Table of Contents

Overview

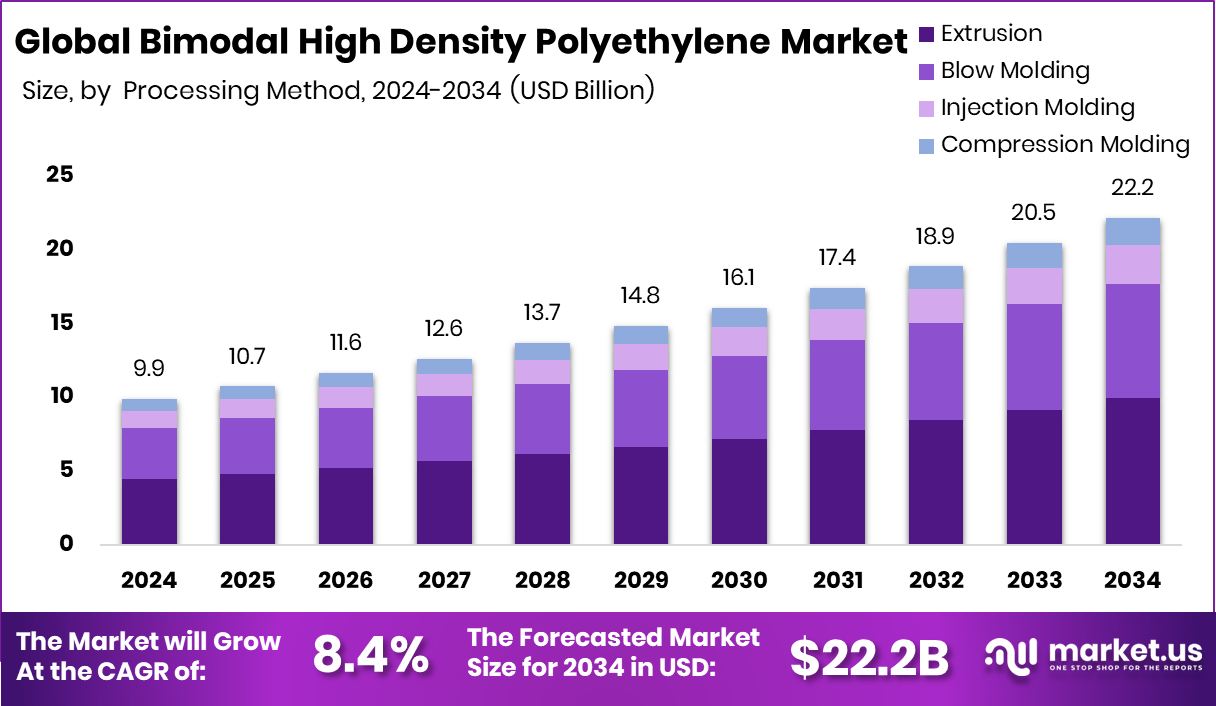

New York, NY – Nov 06, 2025 – The global Bimodal High-Density Polyethylene (HDPE) market is projected to reach USD 22.2 billion by 2034, up from USD 9.9 billion in 2024, growing at a CAGR of 8.4%. Asia Pacific led with 43.8% demand, driven by rapid industrialization and infrastructure projects.

Bimodal HDPE combines high and low molecular-weight fractions, offering excellent stiffness, toughness, and processability. Its superior resistance to stress-cracking and chemicals makes it ideal for pipes, containers, and films.

Government-led infrastructure investment, particularly in water and gas distribution, renewable energy systems, and construction, strongly boosts demand. The material’s high hydrostatic strength and long service life make it essential for durable piping. In the packaging and automotive sectors, its lightweight yet strong characteristics help reduce costs and emissions.

Sustainability and circular-economy shifts are shaping future opportunities. Companies are innovating in catalyst systems and recycling-compatible grades to support eco-efficient products. The market also reflects rising investor confidence—one advanced-materials venture secured US$6.5 million, while another received €23 million to scale plastic-free packaging technologies. As polymer innovation and recycling converge, bimodal HDPE stands positioned as a vital, long-life material in next-generation industrial and consumer applications.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-bimodal-high-density-polyethylene-market/request-sample/

Key Takeaways

- The Global Bimodal High Density Polyethylene Market is expected to be worth around USD 22.2 billion by 2034, up from USD 9.9 billion in 2024, and is projected to grow at a CAGR of 8.4% from 2025 to 2034.

- By processing method, extrusion held a 44.8% share in the bimodal high-density polyethylene market in 2024.

- By application, packaging accounted for a 48.3% share, leading the overall bimodal high-density polyethylene market growth worldwide.

