Table of Contents

Overview

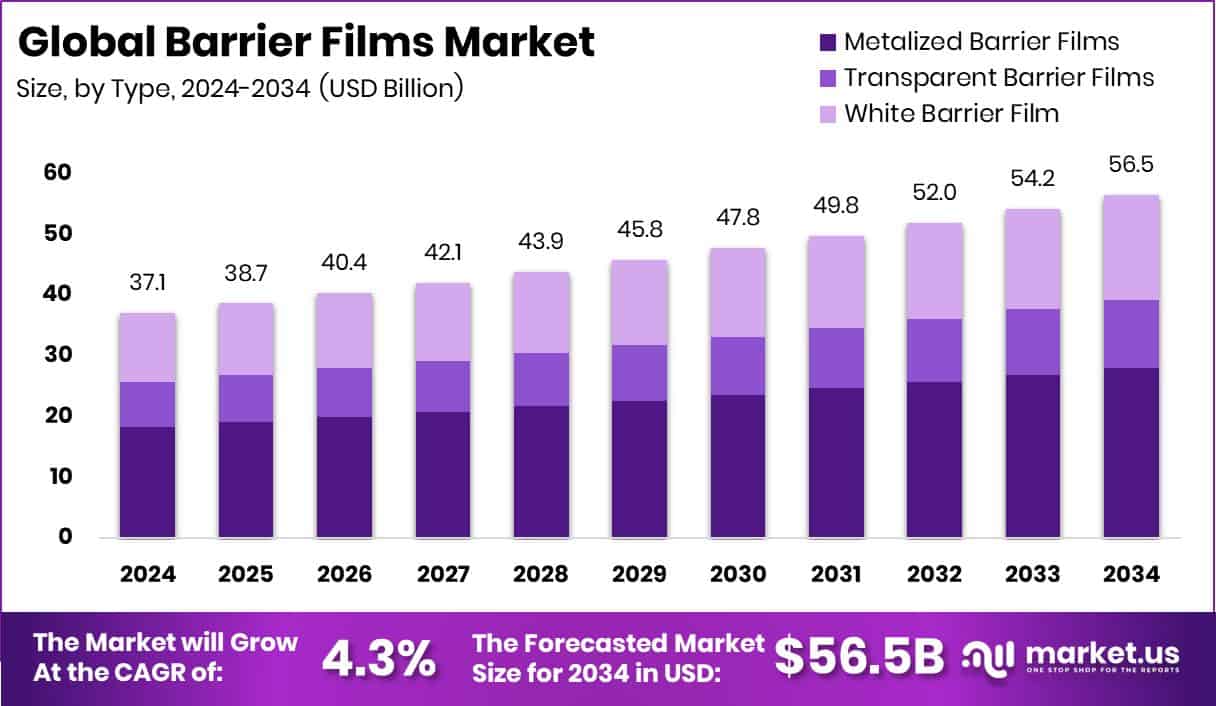

New York, NY – October 22, 2025 – The global barrier films market is projected to grow from approximately USD 37.1 billion in 2024 to around USD 56.5 billion by 2034, representing a CAGR of about 4.3% from 2025 to 2034. A significant driver of this growth is the Asia Pacific region, which holds roughly 43.9% of the market, fueled by accelerating industrialization and heightened awareness around food safety.

Barrier films—thin engineered coatings or laminates—are designed to limit the passage of gases, moisture, oxygen, light, or contaminants, thereby preserving product quality. They are widely used in food packaging, pharmaceuticals, electronics and specialty applications. Rising consumer demand for fresher, longer-lasting goods, combined with longer supply chains and stricter regulatory standards, is encouraging manufacturers to adopt barrier film technologies to minimise spoilage, contamination, and waste.

On the opportunity side, innovation in sustainable and recyclable barrier films is gaining momentum: for instance, Closed Loop Partners invested USD 5 million in Myplas to expand polyethylene recycling; Plastic Energy raised €145 million; and DePoly secured USD 23 million in a seed round; meanwhile, major plastic-resin producers unveiled a USD 25 million recycling fund aimed at PP and PE waste. These investments open pathways for barrier-film producers to tap into recycled feedstocks and deliver “green” solutions to the market.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-barrier-films-market/request-sample/

Key Takeaways

- The Global Barrier Films Market is expected to be worth around USD 56.5 billion by 2034, up from USD 37.1 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034.

- In 2024, the Barrier Films Market saw Polyethylene (PE) hold a 29.3% share due to durability.

- Metalized Barrier Films dominated the Barrier Films Market with a 49.6% share, driven by superior oxygen protection.

- The Food and Beverage segment captured 59.1% share of the barrier films market in 2024.

- The Asia Pacific market value reached USD 16.2 Bn, showing strong packaging demand.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161761

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 37.1 Billion |

| Forecast Revenue (2034) | USD 56.5 Billion |

| CAGR (2025-2034) | 4.3% |

| Segments Covered | By Material (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Polyamides (PA), Ethylene Vinyl Alcohol (EVOH), Linear Low-Density Polyethylene (LLDPE), Others), By Type (Metalized Barrier Films, Transparent Barrier Films, White Barrier Film), By Application (Food and Beverage, Pharmaceutical, Electronics, Agriculture, Others) |

| Competitive Landscape | Amcor Plc, Cosmo Films Ltd., Dupont Teijin Films, Flair Flexible Packaging Corporation, Jindal Poly Films Ltd., Mondi plc, Sealed Air Corporation, Toppan Inc |

Key Market Segments

By Material Analysis

In 2024, polyethylene (PE) dominated the By Material segment of the global Barrier Films Market with a 29.3% share. Its combination of versatility, cost efficiency, and excellent moisture resistance made it the top choice for packaging across food, pharmaceutical, and consumer goods industries. The growing preference for lightweight, durable materials further reinforced its leadership. PE’s ability to integrate into multilayer film technologies enhances protection and extends product shelf life, supporting sustainability and functionality in packaging.

