Table of Contents

Overview

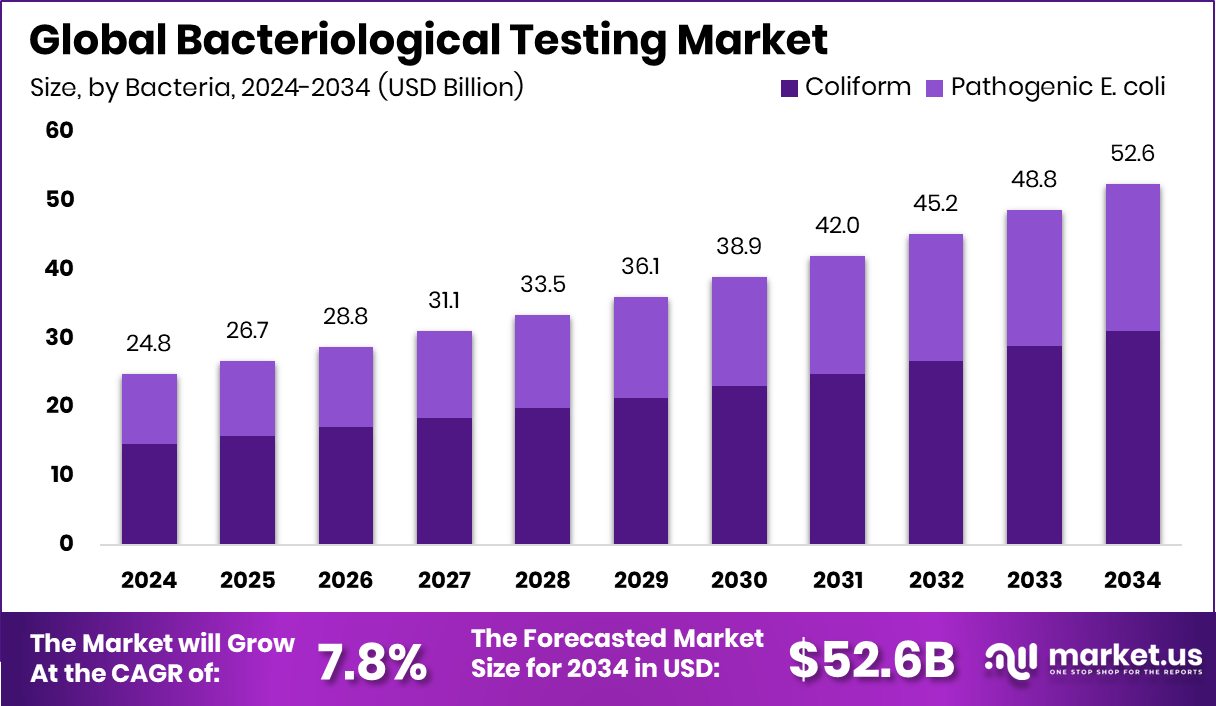

New York, NY – January 23, 2026 – The Global Bacteriological Testing Market, valued at USD 24.8 billion in 2024, is projected to reach USD 52.6 billion by 2034 at a steady 7.8% CAGR, with Europe leading at 43.50% and generating USD 10.7 billion. The market focuses on detecting harmful or spoilage-causing bacteria in food, water, biological samples, and environmental surfaces. These tests are crucial for maintaining hygiene standards, preventing contamination, and supporting regulatory compliance across food processing, healthcare, aquaculture, and environmental monitoring.

Growth is strongly linked to rising safety expectations in food and marine supply chains. Government funding is boosting monitoring demands—such as the USD 1.2 million awarded by the Massachusetts government for commercial fishing initiatives and the UK’s £360 million Fishing and Coastal Growth Fund, both strengthening bacterial surveillance in seafood operations.

Innovation in seafood technology further expands testing requirements. Automation and robotics in processing facilities depend on microbial validation, as seen with Shinkei Systems securing USD 22 million in Series A funding and FaSS reopening with a £6 million investment to enhance seafood infrastructure.

The surge in alternative protein development also fuels long-term testing needs. Startups leveraging microalgae and fermentation are advancing rapidly, with investments flowing to NewFish (USD 1.3 million), Seafood Reboot (€3.2 million), and Bluu Seafood (USD 17.5 million). Large funds, including Bluefront’s USD 100 million and USD 50 million rounds, continue to strengthen the ecosystem, reinforcing the essential role of bacteriological testing.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-bacteriological-testing-market/request-sample/

Key Takeaways

- The Global Bacteriological Testing Market is expected to be worth around USD 52.6 billion by 2034, up from USD 24.8 billion in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034.

- In the bacteriological testing market, coliform detection dominates with a 59.2% share due to routine contamination monitoring.

- Traditional technology holds 33.7% in the bacteriological testing market, supported by low cost and standardized methods.

- Laboratory-based systems lead the bacteriological testing market with 69.3%, driven by accuracy, validation, and regulatory acceptance.

- Food and beverage end-use accounts for 31.1% of the bacteriological testing market demand globally across industries.

- Europe’s 43.50% market share equals USD 10.7 Bn, driven by extensive bacteriological testing adoption.

