance expectations.

By Feedstock Analysis

In 2024, sugarcane / sugar beet emerged as the leading feedstock in the bioplastics market, accounting for a 34.1% share of the By Feedstock segment. This dominance was mainly driven by the wide availability of these crops and their proven efficiency in producing key bio-based inputs such as ethanol and lactic acid, which are essential for bioplastic manufacturing.

Manufacturers favored sugarcane and sugar beet due to their stable harvest yields, comparatively low carbon footprint, and mature processing infrastructure. These factors enable reliable, large-scale production while keeping costs predictable. Their established supply chains also reduce raw-material risk, which is critical for long-term industrial planning.

The use of sugar-based feedstocks closely supports global sustainability and decarbonization targets, making them attractive to producers transitioning away from fossil-based resources. As demand for bio-based plastics increased across industries, sugarcane and sugar beet continued to stand out as the most dependable and commercially viable feedstock options for bioplastic production worldwide.

By Processing Technology Analysis

In 2024, injection molding led the bioplastics market by processing technology, capturing a 35.9% share of the segment. Its dominance was driven by the ability to manufacture complex and precise components, which is essential for packaging, consumer products, and multiple industrial applications.

Producers favor injection molding because it supports high-volume output while maintaining uniform quality. Another key advantage is its compatibility with existing manufacturing infrastructure, allowing companies to process bioplastics using current equipment with minimal adjustments. This lowers transition costs and accelerates adoption across industries.

The technology also offers efficient material usage with reduced waste, which aligns well with sustainability goals. Its flexibility to handle a broad range of bio-based polymers further enhances its appeal. As demand for environmentally responsible materials continues to rise, injection molding remains the most practical and reliable processing method for scaling bioplastics while meeting performance and production efficiency expectations.

By Application Analysis

In 2024, packaging dominated the bioplastics market by application, holding a 44.4% share, driven by rising demand for sustainable packaging across food, beverage, and consumer goods sectors. Companies increasingly turned to bioplastic packaging to address environmental concerns and follow waste-reduction and sustainability regulations.

Bioplastics gained strong acceptance in packaging due to their lightweight structure, good clarity, and ability to replace conventional plastics in products such as films, trays, bottles, and molded containers. These properties make them suitable for high-volume, everyday use while supporting lower carbon footprints.

Wide applicability and ease of integration into existing packaging formats further accelerated adoption. As businesses focused more on recyclability and eco-friendly branding, bioplastics became a practical solution for meeting sustainability targets. With growing consumer awareness and continued regulatory pressure, packaging remained the primary application fueling global bioplastics demand and market expansion during the year.

Regional Analysis

In 2024, Europe led the global bioplastics market with a 42.70% share, valued at USD 6.0 billion, supported by strict environmental regulations, waste-reduction targets, and continued investment in circular material technologies. The region’s strong focus on renewable feedstocks and compostable packaging accelerated adoption across food, retail, and consumer goods sectors.

North America recorded steady growth, driven by sustainability policies and increasing demand for low-carbon materials, particularly in packaging and automotive applications. Asia Pacific showed rapid momentum as manufacturing capacity expanded and consumption of bioplastics increased across emerging economies, especially in packaging and textiles.

The Middle East & Africa experienced gradual adoption as several countries began diversifying away from heavy petrochemical dependence. Meanwhile, Latin America advanced at a moderate pace, supported by the improving availability of bio-based feedstocks. Together, these regional trends highlight the global and increasingly balanced expansion of bioplastics adoption.

Top Use Cases

- Sustainable Packaging for Food, Drinks & Cosmetics: Bioplastics are widely used to make bottles, containers, jars, trays, films and flexible packaging for food, beverages, cosmetics, and other consumer goods. Because they can be plant-based or compostable, they help reduce reliance on fossil-based plastics and support waste-reduction efforts.

- Agriculture — Mulch Films, Plant Pots, Soil-Friendly Films: In agriculture and horticulture, bioplastics are used to make biodegradable mulch films and plant pots. These films help retain moisture, suppress weeds, and can degrade after use — reducing plastic waste and soil contamination.

- Automotive & Transport — Interior Parts and Components: Bioplastics are increasingly used in automotive industry for components like interior panels, trims, housings — offering lighter weight and lower environmental impact compared to fossil-based plastics.

- Consumer Goods, Toys & Durable Products: Bioplastics are being used in everyday consumer goods — from kitchenware, reusable containers, to toys and other household items.

- Healthcare & Medical Devices / Disposables: Bioplastics also find use in the medical field. Because some biopolymers are biodegradable and biocompatible, they can be used to produce disposable medical items, implants, or drug delivery devices that degrade safely — reducing medical waste.

- Textiles & Fibres — Eco-Friendly Clothing and Nonwovens: Some bioplastics can be processed into fibres or nonwoven materials used in textiles, clothing, disposable garments (e.g. hygiene products), and home textiles.

Recent Developments

- In December 2024, Toray announced plans to install a new facility to enable mass production of resin compounds. This facility is intended to begin operation in the fiscal year starting April 2025.

- In October 2024, Its subsidiary Teijin Frontier announced that its “BIOFRONT®” biodegradable resin — a plant-derived polymer with accelerated biodegradation properties — is now fully commercialized in Japan and internationally. This resin can be processed like conventional PLA, and is usable in films, injection-moulded parts, extruded products, fibers and nonwovens.

Conclusion

The bioplastics market is steadily gaining importance as industries move toward more sustainable and environmentally responsible material choices. Growing awareness of plastic pollution, combined with stricter environmental regulations, is encouraging companies to adopt bio-based and compostable alternatives.

Bioplastics offer flexibility across multiple applications, including packaging, consumer goods, textiles, and industrial products, while supporting circular economy goals. Continuous innovation in feedstocks, processing

technologies, and material performance is improving their competitiveness with conventional plastics.

Investments from both private companies and public initiatives are strengthening supply chains and expanding production capacity worldwide. As sustainability becomes a core business priority rather than an option, bioplastics are expected to play a central role in reducing environmental impact and reshaping the future of materials across global industries.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)