Its adaptability to both flexible and rigid packaging formats drives consistent demand worldwide. These combined performance and economic advantages firmly established polyethylene as the dominant material in 2024, maintaining its pivotal role in global barrier film production and consumption trends.

By Type Analysis

In 2024, Metalized Barrier Films dominated the By Type segment of the global Barrier Films Market with a 49.6% share. Their exceptional capability to block moisture, oxygen, and light made them the preferred solution for extending product shelf life and preserving freshness in food, pharmaceutical, and industrial packaging. The reflective surface of metalized films provides enhanced durability while maintaining lightweight efficiency, supporting cost-effective and high-performance packaging solutions.

Compared to traditional foil laminates, they offer superior cost benefits without compromising protection or appearance. Their combination of visual appeal, high barrier strength, and affordability has made metalized barrier films the top choice among manufacturers, firmly establishing them as the leading type in 2024 and reinforcing their importance in global barrier film applications.

By Application Analysis

In 2024, the Food and Beverage sector dominated the By Application segment of the global Barrier Films Market with a 59.1% share. This leadership stems from the rising consumption of packaged and ready-to-eat foods, which demand extended shelf life and strong protection against oxygen and moisture. Barrier films are crucial in preserving freshness, aroma, and quality throughout storage and transportation.

Increasing consumer preference for flexible, lightweight packaging has accelerated its use in snacks, dairy, beverages, and frozen foods. Moreover, these films effectively prevent contamination and minimize food waste, aligning with global sustainability and safety goals. Their functional efficiency and versatility have firmly positioned the food and beverage industry as the primary application area in 2024, sustaining the segment’s dominant role in overall barrier film demand worldwide.

Regional Analysis

In 2024, the Asia Pacific led the global Barrier Films Market with a 43.90% share, valued at USD 16.2 billion. This dominance is driven by rising demand across food packaging, pharmaceutical, and industrial sectors in China, India, Japan, and South Korea. Rapid urbanization, an expanding middle-class population, and the growth of retail and e-commerce have boosted the need for flexible and durable packaging materials.

North America recorded steady growth, supported by growing awareness of sustainable packaging and advanced recycling infrastructure in the U.S. and Canada. Europe emphasized eco-friendly packaging aligned with EU circular economy policies and stringent environmental regulations.

Meanwhile, Latin America and the Middle East & Africa saw gradual market expansion, driven by increasing manufacturing capabilities and investments in the food and beverage processing sector, strengthening their participation in the global barrier films industry.

Top Use Cases

- Packaged snacks & foods: Barrier films are used in flexible packs (e.g., pouches, wrappers) to block moisture, oxygen and light — helping keep snacks, chips, coffee fresh, crisp and flavourful for longer.

- Pharmaceutical blister & pouch packaging: Sensitive drugs often degrade when exposed to moisture or oxygen. Barrier films ensure medications stay effective by sealing out these threats in blister packs or pouches.

- Frozen & ready-to-eat meals: These meals travel long supply chains and often face temperature swings or humidity. Barrier films help maintain product quality by providing high resistance to moisture and gases.

- Industrial & electronics protection: Electronic components or industrial chemicals that are sensitive to moisture or gases are packaged with barrier films to prevent corrosion, degradation or contamination.

- Aroma- and flavour-sensitive goods (coffee, spices, premium foods): Barrier films help lock in aroma and flavour by limiting oxygen or moisture ingress, preserving the sensory quality of products from production to shelf.

- Light-sensitive & high-value products (pharma, specialty foods): Some goods degrade when exposed to light or UV. Barrier films incorporate coatings or layers that block light and protect such goods during storage or transit.

Recent Developments

- In November 2024, Amcor announced that it would combine with Berry Global in an all-stock transaction valued at around USD 8.4 billion. The move strengthens Amcor’s barrier-film and flexible packaging capabilities by merging two large portfolios in consumer and healthcare packaging. The deal was approved by both boards and is targeted to close mid-2025

- In September 2024 (announced ahead of LabelExpo Americas), Cosmo Films announced the launch of six/seven new film products for the US market, which include CPP extrusion lamination films used in packaging applications. These additions signal an enhanced product offering for packaging films that can include barrier applications.

- In February 2024, the company unveiled a global rebranding initiative: DuPont Teijin Films’ film business was re-named Mylar® Specialty Films, signalling a strategic focus on advanced PET/PEN films (including barrier film and functional film segments). This step supports their identity as a specialist in high-performance film, including barrier applications.

Conclusion

The barrier films market continues to evolve as industries prioritize product safety, sustainability, and shelf-life extension. Growing environmental awareness is pushing manufacturers to innovate recyclable and compostable barrier solutions that balance performance with eco-responsibility. Expanding applications across food, pharmaceuticals, electronics, and industrial packaging highlight their essential role in maintaining quality and reducing waste.

Advances in multilayer and high-barrier technologies are enabling lighter, more efficient packaging that meets regulatory and consumer expectations. With steady innovation and sustainability goals driving production, barrier films remain a key component in the global shift toward smarter and more responsible packaging solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)