➤ Directly purchase a copy of the report –https://market.us/purchase-report/?report_id=171480

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 24.8 Billion |

| Forecast Revenue (2034) | USD 52.6 Billion |

| CAGR (2025-2034) | 7.8% |

| Segments Covered | By Bacteria (Coliform, Pathogenic E. coli), By Technology (Traditional Technology, Rapid Technology, PCR, ELISA, Others), By Mode of Use (Portable / Field-use Devices, Laboratory-based Systems), By End-use (Food and Beverage, Fish and Seafood, Dairy, Processed Foods, Fruits and Vegetables, Pharmaceuticals, Cosmetics and Personal Care, Others) |

| Competitive Landscape | Eurofins Scientific, SGS Société Générale de Surveillance SA, ALS, Intertek Group plc, Mérieux NutriSciences Corporation, Certified Group, TÜV SÜD, Symbio Labs, Alfa Chemistry, AGQ Labs |

Key Market Segments

By Bacteria Analysis

Coliform bacteria lead the Bacteriological Testing Market with a 59.2% share in 2024, reflecting their role as the most essential indicator of microbial contamination. Their widespread use in routine monitoring makes them the first line of assessment for hygiene failures, water safety, and potential pathogen exposure. Regulatory bodies also rely heavily on coliform testing, reinforcing its dominance across food, water, and environmental applications.

Because coliform detection is standardized, cost-efficient, and mandated across many safety protocols, laboratories continue to prioritize it within their workflows. This strong regulatory and operational relevance ensures coliform testing maintains its position as the core bacterial analysis method within the global market.

By Technology Analysis

Traditional technology maintains its leadership in the market with a 33.7% share in 2024, driven by its proven reliability, regulatory acceptance, and long-standing use in laboratories. These conventional methods remain central because they offer accuracy, reproducibility, and clear, validated procedures that technicians are highly familiar with. Many facilities continue to adopt traditional approaches for routine and compliance-based testing, where precision and consistency are essential.

Despite advancements in rapid and automated technologies, traditional methods retain a strong foothold due to their dependable outcomes and established infrastructure. As a result, they continue to serve as the foundational tools supporting bacteriological testing across industries worldwide.

By Mode of Use Analysis

Laboratory-based systems dominate global usage with a 69.3% share in 2024, highlighting the importance of controlled environments for high-accuracy and high-volume bacteriological testing. These systems allow for detailed analysis, trained oversight, and thorough documentation, all critical for regulatory compliance and quality assurance. Their ability to manage complex procedures and handle large sample loads makes them the preferred choice for industries requiring dependable microbial testing.

Laboratories also offer standardized workflows and precise interpretation, which further strengthens their central role. This strong operational capacity ensures that laboratory-based systems remain the backbone of bacteriological testing, maintaining their leading position across routine and specialized applications.

By End-use Analysis

Food and beverage applications lead the Bacteriological Testing Market with a 31.1% share in 2024, driven by stringent safety requirements across production, processing, and distribution. Testing is essential for preventing contamination, ensuring product consistency, and protecting consumer health. As food systems expand and global safety standards tighten, routine microbial monitoring has become a non-negotiable component of quality assurance programs.

Regular testing at various stages helps detect risks early, reducing product recalls and maintaining brand trust. Because microbial safety is directly linked to public health, the food and beverage sector continues to rely heavily on bacteriological testing, solidifying its dominant position among all end-use segments.

Regional Analysis

Europe leads the Bacteriological Testing Market with a 43.50% share, valued at USD 10.7 billion, driven by strict regulations, advanced laboratories, and strong emphasis on food safety, healthcare monitoring, and environmental testing.

North America follows as a mature market with well-developed diagnostic systems, standardized protocols, and broad industrial adoption. The Asia Pacific region shows growing demand as large populations and rising safety awareness increase the need for routine microbial testing in food, water, and healthcare sectors.

In the Middle East & Africa, adoption is gradually strengthening as public health surveillance and regulatory requirements expand. Latin America supports market growth through regular testing practices in food quality, medical diagnostics, and environmental monitoring, contributing to the broader global demand for bacteriological assessment.

Top Use Cases

- Ensuring Safe Drinking Water: Bacteriological tests check water for harmful bacteria like E. coli or total coliforms before people drink it. These tests can tell if water is clean or contaminated, helping prevent waterborne illnesses. EPA-approved methods are widely used by labs to monitor drinking, tap, and recreational waters.

- Detecting Infections in Patients: Doctors use bacteriological tests to find out whether someone has a bacterial infection. For example, samples from blood, urine, or mucus can be cultured to see what bacteria are causing sickness and guide the right antibiotic treatment.

- Checking Food Safety: Food manufacturers test food and beverages to find harmful bacteria that can cause food poisoning, such as Salmonella or Listeria. Finding bacteria early helps keep products safe before they reach consumers.

- Monitoring Water Used in Industry: Large facilities and food processing plants regularly test water used in production to ensure it meets safety standards. Simple “presence/absence” tests can show if bacteria are present, helping managers act before problems worsen.

- Environmental Health Checking: Bacteriological testing is used on soil, rivers, lakes, and wastewater to track bacterial levels, check pollution, and protect ecosystems. This helps governments and scientists maintain environmental quality.

- Rapid Field Testing: New simple tests are being developed that don’t need a full lab — for instance, color-changing gels that show contamination in water, milk, or urine within hours, making on-site checks easier and faster.

Recent Developments

- In March 2025, FSNS opened a new food testing laboratory in St. Louis, Missouri to provide 24/7 food safety testing, which includes microbial and bacteriological analyses.

Why it matters: More testing locations help food producers get safety results faster and improve food quality controls. - In June 2024, TÜV SÜD opened a new 1,300 m² testing laboratory in Straubing, Bavaria, Germany. It increases the company’s capacity for extensive product testing.

Conclusion

The Bacteriological Testing Market continues to strengthen as industries place greater focus on safety, hygiene, and regulatory compliance. Growing concerns around contamination in food, water, and healthcare systems are pushing companies and governments to invest in reliable testing methods. Advancements in laboratory technologies and the expansion of accredited testing facilities further support market progress.

As global supply chains become more complex, routine bacterial monitoring is becoming essential for quality assurance and public health protection. Overall, the market is positioned for steady growth, driven by rising safety standards and the increasing need to detect harmful microorganisms across critical applications.