- The Asia Pacific market was valued at approximately USD 4.3 billion during the same year.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=163713

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 9.9 Billion |

| Forecast Revenue (2034) | USD 22.2 Billion |

| CAGR (2025-2034) | 8.4% |

| Segments Covered | By Processing Method (Extrusion, Blow Molding, Injection Molding, Compression Molding), By Application (Packaging, Automotive, Electronics and Electrical (E&E), Construction, Others) |

| Competitive Landscape | Dow Inc., Chevron Phillips Chemical Company, SABIC, Exxon Mobil Corporation, LyondellBasell Industries N.V., INEOS AG, SINOPEC Beijing Yanshan Company, PetroChina Company Ltd., Braskem S.A., Formosa Plastics Corporation, Daelim Industrial Co., Ltd., Mitsui Chemicals Inc. |

Key Market Segments

By Processing Method Analysis

In 2024, extrusion dominated the by-processing-method segment of the Bimodal High-Density Polyethylene (HDPE) Market, capturing a 44.8% share. This leadership stemmed from its extensive use in producing pipes, films, and sheets requiring excellent mechanical strength and stress-crack resistance. The extrusion process ensures uniform material flow, structural consistency, and scalability, making it ideal for large-scale industrial and infrastructure projects.

Its capability to deliver durable and cost-effective outputs supported the rising demand for gas and water pipelines, cable coatings, and protective films. Additionally, the method’s adaptability to advanced bimodal HDPE formulations enhanced its application across sectors, prioritizing performance, longevity, and efficiency.

The combination of reliability, flexibility, and compatibility positioned extrusion as the most preferred processing technique in 2024, consolidating its role in meeting global infrastructure and industrial material needs driven by durability and process economy.

By Application Analysis

In 2024, packaging dominated the By Application segment of the Bimodal High-Density Polyethylene (HDPE) Market, accounting for a 48.3% share. This leadership reflects the growing demand for durable, lightweight, and economical packaging across consumer goods, food, and industrial sectors. Bimodal HDPE’s superior stiffness, impact strength, and environmental stress-crack resistance make it ideal for bottles, containers, and industrial drums requiring long service life and reliability.

Its capability to form thinner yet stronger walls aligns with global sustainability efforts, helping reduce both raw material consumption and transportation emissions. Additionally, the resin’s excellent processability and strength balance enable manufacturers to optimize designs while maintaining product integrity. These advantages have firmly established packaging as the most preferred and value-generating application for bimodal HDPE, driving its continued dominance in 2024 amid expanding industrial, retail, and environmentally conscious packaging demands.

Regional Analysis

In 2024, Asia Pacific led the global Bimodal High-Density Polyethylene (HDPE) Market, holding a 43.80% share valued at approximately USD 4.3 billion. This dominance was driven by rapid industrialization, large-scale construction projects, and growing use of high-performance materials across packaging and infrastructure sectors. Nations such as China, India, and South Korea accelerated adoption of bimodal HDPE for pipelines, containers, and automotive components, leveraging its superior strength and durability.

North America showed steady expansion, supported by demand for lightweight transport materials and sustainable packaging. Europe sustained a stable market, guided by strict environmental regulations and increased focus on recyclable plastics.

Meanwhile, the Middle East & Africa saw growth through petrochemical capacity expansions, improving domestic production capabilities. Latin America experienced moderate gains, aided by industrial infrastructure upgrades and modernized packaging systems, collectively reinforcing global market balance and regional diversification in bimodal HDPE applications.

Top Use Cases

- Pressure Pipes for Water & Gas: Bimodal HDPE grades are used in large-diameter water, gas, and even oil pipelines. They offer excellent slow-crack growth (SCG) and rapid crack propagation (RCP) resistance and meet PE100 / PE4710 standards.

- Durable Packaging Bottles & Containers: The material offers high impact strength, good chemical resistance, and “thin-wall” possibilities, so bottles and industrial drums can use less material yet retain strength.

- Films & Sheets for Packaging & Liners: Bimodal HDPE is used in blown or extruded film/sheet formats because its rheology (flow behavior) and strength deliver better stability in production and stronger output for things like shrink films or liners.

- Geomembranes & Underground Liners: For landfill liners, mining, and tunnel waterproofing, bimodal HDPE offers very long life, high toughness, and better resistance to environmental stress-cracking vs. standard HDPE.

- Industrial Tanks, Chemical Containers & Durable Goods: Because of its high chemical resistance, impact strength, and durability, bimodal HDPE is used for industrial drums, tanks, large crates, and parts that must last in harsh conditions.

Recent Developments

- In June 2025, Dow launched INNATE™ TF 220 Resin—a precision packaging high-density polyethylene innovation tailored for excellent processability and recyclability (targeted at the flexible-film/mono-material market). While not explicitly labelled as “bimodal HDPE”, the architecture and application suggest the use of advanced HDPE resin technology.

- In April 2025, at CHINAPLAS 2025, SABIC unveiled an expanded lineup of material innovations under its polymers business. While the announcement covers a broad set of segments (including electrification, circular economy, and packaging), it signals SABIC’s ongoing push into advanced polyethylene solutions and related high-performance resins.

Conclusion

The Bimodal High-Density Polyethylene market is evolving rapidly with growing applications across infrastructure, packaging, and automotive sectors. Its unique combination of strength, flexibility, and processability continues to make it a preferred material for high-performance and sustainable solutions.

Advancements in catalyst design, polymerization technology, and recycling compatibility are creating new opportunities for innovation. Increasing investments in circular economy initiatives and eco-friendly production practices further strengthen its market outlook. With industries demanding durable and lightweight materials, bimodal HDPE stands as a crucial component in shaping the future of advanced manufacturing and sustainable material development globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)